Joint ventures and strategic alliances are both ways in which companies can achieve many of the same goals as outright mergers or acquisitions.

Informal discussions with dozens of CXOs among DealRoom’s client base show that over 80% would happily consider a joint venture or strategic alliance for their company if they could find the right fit in a partner.

This is just one of the challenges involved. In this article, DealRoom looks at joint ventures and strategic alliances, as well as similarities and differences.

The Main Difference Between Joint Ventures and Strategic Alliances

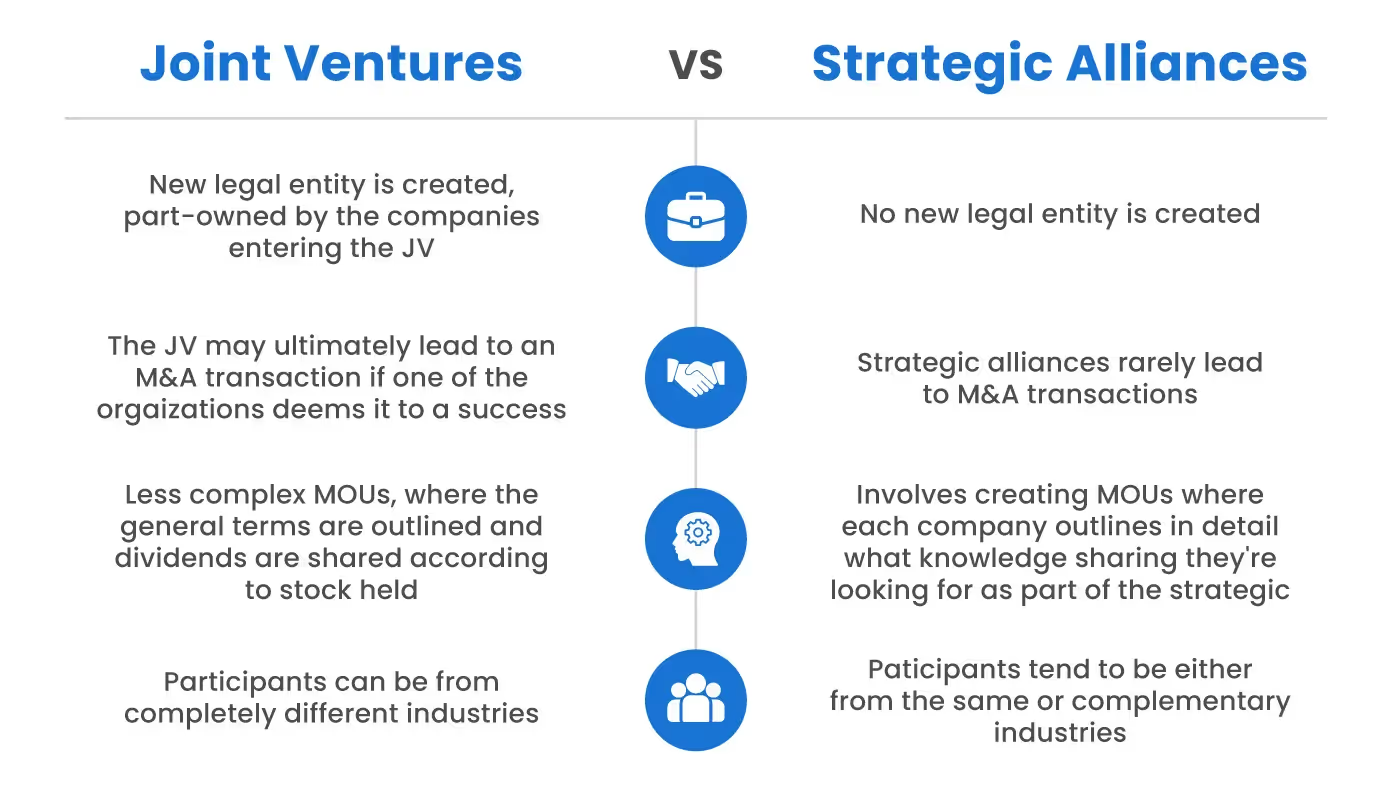

While both joint ventures and strategic alliances have the objective of achieving a specific strategic goal - for example. Entering a new market or launching a new product - the big difference between them is the level of commitment.

With a joint venture, two or more companies create a single legal entity in which each owns a share. By contrast, with a strategic alliance, each company works together but no new legal entity is created.

In this respect, the confines of joint ventures are in some ways easier: A new entity is created, and both companies enjoy the dividends in the proportion of their shareholding in the entity.

Where are the confines of a strategic alliance? The answer tends to be more difficult to define and often involves some form of technology transfer - a sharing of expertise, cross-usage of patents for example.

Joint Ventures

Joint ventures, commonly referred to as ‘JVs’, are essentially a form of merger between two companies where, instead of merging with each other, the two companies merge through a separate legal entity, a "NewCo".

Joint ventures do often eventually lead to full acquisitions, but only when the joint venture has been deemed a success. If the JV isn’t a success, the parent companies can, with relative ease, spin off the JV, with less difficulty than would be possible after a merger or acquisition.

Like the LOI (letter of intent) for a merger or acquisition, joint ventures are preceded by an MOU (memorandum of understanding) between the companies partaking in the JV.

The MOU outlines the terms of the deal, which include issues such as capital commitment expected from each of the investors, milestones expected from the JV, issues around corporate governance, the duration of the deal and options for renewal, and each party’s exit options.

Common Reasons for Joint Ventures

Far from being the poorer relation of a merger or acquisition, JVs can be highly intelligent strategic plays on the part of companies unwilling to enter potentially risky conditions without testing the water first.

There are several recognized motives for a company to undertake a joint venture transaction:

Enter foreign markets

When entering a new foreign market, rather than acquiring a foreign company outright, a company may opt instead to create an investment that leverages the existing resources (usually the distribution network) of a company already existing in that market. Learn about international joint ventures from an executive at General Motors.

Combined expertise

Certain combinations make sense purely on the individual strengths of each of the companies. For example, it made sense, in the decade before last, for computer companies and cell phone manufacturers to come together and create JVs to make smartphones.

Leveraging combined resources

Ideally, a joint venture will create synergies just like a regular M&A transaction through the combination of two companies’ resources. Good examples here in the past have included real estate investors specialized in warehousing and logistics, creating JVs with 3PL (third party logistics) firms.

Lower Costs

The cost of most acquisitions is what makes them so risky. By sharing the costs with one or more companies, the costs, and by extension, the financial risks, are diminished.

See also: How to Develop International Joint Ventures Successfully

Creating Joint Ventures at a Scale - Webinar

Strategic Alliances

Strategic alliances are similar to joint ventures - and you’ll notice that many tend to use the two terms interchangeably - but there is one key difference: With a strategic alliance, no new legal entity is created.

So then, you might reasonably ask, ‘what’s the difference between a strategic alliance and a contract with any regular supplier?’ And that’s where it gets a little complicated: A strategic alliance, by definition, involves some form of technology and/or knowledge transfer in manufacturing, marketing, or R&D.

Strategic alliances are typically divided into three types:

Learning alliances

A formal or informal agreement between two organizations to facilitate know-how transfer between each. Usually, the organizations aren’t direct competitors, so they’re not worried about giving away the ‘special sauce’.

Co-specializations

Similar to the example of the cell phone companies and technology companies outlined above, in co-specializations, each of the organizations brings its set of capabilities to the table, and combines them to achieve some objective.

Coalitions

Often, the trade missions of countries in other countries amount to coalitions - a group of companies from the same industry within the same country (e.g, German industrial firms visiting the US together)with largely the same objectives, cooperating together to create what amounts to a coalition to break the new market.

Common reasons for Strategic Alliances

Their similarity to joint ventures means that strategic alliances usually have largely the same underlying motives.

However, as a rule, the motive to share knowledge or technology tends to be stronger in strategic alliances. To outsiders not privy to the details of the MOU underpinning the strategic alliance, it can be difficult to define what’s happening with the deal, as the value of ‘sharing ideas’ can be virtually impossible to measure.

And yet, nobody doubts that the sharing of ideas can be impactful, giving strategic alliances enduring allure.

Real World Examples of Joint Ventures and Strategic Alliances

Joint Venture Example

One of the textbook examples of a joint venture was the foundation of Micro Compact Car AG (the maker of SmartCars), a new company whose shares were held evenly by Swatch Watch and Mercedes Benz.

After a bumpy first few years, the car ultimately became a success in southern Europe, where it was ideal for the smaller streets and budgets.

Furthermore, the JV benefitted from Mercedes Benz’s automobile industry expertise and Swatch’s ability to market youthful, affordable products.

Strategic Alliance Example

Thanks in large part to ‘boxing clever’, Barnes & Noble is still going strong as the largest brick-and-mortar book retailer in North America.

It has a strategic partnership with coffee chain Starbucks, which has brought co-branded B&N/Starbucks cafes to hundreds of its stores across America.

It’s a great way for both to benefit from what they do best, as well as share many of the resources that would otherwise be invested in setting up locations near to each other.

Key Differences Between Joint Ventures and Strategic Alliances

Carrying Out a Successful Agreement

A joint venture or strategic alliance is an excellent way to achieve the same goals of a merger or acquisition with fewer resources.

See also: Making Joint Ventures Successful

In fact, if your company lacks the resources required for a deal, perhaps it should be considering one of these transactions instead.

But just because you’re not going the full nine yards and not acquiring the counter party, it doesn’t mean you shouldn’t undertake good due diligence. The due diligence process in JVs and strategic alliances can be as powerful a value generation tool as with M&A.

Talk to DealRoom today about how our platform can help you navigate potential joint ventures and strategic alliances.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)