When we think about investment banking, industry giants like Goldman Sachs, Morgan Stanley, JP Morgan, Deloitte, and Chase are often at the top of our minds. Despite their dominating presence, the sector is in itself a behemoth, with approximately 5,500 companies ranging from major firms to middle market and small boutique banks in the United States alone.

In 2023, investment banks generated $130 billion in revenue for various services and transactions. Achieving such returns is a testament to their precision, attention to detail, and strategic planning. This guide will explore investment banking and its role in the capital markets of mergers & acquisitions (M&A), outlining buy-side and sell-side processes, potential career opportunities, and more.

What Is M&A Investment Banking?

M&A investment banking is a niche practice within investment banking that specializes in various types of asset management or financial transactions, including divestitures, asset purchases, consolidations, tender offers, buyouts, and, of course, mergers and acquisitions. Bankers, hedge funds, and other institutional investors in this field provide advisory services to assist companies in executing both sell-side M&A and buy-side M&A deals. This demands a distinct skill set in business valuations, capital raising, investor communications, due diligence, financial analysis, deal negotiations, industry research, and more.

A good investment bank will have expertise in all these areas, allowing them to effectively act as intermediaries for companies looking to acquire or merge with other entities.

Careers in Investment Banking

With so much financial reward, careers in investment banking are among the most coveted jobs. Leading investment banks often receive hundreds of applications for each job opening, giving them significant leverage to choose the most accomplished and dedicated candidates. However, this also means investment bankers often face long working hours once hired. On average, a banker can expect to work over 60 hours per week, even longer hours, if a deal demands it.

While no two days are the same, these bankers will have some everyday obligations. The job requires strong organizational, analytical, and mathematical skills and robust social skills. Additionally, analysts assist senior-level bankers with several assignments, such as creating pitches, models, and valuations and negotiating deal terms for the buy-side and the sell-side.

The Role of Investment Bankers

So, what are the responsibilities of investment bankers? First and foremost, they make deals happen.

Company leaders–the best ones, anyway–will always have a shortlist of companies that interest them. However, they'll hire an investment banker with specific technical skills who excels in M&A deal-making to make those deals happen. This enables them to extract the maximum value as they conduct tasks from their company mandate, which usually include:

Industry Overviews

Investment bankers deliver detailed reports outlining the current dynamics in an industry group. They disclose relevant information that allows the acquisition company to make well-informed decisions. For example, they may provide insights concerning the energy transition in the oil and gas industry. In retail, this could be e-commerce metrics.

Deal Origination

Bankers then create a list of suitable and attractive companies, eventually narrowing it down to the best merger or acquisition targets.

Company Valuation

An investment bank’s core function is to assess the value of public and private companies. They develop precise financial models incorporating the target company's current and projected financial performance results. Additionally, the bank is responsible for advising the company on any potential deviations, such as if the target company's management expects a higher valuation than the one offered.

Negotiations

Direct communication between CEOs can be difficult without an intermediary, in this case, an investment banker. When they are involved, the intention is clear to all parties that one side is seeking a transaction and wants to be upfront about it. If negotiations ensue, the investment banker will assist their client throughout the process.

Due Diligence

Experienced investment bankers have participated as intermediaries on dozens of deals, making them far more capable of knowing the risks to look out for at the due diligence phase than the average business owner. The investment bank will also have its own legal team to review regulatory and compliance issues, financial statements, and other materials relevant to the deal.

Deal Closing

Closing a deal is more complex than signing a contract and taking ownership of a company. It demands a thorough final review of all terms and conditions and consideration of contingencies. Investment bankers, with their extensive experience in corporate finance, are much more adept than the average business owner at ensuring no details are overlooked during the closing process.

Post-Merger Integration (PMI)

PMI, or simply "integration" can maximize or eliminate deal value after closings, which is why it's common for investment banks and the wider consulting community to develop playbook templates, enabling them to assist clients on how best to merge the newly acquired company into their own.

Investment Banker Salaries

High paychecks are an expectation in investment banking. Specifically, entry-level M&A investment bankers at top firms typically earn around $100,000. First-year analysts generally see salaries ranging from $70,000 to $150,000, increasing to $125,000 to $150,000 after a few years. Associates earn even higher wages, with first-year associates often making nearly $200,000 and potentially reaching $300,000 or $400,000. With more experience, some associates can earn close to $500,000 annually. Vice presidents and partners, on the other hand, often approach or exceed the million-dollar mark.

Investment Banker Fees

It shouldn’t be surprising that investment banks aim to generate money during M&A transactions. With bankers producing $130 billion, bankers are responsible for substantial revenue streams. As such, every time a deal closes, the investment bank that provides advisory or consultation services earns a significant commission for their firm’s partners.

Investment banking fees have quite a few variables. At the broadest level, the price or percentage the banker walks away with depends on the type and size of the deal. In addition, some investment bankers require a retainer or “engagement fee.”

Middle- to lower-market deals should expect to pay their investment bankers based on the Lehman or double Lehman formula for even smaller deals, which states the bankers will receive 10% of the first million.

The Aligned Method is another way fees are determined. This method incentivizes the banker to negotiate the best possible deal, earning 1.75%of the first fifty million.

The M&A Investment Banking Process

From an investment banker’s perspective, the M&A process will facilitate the following:

1. Acquisition or Exit Strategy Development

Preparing either strategy includes defining key M&A criteria, analyzing industry group trends, and selecting the appropriate targets or acquirers, among other tasks. Investment bankers may begin this process by contacting prospective buyers or sellers or completing the work for a specific company.

2. Buyer or Seller Communications

A banker may work with the corporate development team to bypass gatekeepers to start conversations with the deal-related managing directors, C-suite executives, or owners.

3. Valuation Analysis

Once the investment bank establishes a connection between the companies and both parties choose to proceed with deal talks, the banker will continue to evaluate prospective targets.

4. Deal Negotiations

If the bank works for the buy-side, they will help the buyer produce and deliver an appropriate offer.

5. Risk Identification

During the due diligence stage, the banker will review all relevant documents, data, financials, etc., and continue serving as one of the buy- and the sell-side’s significant communication sources.

6. Settlement of Final Terms

The investment bank is primarily responsible for negotiating closing and the final deal terms.

Sell-Side and Buy-Side Investment Banking Differences

Investment bankers simultaneously facilitate buy-side and sell-side transactions, actively managing a diverse deal portfolio. Still, their role slightly diverges depending on whether they’re working on the buy-side and, therefore, are looking to acquire another company or on the sell-side and want to sell all or a part of their business.

Sell-Side Deal Types

- Initial Public Offerings (IPOs): An investment bank working on the sell-side can help companies go public by issuing shares on the stock market.

- Secondary Offerings: The sell-side may also aid companies in issuing additional shares after an IPO.

- Divestitures: They consult clients on selling a portion of their business or specific assets.

- Private Placements: Sell-side banks oversee the sale of securities to a select group of institutional investors.

Buy-Side Deal Types

- Private Equity Investments: Buy-side banks support private equity firms and investors acquire company stakes.

- Venture Capital Investments: They recommend early-stage companies (startups) for venture capitalists to invest in.

- Debt Financing: They assist clients in raising debt capital through bonds or loans.

- Real Estate Acquisitions: Investment bankers offer advice on purchasing real estate assets for investment purposes

Mergers vs. Acquisitions vs. Divestitures

In investment banking, each type of transaction has unique strategic goals and requires tailored advisory services:

Mergers involve two companies combining to form a new entity, often to create synergies, expand market reach, or achieve strategic goals. The process typically includes valuation, negotiation, and integration planning to ensure a successful merger.

Acquisitions occur when one company buys another, gaining control of its assets, operations, or market presence. Investment bankers help identify targets, value the acquisition, structure the deal, and facilitate the purchase.

Divestitures involve a company selling off a portion of its business or specific assets to focus on core operations, raise capital, or streamline operations. Investment bankers assist in preparing the business for sale, finding buyers, and managing the sale process.

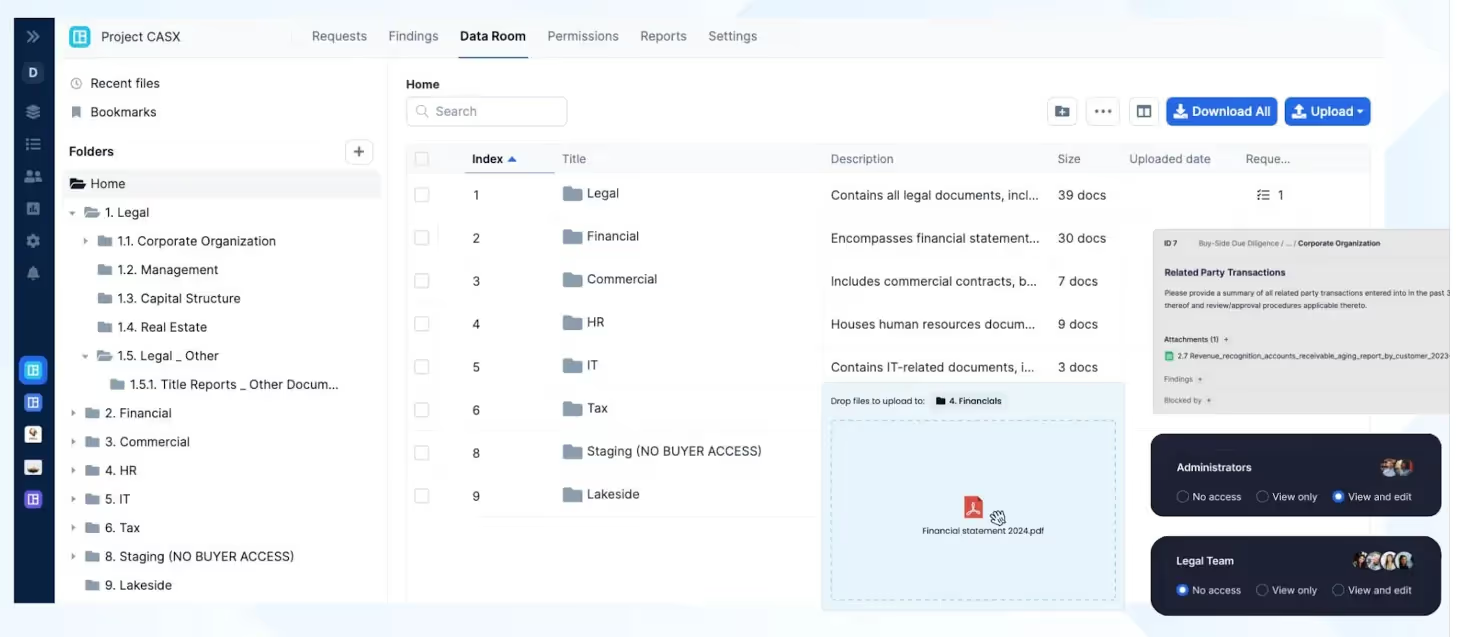

Software for M&A Investment Banking

Most investment bankers use relationship intelligence CRMs to leverage their relationship network, manage deal flow, and automate manual data entry. Virtual data rooms (VDRs) are another standard tool. Bankers may purchase a software platform to manage their VDR or manually set one up using Excel or another spreadsheet tool.

Given M&A’s complexity and time-consuming nature of M&A, those interested in streamlining and enhancing their process should consider a platform that is not only a VDR but an M&A-optimized project management software.

Final Thoughts

M&A investment banking is a specialized sector of the industry that manages transactions involving divestitures, asset purchases, consolidations, tender offers, buyouts, and more. An experienced investment bank, its professionals, and experts within this field offer crucial advisory services to support companies in executing both sell-side and buy-side M&A deals, from industry research to business valuations, capital raising, and deal negotiations. This enables them to act as effective intermediaries for companies seeking acquisitions or mergers.

Many investment bankers rely on DealRoom to navigate M&A challenges and maximize deal execution. By improving efficiency and speed, banking teams can streamline task management, improve collaboration, achieve synergies more quickly, and accelerate deal closures. This allows them to focus on the next strategic initiative or transaction, ultimately optimizing their M&A efforts.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)