Divestitures can be utilized by companies looking to achieve significant growth.

Make Divestitures Part of a Corporate Development Strategy

If you’re looking at a unit in your company that is only a shell of its former self and are considering a divestment, guess what? You’re late to the game. The decision to divest should take place when an asset holds more value.

Rethink of your company as a portfolio of assets. As with any portfolio, the best way to extract value is through active portfolio management. If one division could be valued at 10x EBITDA and another at 2x EBITDA, your "portfolio" may need recalibrating.

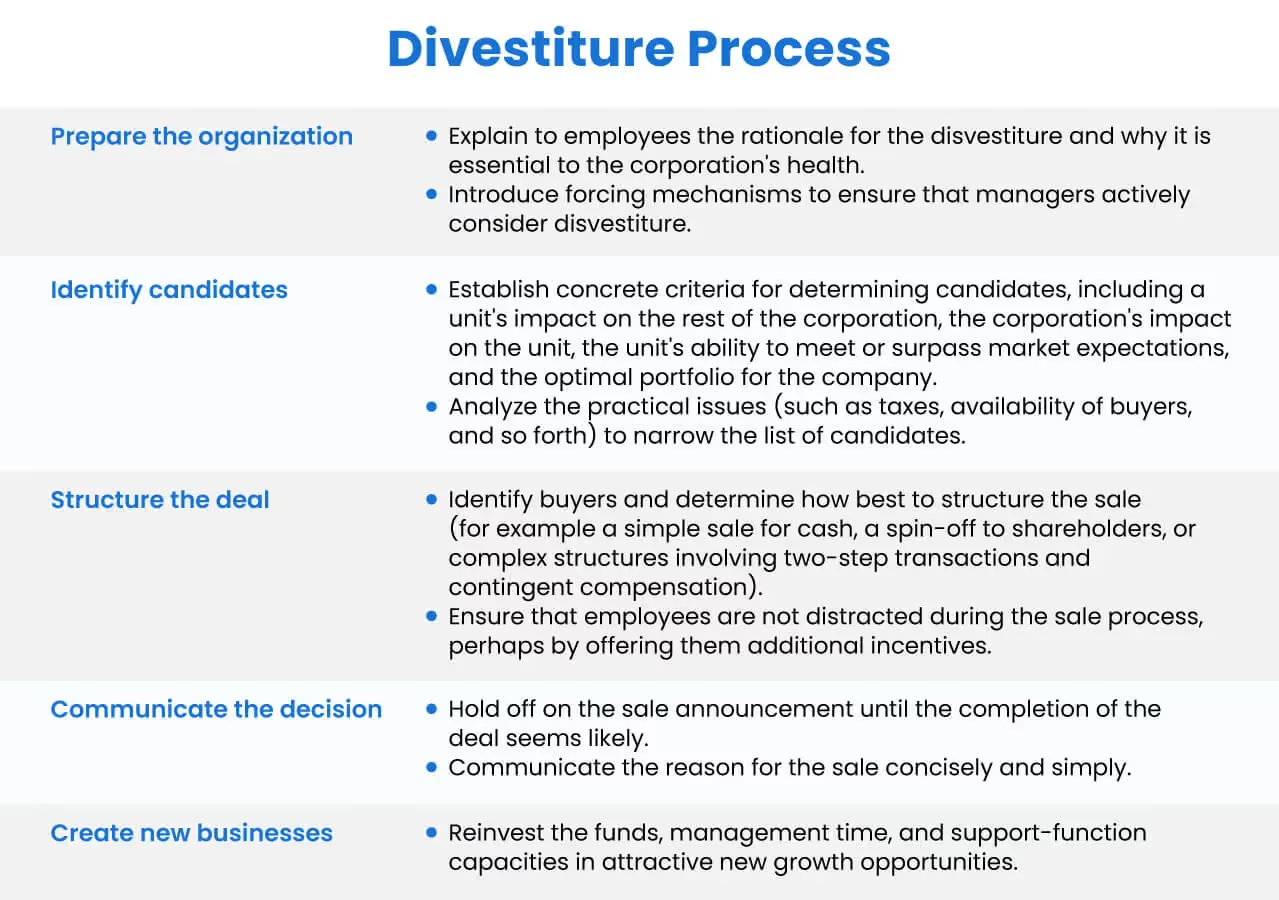

Managing the Divestiture Process

Depending on which assets are being divested, a divestiture process can be far more complicated than a typical acquisition.

Some assets tend to straddle several business units, including cross-functional teams, shared IT systems, and more.

This is where divestiture planning comes in.

If a divestiture is even under consideration, put a team in charge of managing the asset to be divested (and specifically, its disentanglement from the rest of the business), and one team in charge of managing the transaction (usually composed of members of the corporate development team).

Develop a Set of Divestiture Criteria

All assets within a company should be "divestable". So instead of asking "can this be divested", ask "under what criteria can this asset be divested?"

This is best done through an internal audit that enables teams to track the progress of different assets over time.

The set of divestiture criteria will differ with every asset but can include:

- Does the unit generate significant value for the company?

- What is the unit’s estimated income?

- Would it achieve in a market sale (using recent transactions)? If multiples are high, why? If not, why?

- What are its value drivers?

- Are there overwhelming reasons to hold onto the unit?

- What buyers currently exist for the unit?

- What are the short-term, mid-term, and long-term risks of divesting?

- What financial effects would selling the unit have on the company’s existing business?

Structuring the Deal

As with an acquisition, a divestiture can be structured into its component parts. The following represents a typical deal structure:

1. Internal Preparation:

- Communication with internal stakeholders about the deal rationale

- Prepare the divestiture team

- Bring the divestiture team and unit managers onto DealRoom (or another M&A project management platform), ensuring efficient communication and deal preparation

- Begin internal due diligence process (again in DealRoom), including business documentation and its estimated valuation

- Decide where, if anywhere, the proceeds from the sale of the unit should be invested at deal close

2. Create a Buyer Shortlist

- Develop a list, carefully selecting businesses that are not and will not represent a threat to your company if they acquire the unit in question

- Begin buyer reach-out where appropriate

3. Structuring the Transaction

- Decide how the divestiture should be structured (is an equity carve-out an option?), consider all contingencies

- Carefully manage the unit in question to ensure that no value is destroyed during the deal and operational performance is maintained

- Empower employees in the unit who were previously disinvolved in management decisions for the unit

4. Post-deal Phase

- Communicate where the deal has made the company stronger to internal and external stakeholders

- Collaborate with the corporate development team about new growth areas in light of the insights gleaned from the divestiture process

The Power of Divestitures in Action

Let's look at the example of Orsted, Denmark’s largest energy company. Orsted executed a well planned divestment strategy, resulting in significant growth.

Traditionally, Orsted focused on managing Denmark’s North Sea oil and gas assets.

Around 85% of Orsted's assets were in fossil fuels, and as late as 2006, it signed a 30-year gas agreement with Russia’s Gazprom and was using coal for energy generation at several plants.

In 2009, the Climate Change Conference was held in Copenhagen, Denmark. As a sign of the seriousness at which Denmark was taking its role as host, Orsted made a commitment to transition from an 85% fossil fuel company to an 85% renewable energy company within 30 years.

Because Orsted was able to divest its oil and gas assets quickly and reinvest the proceeds into renewable energy, that transition only took a decade.

Orsted’s stock market value grew exponentially, outperforming all of the oil and gas majors at the same time.

By combining divestitures with acquisitions, Orsted was able to execute an extremely bold vision that generated huge value for shareholders.

Orsted is now the biggest producer of wind energy in the world. By 2025, slightly over half the time for which it had originally planned the transition to 85% renewables, Orsted will provide 99% of its energy via renewable sources.

Conclusion: Start Divesting

The chances are that if you are a manager of a company with multiple business units, at least one of them is holding back your company from value generating.

The cash tied up in that business is worth far more than just its market value: the value also includes the additional cashflow that could be generated by plugging the cash into one of your company’s core value drivers.

Start planning divestitures today and avoid the fate of the manager who looks at a business unit wondering where its value went.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)