M&A is inherently complex, especially when managing multiple deals simultaneously. So, it becomes even more necessary for acquisitive companies to find ways to streamline their process and increase their deal efficiencies.

Luckily, there are many tools and software platforms that promise to do just that. Unfortunately, not all tools offer the same value, and it’s important to understand the landscape in order to make the right technology buying decisions for your company. This blog seeks to provide an overview of the M&A technology landscape so you can choose the best tools for your company's unique goals.

In this article:

What Are M&A Software and Tools?

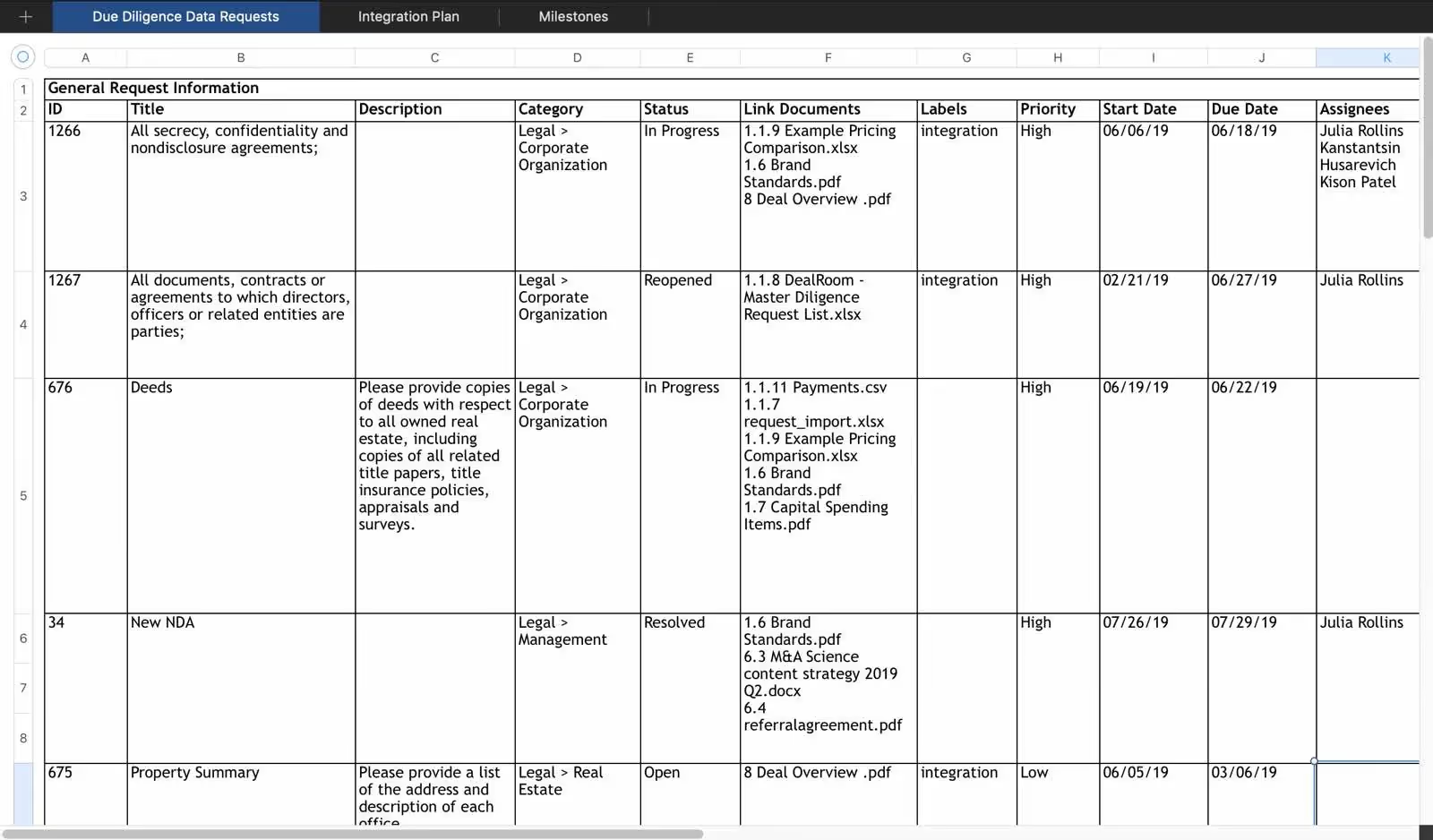

M&A software and tools are platforms used by professionals during an M&A transaction. This can include platforms that perform a variety of functions such as pipeline management, data storage, project management, track deals in real-time, and manage the overall M&A strategy.

Some M&A teams use different tools for different functionalities throughout a deal’s lifecycle. For example, the corp dev team uses a virtual data room while the integration team uses a project management tool. On the other hand, others save time and cost by using one M&A software platform for everything.

Different Types of M&A Tools and Software

There are different types of tools and technologies an M&A team can leverage. While many of these tools have emerged during the last decade, they are changing the way deals are organized and managed. Here are a few M&A tools available to M&A professionals today.

.avif)

Let’s take a moment to walk through the different categories of tools and discuss pros and cons of each.

Related: Reasons for Mergers and Acquisitions

1. Status Quo

“Status Quo” refers to a series of tools that aren’t purpose-built for M&A but are often used by deal teams. Often, these teams are using traditional, siloed approaches to dealmaking that rely on tools like Excel for managing M&A pipeline and “tracking” the status of due diligence requests, all while communicating deal-specific information on Outlook, Gmail and storing documents in Sharepoint or Drive.

For example, once a document has been uploaded into Drive, an individual will have to manually update the line item request and mark it as complete in the Excel tracker.

Pros

- These tools are widely used across industries, making them familiar to team members and requiring minimal training for adoption.

- Many of these tools come at a little or no cost, which is beneficial for teams operating within financial constraints.

- The “Status Quo” approach provides ease of use, cost-effectiveness, and straightforward adoption.

Cons

- Due to deal information being spread across multiple status quo tools, inefficiencies in deal management arise.

- There’s a constant risk of crucial details slipping through the cracks while managing diligence requests in Excel and storing corresponding documents in data rooms.

- The added complexity of not having a centralized platform to exchange deal-specific information or a simple way to request additional details in Excel can result in inefficient collaboration among stakeholders. This further compounds the already complex nature of M&A.

Drawing from their own experience, an M&A professional stated:

“We continue to fall back to doing things a lot more manually. So a lot of excel, a lot of team calls. We have sharepoint now instead of drive and whatnot, but it's pretty complicated for a M&A process”.

2. CRM

CRM systems are invaluable tools for managing deal-related data efficiently, offering a centralized platform for organizing crucial information. Popular CRM tools like Salesforce, HubSpot, and DealCloud are widely used by M&A professionals to streamline their pipeline management processes.

Pros

- In M&A transactions, these systems serve as a repository for storing and organizing all pertinent deal information, enhancing collaboration and accessibility.

- They offer automation capabilities, allowing teams to automate repetitive tasks and ultimately save time during deal execution.

Cons

- Customizing CRM platforms to align with the unique requirements of each deal can be complex and time-consuming.

- Since no two deals are identical in an M&A transaction, extensive customization is often necessary, requiring the expertise of IT professionals or consultants.

- Integration challenges with other M&A tools and software platforms can also arise, potentially leading to data silos and inefficiencies in workflow management.

An experienced practitioner in Mergers and Acquisitions, formerly acquainted with CRM tools, remarked:

“Our CRM and pipeline tool, implemented over a decade ago, has essentially become obsolete. Despite occasional attempts to utilize it, it's proven ineffective. We often resort to manual methods due to its inefficiency. “

3. Financial Database

Financial databases, such as PitchBook, Grata, DealRoom.co, SAP Capital IQ, and more serve as extensive repositories of financial information, offering detailed profiles of companies and market insights.

Pros

- M&A professionals can leverage these databases to conduct due diligence, assess valuation, identify potential targets, and gain a deeper understanding of market dynamics.

- They also provide access to a wealth of data, including financial statements, transaction history, industry benchmarks, and competitor analysis, enabling M&A professionals to make informed decisions and mitigate risks.

Cons

- While they excel in identifying and establishing a targeted pipeline for deal-marketing, they only support a small piece of the M&A deal lifecycle.

- You will need to manage other tools alongside a financial database.

As one user expressed:

“PitchBook is imperfect just because I think it has a very outdated UI and… I use a mix of Microsoft one note to record information in real time. I can manage a pipeline just like a target list in PitchBook which is fine, but there's some issues with that too and it's not a very useful format for reporting.”

4. Project Management Tools

Project management tools like Clickup, Excel, Smartsheet, Wrike and others have been around for years, but their use in M&A is relatively new. Project management in M&A is not geared towards one specific aspect of a deal but towards a team’s overall workflows and processes. These tools help teams identify and create consistent and repeatable workflows that aim to optimize operational efficiency.

Pros

- These tools can enable everyone - internal or external stakeholders to organize their tasks, track progress, and allocate resources effectively.

- These tools promote transparency and accountability, ensuring team members are aligned and informed about deal statuses and responsibilities.

Cons

- Project management tools, while beneficial for overall workflow management, are not specifically tailored for M&A purposes.

- As a result, teams may find themselves juggling between different platforms for storing deal documents, managing requests, and utilizing project management tools.

- This fragmentation can lead to inefficiencies and potential communication gaps, as stakeholders may need to navigate multiple systems to stay informed about the deal's progress.

One of the M&A professionals using smartsheet for their pipeline management stated:

“It’s hard to make any updates on Smartsheets to our deal pipeline midway through the process. We have a couple of 100 companies on that list right now, and it's just hard when you want to add something in like a new column and it just messes everything up. And the analytics on it aren't useful, and we have to redo it from scratch every time you change something -it's not very intuitive."

5. Virtual Data Rooms

Virtual data rooms (VDRs) are one of the most well-known types of M&A tools. VDRs have been around for almost two decades, and there are hundreds of VDR providers available like FirmRoom, DataSite, Share File, IntraLinks,, iDeals, Firmex, and more.

Pros

- They are best known for their ability to securely store confidential information that is collected and shared during the due diligence process. For example, with a virtual data room, investment banks can share critical information between buyers, sellers, and other third parties, while staying in control of who can see what.

- Most VDRs adhere to strict security standards set by FINRA and the SEC, so all information stored in a VDR is 100% secure. Typically, traditional VDRs are only used during due diligence and in correlation with Excel trackers.

Cons

- The abundance of deal-related documents stored within VDRs can make it difficult to determine which document corresponds to specific requests.

- It may require manual efforts to send emails once each document is uploaded, leading to increased workload and organizational complexities.

- VDRs only solve a small piece of the M&A lifecycle. After the due diligence process is complete, teams have to move their documents out of a VDR or consistently reference them across platforms.

An M&A professional shared-

“Share File, acts as our central hub for deal documents and information. Storing documents alongside other prospect-related data creates a cluttered and cumbersome workspace , making it challenging to navigate and locate specific information. SharePoint's lack of organization and cleanliness ultimately impacts our workflow and productivity.”

6. M&A Lifecycle Platform

M&A platforms are designed to be a one-stop-shop for M&A teams. An M&A platform combines the vast majority of features from the above tools (with the exception of financial databases), which in turn creates a platform designed to be used for an entire deal lifecycle. A few of the common M&A platforms include DealRoom, Midaxo, DevenSoft and DataSite.

While every different type of M&A tool provides different benefits, an M&A platform such as the DealRoom M&A Platform is the most advantageous.

DealRoom is currently the only M&A platform that disrupts the disparate ways of traditional M&A processes & tools and provides a single source of truth for end-to-end M&A lifecycle management - from pipeline into due diligence and through post-merger integration.

It helps teams to increase efficiency with automated workflows, alerts, permissions and project management abilities while also eliminating mundane tasks. At the same time, DealRoom helps teams achieve strategic alignment faster by synchronizing diligence and integration. It also prevents teams from having to switch back and forth between multiple platforms just to manage one deal.

DealRoom also provides custom templates and playbooks for the deal process, which include preloaded diligence requests and tasks that can be tailored to your specific M&A needs. You can instantly create comprehensive dashboards for a strategic overview of all deal activities and schedule the delivery of these reports to your stakeholders. It helps to manage, organize, optimize and compare multiple deals in one centralized location.

One of our DealRoom users, Ivan Golubic, CFO at FastLap, stated:

“Partnering with DealRoom changed the game for us. Now we can really plan and see where we're falling behind, where you're on track, and what are things that are missing. That's really hard to do without the right tools. Invest in the right tools, like DealRoom, and your deals will flow a lot quicker and a lot easier.”

Key Considerations When Choosing M&A Software

M&A software should have the flexibility to adapt to the demands of your team, your process, and your pipeline. Here are a few key considerations.

Scalability

Software needs to handle an increasing volume of data while maintaining performance standards and transparency. A platform that struggles to support parallel workflows or growing datasets will quickly create a bottleneck in your deal workflows.

Integration capabilities

M&A software should integrate seamlessly with your team’s existing technologies, such as CRM platforms, ERP systems, email clients, document storage, and analytics dashboards. Tools that operate in silos lead to duplicate work, inconsistent data, and misalignment among teams.

Security and compliance

Any technology platform that handles sensitive deal information must comply with regulations and standards such as those established by GDPR, FINRA, the SEC, and other oversight organizations.

Both sides of an M&A transaction require data protection through encryption, granular access controls, and audit logs. These safeguards also help to maintain trust throughout the deal process.

User-friendliness

A tool that requires weeks of onboarding or a dedicated admin to operate will fail to support the fast-paced nature of M&A. The interface should be clear and functional for all participants including analysts, associates, external advisors, and executives. Complex user interfaces can lead to delays and missed details.

Cost vs. ROI

Finally, weigh cost against ROI. While some platforms operate on a deal-based pricing model, others provide subscription-based pricing. Either way, the investment should be justified by measurable gains.

The ROI should be justified through accelerated due diligence processes and better team collaboration, which reduces the need for manual updates and produces clearer reporting results. Software should drive efficiency by speeding up deal closures and boosting confidence levels rather than adding another file storage option.

Common Mistakes to Avoid When Adopting M&A Tech

New M&A technology can accelerate deal timelines and improve coordination if it’s properly implemented. Teams repeatedly experience preventable issues that hinder efficiency. Here are some common pitfalls to avoid when introducing new tools into your M&A process.

Over-reliance on manual processes

Many teams still rely on Excel trackers to manage deal flow management and diligence request processes. While familiar, these tools introduce risk.

The manual process of updating status fields while managing version control and coordinating between spreadsheets creates opportunities for human error. Essential tasks get missed while data becomes obsolete, leading to delayed decision-making. As deal volume increases, operating multiple deals causes these cracks to widen quickly.

Tool sprawl

The need to switch between different systems, such as a CRM and a project management tool, creates extra obstacles for users. While every platform provides functionality, the lack of integration creates silos.

Teams lose valuable time duplicating data across multiple systems and searching for updates. Tool sprawl also creates blind spots—when platforms don't talk to each other, neither do the teams using them.

Ignoring post-merger integration needs

Closing the deal is important, but M&A teams shouldn’t lose sight of integration needs. When teams don’t prepare for integration during the early stages, critical information gets lost between diligence and execution.

Integration teams find themselves trying to reconstruct earlier decisions because they were made without proper foresight. The M&A tech stack needs to enable a seamless transition between the diligence and integration phases rather than treating them independently.

Underestimating training and change management

Even the best software fails if teams won’t use it. People resist new processes when they lack proper training or implementation plans are unclear.

Users who don’t trust a tool or fail to recognize its benefits typically revert to their previous methods. Change management must be intentional. Stakeholders must recognize how the new platform benefits their workflow and receive support throughout the transition period to ensure successful adoption.

Trends in M&A Technology

M&A technology isn’t standing still. As deal teams push for faster timelines and better outcomes, new tools are reshaping how deals are sourced, evaluated, and executed. Here’s a look at the current and emerging trends in M&A technology.

AI and automation

Due diligence processes are evolving through the application of machine learning techniques. AI technology now enables professionals to pinpoint potential issues while identifying key contractual terms and discovering irregularities in financial information without having to manually examine numerous documents.

The utilization of automated target screening enhances the speed of initial deal sourcing phases by enabling teams to concentrate on leads with greater potential. These tools reduce time spent on repetitive review tasks, letting teams concentrate on strategy and negotiation.

Blockchain for secure document sharing

Blockchain allows users to share sensitive deal documents with built-in transparency and immutability. The self-executing smart contracts built into blockchain systems have the potential to automate processes like losing mechanics, escrow triggers, or compliance milestones. This approach is promising for decreasing conflicts and building trust among parties, although this technology isn’t yet fully mature.

Predictive analytics

Through predictive models, M&A teams can now assess how likely a deal is to succeed and identify possible integration issues. Teams can foresee potential risks and take informed actions early by reviewing historical data such as financial records, team organization, and previous integration timelines.

Collaboration tools

Modern deal environments now frequently utilize real-time co-editing functions alongside fully integrated virtual workspaces. Teams are abandoning static Excel trackers and PDF exchanges in favor of dynamic platforms that allow stakeholders to comment on tasks and share updates in one centralized location. The tools serve to minimize delay and enhance team synchronization, enabling teams to work as if they’re in the same room—even when they’re not.

Frequently Asked Questions

Can small or mid-sized firms benefit from M&A software?

Yes! M&A software is scalable and can be tailored to fit the needs of firms of all sizes. For smaller teams, it helps reduce manual workload and improves deal execution speed without requiring extensive resources.

How do M&A lifecycle platforms differ from other tools?

Unlike standalone tools (e.g., CRMs, VDRs), M&A lifecycle platforms provide an all-in-one solution covering the entire deal process—from sourcing to integration. They reduce tool sprawl by consolidating functionalities like pipeline tracking, diligence management, and post-merger planning into a single platform.

Why is an M&A platform better than using multiple tools?

An integrated M&A platform (like DealRoom) reduces inefficiencies by:

- Eliminating data silos and duplicate work

- Providing a single source of truth for all deal stages

- Synchronizing diligence and integration efforts

- Reducing costs associated with managing multiple subscriptions

How does DealRoom improve the M&A process?

DealRoom is an end-to-end M&A platform that:

- Combines pipeline management, diligence, and integration in one place

- Offers automated workflows, permissions, and reporting

- Provides custom templates and playbooks for faster deal execution

- Ensures secure, compliant document sharing

Key Takeaways

- The M&A technology landscape changes rapidly, and choosing the proper tools can be the determining factor in whether a deal stalls or achieves fast value creation.

- Although specialized solutions serve certain needs, an over-reliance on separate systems creates operational friction and delays progress, which adds risk.

Deal teams need an integrated platform that consolidates all stages of the M&A lifecycle, from deal sourcing to post-merger integration. DealRoom’s M&A platform eliminates outdated workflows through a centralized platform that enhances collaboration and improves transparency and efficiency.

DealRoom enables teams to expedite deal closures while improving integration processes through integrated diligence tracking, secure document sharing capabilities, automated task management system, and real-time reporting features. With all the features you need in a single platform, there’s no need to manage multiple tools. Request a demo today to learn more.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)