Synergies are the main benefit that M&A deals hope to capture. Understanding the types of synergies that drive mergers and acquisitions, analyzing them on paper, and maximizing them once the deal has gone through are essential to getting the most from an M&A transaction.

In this guide, we’ll review everything you need to know about synergies, from definitions and objectives to real-world examples based on actual mergers and acquisitions. We’ll also provide insights and strategies around synergy capture and value creation.

What is Synergy?

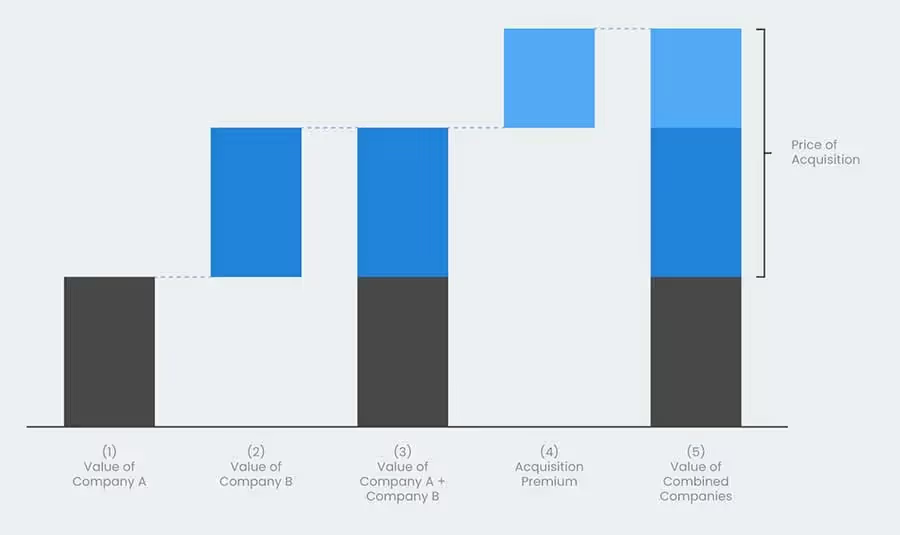

Synergy, as it relates to M&A, refers to the additional value produced by a transaction. When a transaction has synergy, the value of the newly created entity will be greater than that of its individual parts. In other words, synergy is the potential financial benefit achieved when two companies merge.

When justifying large M&A business transactions, companies invariably turn to the synergies that the deal will bring. The ultimate motive of any transaction—be it entering a new market, adding a new product line, gaining economies of scale, or driving cash flow through a bolt-on acquisition—is to generate value. Synergies offer chief executives a shortcut to achieving that value, and offer an excellent means for communicating the benefits of the deal to shareholders and investors.

The Strategic Role of Synergies in M&A

Synergies are the cornerstone of a strong deal thesis. They justify the transaction, shape the integration plan, and determine how success is measured. Strategic buyers pursue synergies with the aim of unlocking value that the two companies couldn’t achieve independently.

This means using M&A to:

- Accelerate entry into new markets

- Enhance competitive positioning

- Broaden product offerings

- Increase operational leverage

- Consolidate fragmented industries

These benefits are often the deciding factor in boardroom approvals and investor buy-in. A deal that demonstrates credible synergy potential is more likely to get funded, supported, and ultimately, executed.

Strategic acquirers also use synergies to define the deal thesis. For example, if the primary driver is cross-selling, integration efforts will focus on aligning sales teams and customer data. If the driver is cost reduction, the focus shifts to streamlining operations and eliminating redundancies. In either case, synergies are the primary goal.

Done right, they shift the entire trajectory of a business. Done poorly, they expose the deal to scrutiny, second-guessing, and long-term underperformance.

How synergy analysis fits into the broader deal lifecycle

1. Target screening

Synergy potential shapes the search criteria. If the goal is geographic expansion or vertical integration, acquirers will filter targets that complement those objectives. Strategic alignment is just the starting point; analysts also model early estimates of revenue and cost synergies to prioritize higher-value targets.

2. Due diligence

Synergy assumptions get tested throughout the due diligence process. Financials, contracts, workforce data, tech stacks, and customer overlap are reviewed to validate whether synergies are realistic or overstated. Teams use site visits, management interviews, and operational data to refine their models and flag integration risks that could undermine value.

3. Valuation

Synergy estimates directly influence the price a buyer is willing to pay. A higher synergy forecast can justify a larger premium, as long as it’s backed by credible data and discounted for execution risk. Most deal models include a separate line item for projected synergies, segmented by type (e.g., cost, revenue, financial) and timing (e.g., one-time vs. recurring).

4. Integration planning

Post-merger integration is where synergy capture becomes operational. Integration teams are built around synergy categories and held accountable for milestones. The work starts before close, with Day 1 readiness plans and 100-day roadmaps built around the fastest, most reliable value drivers.

Throughout the lifecycle, synergy analysis is iterative. Assumptions are refined at each stage as new information becomes available. The most successful acquirers use purpose-built tools like DealRoom’s M&A Platform to continuously update synergy models, track progress, and keep cross-functional teams aligned on the metrics that matter.

Risks and Pitfalls of Synergy Assumptions

Synergies can make a deal “work” on paper, but bad assumptions can also unwind value quickly after close. It’s rare for M&A failures to come from strategy. Most deals miss simply because synergy projections were too high, or execution was too slow to keep pace with the model. Here are the three most common synergy pitfalls.

The inflated bias of deal models

Deal teams are often under pressure to justify valuations in competitive bidding, which can result in overly ambitious synergy projections, such as inflated revenue growth, unrealistic cost reductions, or tax advantages that may not be legally attainable.

These assumptions get baked into the valuation and used to justify a premium. When synergies don’t materialize, the buyer ends up overpaying and underdelivering. A more disciplined approach applies probability weightings, builds in contingencies, and distinguishes between what’s possible and what’s probable.

Culture clashes derailing synergy targets

Culture can derail even the most well-reasoned synergy plan. Differences in management approach, decision-making speed, or employee expectations can hinder efforts to merge teams, standardize processes, or retain top talent.

While it’s difficult to quantify cultural factors, they’re among the most significant threats to synergy realization, especially in deals where integration relies on collaboration across functions or geographic regions. If it’s not baked into due diligence and planning, cultural risk increases the likelihood that your synergy plans will stall.

Delayed integration eroding projected benefits

Synergies lose value as integration gets pushed off. Missed milestones, lack of accountability, or poor communication between business units are all factors that can delay the transition from strategy to execution.

Each delay reduces the net present value of projected benefits and adds operational risk. Fast, focused integration is key to protecting synergy timelines. That means identifying quick wins early, locking in governance structures, and giving integration leads the tools and authority to execute.

Acknowledging these risks up-front (and planning for them) differentiates high-performing acquirers from the rest.

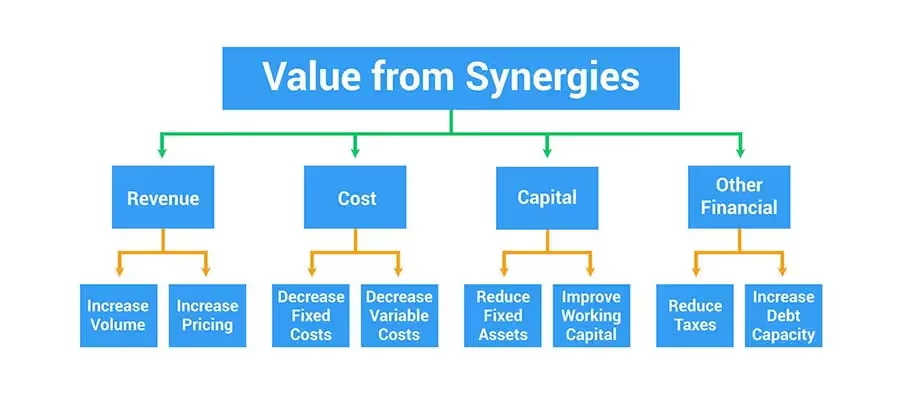

Types of Synergies

Synergies can be divided into three different categories: revenue synergies, cost synergies, and financial synergies.

Any transaction can feature elements of all three; for example, the merger of two consumer goods producers could bring revenue synergies through a complementary product range and cost synergies through savings in warehousing and distribution.

Let’s dive into each type in more detail.

Revenue synergies

Revenue synergy is based on the premise that the two companies combined can generate higher sales than each can on its own. It should be noted, however, that research shows capturing revenue synergies takes several years longer on average than capturing cost synergies.

According to McKinsey & Company, this is due to challenges such as developing appropriate targets, executing new workflows, and implementing sales strategies across all product lines and departments.

There are multiple examples of revenue synergies in M&A, but traditionally, revenue synergies result from:

- Cross-selling

- Reduction of competition

- Access to new markets

An example of revenue synergy

Disney’s acquisition of Pixar in 2006 is often cited as an example of value-generating M&A, and for good reason.The deal made sense on a lot of levels and created a series of revenue synergies that added billions of dollars in value to Walt Disney Company’s stock price.

In 2006, the company had revenues of $33.75 billion. By 2011, it had grown over 20% to $40.89 billion. In contrast, the S&P 500 shrunk 1% over the same period.

Below are just a few examples of the revenue synergies generated by the deal:

- Disney’s scale enabled Pixar to release its extremely popular motion pictures more regularly and through an expanded distribution network.

- Merchandise featuring Pixar’s characters, which included children’s favorites like Buzz Lightyear, could be sold through hundreds of Disney stores globally.

- Pixar’s characters could be promoted through Disney’s theme parks, giving enhanced exposure and sales opportunities to Pixar’s output.

Cost Synergies

If revenue synergies add value at the front-end, then cost synergies add value in the back office.

After an M&A transaction, the two merging companies will be left with excess resources (two HR departments, for example) which can then be reduced with the aim of generating cost synergies. However, achieving these synergies tends to be easier on paper than in practice.

Generally, the merger of two companies creates cost-savings through:

- Marketing strategies and channels: Broader marketing channels and increased marketing resources may result in reduced costs.

- Shared information and resources: Increasing the acquirer’s access to new research and development can yield cost savings through production advancements.

- Reduced salaries: Most companies do not need two of each C-suite position, and the elimination of some heavy-hitting salaries can result in significant cost reduction.

- Streamlined processes: Streamlined processes have the potential to make the new company more efficient; in addition, the new, larger company can usually negotiate better prices from suppliers.

An example of cost synergy

The merger of Exxon and Mobil in 1998 created the world’s largest oil company by market cap and generated massive cost savings.

As two US oil companies, they possessed several assets that were essentially overlapping each other and could be sold, including refineries and 2,400 service stations. In addition, a total of 16,000 people were laid off, generating cost synergies of over $5 billion.

Financial Synergies

Financial synergies are the improvements in financial activities and conditions that come about as a result of a transaction. These typically include a strengthened balance sheet, a lower cost of capital, greater tax benefits, and easier access to capital. The last of these is usually not easy to measure, but the logic behind the reasoning is widely held to be solid.

An example of financial synergy

A real-world example of potential financial synergies was the proposed $160 billion acquisition of Allergan by Pfizer. Ireland-based pharmaceutical company Allergan enjoyed low corporate tax rates, which Pfizer wanted a piece of. The deal would have saved Pfizer billions in annual tax returns, until the US government stepped in and prohibited the deal on that same basis.

"We have enough deal comps in our industry to understand what past transactions have realized in terms of cost synergies and revenue synergies. While they're guideposts, all companies are created differently. If you're not close to industry standards, you've got to explain why."

Speaker: Keith Crawford, Global Head of Corporate Development, State Street Corporation

Shared at The Buyer-Led M&A™ Summit (watch the entire summit for free here)

Quantifying and Valuing Synergies

Accurately estimating synergies is a critical element of a sound valuation. The estimates go beyond pricing, impacting integration plans, investor expectations and whether the deal creates value. Precision is important.

Methods for synergy estimation

Estimate synergies from the bottom up by business function (sales, operations, finance, etc.). Review and validate each line item with historical performance and input from the operations teams.

The key is to tie each estimate to a specific source: duplicate positions being eliminated, contracts being renegotiated, supplier base reduction, etc.

DCF models for synergy cash flows

Discounted cash flow (DCF) is the most common approach for valuing synergies. Break out synergy estimates by year as incremental cash flows, then discount them back to present value using a risk-adjusted discount rate. Recurring synergies have more impact in this model since they compound over time.

Using industry benchmarks

Benchmark against historical deals in the same industry and size range. Look for similar transactions where synergy targets were set and realized (or not).

This can signal where expectations are too aggressive relative to peer performance. For example, if a proposed telecom acquisition targets 30% SG&A savings, compare it to historical telecom integrations with similar scale.

Sensitivity analysis to account for uncertainty

Synergy estimates are never certain. Perform sensitivity analysis to stress test key assumptions. Vary the timing, magnitude, and cost to capture synergies to see how it impacts the valuation. Run multiple scenarios (best-case, base-case, and worst-case) to identify where risk is concentrated.

Distinguishing one-time vs. recurring synergies

Synergies primarily fall into two buckets:

- One-time synergies, including asset sales, facility closures, tax benefits, etc. One-time synergies boost short-term cash flow, but they don’t impact long-term performance.

- Recurring synergies, including consolidated operations, pricing power, cross-sell revenue, and similar benefits. Recurring items have a lasting impact on future earnings and should be prioritized in valuations.

Recurring synergies are harder to achieve but create more sustainable value. Valuation models should clearly distinguish between one-time and recurring synergies.

Discounting for execution risk

Execution risk reduces the likelihood of realizing synergies. The planned outcomes documented on paper do not always materialize because of integration challenges, delays, and other risk factors.

Apply probability weightings to each synergy based on its level of difficulty, dependency on other factors, and past performance on similar deals. A synergy with 90% probability of being achieved should be valued more than one with only 50% chance of occurring, even if the dollar amounts are equal.

Achieving Successful Strategic Alignment

Unlocking the value inherent in combining two or more companies is what should drive all M&A practice. In that sense, what passes for good M&A practice is often the same as achieving successful synergies.

However, not all acquisitions will create synergies, so the following points are important to keep in mind.

Valuation is key

Even if there are synergies to be achieved through a deal, the amount paid for the acquisition has to be low enough to benefit from them. So, if the synergies are estimated at $100M, and the acquisition price is $200M, the deal will still almost certainly be value-destructive in the long run.

You can learn more about valuation in the M&A Science Academy.

Under-promise and over-deliver

When it comes to synergies, it’s always better to understate them before the deal. If you think there is $100M of value that can be unlocked between cost, revenue, and financial synergies, it’s good to aim for them. However, history shows that it’s a much better idea to base acquisitions on realistic rather than ambitious synergies.

Focus on quick wins first

The post-merger integration phase of an M&A transaction is essentially about getting to the synergies of the deal as quickly as possible. Where integration is concerned, speed is everything. Concentrate on the quick wins first (for example, sales channel integration) and slowly work toward the more challenging ones (layoffs and redundancy packages for surplus employees).

Post-Merger Integration Best Practices for Synergy Realization

Successfully capturing synergies requires careful execution and follow-through. The integration phase is where most deals either create or destroy value, and the first 100 days of implementation are critical. Follow these best practices to make synergy objectives a reality.

Develop a first 100 day playbook

The sooner teams can execute on synergies with a high degree of confidence, the more overall value can be unlocked. Objectives for the first 100 days include:

- Finalizing integration leadership roles and responsibilities

- Kicking off cross-functional workstreams focused on delivering specific synergy targets

- Executing on quick wins that validate the deal thesis and create momentum

The first 100 day playbook should be outlined prior to deal close, but execution should begin on day one. Teams should be aware of the key priorities and specific milestones.

Establish a governance structure for monitoring and reporting

Integration without governance quickly devolves into guesswork. Establish a centralized structure that includes:

- Steering committee (executive level) for strategic oversight

- Synergy realization office or project management office to handle tracking and coordination

- Defined reporting cadence, such as weekly dashboards, monthly reviews, and ad-hoc status updates

Use purpose-built M&A software like DealRoom’s M&A Platform to centralize synergy targets, assign ownership, monitor progress, and flag risks. Visibility is critical here, as missed synergies often go undetected until it’s too late to recover.

Cross-functional integration teams for each synergy category

Each synergy bucket (revenue, cost, and financial) should have an integration team dedicated to realizing the targets. These teams require representation from the relevant cross-functional areas. For instance, a cost synergy team could include members from operations, procurement, HR, and finance. Responsibilities include:

- Owning the execution of identified cost synergies

- Identifying and escalating blockers early

- Tracking benefits delivered against baseline forecasts

Direct ownership is key to avoid diffusion of responsibility. It also provides clear visibility to determine what is and isn’t working, and where resources may need to be reallocated to hit overall synergy targets. With the right structure in place, synergy assumptions can be transformed into tangible results.

Examples of Positive (Successful) Synergy

Here are several real-world M&A examples where synergies were successfully captured through cost reduction, expanded market access, or operational alignment.

Facebook and Instagram (2012)

In 2012, Facebook acquired Instagram for $1 billion, in what seemed like a bold move at the time. The synergy came from integrating user data, monetization strategies, and ad targeting capabilities across both platforms.

The acquisition enabled Facebook to create a unique and hitherto unassailable proposition for advertisers looking to reach certain demographics. It also allowed the company to gain access to some of the best developers on the planet, pooling the human capital of the two technology firms.

Finally, Instagram had many of the same users as Facebook and was growing quickly; that growth only accelerated once the deal went through, from an initial 30 million users to over 2 billion. In Q2 2025, Meta earned $47.52 billion in ad revenue, up from $42.31 billion in Q1 2025, marking a 22% year-over-year increase from Q2 2024. Advertising represents 98% of the company’s total revenue.

Sirius and XM Radio (2008)

The $3.3 billion merger between Sirius and XM Radio in 2008 is a prime example of successful M&A synergy realization, particularly in achieving cost synergies. By combining their operations, the two satellite radio giants reduced duplicative infrastructure and streamlined overlapping functions, including satellites, programming, and staff. This allowed the merged company to operate more efficiently at scale while maintaining nationwide coverage and a broad content offering.

The integration delivered more than $400 million in cost savings by consolidating technology platforms, renegotiating content and licensing deals, and eliminating operational redundancies. Beyond the immediate financial impact, the merger enabled SiriusXM to reinvest in product innovation, strengthen its competitive position, and ultimately transition from years of operating losses to sustained profitability.

This deal highlights how thoughtful consolidation in a saturated and capital-intensive market can unlock operational efficiencies, stabilize the business, and create long-term shareholder value.

Amazon and Whole Foods (2017)

Amazon’s $13.7 billion acquisition of Whole Foods in 2017 was a strategic effort to expand into the grocery sector and bridge the gap between digital commerce and physical retail. The deal created a powerful combination of technology, logistics, and customer data synergies.

Introducing Amazon Prime into Whole Foods’ loyalty scheme deepened engagement and drove cross-channel traffic. Price optimizations realigned Whole Foods with Amazon’s value proposition, helping Whole Foods shed its reputation for being overly expensive.

Crucially, Whole Foods’ stores under Amazon’s ownership became last-mile distribution nodes, which enabled rapid delivery and pickup across a broader geographic area for Prime customers. The acquisition enhanced Amazon’s ability to gain valuable high-frequency consumer insights, which improved personalization and inventory management.

Whole Foods, in turn, gained access to enhanced digital capabilities, an expanded supply chain, and a wider channel to market. The combined organization had the potential to unlock efficiencies of scale and a more frictionless omnichannel customer experience.

Red Flags and Negative Synergy Examples

Just as successful synergies are at the heart of all beneficial M&A, the opposite can be said of value-destructive M&A. In many cases, red flags surface during due diligence but are overlooked in favor of other motivations, such as ambitious growth targets or pressure to deploy capital.

Flawed strategic assumptions can further cloud judgment, leading deal teams to underestimate or dismiss key integration risks like cultural misalignment or inflated synergy forecasts. The result is often negative synergies that erode, rather than enhance, deal value.

Synergy estimations seem straightforward in spreadsheets, but due diligence may reveal deeper structural issues, such as vastly different tech stacks, supply chains, or customer profiles, leading to unexpectedly costly and complex integration challenges. Operational overlap may also be less than assumed, reducing the potential for cost savings. Additionally, if synergy claims can’t be backed by data or detailed implementation plans, they’re likely inflated.

Culture is also an underestimated hurdle when it comes to synergy realization. Inefficiencies may arise from mismatches in decision-making, risk appetite, or internal communication norms. A hierarchical and conservative organization acquiring a flat, agile startup, for example, may face difficulty in aligning leadership, priorities, and talent.

When there is a significant mismatch between the two organizations, it frequently leads to failed integration and drives experienced employees to exit soon after the acquisition. If key people leave post-close, the projected synergies can disappear with them.

Quaker Oats and Snapple (1994)

One example of such an acquisition was Quaker Oats’ acquisition of Snapple in 1994 for $1.7 billion. On the surface, the merger seemed to make sense.

Under the hood, however, there were major issues. Although both companies sold fast-moving consumer goods, they did so through distinctly different sales channels: Quaker Oats in supermarkets and large retailers, and Snapple in gas stations and small, independent stores.

The branding for each was distinctly different. Whereas Quaker Oats sought to appeal to mothers and family buyers, Snapple was aimed at teenagers and young adults. It used “shock jock” Howard Stern in its advertisements—not someone you’d expect mothers to listen to when making consumption choices.

In addition, Quaker Oats was ultimately looking to take a slice of the soft drinks market, pitting itself against Coca-Cola. That’s a tall ask for any deal, and one they were unable to reach.

AOL and Time Warner (2000)

The $182 billion merger between AOL and Time Warner was supposed to be a revolution in the online media business. The strategy was to combine AOL’s internet reach with Time Warner’s premium content to dominate the online media space.

In reality, the clash between Time Warner’s traditional corporate culture and AOL’s bold, dot-com-era mindset created friction and hindered strategic alignment. Compounding the challenge, the collapse of the dot-com bubble shortly after the merger dealt a severe blow to AOL’s market valuation.

The deal promised revenue and operational synergies that failed to come to fruition. Leadership struggles and a lack of strategic clarity plagued the newly formed company, which later spun off the two businesses, erasing much of the deal's value.

Microsoft and Nokia (2014)

In 2014, Microsoft purchased Nokia’s mobile device division for $7.2 billion, aiming to establish a strong hardware platform for the Windows Phone operating system. The rationale was product synergy: Nokia’s hardware experience and Microsoft’s software expertise to challenge Apple and Android.

However, market conditions shifted rapidly, with iOS and Android cementing their dominance, and the window for a viable third ecosystem was closing. Execution flaws included poor internal integration and a lack of critical mass in the app ecosystem.

Nokia devices failed to become profitable, and cultural misalignment between the two companies impeded execution. Within two years, Microsoft took a $7.6 billion write-down on the acquisition and cut nearly 8,000 jobs. This complete U-turn was the result of missed market signals and flawed integration planning.

Regulatory and Antitrust Considerations

The best-laid plans for M&A synergies can be disrupted by regulators. Antitrust authorities exist to prevent market consolidation that restricts competition, so they are looking at many of the same synergies that the buyer is touting as deal rationale: market share, pricing power, control of the supply chain and so on. If regulators believe a transaction will have an adverse effect on consumers or competition within an industry, they may block a deal outright or force changes to the structure that will lower its value.

In many cases, this means forced divestitures. Acquirers who must divest business units or overlapping operations for regulatory approval undermine their original synergy predictions. Cost synergies get trimmed, geographic expansion gets scaled back and expected cross-selling opportunities evaporate.

Take Bayer’s acquisition of Monsanto in 2018. The $63 billion merger was approved only after Bayer agreed to sell more than $9 billion worth of assets, including some important divisions of its seeds and herbicide businesses. These compromises were a big reason why the expected R&D and global distribution synergies were diluted.

AB InBev’s $107 billion acquisition of SABMiller had a similar story. To get antitrust clearances across multiple jurisdictions, AB InBev had to offload SABMiller’s holdings across different geographies. This included SABMiller’s US stake in MillerCoors. The acquisition still realized huge cost synergies, but the geographic and brand synergies were inevitably narrowed.

Regulatory constraints can affect the deal structure, slow down integration, force greater compliance costs, and make buyers re-think their post-merger strategy. Regulatory due diligence is an important part of synergy planning early in the M&A process. Buyers can work out fallback synergies in case the original synergy map has to be redrawn.

How to Achieve Strategic Alignment

No one wants a deal that only looks good on paper; that’s why synergy realization is essential. While deals fail for a variety of reasons, one of the most common is the inability to capture predicted synergies.

With this in mind, here’s how to maximize your deal’s synergy realization:

1. Don’t lose sight of your overarching goal/objective

Be sure all stakeholders and team members stay focused on the predetermined objective throughout the M&A process. Adopting a more Agile M&A practice can help with this, as the Agile methodology is focused on achieving the main objective rather than plowing through a long list of tasks that may not be necessary (and can cause deal fatigue).

2. Focus on “easy” value drivers

Because the first year of integration is critical for capturing synergies, it is wise early on to prioritize synergies that are “easy” to capture and will produce the highest return. More specifically, these “easy” value drivers should match your overarching goal, be measurable and trackable, and have a high probability of success.

3. Properly plan for integration

Poor post-merger integration practices and failure to properly plan for integration when diligence begins often result in lost synergies.

4. Keep acquired companies’ key employees (and don’t underestimate the importance of culture)

Employees are what make companies run, and when a merger or acquisition takes place, important employees are often targets for recruiters to poach. In order to retain key personnel and create a comfortable environment for employees of the merged firms, leadership must focus on culture and change management.

5. Track synergy process

When trying to capture different types of synergies, company leaders must find a way to track each one’s progress. A centralized location for this tracking, such as an M&A project management platform like DealRoom’s M&A Platform, is recommended. Moreover, M&A synergy benchmarks for the deal should be created and then revisited on a regular cadence.

6. Analyze your customer base

In order to capture revenue synergies, it’s critical to complete a deep analysis of each customer relationship. When analyzing each customer, specifically consider: how long you’ve had a relationship with the customer, how strong the relationship is, what you currently sell to the customer, and what other services and products the customer uses that you could provide. The sales team should be part of this customer study, as your reps need to understand the strategy as it relates to synergy goals.

How to Create an M&A Synergy Model

Synergies are often calculated by adding the net present value (NPV: the value of the new company) with the premium (P). Consider the following categories as the cornerstones of your model: how to sell, what to sell, and where to sell. Examine where the opportunities to capture synergies and create value exist in these three categories.

Using an M&A project management platform, or another tool such as Excel, can be helpful during synergy valuation. For example, a tool such as the DealRoom M&A Platform is designed to be used before a deal even begins.

Teams can use features like pipeline management to access company information that is vital to evaluating synergies. Another option is to use a valuation spreadsheet, which compares the inputs and outputs of the acquirer and the target individually to the combined inputs and outputs if the two companies were to merge.

Types of Synergies Outside of Mergers and Acquisitions

Generating corporate synergies is not limited to the sphere of mergers and acquisitions. In fact, looking for synergies in a company’s existing operations and partnerships is an excellent way to generate value. Different types of synergies that occur outside of M&A include:

Modular synergies

Pooling resources can be an effective way for two non-competing companies to generate value. These are sometimes referred to as modular synergies, and usually involve companies bundling packages of products or services to generate greater value from the combinations.

For example, Southwest Airlines partnered with hotel firms and car rental companies to provide complete travel packages to customers. Another instance of modular synergy was Coca-Cola teaming up with Jack Daniels to create a “Jack and Coke” offering.

Sequential synergies

Sequential synergies refer to value generated along a company’s value chain. Although in many cases, this value is generated by virtue of acquiring a firm upstream or downstream in a company’s supply chain (see our article on vertical acquisitions here), it can also be achieved by choosing partners that are naturally synergistic with your own.

One example of a sequential synergy was Chanel outsourcing production of their branded watches to Swiss watch manufacturers, then subsequently acquiring them. Another is Amazon Direct Fulfillment, which has become the logistics provider for thousands of small businesses, generating far more value for them in their warehousing and distribution than would have been possible individually.

Examples of M&A Synergy Capture in Different Industries

Let’s explore some of the ways specific industries capture synergy through M&A.

The software industry

The software industry, and especially software as a service, is marked by intense competition and high user expectations around UX, UI, design, and accessibility. Combining two software firms can lead to increased resources for product development and innovation, and software platforms with services or products that complement each other may generate a great deal of value for customers.

The entertainment and media industries

The entertainment and media world has changed at a lightning-quick pace, with digital streaming taking over from traditional broadcast networks, and user-generated content overtaking paid advertisements in terms of engagement. Synergy capture in this arena often comes from combining different media formats, such as print, digital, etc., or from building a larger pool of creative resources for content production and marketing initiatives. Cost synergies are also possible through economies of scale and reduced production and distribution spending.

The telecommunication industry

Telecom companies face challenges related to balancing legacy systems with innovation, increasing rates of change, consumer volatility, and supply chain management. As a result, mergers between telecom companies are especially difficult and require a great deal of forethought and planning to successfully capture synergies. Potential benefits of such a transaction could be network improvements, increased customer satisfaction and loyalty, and penetration into new markets.

The high tech industry

In this rapidly-changing and highly competitive industry, the protection of intellectual property is paramount, as it means staying one step ahead of the considerable competition, particularly in the consumer electronics space. Synergies typically result from access to a broader resource pool to drive innovation, as well as cost reductions across the supply chain.

The healthcare, pharmaceutical, and life sciences industries

R&D costs are huge for companies working to create new medications, medical devices, and other types of healthcare treatments. When companies in these industries merge, synergies are usually related to a greater product portfolio, research cost reductions, economies of scale, and access to new markets.

The table below highlights typical synergy capture timelines by industry.

Frequently Asked Questions

What are the main types of synergies?

The three primary types of synergies in M&A are:

- Cost Synergies - Savings achieved by eliminating redundancies, such as consolidating offices, reducing headcount, streamlining operations, and leveraging combined purchasing power.

- Revenue Synergies - Increased sales generated through cross-selling products, accessing new markets, combining sales forces, or reducing competition.

- Financial Synergies - Improvements to the company's financial structure, including a lower cost of capital, better tax efficiency, improved cash flow, and easier access to debt or equity markets.

Which type of synergy is hardest to achieve?

Revenue synergies are generally the most difficult and take the longest to achieve. They require successfully integrating sales teams, product lines, and customer bases, which involves complex execution and cultural alignment. Cost synergies, while challenging, are often more straightforward to identify and quantify in the short term.

How are synergies valued in an M&A deal?

Synergies are typically valued using a Discounted Cash Flow (DCF) model. The projected future cash flows from the synergies (both cost savings and revenue increases) are estimated for each year and then discounted back to their present value using a risk-adjusted discount rate. This net present value (NPV) of synergies is a key input in determining how much a buyer is willing to pay for a target company.

What is the biggest risk when estimating synergies?

The most common pitfall is inflation bias—overestimating the potential benefits due to deal team enthusiasm or competitive pressure. This leads to overpaying for the target. Other major risks include cultural clashes that derail integration and delays in execution that erode the net present value of the projected benefits.

What is the role of culture in achieving synergies?

Culture is a critical but often underestimated factor. A mismatch in leadership styles, decision-making speed, or company values can lead to employee attrition, poor communication, and failed integration efforts. If key talent leaves, the knowledge and relationships needed to achieve projected synergies often leave with them.

Key Takeaways

- Synergies are the cornerstone of M&A deals, but they must be carefully analyzed, realistically valued, and tracked throughout the entire deal lifecycle to avoid overestimation and failed integrations.

- Capturing synergies requires disciplined post-merger execution, starting with quick wins, strong governance, and cultural alignment, to ensure projected value becomes long-term business results.

No matter what the desired M&A synergy is for a particular deal, it must be considered throughout every stage of the transaction. Synergies can be easy to identify but hard to realize; therefore, it is critical to understand that when the deal closes and the post-merger transition begins there is still a great amount of work to be done to yield the identified benefits. Post-close synergy work needs to be planned early and carried on for months, and sometimes even years, after a close.

Additionally, while practitioners should be ambitious in identifying and outlining expected deal synergies, it’s more important to be realistic and not overestimate the deal’s potential synergies and value drivers.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)