The Ultimate Guide to M&A Pipeline Management

.avif)

While there is no set playbook for each and every merger and acquisition, there is a basic series of events that take place in all deals.

In this article we at DealRoom, creators of M&A pipeline management software, will look at all aspects of pipeline management for M&A deals. So let's start from the beginning.

What is an M&A Pipeline?

An M&A pipeline (or M&A funnel) refers to the flow of events that occur during a transaction and how stakeholders work them. The pipeline steps begin with acquisition strategy and deal sourcing, proceed to acquisition planning, negotiating, and due diligence, moving all the way to transaction and integration.

In order for the M&A process to stay organized and intentional, each milestone of the pipeline should have set entry criteria so it is clear when it is time to move to the next step.

Finally, and perhaps most importantly, an M&A pipeline should be a collaborative and efficient process, not merely steps to work through, in order to close deals that live up to their potential value on paper.

7 M&A Pipeline Stages

Creating and managing a deal pipeline can be challenging and requires a structured approach. In this section, we will guide you through 7 stages of M&A pipeline and provide an overview of what each stage usually looks like - what happens, why, and the goal.

.avif)

Let’s dive in.

1. Strategy Development and Goal Setting

The foundation of any successful merger or acquisition lies in its alignment with the company's overarching strategic goals. This involves understanding the core strengths of the company, the process of each business, and identifying gaps in the market.

This strategic alignment not only justifies the M&A initiative but also sets the stage for successful integration post-acquisition.

For instance, if the corporate strategy is to expand and capture markets overseas, then looking at local companies wouldn’t help. If the corporate strategy is to increase market share in an existing industry, then the company could look at acquiring its competitors.

The corporate strategy must dictate the M&A activity and not vice versa.

Learn more

- Tying Up M&A Strategy with Integration

- How to Create an Agile M&A Strategy

- How to Manage Deals From Strategy to Closing in M&A Part 1 - (& Part 2)

Disney acquired Marvel

A great example of this is Disney. In the early 2000s, Disney was only famous for catering to a younger audience. In the pursuit of growth, Disney wanted more stories and characters for its movies & shows. They also wanted to expand their market and capture the older generations.

Marvel Comic Books, on the other hand, have created many iconic characters. But the innovation of technology has changed the animation industry causing a massive decline in the comic book market. Marvel was fighting for survival and eventually changed their brand name to Marvel Entertainment in 2005, with the hopes of producing movies featuring their very own superheroes.

With both of their corporate strategies aligning with each other, Disney decided to pursue and buy Marvel Entertainment on December 31, 2009. This move helped Disney achieve their corporate strategy and diversify their audience, while Marvel was able to bring their superheroes to the big screen.

M&A Strategy

To formulate the M&A strategy, corporate development professionals usually start by meeting with people in the company who know best. These are usually salespeople and department heads who are in the trenches every day.

“I spent 30 days probably interviewing department heads, meeting people, flying to this location, driving to that location, meeting folks and introducing myself, and really just learning about the business. "

Mike Palumbo, Director of Corp Dev, HALO

Learn more: Evolving Your Corporate Development Function (Mike Palumbo)

After grasping the culture and processes of the company, setting clear success metrics is vital to the success of M&A. These metrics serve as benchmarks throughout the M&A process, providing a clear focus for the entire team and will help them make better decisions.

These could include quantitative targets like a specific increase in market share, revenue growth, or cost savings from synergies.

Qualitative goals might involve acquiring specific technological capabilities or entering a new geographical market.

2. Market Analysis and Target Identification

Many companies maintain a pipeline of more than 100 separate targets to understand its landscape. They systematically create a deal thesis and detailed financial model for each target, regularly updating the data as market conditions change. Despite this fact, however:

Nearly two-thirds (67%) of M&A dealmakers have been unable to identify suitable target companies in 2022

Source

These are the levels of intelligence and extents of which market leading companies have to go to with their M&A target pipelines.

That being said, at this stage, companies analyze the market and identify the right business that could help achieve the company’s strategic goals.

It involves:

- Industry Trends Analysis: Companies keep up with the latest industry trends, technological advancements, and consumer behaviour shifts.

- Competitor Benchmarking: Teams analyze competitors’ strengths, weaknesses, market positioning, and strategies.

- Identifying Market Gaps: Recognizing unmet needs or underserved areas within the industry can reveal opportunities for growth through acquisition.

The goal is to recognize potential areas for growth that can be addressed via M&A.

After much analysis, teams build a target customer profile to help identify the ideal target company, including size, market position, financial health, and cultural fit.

Once an ideal target company profile is identified, "pipeline filtering system" comes into play.

A negative practice M&A teams undertake is boiling the ocean and listing down every company in the desired industry. It’s considered best practice to only consider viable companies as potential M&A targets.

Scorecard

Many practitioners use a pipeline scorecard that serves as a filter on how they look at companies, based on an inward assessment of their ability to enter a market organically, dictated by their customers.

The scorecard typically includes metrics management consistently tracks. Ie. If an organization cares a lot about sales metrics, the scorecard should be based on that.

Another aspect to consider is the difficulty of the target company's integration. This can be measured by identifying the differences between you and the target, which includes culture and other change management aspects.

"Every company should have a scorecard for internal, and all corp dev teams should start from that scorecard."

Matt Arsenault (How to Formulate Your M&A Strategy)

To effectively screen the target companies even before approaching, professionals use tools like Pitchbook, Crunchbase, Capital IQ, Bloomberg, Factset, Glassdoor, and others. These tools help identify the target company’s size, financial health, and cultural fit.

While not every company will make it through the criteria, the list can still get very long and complicated, with all the information that goes along with the company’s name.

It is considered imperative to maintain a centralized intelligence that enables clear, organized view of all potential targets and related documents, communication, and other deal data in one place.

3. Initial Contact and Preliminary Assessment

With a well-vetted list, the next step is approaching the target company.

Whether it’s a cold email, LinkedIn outreach, or a simple phone call, dealmakers usually start by introducing themselves.

It is not advisable to approach the target immediately to buy. Learn more about the target company first. It's a get-to-know-each-other phase, so practice active listening and educate the target about who you are and what your organization does. The most successful corporate development folks always present an opportunity to grow together, and if it’s possible, they discuss it in person.

During the first meeting, try to be as productive as possible. One of the best things to do is to prepare five major topics to discuss to give you enough information on whether to pursue a deal.

After gathering more information regarding their business, there is better clarity on whether or not to pursue a deal. Ideally, the target company agrees to provide sensitive information regarding their business in exchange for a signed NDA.

Learn more

- How to Approach Deal Targets

- How to Negotiate and Structure NDAs in an M&A Deal

- How to Best Cold Call and Break Through Gatekeepers at Target Companies

- How to Stand Out Among Buyers and Determine Potential Value Alignment

4. In-Depth Evaluation and Due Diligence

If the target company passed with flying colors during the preliminary assessment, it’s time to dive in and commit to the transaction.

It’s standard practice to issue a Letter of Intent (LOI) in favor of the target company, stating the intention to acquire and perform a confirmatory due diligence process within a certain timeframe.

Based on Bain's M&A report, a thorough evaluation of the target company is increasingly important particularly during uncertain economic times.

Acquirers must understand the target company’s financial health, operational efficiency, legal compliance, and cultural aspects before pursuing further.

M&A due diligence is a lengthy and intimidating process that involves multiple parties and phases.

Below are some of the most common steps of the due diligence process:

1. Evaluate the Goals of the Project

This helps identify the resources required and ensure alignment with the firm’s overarching strategy.

2. Analyze the Business’ Financials

Analyzing the financials helps gauge the company’s asset health, assess overall financial performance and stability, and detect any red flags.

4. Thorough Inspection of Documents

This step includes inspecting other documents of the target company, such as contracts. The goal is to gain a better understanding of the firm as a whole and to better appraise long-term value.

5. Integration planning

Assess how well the target company will integrate with the acquiring company. Plan all the necessary steps to fully integrate the business.

6. Final Offering Formation

Every individual and team involved must collaborate to share and evaluate their findings during the diligence process. The result will be the final offer for the purchase price agreement.

7. Risk Management

Risk management is looking at the target company holistically and forecasting risks that may be associated with the transaction.

It is important to note that due diligence is not everything.

McKinsey suggests that, while diligence is crucial, it often overlooks up to 50% of potential merger value. Companies should look beyond due diligence to uncover additional synergies and value.

Learn more:

- Due Diligence Process: A Complete Guide

- M&A Risk Management Basics & How To Prevent Deal Fever

- How Successful Diligence and Integration Planning Frames Successful M&A and Valuation

5. Deal Structuring and Negotiations

M&A deal structuring usually takes into account issues such as the nature of the consideration in the transaction, the role of management on both sides after the deal has closed, conditions that need to be fulfilled for the deal to close (for example, regulatory clearance), and other contingencies.

The M&A deal structure is extremely important, as it essentially outlines how the deal will generate value for all parties involved.

A comprehensive M&A deal structure will take into account issues arising several years into the future and in particular, unforeseen risks that could impact the deal. The process through which this occurs is called ‘deal structuring’.

“There are three dials in every deal: Valuation, Risk Management, and Integration. And every time one dial is turned, the other two get affected. For instance, if you put an earnout in the deal structure, it increases the risk protection but may hinder you from fully integrating the business as quickly as possible. If you pay cash upfront, you can fully integrate quickly, but will increase your risks.”

Carlos Cesta, VP Corp Dev, Presidio

Similarly, negotiations are inevitable, and anyone should expect the seller to push back on their initial offer. Draw the line on the non-negotiable areas as they are vital to the strategy. It equally as important to make the other party feel good about the deal.

The goal is to find a win-win situation. The best deals are the ones where both parties walk away happy.

Learn more:

6. Finalizing the Deal and Legal Closure

This stage marks the culmination of the M&A process, where both parties sign the purchase agreement and strive to close the deal.

But before that happens, acquirers must obtain and secure closing requirements, such as regulatory approval, corporate approval, and third-party approval.

Both parties must beware, as there are still risks involved during this interim period, and either one of them can still back out of the deal legally. Some of the most common risks are breach of reps and warranties, lack of closing requirements, and material adverse effects.

Learn more:

7. Effective Post-Merger Integration Execution

Post-merger integration is a misnomer.

The ‘post’ prefix leads practitioners to believe that it is both separate to due diligence and after the transaction has closed. Neither is the case.

Post-Merger Integration builds on due diligence, extracting value from the analysis conducted.

Whether the M&A motive is extending the product or service line, increased market share, or entering a new geographic market, the reason why should underpin everything during the transaction, including the integration phase.

Best practices that help realize deal's projected value include:

Early Integration Planning

Integration should not be an afterthought. Successful acquirers begin planning for integration early in the M&A process, often parallel to the due diligence phase. This proactive approach allows for a smoother transition and quicker realization of synergies.

Identifying Synergies and Risks

Early planning involves identifying potential synergies – whether in cost savings, revenue enhancements, or strategic advantages – and understanding the risks and challenges that might impede their realization. This foresight is crucial in setting realistic integration goals and timelines.

Aligning Due Diligence with Integration

The due diligence phase is not just about evaluating the target's worth; it's also an opportunity to gather insights for integration. Aligning due diligence findings with integration planning ensures the transition is based on a deep understanding of the target's operations, financials, and culture. The most experienced integration leaders convert the due diligence findings into mitigating actions in real time.

“If you look at what goes into the integration plan, it’s everything that you find out in due diligence.”

Erik Levy, Head of Corp Dev and M&A, DMGT Group

Related:

- Agile M&A: Unifying Corporate Development and Integration

- How to Plan M&A Integration and Create Integration Strategies

- How Microsoft Bridges the Gab between Corp Dev & Integration

Informed Decision-Making

This alignment helps in making informed decisions about integration priorities. For instance, due diligence might reveal areas of the target's business that are particularly profitable or innovative, which should then be prioritized during integration to maximize value.

Learn more about how corporate development professionals can focus on integration here:

Cultural Integration

Acknowledging Cultural Differences: One of the most challenging aspects of M&A integration is managing cultural differences. The acquirer must recognize and respect the target company's culture while finding ways to balance the two companies together.

Effective Communication and Engagement: Clear, consistent communication and engagement strategies are vital in managing cultural integration. This involves not just top-down communication about the integration process but also fostering a two-way dialogue to address concerns and expectations of employees from both companies.

To learn more on how to conduct a cultural assessment, read here:

Developing a Detailed Integration Roadmap

Blueprint for Success: A detailed integration roadmap is a blueprint for the entire process. It outlines the key milestones, timelines, responsibilities, and resources required for successful integration.

Flexibility and Adaptability: While it's important to have a structured plan, flexibility is key. The integration process can uncover new information and challenges, requiring adjustments to the roadmap. Being adaptable while focusing on the end goals is crucial for effective integration. This approach is also known as Agile M&A.

An agile approach entails Implementing a regular cadence of meetings to ensure constant communication and alignment with the integration team. This approach will increase the likelihood of a smooth integration process.

Monitoring and Adjusting: Regularly monitoring the integration progress against the roadmap is essential. This involves tracking key performance indicators (KPIs), addressing unforeseen challenges, and making necessary adjustments to ensure the integration stays on track.

Learn more

- How To Create A Successful M&A Integration Plan

- How to Execute an M&A Integration Plan on Day 1

- What Successful Integration Looks Like

- Ensuring alignment for deal success

- How to Focus on Integration as a Corporate Development Professional

M&A Pipeline Challenges

Think you know everything about M&A pipeline management? Think again.

When most executives are asked about the challenges of M&A pipeline management, their mind focuses on target search and deal initiation.

This simplified view of how M&A pipelines function overlooks the myriad challenges that exist in ensuring that companies on a shortlist make it the deal initiation stage.

Understanding the full scope of M&A pipeline management is crucial. While the initial stages often capture the most attention, it's the deeper, often overlooked challenges that truly dictate a deal's success.

To gain a more thorough understanding and enhance your strategic acumen, explore this in-depth discussion in our new dedicated article: Top 10 M&A Pipeline Challenges (with Solutions)

How to Build an M&A Pipeline

1. Acquisition Strategy & Deal Sourcing

The pipeline begins with acquisition strategy and deal sourcing. At the commencement of this step, the acquirer needs to firmly establish the rationale and motivations behind its desire to acquire targets and engage in the M&A process.

Without this critical step, the acquirer is less likely to select appropriate and fruitful targets.

Certainly the most common motivation for M&A is financial reward based on maximizing synergies, such as cost and revenue synergies. Other motivations include diversification, tax benefits, empire-building, and international goals.

Once the acquisition mission is set, the Corporate Development team needs to generate a database of targets. The target list must then be refined based on the acquirer’s motivations, resources, and goals; at this stage, criteria such as deal size and strategic fit are examined.

You can now learn about the best strategies for building your M&A origination process. Grab your copy of the playbook here.

2. Connecting with the Seller & Initial Data Requests

When a target is a strong strategic fit, Corporate Development must work to connect with the seller and establish a connection, while at the same time gathering initial information such as KPIs.

It's so important to build trust and relationships with target companies so you can leverage the intangibles in addition to competitive price, speed, and certainty to close

Jeremy Segal, VP Corp Dev, Progress

Following this connection and collection, the Corporate Development team must make the critical decision of whether to continue pursuing the target.

If it has not gathered enough information to make a sound, informed decision, the team will need to send over an initial data request.

If the decision to move forward is made, an in-person meeting should be scheduled, and this meeting should focus on five essential questions specific to the target that will provide Corporate Development with enough information to keep the potential deal moving forward toward due diligence.

Throughout this time period, Corporate Development must be discussing potential offer and negotiation strategies. Additionally, it needs to be sure it can articulate the value of the potential deal to the other stakeholders at the acquiring company.

Corporate Development should even begin thinking about the integration process.

3. Due Diligence

Thanks to the Securities Act of 1933, due diligence is an M&A necessity. While it is meant to provide companies with valuable information, diligence often gets a bad rap as it can be an overwhelming, time-consuming task of data collection, that, if done incorrectly, can lead to loss of profits and bad blood.

Here it is important to acknowledge that due diligence is not only about legalities, but also about fleshing out the buyer’s picture of the target’s business model, value drivers, and people.

The type of information uncovered during diligence allows the acquirer to see both the big picture and the details through the collection of information that is not public knowledge. The due diligence process is usually carried out by the acquirer and its stakeholders and advisors, such as attorneys, financial advisors, and team leaders, and takes, on average, 30-90 days.

Much of the work is done on-site and via collaborative and secure virtual data rooms (VDRs). Everything including tax documents, sales breakdowns, future budget plans, employee contracts, and more is collected during this time.

Gaining an in-depth understanding of a company can be a highly specialized process beyond most people without experience in the field, however.

Access to our proven due diligence templates helps DealRoom's clients complete due diligence up to 50% faster, which ultimately leads to, as told by one of our clients, better deal outcomes.

"Using DealRoom for due diligence, we saved an average of 3 to 4 hours a day during the process, minimizing the need for long hours and late nights"

Amanda Mucek, Corporate Development, Paylocity

4. Integration

Integration is the combining of two companies - their employees, operations, and finances. It has the power to make or break deals, and the best acquirers have robust integration practices.

These practices include beginning integration planning early on in the M&A process, using diligence team members as integration team members later in the process in order to establish continuity, and developing integration plans before the deal closes.

Acquirers who do not give integration enough serious forethought may lose out on capturing synergies or lose key employees. Learn more about integration strategies and find out how to fortify your integration practices.

DealRoom's clients using m&a pipeline software can, among other pipeline stages, enjoy a complete range of Post Merger Integration Checklists with a built-in Integration Planning Roadmap Tool®, which is proven be further helpful in setting your company up for post-close integration success.

How to Manage Your M&A Pipeline

1. Store Documents Safely

Clearly, in order to manage your pipeline, you first need a secure place to safely store all of your documents.

Virtual data rooms or M&A lifecycle management software like DealRoom are the preferred storage tool as they eliminate the unwieldy and inconvenient exchange of hard copies and provide more safety and security, which increases collaboration and protects the deal; at times, VDRs also offer project management features.

2. Eliminate Work Silos With Strategic Communication

Transparency throughout the M&A process breeds efficiency and brings concerns and potential roadblocks to the forefront.

Daily stand-ups for teams (15-30 minute meetings) are ideal. In addition, team leaders should then meet weekly or biweekly to share out information; this pattern of reporting upwards should continue until it reaches the highest level.

With this Agile inspired style of managing the pipeline, deals cannot fall into the trap of working in silos, which, in turn, eliminates redundant work, holds team members accountable, and keeps stakeholders in the loop.

.avif)

M&A Pipeline Management Tools

Anecdotal evidence suggests that well over half of M&A practitioners are still using Microsoft Excel for their M&A pipeline management.

When students of mergers and acquisitions look at where value is generated and lost in the value chain, they would be well advised to concentrate on the lack of resources invested by companies in their pipeline management process.

These companies fail to remember the dictum, ‘rubbish in, rubbish out.’

The idea that billion-dollar transactions can be closed based on ‘back of the envelope’-style lists of target companies is simply naive. Even if the target list is short - say, less than 10 companies - as is the case with many companies in the lower and middle market, there are ways that companies can generate and destroy value from an M&A pipeline, depending on how it is managed.

Below, we discuss this further.

Excel - The Status Quo

The status quo is best represented by Microsoft Excel.

To many, Excel is the best software tool ever created, and we’re not inclined to disagree.

But it wasn’t created for pipeline management. A typical M&A pipeline will involve anything from 5-10 columns with headings such as ‘target company name’, ‘date contacted’, ‘contact person’, ‘status,’ ‘valuation range’, ‘last contact date’, and more.

This is a misuse of Excel.

It is a tool whose primary function is numerical processing and presentation. Anyone who has ever tried to use Excel for purposes outside of this will be acutely aware of the challenges being referred to. In the case of M&A transactions, there are too many issues that need to be addressed on an ongoing basis than a crude Excel list can deal with.

The limitations of Excel from the viewpoint of M&A pipeline management include:

- Poor user experience: It may appear po-faced to criticize the user experience of Microsoft’s flagship product (outside of Windows), but anyone who has tried to link to external sources or collaborate within Excel (“which cell are we talking about?”) will know what is meant by this.

- Limited collaboration: Mentioned above, to date, Microsoft has largely left collaboration unaddressed in its latest versions of Excel. There is still no real-time collaboration between users, and the online versions (Excel 365) are highly prone to bugs, glitches, and poor version control.

- Data security: Executives will be now all be familiar with refrains such as ‘is your company data security ready?’ If your company is using Microsoft Excel for its M&A pipeline management, the answer to the question is ‘no.’ Using spreadsheets like Excel opens a data security can of worms for companies.

M&A Pipeline Management Software - The Alternative

A growing number of M&A pipeline management tools offer an antidote to the over-reliance on Microsoft Excel.

This movement began with practitioners who were dealing with pipelines that included hundreds of potential targets and has cascaded down to buyers of all sizes. The rationale is simply too strong to ignore.

Among the benefits of utilizing strong M&A pipeline management software include:

- Dedicated and Integrated Framework: An M&A pipeline management tool can offer solutions that Excel simply isn’t designed for. This includes in-platform messages, tasks, updates, target company valuations, and more. Having this all under one roof is a huge time saver and value generator.

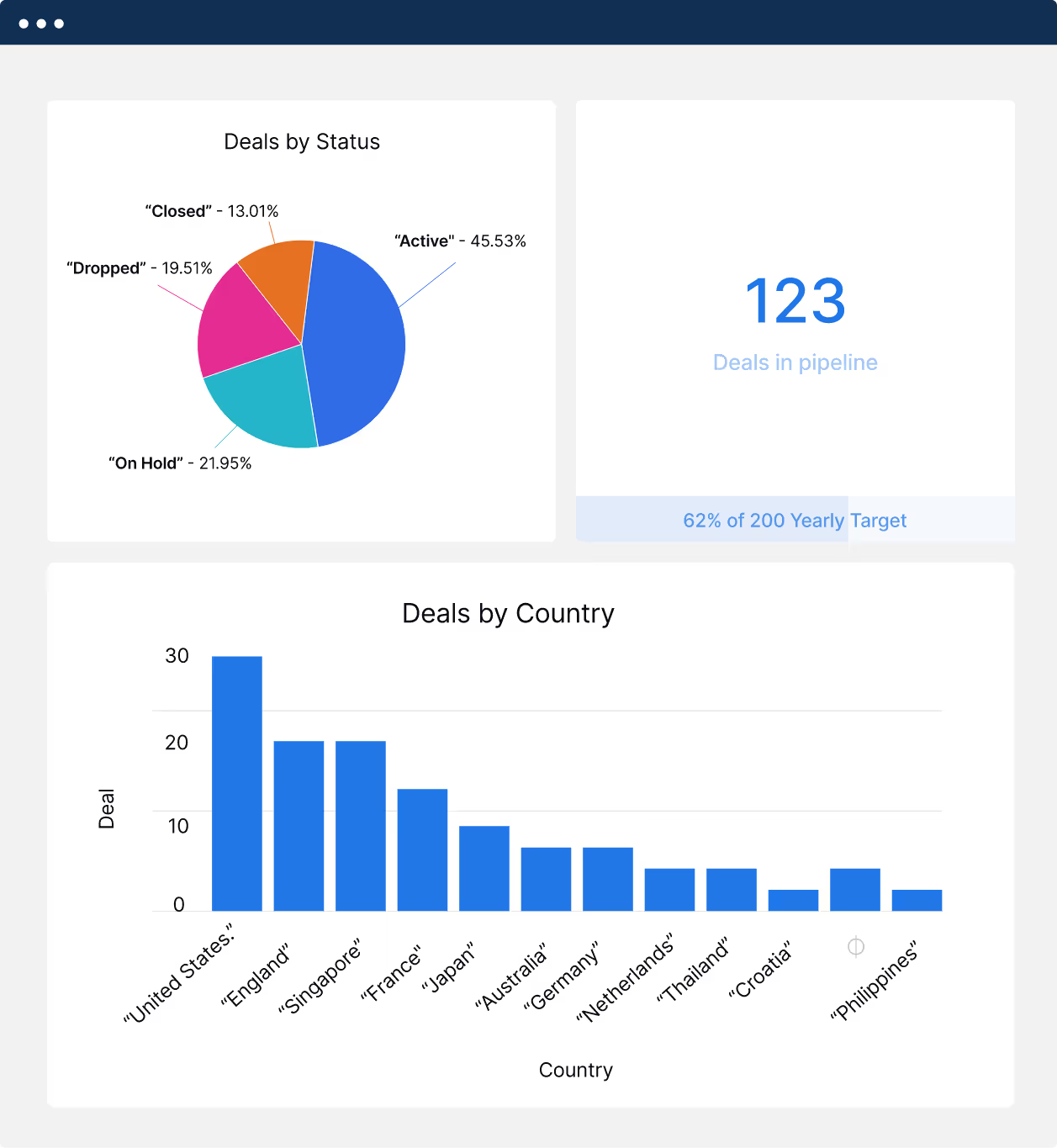

- Enhanced Visualization & Reporting: While Excel’s data visualization capabilities continue to improve, it says a lot that Microsoft BI is already marketed by Excel’s parent company as an alternative. The best M&A pipeline management tools include powerful data visualization tools that enable executives to understand targets faster.

- Customizable Dashboards: How has one target grown over the past five years compared to another? What are the cultural issues in each target company? What are the different executives’ opinions on each firm? This is all possible within pipeline management software and within manageable timeframes.

%2520(1).avif)

What is M&A Pipeline Management Software? A Closer Look

M&A pipeline management software is essentially M&A project management software that, ideally, is intuitive and collaborative, allowing for stakeholders and team members to communicate and remain accountable throughout the M&A process.

Pipeline management software can revitalize your M&A practices as it fosters organization and efficiency when multiple deals are in progress. Have a closer look at how M&A deal pipeline software benefits teams in their deal pipeline tracking efforts.

Benefits of DealRoom’s Pipeline Management Software

From origination to post-merger integration, M&A transactions are large projects composed of several separate phases. The challenges they bring tend to grow in an exponential rather than linear fashion with each extra deal.

Why?

Because individual roles, corporate targets, and timelines are all moving according to where each deal is. And experience shows, the more deals that a company takes on, the higher the chances that unexpected events will occur.

This underlines the importance of employing a good pipeline management function. If the success of multiple deals is underpinned by good organization, good organization is underpinned by strong M&A pipeline management software like DealRoom.

.avif)

And to reiterate, this is more true as the number of deals that a company looks to undertake increases.

Some of the advantages of employing pipeline management tools include:

Convenient overviews: Corporate development teams can gain convenient overviews of where each deal is in its process, what resources, information, and processes are required, and what the outstanding requests are to reach the next phase of the deal.

Centralized location: With more deals, using a host of different platforms creates difficulties that tend to run into problems- requests overlooked, deadlines missed, and more. One centralized location enables users to avoid these problems.

Customizable platform: Best of all, with a tool like DealRoom, the platform can be easily customized to the user’s own requirements.

M&A Pipeline Management Software Providers

1. DealRoom - Similarly, DealRoom is an ideal choice for M&A pipeline management because of its centralized location and smarter system, which simplify the entire M&A process from tracking potential targets to due diligence.

For instance, users no longer need to rely on emails and spreadsheets, as communication is streamlined in a central hub. Within this hub, there are many features that allow for a more efficient and Agile workflow: tasks are clearly and easily assigned, duplicate requests are eliminated, and items can be tagged for integration and future use, allowing teams to stay organized in a process that is historically chaotic.

2. Devensoft - Devensoft also has a toolkit pack that includes items such as checklists for tracking targets, diligence, and integration, making it another appropriate for pipeline management.

3. Intralinks - Intralinks is a VDR often used for M&A, and while it boasts top notch security and can increase collaboration and efficiency, it does not provide specific features related to workflow and pipeline management.

To learn more, check out this M&A pipeline management software providers comparison.

M&A Pipeline Template

M&A pipeline templates are a necessary resource for all dealmakers, especially those navigating multiple deals in different stages of the M&A process.

Templates allow stakeholders and team members to track everything from prospects and background information on each prospect, to deals and their leaders in every stage of the M&A process.

.avif)

While these Excel templates provide an option for an M&A deal management, it is important for users to remember to input only essential information - the templates should provide just a brief overview of information related to the deal.

Using an M&A pipeline software is a game-changer. The DealRoom Pipeline gives you a single, customizable view for tracking, analyzing, and prioritizing M&A targets.

With advanced filters, real-time updates, and integrated communication tools, it streamlines your entire M&A process, ensuring you never miss a critical opportunity or detail.

Free Download: Excel M&A pipeline template

What To Track On Your M&A Pipeline

1. Tasks

Prioritizing tasks correctly, not just marking everything “high” or “low” priority (because let's face it, the tendency is to mark the majority of items “high priority”), can simplify the diligence process and eliminate wasted time by reducing wait-time and redundant tasks.

The buy side can begin this process in the pipeline by creating a rough, preliminary outline of the deal’s milestones (ideally, this would be done at the kick-off meeting with stakeholders from both sides).

More specifically, this initial outline can be made into a list of tasks that are ranked in descending order of importance so all parties are aware of the next step.

In addition, establishing this list in a virtual dashboard allows everyone to easily access it and track deal progress.

2. Risks and potential issues

Since the goal of M&A is usually to generate revenue, risks related to products, customers, and the target’s go-to market must be tracked.

Additionally, the people aspect cannot be overlooked; the best acquirers take into consideration and track company personnel risks/issues, as well as change management and culture risks/issues.

3. Specific data on potential targets

You will want to track potential targets to provide Corporate Development with valuable data on your M&A practices. For instance, you should track how long it takes targets to move through the pipeline and the value of the targets in the pipeline, also noting if this value changes.

Common Difficulties:

- Loss of momentum/deal fatigue

- Redundant work/lack of efficiency

- Worker burnout and reduced company morale

- Growing stakeholder dissatisfaction

- Failure of deals to reach their financial potential

Using Excel for M&A Pipeline Management

Keeping track of all your targets and deals in one location is essential to easing some of the chaos and stressors that can be associated with dealmaking. Excel is a tool most practitioners are familiar with that can easily be leveraged to help organize deals in your M&A pipeline.

More specifically, here are our Excel field recommendations:

1. Be sure to cover the basics such as:

- Target name

- Target location

- Business category

- Basic company information / brief description of the company

- Team leader/person in charge of this deal

2. Additionally, you’ll want your Excel sheet to include a short version of your company’s rationale behind the deal - how does this deal tie into your overall strategy?

3. Since you’re using Excel to keep track of multiple deals, you will want a field for deal status so you can easily track where each deal is in the pipeline. You might also choose to include a brief description of status.

4. Finally, many practitioners also include a field for financial information (such as tax returns, accounts payable, accounts receivable, balance sheets, income statements, and credit report).

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)