The buy-side M&A process is a complex, multi-step journey that requires careful planning, rigorous due diligence, and precise execution. Whether your goal is market expansion, the acquisition of innovative technology, or achieving economies of scale, strategic buy-side M&A planning is essential for long-term success.

As the M&A landscape evolves, companies can no longer afford to take a reactive or fragmented approach to acquisitions. Traditional buy-side M&A processes often rely on banker-driven workflows, multiple disconnected tools, and a lack of strategic alignment. Shifting to a buy-side M&A approach, such as Buyer-Led M&A™, ensures that every deal is sourced intentionally, executed efficiently, and integrated seamlessly to create long-term value.

At DealRoom, we’ve worked with thousands of buy-side M&A participants, helping them streamline their due diligence process and navigate the key stages of an acquisition. Drawing from our experience, this guide outlines every step of the buy-side M&A process, from identifying potential targets to post-merger integration, tying in the five pillars from the Buyer-Led M&A™ strategy, so you can approach your next acquisition with confidence.

Unlike traditional M&A checklists, we break the process down into seven clear and actionable steps, providing insights and best practices along the way. Whether you’re new to buy-side M&A or refining your current approach, this guide will serve as a valuable reference. And if you’re looking for tools to optimize your process, DealRoom is here to help.

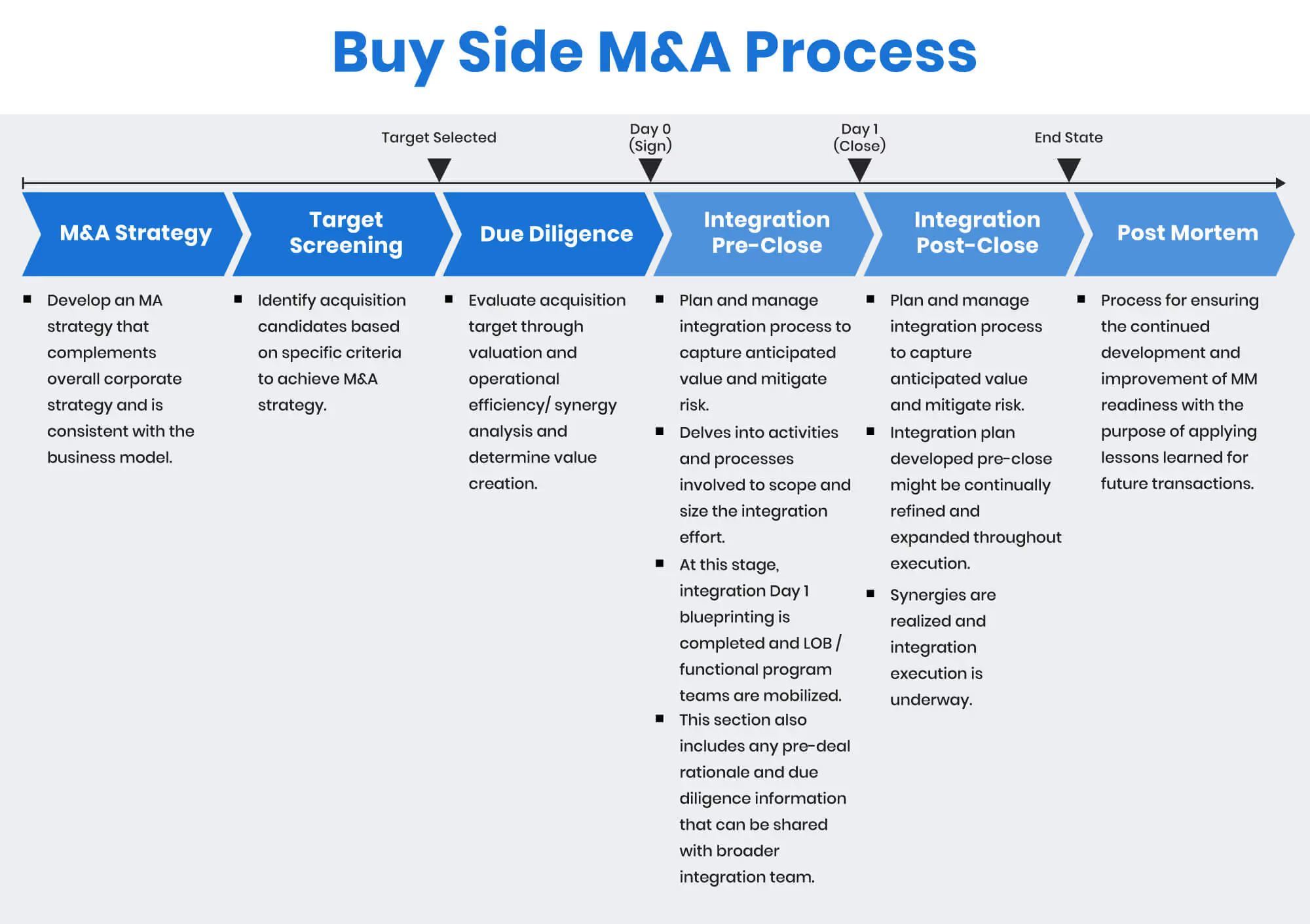

So, the classic buy-side M&A process can be visualized in the following image:

But we want to describe this process from a slightly different angle to make it clearer for the reader. In this article, we outline the 7-step process and explore the key principles of Buyer-Led M&A™, along with important regulatory and legal considerations.

In this article:

- Buyer-Led M&A™: Key Principles of a Successful Buy-Side M&A Strategy

- Buyer-Led M&A™ Methodology and Its Role in Supporting Buy-Side M&A Transactions

- Buy-Side Team Structure & Roles

- Buy Side M&A Process Steps

- Risk Management Across the M&A Lifecycle

- Regulatory and Legal Considerations

- Frequently Asked Questions

- Conclusion

“Disorganized teams don’t just lose slower—they lose deals.”

- Kison Patel

Shared at The Buyer-Led M&A™ Summit (watch the entire summit for free here)

Buyer-Led M&A™: Principles of a Successful Buy-Side M&A Strategy

Before we dive into the 7 steps, here’s a quick primer on Buyer-Led M&A™. The Buyer-Led M&A™ framework is a proactive approach to M&A that empowers buyers to lead the entire process, ensuring strategic alignment and long-term value creation. This methodology addresses common pitfalls in traditional, seller-driven M&A processes by emphasizing intentionality, efficiency, and collaboration.

The Buyer-Led M&A™ approach focuses on five strategic pillars designed for optimal execution. We’ve briefly summarized the five key pillars below.

- Never M&A on Impulse

Prioritize sourcing deals that align with your long-term strategy. Continuously assess the deal thesis (the value the deal will bring), cultural alignment (the feasibility of integration), and integration strategy (execution plan) to ensure each acquisition is deliberate and purposeful.

- Unified Processes, Tools & Data

Implement a centralized platform, such as DealRoom’s M&A Platform, that serves as a single source of truth for all M&A activities. This integration enhances visibility, streamlines workflows, and maximizes the return on investment from AI tools, promoting alignment among all stakeholders throughout the M&A lifecycle.

- Synchronized Diligence & Integration

Align due diligence and integration phases to achieve Day 1 Readiness and expedite synergy realization. This synchronization reduces the knowledge gap between these stages and prevents the need for redundant diligence efforts post-close.

- Built for Scalability

Develop scalable processes that support efficient growth through multiple concurrent acquisitions. Foster a culture of continuous learning, utilize flexible team structures, and allocate resources effectively to manage deal flow, prevent burnout, and maximize deal success.

- Win-Win Approach

Commit to creating lasting value for both buyers and sellers. This involves focusing on all aspects of the deal (financial, human capital, product, and physical assets) to ensure that both parties can maximize their assets in the post-close combined entity.

Buyer-Led M&A™ Methodology and Its Role in Supporting Buy-Side M&A Transactions

The Buyer-Led M&A™ methodology stands apart by providing a proactive, strategic framework that supports buy-side M&A transactions at every stage. Traditional M&A processes often place the seller at the center of deal flow, relying on banker-driven methods and fragmented systems.

In contrast, the buy-side approach allows the buyer to take full control, ensuring that each deal aligns with long-term strategic goals, rather than simply reacting to market opportunities.

A critical aspect of the Buyer-Led M&A™ approach is its focus on intentional deal sourcing. Rather than waiting for potential targets to come to the table, this methodology empowers buyers to actively identify and approach companies that align with their strategic roadmap.

By using specialized deal-sourcing tools, such as DealRoom’s M&A Platform, acquirers can streamline target identification, ensuring only companies that meet specific criteria are considered.

The integration of deal-sourcing tools enhances the buy-side M&A process by centralizing target data, automating initial evaluations, and improving stakeholder communication. This unified platform not only accelerates deal sourcing but also ensures that all parties, including investment bankers, legal advisors, and M&A teams, are aligned, reducing the risk of missed opportunities or inefficiencies.

Furthermore, by managing all deal-sourcing activities in one place, buyers can leverage AI-powered tools to predict target suitability based on past M&A trends and metrics.

In addition, the Buyer-Led M&A™ methodology emphasizes aligning due diligence with integration activities. By ensuring these phases are planned in parallel, buyers can reduce delays and foster team cohesion more effectively.

This strategic alignment across sourcing, diligence, and integration creates a seamless workflow that drives successful buy-side acquisitions, ensuring each step of the process adds measurable value.

By combining the Buyer-Led M&A™ methodology with cutting-edge deal-sourcing tools, buyers can gain a distinct competitive advantage, ensuring that their acquisitions are purposeful, efficient, and aligned with long-term business objectives.

Visit this article for a more detailed explanation of Buyer-Led M&A™.

Buy-Side Team Structure & Roles

Buy-side deals collapse when ownership is undefined. High-functioning teams define clear points of accountability upfront and maintain that accountability throughout due diligence and integration. Clear lines of responsibility enable rapid decision-making and reduce rework.

Deal Sponsor

The deal sponsor owns the “why.” Typically, this is the person who crafts the acquisition thesis, signs off on major strategic decisions, and removes roadblocks when cross-functional teams cannot reach alignment.

The deal sponsor should not manage task lists. Rather, they should champion the deal's strategic intent and get involved when trade-offs arise.

Corporate Development/M&A Team Lead

This individual owns the process. They are responsible for timelines, coordination, and decision-making flow. The CD team lead translates strategy into execution and keeps the diligence machine humming without chasing people for updates all day. Having one point person is more effective than five part-time owners.

Functional Diligence Owners

Each function owns its lane:

- Finance validates the numbers.

- Legal handles risk exposure.

- Product and technology assess fit and scalability.

- HR evaluates talent risk.

Ownership here means real accountability, not review-only signoff. Each lead drives findings and flags issues early.

Integration Lead

The integration leader owns value capture after transaction close, but they should also influence decisions before close. This person assesses integration readiness, identifies dependencies, and raises any concerns about how those dependencies will impact promised synergies.

How Buyer-Led M&A™ Reduces Handoffs

Buyer-Led M&A™ keeps ownership with the buyer from start to finish. Strategy, diligence, and integration stay connected. Work does not bounce between bankers, consultants, and internal teams without context.

When there are fewer handoffs, there are fewer gaps and holes in the team’s understanding of what matters and why decisions are made.

Why Integration Leadership Should Be Identified Pre-LOI

Integration risks don’t begin at transaction close. They begin when your target enters your deal funnel. If you wait until after the letter of intent (LOI) to designate an integration leader, you’ll continue to be surprised by unforeseen issues, such as technology or product mismatches, talent risk, or hidden dependencies between the two companies.

Waiting until after the LOI to assign an integration leader may mean your teams discover these risks too late. When you involve your integration leader before the LOI, your teams can challenge assumptions well before the deal terms are agreed. Synergy plans remain realistic, and post-close execution is smooth because planning began well before signing.

Buy Side M&A Process Steps

Now, let’s review the 7 steps in the buy-side M&A process, including:

- Developing a long list of companies

- Making initial contact

- Choosing between targets

- Making an offer

- Due diligence process

- Closing the deal

- Post-merger integration

1. Developing a long list of companies

Successful buy-side M&A begins long before a deal is in motion. Effective M&A target identification is the keystone to good dealmaking.

It’s not enough to take a scattergun approach and develop a long list by looking at all companies that fit a broad set of criteria. If you find yourself doing this, step back and ask yourself why you want to acquire a business in the first place.

Instead, take a strategic approach to developing a buy-side M&A target list. Consider how each target aligns with your strategic growth objectives. What does the merged firm subsequently look like? Are you looking to enter new markets? Does your company want to gain an edge by acquiring new technologies? Are you aiming to achieve economies of scale?

The more questions you ask, the greater your filter will be. It’s also helpful to establish comprehensive buy-side acquisition criteria. Factors such as industry sector, company size, geographical location, and financial performance can help you refine your target market for acquisitions.

This process will help you arrive at a suitable long list of targets.

-2.avif)

2. Making initial contact

Experience tells us that your long list will quickly be whittled down to a shortlist.

The reasons for this are manifold, but typically include:

- The owners of a target company have no interest in selling.

- They are interested in a sale but not at a reasonable price.

- The current state of the target company’s financial statements makes a deal unappealing or unfeasible.

The companies that don’t bring this baggage make it onto your shortlist.

Initial contact typically falls into unsolicited contact, where you reach out via LinkedIn, a call, or an intermediary such as a lawyer or investment banker, or solicited contact, where the target company is already listed for sale on one of the many M&A platforms.

In the case of the former, we strongly suggest using an intermediary if the target is a company in your vicinity. The approach will be taken more seriously, and there’s less risk of it looking like you’re simply aiming to gain trade secrets from a rival firm.

In the case of dealing with a company listed on an M&A platform, you typically will not be able to establish the identity of the company before signing a confidentiality agreement with that company’s investment banker.

Once signed, the investment banker will provide you with the company's investment memorandum. This is a confidential document, typically 20-30 pages, that outlines the most relevant details of the company.

This step ensures that only viable, strategically aligned opportunities move forward, reducing wasted time and effort throughout the buy-side M&A process.

Related: Best Mergers and Acquisition Courses

3. Choosing between targets

Use the information gained from step 2 to make a more informed decision about which company represents the most attractive acquisition. Focus on gathering strategic insights about the target’s motivations, culture, and market position to refine your shortlist.

Having spoken to a few companies by now, you should have a better feel for the industry dynamics and which companies look better placed to take advantage of them. Consider factors such as the company’s financial and operational fit, cultural alignment, and integration potential. Can the target company be successfully integrated into your organization’s existing structure without excessive disruption?

When deciding which company you would like to proceed with a transaction on, it's always a good idea to return to your initial question of why you’re undertaking this process in the first place.

4. Making an offer

Having discussed a potential deal with the company owner and/or its investment banker, you should now already have a feel for what the sell-side is looking to achieve in a sale, and what you’re willing to pay.

There is invariably divergence between the two. This is to be expected.

But be aware that your offer should be in the ballpark of the amount cited by the sell-side. If you feel you’re too far out, be polite and say it. Do not make a derisory offer, as it may jeopardize a future deal between your companies.

A reasonable offer is made through a Letter of Intent (LOI). This is a non-binding initial written offer that outlines how you will structure the deal for the target company and defines the due diligence scope upfront to prevent surprises later in the process. Include any other details that you would like to be addressed to ensure alignment on valuation, deal terms, and post-close expectations.

Assuming your LOI contains a reasonable offer, you can expect the seller to ask their attorney to review the letter's finer details and to receive a response within a few days, often requesting changes.

Effective negotiations require a balance of strategic planning, flexibility, and clear communication. Here are key strategies for structuring offers, managing counteroffers, and handling common negotiation challenges.

Structuring offers

Begin with a well-researched, competitive offer that reflects the company’s true value, factoring in strategic fit, synergies, and market trends. Clearly outline deal terms, payment structure (e.g., upfront cash, earnouts, or equity components), and any contingencies.

Managing counteroffers

Expect the seller to push back on terms. Be prepared with data-backed justifications for your offer and have flexibility in areas such as financing structures, transition periods, or non-compete agreements. Prioritize non-monetary concessions that create value without inflating costs.

Handling common negotiation challenges

Common negotiation challenges include price gaps, cultural fit concerns, and seller emotion. If there’s a significant valuation gap, explore earnout structures or performance-based incentives to bridge the difference.

Address integration concerns early by discussing leadership roles, employee retention strategies, and shared company values.

Many business owners have strong emotional ties to their companies. Approach negotiations with empathy, demonstrating how your acquisition will preserve and enhance their legacy.

After some back and forth, you should hope to reach a deal in principle that will allow you to begin due diligence.

5. Due diligence in buy-side M&A

Do not rush due diligence.

As tempting as it may be at this stage to spend as little time as possible on the process in order to push through a deal and take control of the target company, it pays in the long run to invest time and effort here.

Traditional M&A processes often treat due diligence and integration as separate phases, leading to inefficiencies and unexpected post-close challenges. Aligning due diligence with the buy-side M&A process integrates these steps to accelerate synergy realization.

As an experienced conduit in due diligence proceedings, DealRoom's diligence module has collected due diligence templates for buy-side M&A. Do yourself a favor and look through the lists here before beginning:

- Financial due diligence

- Legal due diligence

- Operational due diligence

- HR due diligence

- Intellectual property due diligence

At all stages of the buy-side M&A process, keep in mind how (and if) this company is going to fit with your own after the transaction has closed. Begin integration strategy discussions while conducting due diligence to ensure day-one readiness. Use a unified platform like DealRoom’s M&A Platform to store diligence findings, integration plans, and communication records.

Ensure that finance, legal, HR, and operations teams are aligned throughout the diligence process. Even if the company looks good under the hood, it may be that it’s just not going to merge well with your own company, whether for cultural reasons, strategic fit, or any other motive.

Whatever the reason, don’t be afraid to pull out of a deal if the due diligence process tells you that it’s the right thing to do.

Useful resources:

How to Conduct Due Diligence When Buying a Business: Advice from M&A Experts

M&A, Due Diligence, and Integration from an Attorney's Point of View

6. Closing the deal

If you conducted due diligence properly, you will now know the target company (and its competitive environment) intimately.

Do the initial deal terms outlined on the LOI still strike you as reasonable?

If not, now is the time to contact the target company owner and outline your reasons. Use kid gloves: At this stage, they’re already committed to selling the company, and being told it is overpriced will be deflating.

The final contract for sale will look a lot like the LOI, the difference being that it is a legally binding document (and states as such at the outset).

It includes details about how the target company’s share certificates will be transferred to you.

Typically, both parties to the transaction agree in advance on an attorney who will act as the escrow agent. With the money transferred and share certificates in hand, you have officially closed the deal for the target company.

Use a centralized platform like DealRoom’s M&A Platform to ensure compliance and documentation control and facilitate transparent communication between all stakeholders to maintain trust and momentum. Most importantly, keep in mind that closing is not the finish line. It’s the starting point for realizing the value of the acquisition.

7. Post-merger integration for buy-side M&A

In a successful buy-side M&A, post-merger integration (PMI) is just as important as the deal itself. While traditional, seller-led integrations often focus on the seller’s needs and preferences, buy-side integration flips the script by prioritizing the acquirer's strategic goals and ensuring that the acquisition seamlessly aligns with their existing operations and long-term vision.

A buy-side integration approach provides greater control and flexibility, enabling the buyer to integrate the target company in a way that maximizes synergies, reduces disruption, and enhances value creation.

In a buy-side M&A, integration strategies should start as early as possible to ensure smooth transitions. By beginning integration planning during the due diligence phase, buyers can set the stage for day 1 readiness and align operational, cultural, and strategic elements well before the deal closes.

This early preparation also helps identify potential obstacles in advance, whether related to technology integration, workforce alignment, or customer transition. By proactively addressing these challenges, buyers can avoid common pitfalls that hinder post-acquisition success.

Here are a few tips to keep the post-merger integration process running smoothly:

- Prioritize employee engagement and leadership integration to minimize disruption.

- Develop retention strategies, such as incentive plans and career development opportunities, to keep critical employees engaged.

- Ensure seamless technology transitions by consolidating platforms, data sources, and security protocols.

- Execute on identified synergies, such as cost savings, operational efficiencies, and market expansion opportunities, as early as possible.

- Use post-close insights to refine future M&A processes, enabling a scalable and repeatable framework for growth.

- For this process, too, DealRoom has developed a set of integration templates that you can avail of to ensure that you’re ticking all of the boxes and maximizing value from the process.

By focusing on buy-side integration, companies can drive a more strategic and controlled post-merger process. This approach differs from traditional seller-driven models, in which integration plans are often dictated by the seller's needs. In contrast, buy-side integration puts the acquirer in control, enabling a more thoughtful, deliberate process aligned with long-term goals.

Finally, using a unified M&A platform like DealRoom can streamline buy-side integration by centralizing plans, tracking progress, and fostering cross-team communication. This centralized approach reduces confusion, ensures that deadlines are met, and helps you stay on track to fully integrate the target company, realize synergies, and achieve the desired outcomes from your buy-side M&A transaction.

Risk Management Across the Buy-Side M&A Lifecycle

Every buy-side deal carries risk. The mistake teams make is treating risk as something to manage only during diligence. Real risk management spans the full lifecycle, from sourcing through integration. Strong buyers plan for it early and accept walking away when the math or reality no longer works.

Sourcing Risks

Bad deals often look compelling early. The strategic fit may be thin. The story may lean too hard on the banker’s narrative. Operational reality remains unclear. When sourcing remains reactive, teams continue to invest time in deals that should have exited the funnel much earlier.

Diligence Blind Spots

Running into risk during diligence is often the result of teams focusing on checking boxes rather than making decisions. Financials get reviewed in a vacuum. Technology risk is understated. Commercial assumptions go unchecked. These blind spots usually surface late, when timelines feel tight and teams are under pressure.

Regulatory Delays

Regulatory risk slows momentum and burns internal patience. Missed filings, underestimated review timelines, and unclear ownership of regulatory workstreams can delay deal progress. Delays here often ripple into financing, employee retention, and deal credibility.

Integration Failures

Most deal value is lost after closing. Systems aren’t connected, key employees leave, or operating models don’t align. Failure to integrate is rarely the result of one catastrophic error. It’s the cumulative effect of dozens of small risks left unchecked.

How Buyer-Led M&A™ Mitigates Risk

Buyer-Led M&A™ shifts risk management from reactive to deliberate. Instead of discovering problems late, teams surface them early while options still exist. Ownership stays with the buyer, decisions stay grounded, and risk gets addressed before it compounds.

- Parallel Diligence and Integration - Buyer-Led M&A™ treats integration planning as part of diligence. Teams assess feasibility while validating the deal. Risks surface earlier, and adjustments happen before commitments lock in.

- Centralized Data - A single source of truth limits miscommunication. When diligence findings, deal assumptions, and integration planning are housed in a single central repository, risks are identified much more quickly. Teams can make decisions based on facts rather than memory or water-cooler conversations.

- Early Go or No-Go Discipline - Strong buyers know when to walk away. If the deal no longer makes strategic or operational sense, they don’t feel pressure to move forward. There’s no sunk cost fallacy and no carrying momentum forward simply because that’s how things have always been done.

Sometimes, Walking Away is the Right Choice

If you’ve run a rigorous process and walked away from a transaction, that doesn’t equal failure. Walking away saves your team capital, time, and most importantly, your credibility when dealing with future sellers. The best buy-side teams judge success by decision quality, not deal volume.

The table below breaks down buy-side M&A risks by stage and mitigation strategy.

Regulatory and Legal Considerations

M&A transactions must comply with a wide range of regulatory and legal requirements to avoid complications and ensure a smooth process. Here are a few best practices to ensure compliance:

- Ensure compliance with national and international competition laws to prevent monopolistic practices and regulatory challenges.

- Obtain necessary approvals from industry regulators, government bodies, and financial authorities to move forward with the deal.

- Review existing contracts, supplier agreements, and customer obligations to ensure compliance and avoid legal conflicts.

- Address employee rights, benefits, and union agreements to facilitate a smooth transition.

- Ensure proper handling of sensitive data, compliance with GDPR, CCPA, or other relevant privacy laws, and secure IT system transitions.

Frequently Asked Questions

What is Buyer-Led M&A™, and how is it different from traditional M&A?

Buyer-Led M&A™ is a structured approach where the acquiring company takes full control of the M&A process, from deal sourcing to post-merger integration. Unlike traditional M&A, which often relies on banker-driven processes and fragmented tools, Buyer-Led M&A™ emphasizes strategic sourcing, unified data management, synchronized diligence and integration, and a win-win outcome for both buyers and sellers.

Why is intentional and strategic deal sourcing important in buy-side M&A?

Intentional sourcing ensures that every acquisition aligns with long-term business goals, reducing the risk of impulse-driven deals. By identifying and prioritizing targets that fit a strategic roadmap, companies can maximize synergies, avoid cultural misalignment, and ensure successful integration post-acquisition.

How can companies ensure successful post-merger integration?

Successful integration starts with early planning. Companies should focus on aligning corporate cultures, integrating IT systems, retaining key talent, and achieving projected synergies. Using a centralized data platform and maintaining clear communication across teams helps streamline the process.

How does synchronized diligence and integration improve deal success?

By conducting due diligence and integration planning simultaneously, buyers can reduce inefficiencies, avoid post-close surprises, and accelerate synergy realization. This approach ensures that integration strategies are already in place by Day 1, minimizing disruptions and maximizing value.

How can companies scale their M&A strategy for multiple acquisitions?

Scalability in M&A requires a repeatable process, the right team structure, and a technology-driven approach. Companies should continuously refine their strategy based on past deal insights, allocate resources effectively, and use AI-driven tools to manage concurrent acquisitions efficiently.

How does a unified platform (like DealRoom) improve the due diligence phase compared to using spreadsheets and shared drives?

Traditional tools create data silos, version chaos, and communication gaps. A unified platform centralizes all requests, documents, and findings, ensuring everyone works from the latest information. It automates Q&A workflows and tracks progress transparently. Critically, it structures data so it seamlessly informs integration planning, turning diligence from a compliance exercise into a value-creation foundation.

How early in the process should we involve functional teams (IT, HR, Operations) beyond the core M&A team?

Immediately. Under the Buyer-Led M&A™ methodology, functional diligence owners should be identified and involved from the target shortlisting phase. Their early input on technical feasibility, talent risk, and operational fit is critical for realistic synergy planning and prevents late-stage surprises that can derail a deal or destroy value post-close.

Key Takeaways

- Successful buy-side M&A requires a proactive, Buyer-Led M&A™ approach that prioritizes intentional deal sourcing, unified tools and data, and synchronized diligence and integration to avoid reactive, banker-driven deals that destroy value.

- The real determinant of deal success is what happens before and after signing, with early integration planning, clear ownership, and disciplined risk management across the full lifecycle being essential to realizing long-term strategic value.

Buy-side M&A success goes beyond closing deals. Real success comes from creating long-term value. The Buyer-Led M&A™ framework ensures that acquisitions are strategically sourced, efficiently executed, and seamlessly integrated.

If you’re one of the companies fortunate enough to be on the buy-side, you’ll benefit from using DealRoom’s buy-side M&A checklists for the process, which was developed based on feedback from some of the biggest intermediaries in the industry.

Ready to take a buyer-led approach to M&A? Talk to DealRoom today to see how our platform can help you streamline your acquisition process and maximize value creation.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)