Divestiture 101: Its Definition, Process, and Strategies

.avif)

Divestitures do not get the recognition they deserve in the world of traditional mergers and acquisitions (M&A). While they may strike fear in the hearts of some sellers, if done correctly, they can produce optimal results for businesses across many industries and sectors. In fact, a report by Bain and Company, which examined 2,100 public companies, found that companies that focus on divestment outperform those that don’t by about 15% over ten years. The results were even more impressive in companies with robust M&A practices.

As experts in this area, dozens of organizations use DealRoom to manage their divestiture process. Given that knowledge, this article will examine divestiture’s true meaning, process, best practices, and value.

What Is a Divestiture?

A divestiture occurs when companies sell off an asset such as a service, real estate, intellectual property, or product line. This allows businesses to generate cash flow, eliminate segments that don’t fulfill their primary objectives, lower debt, and increase shareholder value.

Understanding Divestitures

The most common explanation for divestitures is bankruptcy, where a company needs to liquidate all its investments and supplement its cash flow to resolve excessive debt, declining sales, operational issues, legal liabilities, unfavorable market conditions, and other unforeseen events. Still, divesting shouldn’t be seen as a last resort or worst-case scenario but instead as an integral part of a company’s ongoing M&A strategy.

Like acquisitions, divestitures can generate value by allowing companies to exit failing investments at the appropriate, consequential time and restructure their business. Similarly, the transaction can yield significant gains when a parent company divests from an underperforming asset, strengthening corporate finances or its valuation for an upcoming M&A deal.

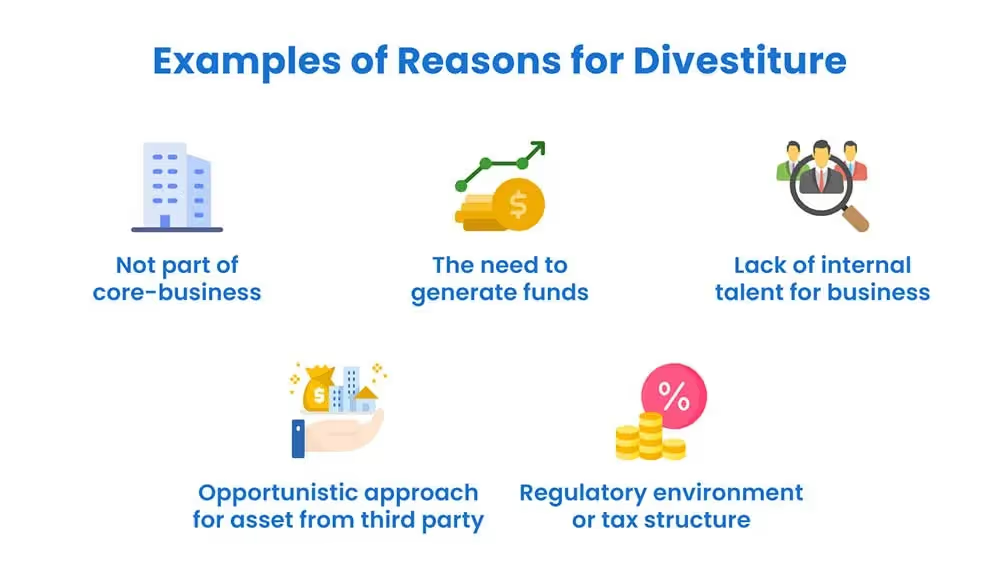

Core Reasons for Divestitures

Establishing the "why" in an acquisition is just as important in a divestment. Selling an asset too soon, or the contrary, holding onto it for too long, can decimate its value. Organizations get rid of assets all the time for common reasons, including the following:

1. It’s no longer relevant to the business's core operations

Managers often opt to divest from assets when a parent company adjusts its strategic focus. For instance, the business shifts to a new market, making the asset no longer necessary to the corporate strategy. This was the case when the American company UPS sold Coyote Logistics to RXO, Inc.

“As UPS positions itself to become the premium small package provider and logistics partner in the world, the decision to sell our Coyote Logistics business allows an even greater focus on our core business.” –UPS Chief Executive Officer Carol B. Tomé.

2. To generate additional funds

This is a common divestiture strategy to avoid selling a business's shareholder equity, improve balance sheets, issue debt, and more. There is an apparent overlap between this and the corporate restructuring tactic highlighted in reason one, as supplementary funds are required to make an acquisition.

Tellurian closed a $260 million asset sale to affiliates of Aethon Energy Management, utilizing the proceeds to retire the $230 million of non-convertible Senior Secured Notes scheduled to mature in 2025.

“This transaction is a significant step in securing our balance sheet and progressing Driftwood.” – Tellurian Executive Chairman Martin Houston.

Additionally, PAR Technology Corporation, a global restaurant technology company, sold its Government operating segment by selling its wholly-owned subsidiaries for a combined total of $102 million.

“The divestiture is part of our efforts to divest non-core assets and reinvest capital where it will receive the highest return.” –Savneet Singh, PAR Technology’s Chief Executive Officer.

3. To acquire internal talent

The motive here is less apparent than others, but given today's global talent shortages, it may gain popularity in the coming years. A lack of human capital may impede an organization's ability to continue providing services, forcing a divestment from the business unit in question.

Remember, communication with your employees and stakeholders is as important as communication with clients.

Demonstrating this logic, the English company, H.I.G. Capital, a leading global alternative investment banking firm, sold its portfolio company Acqua & Sapone to funds managed by TDR Capital LLP, a top European private equity firm. In this divestiture, H.I.G. and the Barbarossa family retained a significant equity stake in the Company.

“H.I.G. has been a tremendous partner in helping us to further scale the business, execute M&A, improve service levels, achieve synergies, and make Acqua & Sapone the undisputed leader in the Italian market. We are grateful for the continued support from H.I.G., and we welcome our new partnership with TDR to keep building on our 40-year-long success story.” –Nando Barbarossa, on behalf of the Barbarossa family.

When The Knot Worldwide acquired Simply Eloped, the go-to online platform for elopements and micro weddings in the U.S., it also obtained its employees, including the founder, Janessa White.

“With The Knot Worldwide’s support, we can reach even more couples and offer our personalized approach to wedding planning on a larger scale.” –Janessa White, Director and General Manager of Simply Eloped.

4. It’s an opportunistic approach to acquire assets from a third party

Occasionally, a company receives an enticing offer from a third party, typically another business in its industry or a private equity firm. Such scenarios can generate significant market value for the target company, as they are often in a stronger negotiating position when approached to sell an asset rather than actively seeking buyers.

Iconic assets like brands and real estate are particularly prone to these vanity purchases, where the buyer's motivations may be driven by prestige or ego instead of a strategic alignment.

Following consultation with its financial and legal advisors, the board of Vista Outdoor Inc. unanimously rejected MNC Capital's all-cash, unsolicited offer of $42.00 per share. Instead, they accepted a deal from the Czechoslovak Group (CSG), who agreed to $7-$16 more per share.

5. To evade regulatory environment or tax structure shifts

Specific regulatory changes in an industry or product category can compel a company to divest assets. This move is deemed strategic for reasons like being placed in a higher tax bracket or facing increased government regulation for public interest or safety concerns.

The U.S. has targeted foreign-owned companies like TikTok for forced divestments amid the ongoing US-China trade feud. The Committee on Foreign Investment has already required several Chinese investors to divest from their US-based assets. These actions will likely provoke similar reactions from China, impacting the market value of companies operating in these adversarial countries.

Types of Divestiture Strategies

A range of transactions can fall under the divestiture category. The most common examples of divestiture types include:

1. Spin-off

During a spin-off, a company separates a subsidiary into a standalone company and distributes shares of this new entity to its investors. While spin-offs do not generate cash, they tend to increase shareholder value and are often part of a company’s comprehensive strategic exit plan.

2. Split-off

As the name suggests, a split-off is similar to a spin-off. It creates a new business entity independent of the parent company. The main distinction is that shareholders can take shares in the newly created entity.

3. Carve-out

A carve-out occurs when the target sells not part of its core operations. Shares are sold through an IPO (initial public offering), creating a new set of shareholders. Unlike a spin-off, the parent company usually supports the subsidiary, even though they are separate legal entities. Carve-outs are regarded as the most complex type of divestiture.

4. Sell-Off

In a sell-off or trade sale, the seller transfers a part of the business or subsidiary to another company. Many practitioners consider sell-offs to be easier divestitures because they are typically quick. Though they are the most common type, the proceeds from the sale are subject to taxes, necessitating some extra financial work.

5. Asset Liquidation

Liquidating assets often entails selling a company in segments for their asset value, serving as an exit strategy for departing a particular business.

The Divestiture Playbook: From Planning to Executing Divestments

Selling off subsidiary business interests or investments can be complicated but necessary for companies seeking to streamline operations, reduce debt, or focus on core activities. This guide outlines each step in the divestiture process, from initial planning to the final execution.

1. Begin Divestiture Planning

The first step in the divestiture process is thorough planning. This involves identifying the assets to be sold, analyzing market conditions, and setting clear objectives for the divestiture. Companies must evaluate the strategic fit of the assets within the overall business portfolio and determine the potential value that can be realized through the sale.

2. Define Your Objectives

Before divesting, sellers must determine their goals for the transaction. This process, commonly known as "baseline assessment" or "strategic planning," involves identifying which investments they wish to sell, the reasons behind this decision, and assessing the capabilities connected to these assets.

3. Determine Divestiture Type

As strategic planning progresses, after reviewing the data and company objectives, the seller must decide the appropriate divestiture type, whether a carve-out, spin-off, or trade sale.

4. Asset Sale Preparation

Once the decision to divest has been made, the next step is to prepare the assets for sale. This includes due diligence, where companies gather all relevant financial, legal, and operational information. Businesses should ensure that the assets are presented to potential buyers in the best possible light, addressing any issues that could impact the sale value.

5. Integrate HR

HR should be involved from the outset. Their role is pivotal to the deal lifecycle as they determine the asset's success and value. Normally, HR partners with Corporate Development, preparing documentation specifying the transaction scope, key employees, and more, refining everything until the finalized announcement. Ring-fencing is a term HR practitioners use to describe retaining employees critical to the divestiture, protecting the deal's value and the seller’s reputation. As mentioned, HR will want to specify this group or narrow it down early on. HR will communicate with the employees “on the fence,” communicating that they may be unable to apply for other positions.

6. Identify Potential Buyers

Identifying and targeting the right buyers is paramount for a successful divestiture. This step involves market research to pinpoint potential buyers who would benefit from acquiring the assets. Companies may also engage with financial advisors to assist in finding and approaching potential buyers.Preparation as a seller is paramount to upholding the company's integrity during divestiture and securing an optimal valuation. If the seller has experience as a buyer, they can adapt past questionnaires and surveys to predict potential buyer queries. Additionally, documenting questions from interested buyers in a FAQ document throughout the process helps maintain effective communication.

7. Asset Valuation

Accurate valuation of the assets ensures a fair transaction. Organizations must conduct a thorough valuation process, considering factors such as market conditions, asset performance, and future potential. This step may involve using various valuation methods and consulting with financial experts.

8. Asset Marketing

Effective marketing is key to attracting potential buyers. This involves creating comprehensive marketing materials, including detailed information about the assets and their potential benefits. Companies may also conduct targeted marketing campaigns and engage with interested buyers through various channels.

9. Provide Letter of Intent

Once a buyer is identified, the next step is to draft a letter of intent (LOI), which marks the beginning of the actual divestiture process. Like traditional mergers and acquisitions, the intensive due diligence process follows and involves gathering and analyzing information about the target. Come prepared.

10. Sale Negotiations

Negotiation, including payment terms and other transaction conditions, is critical in the divestiture process. Companies must be prepared to engage in detailed discussions with potential buyers to agree on the final terms of the sale.

11. Create a Purchase Agreement

Draft the purchase agreement (PA) while due diligence is underway. The PA covers the purchase price, payment terms, representations, warranties, and closing conditions. HR should review these agreements and offer insights into employee-related matters and benefits.Transitional Service Agreements (TSAs) allow deals to proceed even if the buyer lacks the infrastructure to start operations immediately. Again, HR will communicate with the buyer and consider employee needs as they develop the TSA, allowing the seller to provide transitional services for about a year.

12. Deal Closure

Once the terms are agreed upon, the final step is to complete the transaction, where stakeholders draft and sign the sale agreement, transfer ownership of the assets, and ensure compliance with all legal and regulatory requirements. Proper documentation and communication are essential to ensure a smooth transition.Closing a divestiture deal culminates your strategic planning, meticulous preparation, and diligent negotiation. Of course, celebrate its end, but don't ignore your post-closing responsibilities. Effective transition planning will ensure a seamless handover of operations to the buyer, maintaining business continuity. By following these steps, companies can successfully navigate the divestiture process, maximize value, and achieve their strategic objectives.

Notable Divestiture Examples

When executed correctly, divestitures can add as much value as acquisitions. They allow a company to withdraw from non-strategic business initiatives and use the proceeds to invest in core strategic areas, enhancing overall value. Some well-known examples of companies successfully implementing divestitures include:

Neste Oil

The Finnish company Neste Oil changed its name to Neste in 2015, reflecting a new focus on renewable energy. Since then, the company has divested most of its oil and gas-related assets, reinvesting the acquired funds into renewable energy. The shift led to an 8-fold increase in its stock price in just five years.

Microsoft

Although Microsoft’s $68 billion acquisition of Activision Blizzard is its largest to date, over 20 years ago, the company divested from its video game manufacturers, as they were not part of its core strategy.

In 2003, Microsoft sold DreamWorks Interactive, the Medal of Honor series developer, to EA Games, Activision Blizzard’s biggest competitor in the gaming market today.

Procter & Gamble

A strategic and financial review of Procter & Gamble’s operations in 2014 revealed to its CFO that around a third of the conglomerate’s brands generated 95% of its income. This insight led to a series of divestitures, including selling 43 beauty brands to Coty in 2015 for a combined $13 billion and its stake in Duracell to Berkshire Hathaway in exchange for the company’s shares.

After Russia invaded Ukraine in early 2022, several large international investors, including the Norwegian Sovereign Wealth Fund, Shell Oil, and BP, announced their intention to divest their assets in Russia, citing political and economic motives.

Key Factors to Evaluate Before You Divest

The divestiture process is far more complicated than a typical M&A process, with unique complexities that will develop during its execution. For an in-depth look, check out our step-by-step guide on M&A Science.

1. Divestitures are just as complex as traditional mergers and acquisitions.

When divestment becomes an option, business stakeholders must communicate their intentions to each other and with human resource leaders. The more proactive sellers are, the smoother the deal and its transition will be, as they can better manage the narrative with their employees.

2. Are buyers interested in the asset or its capabilities?

Identifying potential buyers who can maximize the divested assets’ capabilities will help drive its price. Nevertheless, sellers should be wary of divesting into strong competitors if this sale hurts the remaining business products and services.

3. What gaps will the buyer need to fill?

What will the buyer need to be operational on Day 1? Anticipating these answers will assist the sell-side in preparing for the transaction and conducting divestiture diligence.

4. What type of divestiture is best for the company’s strategy?

For instance, carve-outs are more successful when the parent company remains active and maintains a significant ownership percentage. In contrast, spin-offs help address marketing and management issues and provide tax advantages.

5. Timing, as always, is pivotal.

When companies keep assets that no longer serve them, the assets tend to lose value.

Your Divestiture Checklist Is the First Step to Any Divestiture

In an M&A Science interview, Rhonda Rein, Director of Corporate Development at Thomson Reuters, eloquently summarized common divesture challenges:

“It can look simple, but when you start getting into the details, it can get very complicated very quickly.”

This process involves constant evaluation of core assets, non-core assets, opportunities, and threats that blur the lines between them. Referring to and continuously updating a checklist can help manage the need for constant analysis.

Final Thoughts

With divestments growing in frequency, thorough preparation becomes the cornerstone of a successful strategy to align operations with the selling entity, ensure clarity, and communicate. HR plays a central role in collecting vital information from different segments of the parent company.

Ultimately, impactful divestitures hinge on the strategic objectives and recognition of the employee’s contributions to the asset's value.

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

.png)

.png)

.png)

.svg)

.svg)

.avif)