The Ultimate Guide to Corporate Development

.avif)

No matter how great a company is, it will eventually hit a wall. Organic growth has its limits and can only take a company up to a certain point. This is where Corporate Development comes in. These Corp Dev officers play a significant role in helping companies achieve rapid growth and expansion.

To learn more about this function and its fundamentals, the DealRoom team prepared a complete guide to corporate development.

In this article:

- What Does Corporate Development Do?

- Corporate Development Structure

- Corporate Development Goals and Activities

- Why Do Companies Need Corporate Development Teams?

- Corporate Development Salary & Career Guide

- Implementing Corporate Development Strategy

- The Right Fit for Corporate Development

- Corporate Development Team Structure

- Difference Between Corporate Development and Business Development

- Difference Between Corporate Development and Corporate Strategy

- Difference Between Corporate Development and Investment Banking

- Stages of Corporate Development

- Essential Tools for Corporate Development Teams

- Metrics to Measure the Effectiveness of Corporate Development Strategies

- Corporate Development Best Practices

- Frequently Asked Questions

- Key Takeaways

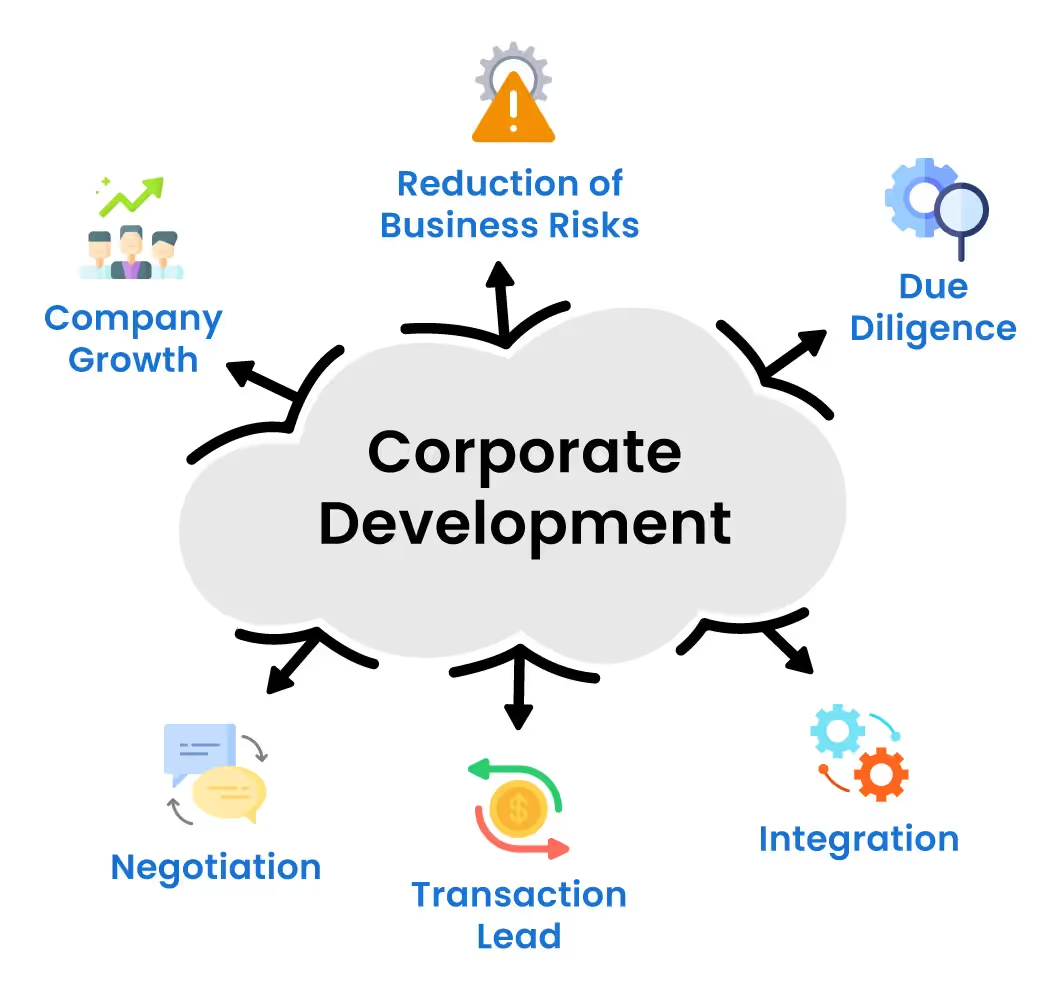

What is Corporate Development (Corp Dev)?

Corporate development is a dedicated function inside a company that focuses on developing strategic initiatives that could grow and add value to a company outside of its normal operations. This is usually referred to as inorganic growth.

The most common ways to achieve inorganic growth are transactions such as mergers and acquisitions, joint ventures, divestitures, strategic partnerships and more.

The corporate development function is usually found in large companies that do a lot of acquisitions.

What Does Corporate Development Do?

The primary role of corporate development is to generate strategies on how to achieve the overarching goals of the company, whether it's to increase revenue quickly or enter new markets.

An effective corporate development officer must first study and fully understand the business operations and strategy before identifying opportunities to add value. A significant part of this role involves building relationships and engaging in meaningful conversations.

Any corporate development officer worth his salt should have a strong network of external relationships and the ability to unlock new opportunities for the organization.

The primary focus of corporate development is executing M&A deals. This involves establishing a solid M&A strategy and identifying potential target companies.

Behind the scenes, corporate development teams are continuously researching, studying, and analyzing markets to drive strategic recommendations and informed decision-making.

.avif)

Source: Building Corporate Development - Certification Courses on M&A Science

Corporate Development Structure

How a corporate development function is structured can significantly influence how a company pursues growth strategies. There are three common models of structuring these teams, each with distinct advantages and challenges:

Centralized model

In a centralized structure, the corporate development professionals are concentrated within one main team to ensure everyone in the company is on the same page and follows the same plan. They handle all the big decisions and aspects of the corporate strategy, M&A, joint ventures, and partnerships.

In this structure, decision-making and strategy implementation is more consistent across the entire organization, and it’s easier to manage resources. As a result, the company follows a unified strategic direction.

However, centralized decision-making can also be a disadvantage. Since all decisions have to go through the main team, responses to local opportunities and challenges tend to be slower, which can stall progress.

Decentralized model

In a decentralized model, the responsibility for corporate development activities is distributed among different business units or regions that operate independently. These decentralized teams make their own decisions about growth and partnerships, which allows them to make faster decisions and respond to local challenges quickly.

The main downside to decentralized teams is the lack of alignment with the overall corporate strategy and redundancies due to duplicated efforts across units. This may not only lead to inefficiencies, but it may also provoke internal competition within the different divisions.

Hybrid model

A hybrid model is a mix of a centralized and decentralized function. To put it simply, the core team at the headquarters makes the major, high-level decisions, but local teams in different regions or departments can make smaller decisions that fit their area.

This model offers a more flexible setup, allowing the corporate development teams to immediately address local needs while remaining aligned with the company’s main goals. However, this model requires excellent communication to make sure both the local and central teams work well together and avoid conflicting strategies.

Read into corporate development vs business development to understand the difference between the two.

Corporate Development Goals and Activities

Corporate development teams are usually responsible for activities such as:

- Market mapping and opportunity analysis

- Identifying and investigating potential target companies

- Developing relationships with said targets (which includes getting past the gate-keeper)

- Pipeline management

- Additional M&A related activities (negotiation, due diligence, and integration)

- Securing financing

- Financial modeling and analysis

- Portfolio management

- Improving the customer experience

- Communicating strategic plans to company executives

Here is an example of where a strategic M&A transaction is visible among the spectrum of corporate development activities:

When Starbucks wanted to expand from coffee into tea, instead of starting from scratch, it acquired the upstart tea brand, Tazo, for $8m (in 2017, it sold out to Unilever for $384 million).

%2520(1)%2520(1).avif)

Why Do Companies Need Corporate Development Teams?

Before we answer this question, let us be perfectly clear. There are companies that execute mergers and acquisitions and other inorganic growth strategies without a dedicated corporate development team. This is especially true for smaller companies that do acquisitions once a year.

However, the value of having a dedicated person or team focused exclusively on corporate development is unmatched. Executives managing day-to-day responsibilities cannot possibly achieve the same level of effectiveness as a dedicated corporate development function.

For larger companies that want to initiate more inorganic growth, a dedicated corp dev team is essential. Keeping track of all the technology advancements and market shifts can be overwhelming for executives juggling daily operations. It is the role of the corp dev team to proactively seek opportunities and ensure the company can adapt to changes and remain competitive.

Furthermore, a dedicated corp dev team can execute more than one deal at a time, if necessary. They have existing relationships with other companies in the industry, and they have vast experience in assessing transaction risks.

Over the course of several years, DealRoom was approached by several clients about their corporate development needs.

These conversations ultimately led M&A Science to develop a set of corporate development courses that draw on the corp dev experience of industry professionals to enable our clients to improve their in-house expertise.

Corporate Development Salary & Career Guide

Corporate development professionals are responsible for identifying growth opportunities, executing transactions, and integrating acquired assets into the company’s operations. This role requires a blend of financial expertise, strategic planning, and negotiation capabilities.

Corporate development career path

The corporate development career path generally begins with experience in investment banking or equivalent fields like management consulting and private equity. The Corporate Development Analyst or Corporate Development Associate positions that entry-level professionals often start with involve responsibilities such as conducting market research, performing financial modeling, and executing due diligence tasks.

Experienced professionals move up to Corporate Development Manager or Senior Associate positions where they manage complex transactions and direct smaller deal components. At the Director level, professionals manage deal origination and lead negotiations while handling integration strategies.

The most senior positions include Vice President and Head of Corporate Development. These roles focus primarily on strategic decision-making together with relationship management and high-level negotiations. Professionals with deal-making skills often move into executive positions such as Chief Strategy Officer (CSO) or Chief Financial Officer (CFO) roles to drive company growth.

Corporate development roles

Let’s take a look at the key roles in corporate development.

- Corporate Development Analyst - The Corporate Development Analyst role involves conducting market research, performing financial analysis, and helping with due diligence processes.

- Corporate Development Associate - This role includes conducting detailed financial modeling, supporting negotiations, and managing transaction processes.

- Corporate Development Manager - This role involves project team management. Corporate Development Managers also execute strategic initiatives and work together with multiple department functions.

- Director of Corporate Development - The Director of Corporate Development creates acquisition strategy formulation and manages both negotiation terms and integration planning oversight.

- VP of Corporate Development - The VP of Corporate Development creates acquisition strategies for the company while assessing expansion opportunities and handling extensive M&A projects.

- Head of Corporate Development - This position establishes a strategic plan for inorganic growth while leading professional teams and executing valuable acquisitions.

Corporate development salaries

Corporate development roles offer competitive salaries because they play a crucial strategic function within their companies. Salaries range significantly depending on the specific role, the professional’s background and experience, and their geographic region.

According to Levels.fyi, the median annual compensation for corporate development roles is $200,000 per year, ranging from $149,000 to $350,000 annually. ZipRecruiter reports an average annual salary of $103,730.

The table below breaks down the average annual salary and salary ranges for key corporate development roles.

Implementing Corporate Development Strategy

As mentioned above, the main job of the corporate development team is to develop and execute strategies that will help the company achieve its overarching goals.

For instance, the company wants to expand their reach and enter global markets. The corp dev team must assess and develop strategies on how to achieve that goal. They could either build their own brand from scratch overseas, partner with someone who already has a presence in the market, or acquire an entity in their desired location.

Before they can make an educated decision, they must consider several factors such as time to market, return on investment, risks and existing opportunities.

Here are a variety of transactions that the corp dev team could implement:

1. M&A

M&A is a type of transaction where the company buys another entity for growth. The larger the company (i.e. Fortune 500 companies), the more likely corporate development is using M&A and spending a great deal of time deal-sourcing, developing relationships, and cultivating a pipeline.

M&A allows for growth in numerous ways (and somewhat faster growth), such as entering new markets, reducing competition, and acquiring talent and technology.

This initiative can help companies diversify their business models and revenue streams so that they don’t rely only on a single market or product line. By unlocking financial synergies, M&A activities can increase a company’s value.

Corporate development teams in larger companies tend to have dedicated resources and expertise to manage and execute these complex transactions efficiently. DealRoom is a popular corporate development tool they use to reduce the administrative overhead associated with M&A deals.

2. Divestitures

A divestiture is where the company sells a business unit, or a specific asset only. This can help companies raise capital and initiate growth. Also, divestitures are commonly executed to help companies refocus on their core business, optimize resource allocation, and improve financial health.

The corporate development team manages the transition and restructuring process. They ensure that assets, employees, and customer relationships are smoothly transferred to the new owners.

Corp dev is also in charge of effectively separating the IT and other services, and evaluating the impact of the overall transaction to be able to adjust the corporate strategy to reflect the company’s new structure.

Related: A Guide to Planning Successful Divestitures by a Divestiture and M&A Advisor

3. Carve-outs

Carve-outs are somewhat similar to divestitures as they allow a company to concentrate its resources and management attention on its core businesses that promise the best growth and profitability. However, the difference is that it creates a new independent identity from an existing business unit or division.

Carve-outs can help reveal the true value of a business unit that might be hidden within the larger corporate structure. This can attract investors, either from public markets or private equity, especially if the company operates in high-growth industries or possesses unique technologies. This can lead to better valuation and investment terms.

Corporate development functions have all the skill set and focus required to execute these initiatives successfully, ensuring that these transactions align with the company’s overall strategic goals.

4. Joint ventures

Joint ventures (JVs) involve two or more entities joining together for a particular project. In this type of agreement, parties create a new entity and pool all their resources and capabilities to achieve specific objectives. Both companies still keep their independent entities while working with another company.

Joint ventures are common in tech industries, especially when they need resources for innovation or developing new technologies. It’s more flexible than mergers or acquisitions, which means companies can achieve specific objectives without the need for full integration. It can also be a lot easier to exit a joint venture compared to unwinding a merger.

5. Strategic partnerships

Similar to joint ventures, partnerships are collaborative agreements between companies. However, unlike joint ventures, partnerships are not bound by a specific timeframe and can continue indefinitely based on the agreement between the partners. While joint ventures are often formed with a singular objective in mind, partnerships are typically established for long-term business operations aimed at sustained profitability without a predetermined end date.

Nike and Apple and Casper and West Elm are two notable partnerships we’ve seen recently. In addition to the aforementioned benefits, these companies also have prospered from co-marketing strategies.

6. Strategic alliances

Strategic alliances are also mutual agreements by two or more companies, but they are very different from JVs and partnerships. Alliances are more informal. In fact, they usually don't have a formal agreement at all. Alliances usually form via handshake, and nothing more.

Also, the companies need not work together physically. These parties work together but operate separately and independently from one another. Management and governance of the alliance is usually delegated to an existing employee.

7. Licensing

Licensing is an arrangement where one company agrees to pay another for licensed usage of its products (tangible and intangible) and/or services.

For a more in-depth understanding, here’s how it works: A company (the licensor) grants another company (the licensee) the rights to use its intellectual property (IP), which could include patents, trademarks, software, or know-how, in exchange for a fee. This fee can be a one-time payment and/or royalties based on sales.

Licensing is a great way to generate revenue by monetizing the company’s intellectual property. Since the licensee won’t need large capital investments in production, marketing, or distribution, they can easily enter and expand to new markets. However, they also bear the business risks associated with the sale and distribution of the products.

Stimulating innovation is easier when companies license their IP since they can have more control over their core technology or brand. Licensing also helps the company’s product or services become more widely used and recognized, strengthening their brand visibility.

This strategy is especially prevalent in industries where intellectual property is a critical asset, like pharmaceuticals, technology, entertainment, and consumer goods.

.avif)

The Right Fit for Corporate Development

Corporate development teams typically include at least a couple of people with investment banking experience.

These individuals will be tasked with ensuring that the core financial elements of each transaction are in order: ensuring that the company can raise the finances for a transaction, that the transaction is being valued properly, and that shareholder value is being created by the transaction.

That being said, the corporate development team is usually a crossover with the company’s strategy team, meaning there is room for individuals from non-banking backgrounds.

Furthermore, the more a company’s acquisition or divestment strategy requires industry expertise (for example, in the biosciences), the more likely it is that the team will be filled with those with industry knowledge who can bring value to the company’s transactions.

Corporate Development Team Structure

Corporate development teams spend a majority of their time working on deal sourcing, analysis, and execution, and while the structure of the team depends largely upon the business (size, market, and goals), there are a few consistencies seen across corporate development teams.

First, especially at larger companies, there is often a corporate development executive with a robust M&A background as well as credentials such as a CPA or MBA. Teams might also look for members with experience in investment banking and law.

In general, Corporate Development groups contain:

- A VP or Head of Corporate Development

- A Director/Senior Director

- A Manager or Associate

- An Analyst

Because of the large and extremely important scope of corporate development teams, most individuals working in corporate development do not begin their careers there because they lack experience with running deals.

Overall, industry background is of the utmost importance for corporate development practitioners.

Difference Between Corporate Development and Business Development

While both corporate development and business development add value and are essential to companies, their definitions and activities differ.

We know corporate development is creating and acting on strategies to meet a company's overarching goals and objectives, via activities such as M&A, long-term partnerships, divestitures, and carve-outs, as well as creative transactions for optimizing shareholder value. Generally, these initiatives take a great deal of time (months, even years) to carry out.

Business development focuses more on the market; bringing in customers, working with vendors, and marketing. Consequently, business development activities often include marketing and sales related tasks. Both genres of development clearly include networking and developing relationships and partnerships.

Difference Between Corporate Development and Corporate Strategy

Corporate development and corporate strategy sounds the same, but they are actually different. They often interact closely though; corporate strategy provides the framework and direction for growth, while corporate development then executes specific initiatives based on this direction for growth.

For example, if corporate strategy emphasizes expanding into a new market, the corporate development team may go for an acquisition or partnership to facilitate this growth.

In many cases, these roles can overlap or be integrated to some extent. Both play a crucial role in helping the company achieve its long-term objectives.

Difference Between Corporate Development and Investment Banking

While corporate development and investment banking both deal extensively with mergers and acquisitions, these fields have far more differences in their primary functions and goals.

For instance, corporate development professionals focus on their own company’s growth and strategic needs. In contrast, investment bankers focus on providing services to a range of external clients.

Both roles involve transactions, but investment bankers are primarily concerned with executing these transactions effectively for their clients. Corporate development professionals, however, are more concerned about how these transactions fit into the broader strategic goals of their own company.

A corporate development professional thinks about long-term integration and strategic alignment post-transaction. Investment banking is more concerned with the immediate successful execution of deals.

Both roles require a deep understanding of finance, strong analytical capabilities, and excellent negotiation skills, but they apply these skills in different contexts and with different ultimate goals.

Stages of Corporate Development

#1 Development

The company wants to start inorganic growth and is looking to start a corporate development function. They are now looking for a Head of Corporate Development to build and oversee the new department. When hiring, look for an expert in the respective field for faster adaptation. That may mean promoting someone within the organization or hiring an experienced person.

#2 Start-up

The newly hired Head of Corporate Development must now do internal due diligence and understand the company completely. This will help identify the gaps that exist in the company, and how to reach their overarching goals. During this process, the Head of Corporate Development is now talking and building relationships both internally and externally. Getting his name out there with his new company can help open up opportunities for future transactions.

#3 Execution

At this stage, the Head of Corporate Development has now executed one or two deals. Hopefully, these are successful transactions that are yielding growth for the company.

#4 Expansion

After a few successful transactions, the function now needs more people. The next hire will either be a Junior Analyst, or a Vice President of Corporate Development. This will allow them to look at more deals and execute on them.

#5 Maturity

If the function has truly become successful, then it’s time to hire more dedicated people and build templates and playbooks for repeatable processes.

Essential Tools for Corporate Development Teams

Files management

Files management tools are used for organizing and securing all the documents associated with strategic initiatives like M&A and partnerships. These tools allow the storing, sharing, and collaborating on documents efficiently.

It’s important that all corporate development team members and stakeholders have access to up-to-date information, especially when deals involve large volumes of sensitive and confidential data. Popular tools for file management include DealRoom, SharePoint, Google Drive, and Dropbox.

Due diligence trackers

Due diligence is the deep investigation phase into the target company’s business. With due diligence trackers, you can manage the process of a strategic initiative effectively by tracking the progress of due diligence activities, storing results, and highlighting areas of concern.

These specialized tools ensure that nothing is overlooked and that all findings are properly documented and accessible. Platforms like DealRoom or Intralinks provide robust due diligence tracking functionalities.

Integration tools

After a deal is closed, the focus shifts to integration, which is key to realizing the value of an M&A deal. Integration tools, like DealRoom’s modern post merger integration software, help manage the complex task of merging different systems, processes, and cultures.

These tools ensure that integration efforts are coordinated and effective by assisting with project management, workflow automation, and communication across teams. Examples include Smartsheet for project management and Slack for communication.

Pipeline management tools

With a pipeline management tool, it’s easier to manage a pipeline of potential deals, from initial contact through negotiation and closure.

These tools have dashboards and reporting features that can help in adjusting strategies, tracking each potential deal at various stages of the development process. They also provide visibility into the health of the deal pipeline and help prioritize efforts.

Salesforce and Pipedrive are commonly used for this purpose, but you don’t want to miss out on DealRoom’s modern pipeline management software.

Metrics to Measure the Effectiveness of Corporate Development Strategies

Return on investment (ROI)

To measure the effectiveness of corporate development strategies, teams rely on the financial returns of initiatives such as M&A. The ROI helps determine whether the financial goals of a transaction were achieved and how well the capital invested in the project has generated value for the company.

Deal synergy realization

This metric includes cost savings, increased revenues, or enhanced market share, which measures how effectively the anticipated synergies are being realized from a merger or acquisition. Tracking this metric involves comparing the forecasts before the deal and the deal's actual performance right after. This tells how accurate the synergy predictions were and the effectiveness of the integration process.

Strategic fit

The strategic fit tells how well a new acquisition aligns with the company's existing strategic goals and if it enhances the company's long-term strategy. This can be evaluated through other sub-metrics like market share improvement, entry into new markets, technology enhancement, or talent acquisition.

Time to close

Another key metric is the time to close a certain deal from when it is initiated to when it is completed. A shorter time to close can indicate that the corporate development team is well-organized and their processes are streamlined. However, a longer time might imply potential inefficiencies or complications in deal execution.

Employee retention rates post-merger

Employee retention after a merger is a strong indicator of the strategic initiative’s success. When employees from the acquired company choose to stay, it sends a clear message about the effectiveness of the integration and the confidence in the new organizational direction post-merger or acquisition.

Integration efforts are successful when there are high retention rates. That could also mean good cultural fit and effective change management strategies. Low retention rates, on the other hand, can tell a lot about the human impact of the corporate development strategy and may signal integration issues.

Customer retention and satisfaction

It’s important to measure how well the company maintains its customer base and satisfaction levels after a strategic initiative. Changes in customer retention rates and satisfaction can reflect how the deal affected the company's market position and customer relationships.

Corporate Development Best Practices

Have experienced M&A practitioners on your corporate development team

When it comes to corporate development there really is no substitute for experience; the wider the variety of experiences and areas of expertise on your team, the better.

Be organized and consistent (yet flexible) with your M&A practices and language

This means making sure all team members and executives are using the same language and tools. Additionally, pipeline management is consistent. Finally, basic foundational approaches (“playbooks”) are utilized, but teams tailor each deal to their specific needs/characteristics, remaining Agile.

Keep your pipeline up to date and “healthy"

Building off the above best practice, keeping a healthy pipeline and ensuring it is always up to date is essential. You must move beyond the archaic Excel spreadsheet and look to smarter project management platforms that allow for safe and methodical sharing and updating of information.

Build and maintain relationships

Your corporate development leaders should be “people” persons. It is of the utmost importance that they can build and maintain genuine relationships with potential targets.

Keep data on past deals and learn from them

Based on past deal experiences, new deals should become more efficient, and strategies should continuously be honed.

“If you don't have it organized where everybody can see what everybody is working on, people are just talking past each other, they’re not on the same page. It’s a horrible trap to get caught in, not having that inner communication.” — Michael Palumbo

Quote from: The Corporate Development Podcast at M&AScience.com

%2520(1)%2520(1).avif)

Frequently Asked Questions

What is the difference between M&A and corporate development?

Mergers and acquisitions (M&A) are specific strategies within corporate development that focus on buying, selling, merging, or restructuring companies to drive growth. Corporate development, on the other hand, is a broader strategic function that includes M&A but also encompasses joint ventures, strategic partnerships, capital investments, and other growth initiatives.

How to break into corporate development?

Breaking into corporate development typically requires a strong background in finance, investment banking, or management consulting. Building expertise in financial modeling, strategic analysis, and market assessment is crucial. Networking, obtaining an MBA or relevant certifications, and gaining experience in M&A or strategic planning roles can also significantly improve your chances.

What is the difference between business development and corporate development?

Business development focuses on expanding a company's market reach, boosting sales, and forming strategic partnerships to drive revenue. Corporate development, however, is more strategic and includes M&A, investments, and other initiatives aimed at long-term growth and market positioning. Business development is often revenue-centric, while corporate development is focused on strategic growth.

What are the key stages of corporate development?

The key stages of corporate development include:

- Strategy Formation – Identifying growth opportunities and setting strategic goals.

- Target Identification – Researching and analyzing potential acquisition or partnership targets.

- Due Diligence – Conducting a thorough analysis of financials, operations, and strategic fit.

- Negotiation and Deal Structuring – Defining terms, valuations, and integration plans.

- Integration and Execution – Merging operations, aligning cultures, and tracking synergies.

- Performance Monitoring – Continuously evaluating the impact on business goals and making adjustments as needed.

Key Takeaways

- Corporate development is a strategic function focused on inorganic growth through M&A, joint ventures, divestitures, and strategic partnerships.

- Corp dev teams are responsible for identifying growth opportunities, executing transactions, integrating assets, and managing strategic initiatives that align with company goals.

- Corporate development teams typically include a VP or Head of Corporate Development, Directors, Managers, Associates, and Analysts. Experience in investment banking or private equity is common.

- There’s a growing reliance on technology and Agile methodologies to enhance deal efficiency and relationship-building. Cultivating strong networks and leveraging digital tools is critical for competitive advantage.

As corporate development teams become more common, and tools are generated to help them with their strategies and deal management, it is easy to see more and more companies are relying on the creativity and skills of corporate development leaders to enhance and grow their businesses.

In fact, a study done by Deloitte notes that 62% of corporate development practitioners believe their role as a “source of innovation” has increased over the last two years.

This does not mean, however, that the jobs of corporate development teams are getting easier. With more M&A activity flooding the market, it becomes increasingly challenging for these teams to make themselves stand out to potential targets.

Consequently, it becomes essential for corporate development practitioners to cultivate genuine relationships and avoid the all too tempting comfort of putting their heads down and blindly following playbooks.

This is where Agile thinking and methodologies, as well as interpersonal skills (often referred to as “soft skills” - though they’re anything but) come into play.

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

.png)

.png)

.png)

.svg)

.svg)

.avif)