The Ultimate Guide to the Due Diligence Process in M&A

.avif)

Due diligence is the process that allows buyers to fully understand target companies in mergers and acquisitions. For confidentiality purposes, companies do not disclose every detail of their operations to every company that expresses an interest.

Thus, the due diligence process allows the buyer to gain more insight into the company, its people, and how it operates.

If you’d like to know more about how DealRoom M&A Platform can transform your company’s due diligence process, click the link and visit our due diligence page.

In this article:

- What Are the Types of Due Diligence?

- How to Perform Due Diligence in M&A

- How to Perform Due Diligence for a Private Company

- How Long is the Due Diligence Period?

- Due Diligence Process Timeline Example

- What Are the Requirements Before Starting the Due Diligence Process?

- Who Can Perform Due Diligence?

- When to Conduct Due Diligence

- Red Flags to Watch for During Due Diligence

- Conduct the Due Diligence Process the Right Way

- Due Diligence Checklists

- Why is Due Diligence Important?

- What Are the Challenges of Due Diligence?

- Industry-Specific Due Diligence Considerations

- M&A Science Diligence Management Certification

- Frequently Asked Questions

- Easy Due Diligence Process with DealRoom

What is the Due Diligence Process?

The due diligence process is a solid review or audit of a company undertaken before a financial transaction, usually a merger or an acquisition. The aim of due diligence in business is to ensure that any decision taken regarding the company in question is an informed one, maximizing your chances of adding value in an M&A transaction.

The due diligence process surfaces lots of information on the target company across all of its operational areas. The goal of the due diligence review is to piece together all of this information into a coherent story. This usually involves the people in charge of the due diligence process convening and deciding if there’s anything that was disclosed in the process that changes their initial opinion on a deal.

What Are the Types of Due Diligence?

In mergers and acquisitions, we typically think of four major types of due diligence:

- Financial due diligence: Focusing on the financial performance of the company until the present date and ensuring that the numbers presented in the financial statements are accurate and sustainable.

- Legal due diligence: Focusing on all legal aspects of the company and its relationships with its stakeholders. Areas typically analyzed include licenses, regulatory issues, contracts, and any legal liabilities that may be pending.

- Operational due diligence: Focusing on the company’s operations - essentially looking at how the company turns inputs into outputs. This is generally considered to be the most forward-looking type of due diligence.

- Tax due diligence: Focusing on all of the company’s tax affairs and ensuring that its tax liabilities are paid in full to date. Due diligence in tax also looks at how a merger would affect the tax liabilities of the new entity created by the transaction.

The table below breaks down the different types of due diligence and example questions.

How to Perform Due Diligence in M&A

Conducting due diligence is an essential component of any M&A transaction. It is a lengthy and intimidating process that involves multiple parties and phases. To conduct due diligence, one should thoroughly analyze the complete business before making any informed decision. This is typically done by a potential buyer prior to any business transaction.

The due diligence process can vary depending on the specifics of the transaction, but there are certain steps that are common to most deals. As a general rule, the larger and more complex the deal, the more due diligence it will require.

Here’s a simplified guide to help you navigate through the due diligence process using a straightforward example.

Example Scenario: Imagine you’re considering acquiring a small software development company called "Tech Innovators."

Listed below are general due diligence process steps.

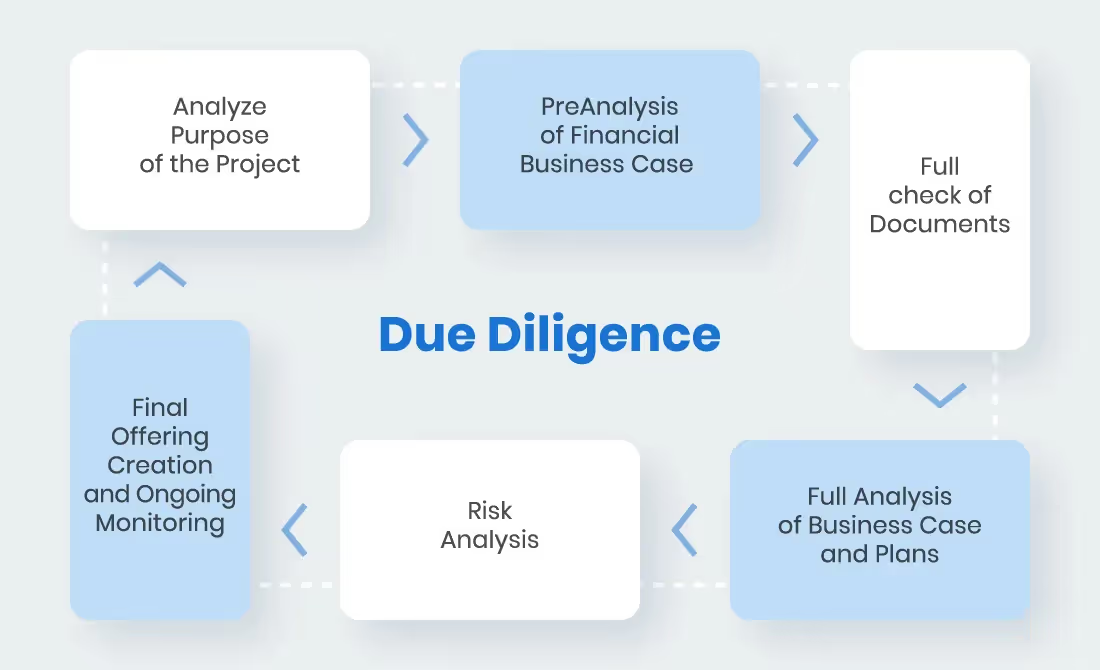

1. Evaluate Project Goals

Goal Setting:

Determine what you aim to achieve with the acquisition. This could include expanding your market share, acquiring new technology, or entering a new market. Setting clear goals helps you identify the resources needed and ensures alignment with your company’s overall strategy.

Example:

Your company wants to acquire Tech Innovators to integrate their cutting-edge software into your existing product line, enhancing your technological capabilities and market position.

2. Analyze Business Financials

Financial Audit:

Examine the financial records of the target company to ensure they are accurate and reliable. This includes reviewing balance sheets, income statements, tax documents, and debt schedules. This step helps you assess the company's financial health, performance, and any potential red flags.

Example:

- Balance Sheets and Income Statements: Ensure that Tech Innovators’ revenue and profits are consistent with their reported figures.

- Inventory Schedules: Check the current inventory and how it is valued.

- Future Forecasts: Review projections to understand the growth potential.

- Debt Analysis: Assess any existing short-term and long-term debts.

- Tax Documents: Verify compliance with tax obligations.

Start your evaluation with this detailed financial due diligence checklist.

3. Thorough Inspection of Documents

Document Review and Interviews:

Request necessary documents from the target company and conduct interviews with their key personnel. This helps verify that their business practices comply with legal and industry standards and provides a deeper understanding of the company’s operations.

Example:

- Site Visits: Visit Tech Innovators’ offices to understand their operational environment.

- Interviews: Talk to their management and key employees to gauge their expertise and company culture.

- Legal Compliance: Ensure that all legal documents, such as contracts and intellectual property rights, are in order.

4. Business Plan and Model Analysis

Business Model Assessment:

Analyze the target company’s business plan and operational model to determine its viability and how well it aligns with your company’s goals. This step helps you understand the target company’s sustainability and strategic fit.

Example:

Review Tech Innovators’ business strategies, customer base, and market positioning to ensure that integrating Tech Innovators will enhance your company’s offerings and strategic direction.

5. Final Offering Formation

Valuation and Offer:

Combine all the collected information to form a final valuation. Use this valuation to determine the offer you will make to the target company. This step involves collaboration among various teams to ensure a fair and justified offer.

Example:

- Valuation Techniques: Employ methods like discounted cash flow analysis or comparable company analysis to determine a fair price.

- Offer Decision: Based on your findings, decide on the final amount you’re willing to pay and prepare for negotiation.

6. Risk Management

Risk Assessment:

Identify and evaluate potential risks associated with the acquisition. This includes financial risks, operational risks, and market risks. Proper risk management ensures that you are prepared for any challenges that may arise post-acquisition.

Example:

- Financial Risks: Consider any financial instability or hidden debts at Tech Innovators.

- Operational Risks: Assess risks related to integrating Tech Innovators’ systems and processes with yours.

- Market Risks: Evaluate the potential market reaction and the impact on your existing business.

By following these steps, you can conduct a thorough due diligence process, ensuring that you make a well-informed decision when considering an acquisition like Tech Innovators. This structured approach will help you identify potential risks and benefits, ultimately leading to a successful M&A transaction.

"In our preliminary non-binding bid, we have a long list of assumptions. One of the assumptions is that all third party contracts are at or near their historical costs and fee levels. That's gonna impact your underlying valuation if you come in and you're paying 25% more on a large third party contract."

Speaker: Keith Crawford, Global Head of Corporate Development, State Street Corporation

From The Buyer-Led M&A™ Summit (watch the entire summit for free here)

How to Perform Due Diligence for a Private Company

No two M&A deals are the same.

Each transaction is shaped by its unique combination of company size, ownership structure, leadership style, culture, and industry.

Transactions become more complex - and the due diligence process more challenging - when the target is a privately held company.

Unlike publicly traded companies, private companies are not auctioned and traded conventionally on the stock market. Investors cannot easily buy shares unless they are founders, employed there, or have invested by venture capital or private equity firms.

Investing in privately held companies is inherently more challenging, not only because access is limited, but also because they aren’t required to publicly disclose as much information. Compared to private companies, public companies are also held to stricter business and accounting practice standards. While buying out privately owned companies and startups may have a high payoff and rewards, they also come with distinct complexities. These may affect or hinder the M&A process.

To save some headaches down the line, detailed below are some best practices for performing due diligence for private equity:

- Understand Your Financial Situation: Before even researching companies or drafting out a Letter of Intent (LOI), you need to look at your own books. Do you have enough resources to complete the transaction and bounce back if it does not work out? If not, maybe consider a smaller-scale investment or wait a little while.

- Accounting Procedures and Financial Statements - Publicly held companies must abide by GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) and are audited regularly to ensure compliance. Regulations on privately held companies are not as strict. This allows them to use different accounting procedures or even practices off the beaten path. Rather than traditional accrual accounting, it may not be unusual to see cash-basis or something else more arbitrary.

- Size - Private companies are almost always smaller than public companies. This doesn’t only mean fewer employees and less office space, but also likely smaller revenues.

- Human Resources Practices - Smaller, younger businesses may not have standardized HR processes. Here, you want to check out items such as questionable terminations, harassment charges, hiring practices, and if/what workplace policies exist.

- Legal - The last thing you want from any investment is to find that it is riddled with legal issues soon after closing the deal. Some details to consider here are tax compliance, any past or outstanding lawsuits, and overall obedience to applicable jurisdictions.

- Valuation - Valuation methodologies are the same between private and public companies. However, you have to adjust for the lack of liquidity and publicly available market caps.

- Management and Leadership - The company you are considering buying could have been the brainchild of siblings or friends. Meaning, they could be a little protective. You will want to meet and get to know them to determine if there is any hostility associated with the transaction. By and large, poor, disgruntled management will trickle down the M&A buy-side due diligence process and negatively impact the business.

- The Business - Overall, do you believe in the company, their strategy, and mission? Is this something you see as truly being successful?

The table below breaks down some key differences in the due diligence process for public companies vs. private companies.

How Long is the Due Diligence Period?

While road mapping, it may seem difficult to forecast how much due diligence is enough. Despite its comprehensive nature, the due diligence process should only last between 30 and 60 days.

This is achievable if delegated to an efficient, dynamic team comprising members from multiple business functions. Ultimately, you want to close the deal as soon as possible, while also being thorough.

But, in reality, it is impossible to uncover all issues and potential complications during the investigation. Some items will not be uncovered until integration. However, the same is true when it comes to realizing potential benefits.

This reinforces the importance of being energetic and efficient while maintaining quality to meet the due diligence period deadline.

Due Diligence Process Timeline Example

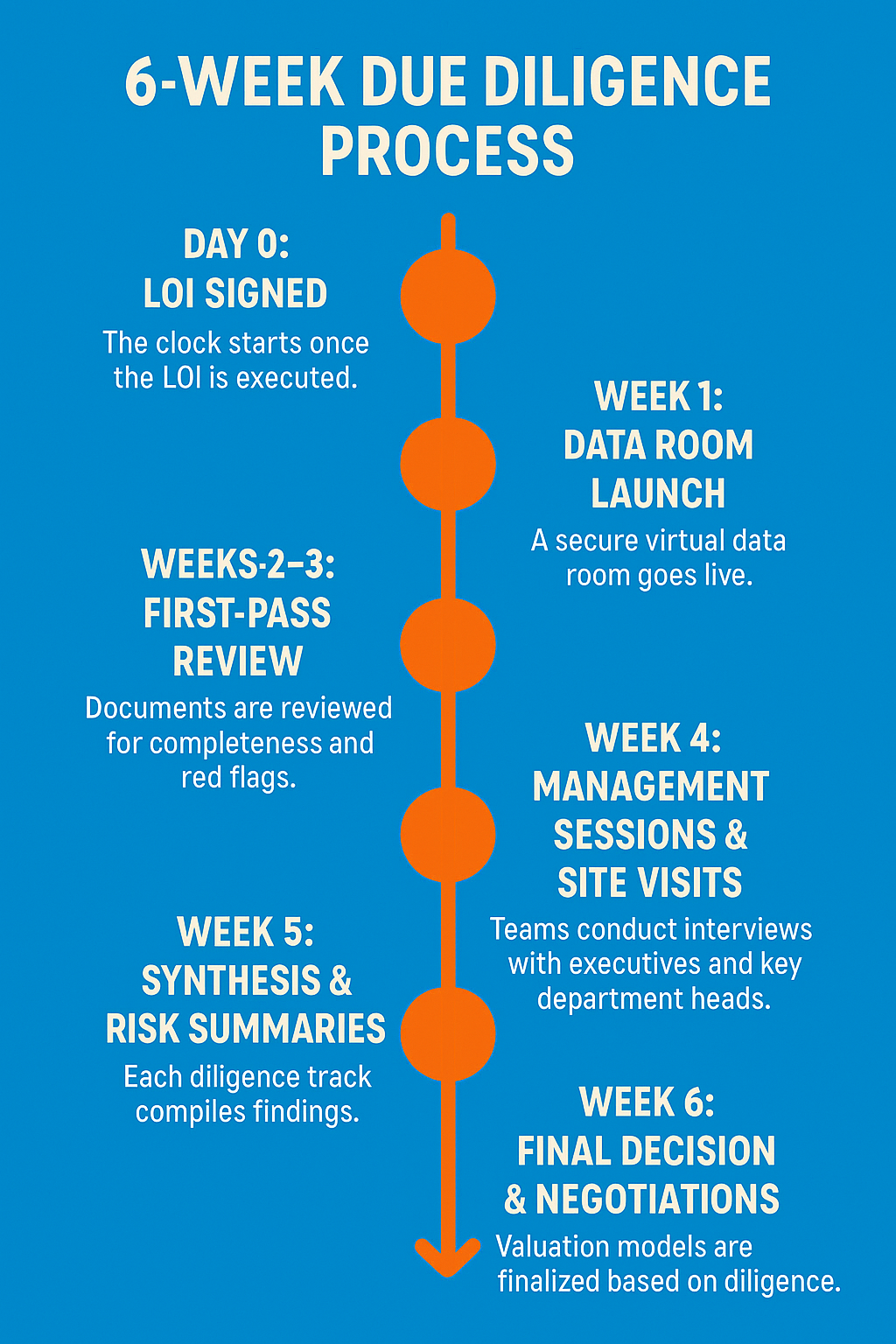

Improvisation rarely produces effective results. A well-executed M&A deal is the product of a structured, time-bound process that focuses on due diligence. Here's an example of what the timeline might look like for a 6-week due diligence process when managed efficiently.

Day 0: LOI Signed

The clock starts once the LOI is executed. This document sets the framework - scope, exclusivity, and timeline. Deal teams align internally, define objectives, and set expectations with the seller.

Week 1: Data Room Launch

A secure virtual data room (like DealRoom) goes live. Initial document requests are sent, including corporate records, financials, legal files, and cap tables. The seller uploads documents while the buy-side begins triage.

Weeks 2–3: First-Pass Review

Documents are reviewed for completeness and red flags. Subject-matter experts (SMEs) conduct deep dives into financial and legal issues. Requests for clarification or additional documentation are logged in real time.

Week 4: Management Sessions & Site Visits

Teams conduct interviews with executives and key department heads. Site visits may occur for operational diligence. This is when soft risk factors emerge, such as cultural fit, management readiness, and integration hurdles.

Week 5: Synthesis & Risk Summaries

Each diligence track compiles findings, categorizing them by severity and impact. Deal teams evaluate gaps, potential exposures, and required deal protections (e.g., indemnities, escrows, earnouts).

Week 6: Final Decision & Negotiations

If no deal-breakers are found, valuation models are finalized based on diligence findings. Terms are revised if needed. Legal teams begin drafting definitive agreements with reps, warranties, and closing conditions informed by diligence.

A 6-week timeline is aggressive but realistic with the right tools and process. Delays usually stem from incomplete data, lack of ownership, or poor collaboration. DealRoom’s M&A Platform was built to counter all three: centralizing requests, eliminating status-tracking chaos, and reducing back-and-forth friction. When teams align behind a single source of truth, diligence doesn’t drag; it drives confident decision-making.

What Are the Requirements Before Starting the Due Diligence Process?

Cultivating good organization and strategizing is key when trying to navigate the due diligence process and meet the necessary requirements.

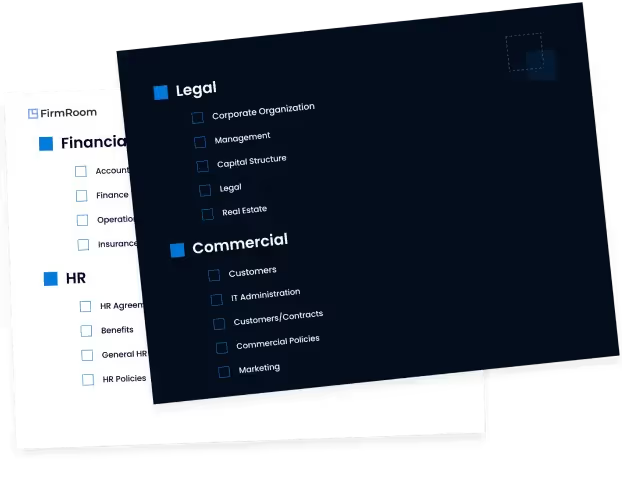

So you can stay systematic, outlined below is a typical due diligence management folder structure for M&A transactions:

- Transaction Related Documents

- Corporate Documents

- Contracts and Agreements

- Customers, Sales, and Marketing

- Procurement (Suppliers)

- Property and Equipment

- Environmental

- Legal, Litigation, and Regulatory

- Intellectual Property

- Financial

- Tax

- HR and Employees

- Insurance

- Operations

- Information Technology

- Industry and Other

Who Can Perform Due Diligence?

Due diligence can be performed by various professionals, each bringing their expertise to ensure a thorough and accurate assessment of the target company. Here’s a breakdown of who can conduct due diligence, along with examples:

Internal Teams

These are employees from within the company, typically from departments such as finance, legal, HR, and operations. They have a deep understanding of the company's internal processes and industry context.

Example: If your company is considering acquiring another business, your finance team would review the target company's financial statements, your legal team would examine their contracts and compliance issues, and your HR team would assess their employee policies and benefits. This internal knowledge ensures that the evaluation is aligned with your company’s specific needs and goals.

External Advisors

These are third-party experts who bring specialized knowledge and experience to the due diligence process. They can include investment bankers, M&A consultants, legal advisors, and accounting firms.

Example: To ensure an objective and comprehensive evaluation of the target company, you might hire an investment bank to conduct a financial analysis, a legal firm to review legal documents and compliance, and an M&A consultant to provide strategic advice. These advisors have extensive experience in M&A transactions and can identify issues that internal teams might overlook.

Specialized Firms

These are companies that specialize in providing due diligence services. They offer comprehensive analysis and reporting on various aspects of the target company.

Example: You could engage a specialized due diligence firm to perform a thorough assessment of the target company. These firms have dedicated teams and tools designed for due diligence, providing detailed reports on financial health, operational efficiency, market positioning, and potential risks.

When to Conduct Due Diligence

Due diligence should be conducted as early as possible in the M&A process. Ideally, it begins after initial interest and intent are expressed but before finalizing any agreements. Starting early helps identify potential issues and allows ample time for thorough investigation.

For example: Suppose your company expresses interest in acquiring another business and signs a letter of intent. The due diligence process should start immediately after this. Early initiation allows you to uncover any financial discrepancies, legal liabilities, or operational inefficiencies in the target company before moving forward with the acquisition. This proactive approach ensures that you are well-informed and can negotiate better terms or decide to walk away if significant issues are found.

Red Flags to Watch for During Due Diligence

Red flags in due diligence aren’t always glaring. Sometimes, it’s the things that are missing or simply don’t add up that signal trouble. Here are the signs that should immediately trigger deeper scrutiny or a reassessment of the deal.

Inconsistent Financials

Numbers that don’t reconcile across statements, unexplained year-over-year swings, or last-minute adjustments to EBITDA raise immediate questions. Patterns of deferred revenue recognition or aggressive capitalization can indicate earnings manipulation.

Legal Exposure without Disclosure

Undisclosed litigation, regulatory warnings, missing permits, or IP ownership disputes are serious risks. If legal counsel hesitates or delays document delivery, assume there’s more under the surface.

Customer Concentration

If more than 25–30% of revenue comes from a single customer, that’s a dependency risk. Dig into contract terms, renewal timelines, and whether the relationship is with a company or a single contact who could leave.

High Churn in Key Roles

Repeated turnover in finance, legal, or engineering leadership - especially in the 12 months before the deal - suggests instability. It could be burnout, a toxic culture, or leaders exiting ahead of issues surfacing.

Non-Standard Accounting Practices

If the company isn’t following GAAP or consistently deviates from standard accounting treatments, expect surprises. Cash-basis reporting, unusual revenue timing, or informal expense tracking are all causes for pause.

Unverifiable IP Ownership

Founders often assume they own the code, content, or brand, but these assumptions don’t always hold up in court. If intellectual property assignments aren’t signed, or ex-contractors developed core assets, that’s a potential legal minefield.

Inflated Forecasts

Forecasts that hinge on unrealistic growth rates, undefined product launches, or “pipeline” deals with no signed LOIs should be heavily discounted. Optimism is not a substitute for traction.

Culture Misalignment

Misalignment between how the target operates and how your team runs deals can derail post-close cultural integration. Pay attention to communication style, decision-making speed, and employee sentiment during interviews.

Conduct the Due Diligence Process the Right Way

Conducting proper due diligence is an important, yet tedious process. Here are a few helpful tips:

- Use a Diligence Management Software - Diligence management software combines the features of a traditional virtual data room with project management capabilities. This allows users to not only securely store data but also effectively manage and share files.

- Start Early - The diligence process can be extremely time-consuming. It’s best to get started early in an organized manner. When teams utilize a tool like DealRoom, they can start the process within minutes.

- Utilize Checklists - When teams use diligence management software, they can easily create organized checklists. For example, rooms can be broken down into different stages of diligence. Users can efficiently check items off as they are completed.

- Address Potential Risks Throughout the Process - If potential bottlenecks and risks arise during diligence, teams should address them promptly.

- Employ Experts - Hiring M&A professionals, such as investment banks and consultants, make the due diligence process more efficient. Deal teams have experience with conducting diligence and know the necessary steps to take.

Due Diligence Checklists

DealRoom's Due Diligence Reports and Playbooks help teams efficiently manage due diligence from the start. Diligence incorporates many moving parts, and it is critical to a deal's success.

DealRoom M&A Platform has been a catalyst for due diligence in hundreds of M&A transactions, and the following steps for due diligence were present in each of them:

- Income statements

- Balance sheets

- Partnership agreements

- Existing contracts

- Profit/loss records

- Annual reports

- Tax filings

- Business and operational practices

You can find the detailed due diligence checklist here. Our library of pre-built ready to use playbooks enables teams to thoroughly and effectively collect necessary diligence information.

Why is Due Diligence Important?

A merger or acquisition is the biggest corporate transaction that any business will undertake.

Due diligence enables companies to undertake these transactions from an informed standpoint.

It can add significant value for the buyer by showing where the target company’s weaknesses (or red flags) are as well as identifying some opportunities within the target company that it previously wasn’t aware existed.

What Are the Challenges of Due Diligence?

Gaining an in-depth understanding of a company can be a highly specialized process beyond most people without experience in the field.

There tend to be a myriad of challenges, but the following are usually among the most commonly encountered:

- Not knowing what questions to ask: It is vitally important to know in advance what the issues are and what diligence questions need to be asked to investigate them properly.

- Slowness of execution: Asking sellers to acquire documentation or information can take time, often with the consequence of delaying the transaction’s closing.

- Lack of communication: Sellers, even willing sellers, tend to regard due diligence as a hassle, leading to impatience, poor communication, and even friction.

- Lack of expertise: There is a good chance that you’ll have to bring in some hired hands for at least some parts of the due diligence process (e.g., an IP expert).

- Cost challenges: Due diligence can be expensive, running into months and extensive specialist hours, making many erroneously think that they can cut corners.

Industry-Specific Due Diligence Considerations

Due diligence must be tailored to the realities of the target’s industry. Each sector brings its own regulatory burdens, operating nuances, and valuation risks. Here’s what focused due diligence looks like across key industries.

Technology

In technology deals, intellectual property is the core asset. Confirm code ownership through signed IP assignments from all contributors - employees, freelancers, and contractors. Unlicensed open-source use can lead to forced reengineering or future litigation.

Infrastructure also matters. Examine whether the product is built to scale or held together by fragile dependencies and technical debt.

Security posture is critical. Request SOC 2 or ISO 27001 certifications, incident logs, and vulnerability disclosures. Finally, don’t just look at top-line ARR. Analyze retention rates, net revenue expansion, and customer cohort behavior to verify true product-market fit.

Healthcare

Healthcare targets face constant regulatory pressure. Start with compliance: HIPAA violations, FDA clearances, and billing audits must be disclosed.

Review the target’s payer mix. High Medicare or Medicaid exposure introduces margin compression and reimbursement risk. Credentialing is another must-check: verify that physicians or providers are licensed, in good standing, and free of disciplinary action.

If the company engages in value-based care or outcomes-based contracts, examine performance metrics closely. Weak clinical outcomes can severely limit growth potential and reimbursement rates.

Manufacturing

For manufacturing targets, supply chain resilience is non-negotiable. Identify single-source suppliers, weak service level agreements, or any offshore dependencies that may disrupt operations.

Environmental liabilities often lurk in legacy operations. Review EPA reports, soil tests, and waste management practices. Examine machinery maintenance records; deferred capital expenditures often mask declining capacity under the guise of stable EBITDA.

Labor agreements also require scrutiny. Expiring union contracts or pending disputes can turn into costly interruptions after close.

Financial Services

In financial services, compliance is key. Examine regulatory history under FINRA, the SEC, or the FDIC. One gap can lead to fines or shutdowns.

Client books must be audited for quality. Is revenue stable, or is it dependent on individual brokers? Weak KYC (Know Your Customer) or AML (Anti-Money Laundering) controls pose legal and reputational risks. These programs must be well-documented and tested.

Assess the core systems used for trading, reporting, and customer relationship management. Legacy software stacks drive up integration costs and restrict long-term agility.

Consumer Goods

Consumer goods companies live and die by distribution. Overreliance on a single retail channel - especially Amazon or major chains - creates pricing pressure and loss of control.

Inventory quality must be verified; old or unsellable stock inflates book value and distorts margins. Validate brand strength with market data and customer reviews, not just pitch decks.

If the company relies on private label manufacturing, confirm ownership of the brand. If they don’t control it, volume means little in the long term.

Industry-specific diligence is critical for surfacing risk before it becomes costly. A generic checklist won’t expose weak links. Context is what turns good diligence into smart dealmaking.

The table below highlights the primary due diligence considerations and unique risks across various industries.

M&A Science Diligence Management Certification

Learn how to approach diligence, build a diligence team, the art of asking good questions, why due diligence is an iterative process, and the importance of data integrity. No degree or prior experience required.

Principal of Corporate Development Integration at Google

- 50+ courses by M&A Experts

Get access to diligence, integration, divestment and strategy courses. 100% online and at your own pace.

- Get Diligence Ready

Learn diligence strategy and critical skills, diligence requests, workflow management and receive certificate of completion

{{cta-block3="/cta"}}

Frequently Asked Questions

How does due diligence differ for private vs. public companies?

Private companies have less regulatory disclosure, making due diligence more challenging. Buyers must verify financials, contracts, and ownership structures carefully, whereas public companies provide audited filings (e.g., 10-Ks, SEC reports).

What happens if due diligence uncovers major issues?

If due diligence uncovers major issues, buyers can renegotiate the deal terms (e.g., lower price), request indemnifications or escrow agreements, or walk away from the transaction if risks outweigh benefits.

When should due diligence begin in an M&A deal?

Ideally, due diligence in an M&A deal should begin immediately after signing a Letter of Intent (LOI) to allow time for thorough analysis before closing.

How can technology streamline due diligence?

Tools like DealRoom’s M&A Platform centralize document sharing, track progress with AI-powered analytics, and improve collaboration between teams, cutting diligence time by up to 50%.

Easy Due Diligence Process with DealRoom

Traditionally, the due diligence process is completed across various tools - using a virtual data room to store all documents, Excel trackers for listing requests and tracking progress, and one-off emails for back-and-forth deal-specific communication. Unfortunately, this leaves room for inefficiencies such as version control worries, miscommunication, duplicate work, and information silos.

Easily switch from disconnected Excel trackers, VDRs, and email communications to DealRoom Diligence. Reduce your diligence time by 50% by centralizing your process with built-in virtual data room, granular permissions to control access to sensitive documents and requests and by enabling transparent and clear discussions on the platform among different stakeholders for better decision-making. With AI-powered document analysis you can analyze and extract key information from deal documents and easily create, save and share custom prompt templates across organizations and shareholders.

Amy Weck, VP, M&A and Integrations at The Liberty Insurance, stated:

Saved $200,000/ year by switching to DealRoom. From the time cost to eliminating the need for multiple disparate solutions.

.png)

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

.png)

.png)

.png)

.svg)

.svg)

.avif)