For both seasoned M&A professionals and newcomers, the difference between divestitures, spin-offs, carve-outs, split-offs, liquidations, trade sales, and more can make one's head spin. Some of these terms are related, but each represents a unique type of transaction that can be included in an M&A strategy.

After 10+ years in business working with hundreds of M&A teams, we at DealRoom have witnessed plenty of these transactions. This blog post provides a comprehensive overview of corporate carve-outs so you can better understand what they are, how they work, and how they create value for both parent and subsidiary companies.

What is a carve-out?

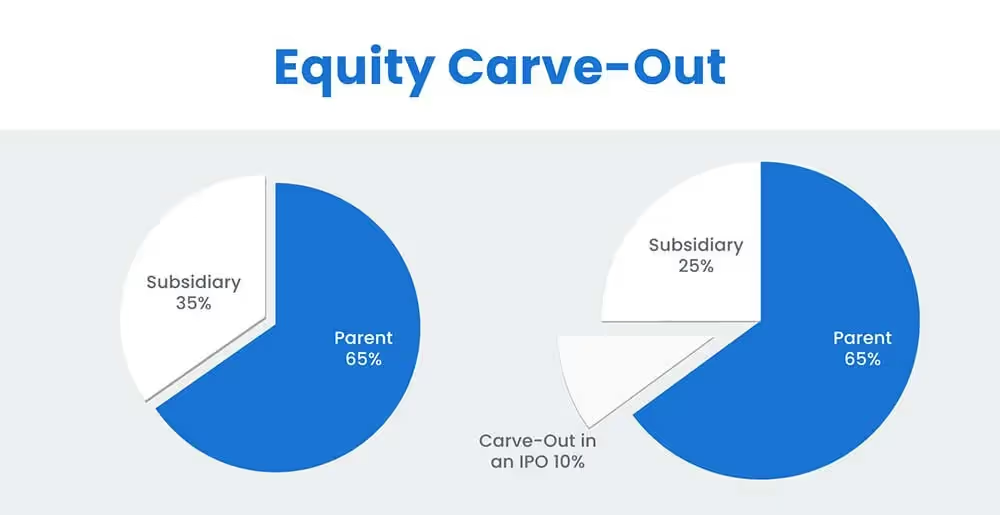

An equity carve-out describes the process by which a company sells some of its shares in its subsidiary through an initial public offering (IPO) for financial or strategic reasons. The company that results from the carve-out has its board of directors, financial statements, and corporate strategy; however, the parent company usually holds a majority stake in the newly created entity.

Corporate carve-outs are standard among large FMCG and technology conglomerates that move into and out of industry segments as their corporate strategy evolves.

Key Takeaways

- A carve-out occurs when a parent company sells a fraction of subsidiary shares through an IPO, establishing the subsidiary as a standalone company with a mix of new and existing shareholders.

- When appropriate, carve-outs are an effective strategy for companies to sharpen their strategic focus, improve their financial standing, and drive operational efficiency.

- Corporate carve-outs are similar but have key differences compared to divestitures, spin-offs, and liquidations.

How do carve-outs work and create value?

Suppose the logic behind any good acquisition is that the two companies would create more value by merging the sum of their parts. In that case, the logic of a carve-out may be the opposite: Separately, both companies may be worth more.

The reasons for this differ but usually involve strategic focus to some degree. Even companies in the same industry can have strategies that, by their nature, drag the two in different directions.

For example, a premium retailer and a heavy discounter sell many of the same items, making their business models contradictory.

3 ways carve-outs create value for both entities:

Strategic alliances

As part of its independence, the carved-out entity may find it easier to create strategic partnerships, for instance, with companies that may have considered the parent company to be a direct competitor and were thus unwilling to cooperate before the carve-out.

Separate funding

The carved-out company may find it easier to arrange funding on its own. With a debt-free balance sheet and a different cost of capital than its parent, the new entity can seek out financing independent of the parent company and may find it significantly more manageable, given the favorable funding environment for smaller companies.

Improved access to suppliers and customers

Similarly to the strategic alliances mentioned above, the carved-out entity’s independence may increase access to new suppliers and customers, mitigating previous commercial conflicts of interest.

How do we measure the value created?

One way to measure the value generated by carve-outs is through an industry sale or an IPO of the carved-out entity.

As an example, one DealRoom client, a large oil and gas conglomerate, recently found that its own stock price would likely rise (through the cash proceeds generated by the IPO), and its carved-out chemicals division would yield a higher multiple (as multiples for chemicals firms are currently higher than those for oil and gas firms), creating significant value for shareholders in the process.

What is the difference between corporate carve-out and spin-off?

Corporate carve-outs are similar to, and sometimes confused with, spin-offs. The difference, however, remains very straightforward:

Whereas a carve-out involves the parent company creating a new entity and—this is important—divesting some of its ownership, a spin-off, on the other hand, distributes shares of the new subsidiary to existing shareholders on a pro-rata basis (i.e., in the same ratio as the shares they already own in the parent company).

- As with a carve-out, a spin-off creates a new entity with a separate board of directors, financial statements, and corporate strategy.

- Unlike a carve-out, this spin-off case’s shareholder composition remains the same.

Recent Spin-off: 3M

3M spins-off health care business, Solventum Corporation

- In April 2024, 3M, an American multinational conglomerate focused on industry, worker safety, and consumer goods, sold its healthcare business, launching Solventum Corporation as an independent entity.

- Solventum Corporation was listed on the New York State Exchange as part of the transaction. In addition, holders of 3M stock received one share of Solventum stock for every four shares of 3M.

- This carve-out was completed so that both companies could pursue their growth in a more focused manner.

What is the difference between a carve-out and a divestiture?

Corporate carve-outs and divestitures are often confused or used interchangeably. But they are different. Sometimes, we even hear carve-outs referred to as partial divestitures. While both refer to selling off part of the parent company, the difference mainly lies in the ownership after the sale.

- In an equity carve-out, the original parent company retains some ownership of the new, standalone company.

- In a divestiture, the parent company usually has no remaining stake or control of the asset being sold. In addition, divestitures typically have a more negative connotation than carve-outs. In these scenarios, the parent company is often selling off the asset because of poor performance or lack of alignment with its strategy.

To summarize, divestiture results in the total separation of the parent company and the sold-off asset after the sale. In a carve-out, the parent company remains a partial owner in the new, standalone company.

Recent divestiture example: Meta (formerly Facebook) sells Giphy to Shutterstock.

This was an interesting divestiture as it was actually forced by U.K. regulators, who believe the acquisition violated the UK’s antitrust laws. The sale, which came in at $53 million, occurred only three years after Meta purchased Giphy for $315 million. Unlike carve-outs, the parent company, Meta, did not maintain any ownership of Giphy after the sale.

When to consider an M&A carve-out

If your company has a division or subsidiary that could benefit from more strategic focus, then a carve-out might be the answer. This happens in a lot of businesses across just about every sector. Firms enter new segments believing they’ll add value, and they often do at the beginning. But even companies in the same industry face subtle differences - market and competitive dynamics, suppliers, customers, direct inputs, and more. A carve-out may be the solution in such a case.

There’s another less commonly mentioned reason for a carve-out. Carve-outs can happen when divisions or subsidiaries are underperforming or when the parent company needs the cash from an eventual divestiture.

CEOs are far less inclined to cite either reason for their carve-out. However, such transactions often indicate underperformance in one or both the parent company and the subsidiary.

“No two carve-outs are alike. Templates are maybe 80% right—there’s always 20% white space you have to figure out.”

- Keith Crawford

Shared at The Buyer-Led M&A™ Summit (watch the entire summit for free here)

How to approach carve-outs

Of all the different forms of M&A transactions, carve-outs are among the most complex. The more integrated the two companies are, the more complex the carve-out is likely to be.

A critical first step is to divide the tasks needed for a successful carve-out into defined phases. For optimal success, each transaction phase should be well-defined to ensure no important details are missed. An M&A software platform or virtual data room can be helpful for organizing each phase and the work associated with it. This process can take between 8 and 24 months.

Consider the following six steps to guide your planning when approaching carve out.

1. Establish a motive for the carve-out

Why are you looking to carve out the new entity? What is the strategic goal you are trying to achieve? Consider if a carve-out is the best answer to solve your strategic issues.

2. Define what needs to be carved out

Is it the whole division or just a subdivision? Assess the cost of carving out the entity versus making organizational changes.

3. Establish how the equity carve-out will affect the parent company over an extended period

Does this move impede the parent company in any way? What will be the impact on stakeholders? What will be the market reception?

4. Create a strong project management team

To ensure success and maximize the speed of the transition, create a dedicated project management team to lead the carve-out. This should include M&A team members, functional leaders (HR, finance, product, etc), and external support like consultancies, venture capital firms, and law firms as necessary.

5. Identify your tasks & organize them

Create a list of tasks that need to be addressed, who is responsible, and the timeframe for each. For the most efficient carve-out process, these tasks should be documented and tracked in a single location.

6. See the carve-out through

While in a divestiture, the parent company is no longer associated with the divested subsidiary, in a carve-out, the parent company should still be concerned about the carved-out subsidiary’s success. There, it’s vital to begin implementation by focusing on the critical path, meaning those issues that are crucial to get right rather than the several hundred minor issues that could appear. Like an integration process, when done effectively, this will lead to an effective deal close and, therefore, long-term value for both the parent and subsidiary.

Maximizing equity carves out deal value

As always, the best ways to maximize value are to have strong strategic motives, create a robust plan, bring in a team of key stakeholders, and execute all the way through post-carve out (launch of two separate companies). Based on our experience with hundreds of M&A teams, the companies that generate the most value from carve-outs are those that follow these specific practices:

Set goals for both companies

It’s important that neither the parent nor the new subsidiary loses strategy focus during the carve-out. Set short-term goals to be achieved within each of the first three years after the transaction to ensure that attention doesn’t shift from both’s success.

Put a project management team in place

This is the golden rule for equity carve-outs. Without a strong project management team and a set of tools for them to work with, the carve-out is unlikely to generate value, regardless of how compelling the motives for it are.

Create a checklist of areas where the carved-out entity needs new resources

For example, if the carved-out entity has been using the parent company’s factory floor until now, it will need one of its own. There’s a good chance this goes for most of the support functions as well.

Create an interdepartmental team to implement the carve-out

The links between the two companies may extend from finance to IT and HR. Create teams with insight into where the two companies overlap and confirm they contribute to ensuring that the carve-out happens with minimum disruption.

Communicate internally and externally

Clearly and transparently communicate the intended value and roadmap of the carve-out to your internal teams and external stakeholders. Ask them for feedback early and often, especially regarding their concerns about the transition.

When is an equity carve-out not a good idea?

An equity carve-out is not likely to generate value when significant strategic or operational synergies between the parent company and the subsidiary remain.

These synergies will all largely be lost after the equity is carved out, with legal restrictions meaning that transactions that previously took place within the entity (for example, raw materials purchased in bulk by the parent company) now have to take place at fair market value.

Any equity carve-out strategy should thus quantify these synergies before undertaking the transaction.

Benefits of carve outs in M&A

At DealRoom, we have worked with hundreds of companies evaluating carve-out strategies. And many have moved forward with a carve-out based on the potential benefits. When a carve-out is a good choice, the benefits apply to both the parent company and the new subsidiary. The most common benefits we see are:

“If you can’t define the perimeter, you don’t know what you’re buying.”

- Keith Crawford

Shared at The Buyer-Led M&A™ Summit (watch the entire summit for free here)

Sharpen Strategic Focus

For the parent

By carving out a potentially misaligned segment of the business, the core company can double down on its defined strategic focus without the distractions or limitations of the potential subsidiary.

For the subsidiary

Once carved out, the subsidiary now has more freedom to define and execute its strategic focus, which may not have been aligned with the parent company. This gives the subsidiary more flexibility to hone its differentiation and go-to-market more precisely targeted at its ideal customers.

Increase Financial Gains

For the parent

When entering into a sale of a piece of their business, the parent company has the potential to generate capital. These funds can be used to pay off debt, make a new acquisition, or re-invest in the business.

For the subsidiary

The investment in a new business could benefit the buyer of the subsidiary’s overall financial portfolio. This is especially true if the carve-out asset is in a new or less saturated market. With a more dedicated focus on the subsidiary, the business can often grow and increase its valuation more than it had been as part of the parent company.

Note: depending on the carve-out details and the regulatory environment, there may also be tax incentives for both the parent and buyers that can positively impact overall finances.

Improve Operating Efficiency

For the parent

In many carve-out scenarios, the potential subsidiary is not aligned with the business’s core focus, which results in strained operations. The parent company can streamline operations in its core focus areas by carving out this less-aligned industry element, hopefully increasing efficiency and improving business outcomes.

For the subsidiary

After a carve-out, the company can create its own operational processes and management team that are more aligned with its strategic focus and needs. This enables the subsidiary to function more efficiently and generate more bottom-line revenue.

M&A carve out examples

Corporate carve-outs happen across industries, geographies, and markets for various reasons. As opposed to divestitures or spin-offs, which we often hear about in the news, carve-outs are less reported. Here are a few examples of recent carve-outs to help you better understand how they are used to drive the business’s strategic priorities:

FIS completes equity carve-out of Worldpay

- FIS, Fidelity Information Services, a fintech company, sold a majority stake in Worldpay to GTCR, a PE firm.

- After initially planning to spin off Worldpay, FIS sold 55% of the business to GTCR for $11.7 billion in cash.

- Now that they are two separate entities, FIS and Worldpay can focus more on their two unique go-to-market strategies. However, they will continue to work together through a partnership.

- This equity carve-out was valued at $18.5 billion.

Exelon carves out Constellation Energy Corporation

- Exelon Corporation, the largest electric parent company in the United States, completed a tax-free carve-out via the IPO of Constellation Energy Corporation, the former power generation unit of Exelon.

- This was the highest value carve out of 2022, valued at $17.3 billion.

- Exelon’s move to separate its power generation unit aimed to focus the parent business on its transmission and distribution utility.

DuPont carves out its Mobility & Materials segment to Celanese

- Dupont agreed to divest most of its Mobility & Materials segment to Celanese, an American technology and specialty materials company.

- The sale included product lines within the Performance Resins and Advanced Solutions business lines for $11 billion in cash.

- Dupont’s move was the latest in a series to focus the business on high-margin operations.

- Dupont planned to use the proceeds to pay for the pending acquisition of Rogers Corp for $5.2 billion. This acquisition was later terminated, and the proceeds were used for share buybacks and other acquisitions.

Key Takeaways

Carve-outs are where the lines between M&A deals and corporate restructuring begin to blur. When implemented well, a carve-out strategy can generate significant value. But companies must be ready to embrace the complex process that often comes with carve-outs.

To achieve a successful carve-out transaction, companies need to align around the strategic goals, prepare a cross-functional team, clearly document the required steps to success, and see the carve-out through post-separation.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)