In many respects, there has never been a better time for companies to raise capital.

Interest rates are hovering close to zero for a longer period than at any stage of history, the government has just made a historic cash injection into the economy, and there is an ever-growing number of funding sources to choose from.

DealRoom works with hundreds of companies both seeking and providing capital on an ongoing basis, providing them with a virtual deal room that is designed to smoothen the process of raising funds, whichever side of the transaction they’re on.

In this article, we share some of the insights we’ve gathered from helping companies through their capital raise process.

In this article:

- Types of Capital Raising

- How to Raise Capital for Your Business

- Why Do Companies Raise Capital?

- Who Does the Capital Come From?

- Capital Raising Strategies for Different Business Sizes

- Alternative Capital Raising Methods

- Common Pitfalls of Capital Raising

- Tax Implications of Debt vs. Equity

- Investor Rights and Protections

- How to Prepare for the Capital Raising Process

- Capital Raising Trends

- Frequently Asked Questions

- Conclusion

What is Capital Raising?

Capital raising definition refers to a process through which a company raises funds from external sources to achieve its strategic goals, such as investment in its own business development, or investment in other assets, for example, M&A, joint ventures, and strategic partnerships.

Types of Capital Raising

In broad terms, there are 3 ways how companies can raise capital: debt, equity, or a combination of the two, otherwise known as hybrids.

Debt Raising

Debt raising involves raising funds through loans provided by third parties. The lenders of the debt have traditionally been banks and public debt markets (i.e., the bond markets) but now include a host of financial institutions and increasingly private equity funds. In its simplest form, debt raising involves paying the lender back its principal and an agreed amount of interest over the duration of the loan.

The size of the debt market (in 2024, the global debt market was valued at $323 trillion) means that anyone debt raising can use multiple forms of debt. Lenders can include a range of terms and conditions on their loan that protect them on the downside in the event that your company cannot (or will not) repay the money.

In broad terms, there are four forms of debt that companies can take advantage of:

- Secured debt: Where collateral is used to secure the loan, thus enabling the company to avail of lower interest rates (as the risk is lower for the lender).

- Unsecured debt: This form of debt includes no borrower collateral, so the interest rate depends on the company’s credit history.

- Tax-exempt corporate debt: Some debt may be eligible for tax exemption. For example, projects related to sustainability.

- Convertible debt: Usually considered a hybrid (i.e., a mixture of debt and equity), whereby the debt can be converted into equity if the borrower prefers.

Check out the pros and cons of each debt type in the table below.

Which type of debt a company raises depends on a number of different factors - primarily the condition of their financial statements (and in particular, the amount of debt outstanding on the balance sheet), their credit (rating) history, quality of the collateral, and borrowers’ and lenders’ own appetites for risk. At most points of an economic cycle, debt is possible for a company to raise, but the cost of interest is not always attractive.

Pros and Cons of Debt Raising

Pros:

- Relatively fast access to cash for companies that require it.

- In low interest rate environments, debt offers a cheap way to access liquidity.

- Debt repayments (in interest) can be forecasted accurately for budgeting purposes.

- The interest paid is tax deductible.

Cons:

- Generally, raising debt reduces a company’s credit rating.

- The mere availability of debt may induce managers to raise it when it is not required.

- The money has to be repaid, even if the business isn’t performing well.

- Debt on a balance sheet reduces management’s strategic options.

Equity raising

Equity raising occurs when a company seeks to raise funds through the sale of its equity (i.e., a share in the ownership of the company). Equity investors can generally be anyone who possesses the cash required and is willing to meet the company’s owners on its valuation. A company that overvalues its equity risks alienating most investors, who will fear not seeing an adequate return on their investment.

Most companies with positive outlooks (i.e., their equity is attractive to investors) can avail of equity funding. Like debt raising, certain equity raising agreements can have different conditions attached, and when this happens, it is usually referred to as ‘preferred equity.’ The stock market is the largest and most well-known method of equity raising, where publicly listed companies sell their equity to raise funds and maintain liquidity.

Pros and Cons of Equity Raising

Pros:

- Access to the management advice of seasoned equity investors.

- No requirement for regular interest repayments (as with debt raising).

- Possibility for company management to set the company valuation.

- Technically, a lower risk solution than debt raising.

Cons:

- Company management is giving up (some) control of the business.

- The equity may come with some provisions on consulting the investors on big decisions.

- The presence of external investors may lead to friction within the company.

- The upside potential of the company now has to be shared with outsiders.

Equity Raising Examples

There are several types of equity funding, with the big differentiator between them being the stage of a company’s evolution to which it applies. In broad terms, the different types of equity raising - in chronological order, from early companies to mature companies, are:

- Crowdfunding

- Seed financing

- Angel financing

- Venture capital

- Private equity

- Public capital markets

Hybrids of debt and equity

A hybrid of debt and equity gives the advantages (and disadvantages) of debt and equity raising and tends to be seen as a compromise between the two. The terms of a hybrid capital raising agreement determine whether the benefits favor the company or its owners over time. In essence, if the company thrives and the debt is convertible to equity, investors win. Otherwise, the benefits tend to be derived by the company.

Pros and Cons of Hybrids of Debt and Equity

Pros

- More flexible arrangements are possible for the company and investors.

- Can provide both sides of the transaction with a lower risk proposition.

- May give companies access to a broader range of investors.

- May enable investors to diversify across a broader number of companies by combining fixed income (debt) with equity investments.

Cons

- Hybrid capital raising tends to be more complex than either debt or equity raising.

- Tends to favor investors at the expense of companies.

The table below provides a comparison between debt financing, equity financing, and hybrid financing in terms of factors such as repayment obligations and tax benefits.

How to Raise Capital for Your Business

Whether a company is raising debt or equity capital, it essentially faces a sell-side investor dynamic similar to that of owners looking to divest their companies. After all, equity raising is fundamentally the sale of a portion of the business.

On this basis, company managers face many of the same challenges as they would in M&A: providing investors with the right documentation, valuing the company correctly, and getting their house in order.

For this same reason, managers at these companies would be well advised to use data room due diligence software like DealRoom or an alternative.

Not only does DealRoom enable companies to efficiently organize their capital raising process, but it can also help identify potential weaknesses in the company’s value proposition before approaching investors for debt or equity raising.

Here is a step-by-step approach to raising capital for your business:

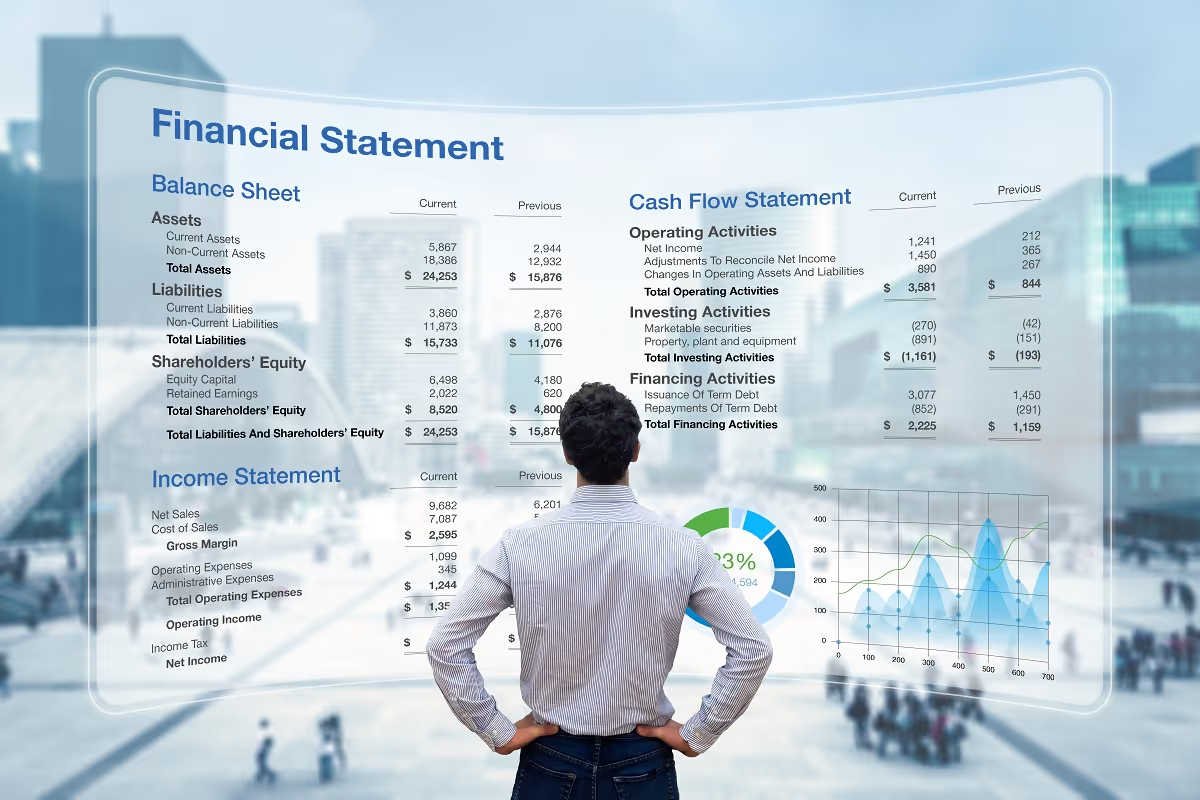

Step 1: Clean up your financials

Most lenders will focus on two things: The executive summary of your business plan (see next bullet point) and your financial statements.

Ensure both are as good as they can be. That means paying off credit card debt so that it’s not on the balance sheet, becoming more aggressive in the short term about credit terms so that your receivables are lower, and maybe even cutting back on some operating expenses.

Step 2: Write a business plan

Whether the funds are coming from a financial institution, a private equity-style fund, independent investors, or even the SBA, it pays to have a strong business plan that shows exactly why you need to raise capital, and why the lender can be sure that they’ll receive the principal with interest within an agreed timeframe.

Step 3: Emphasize the sources and uses

As part of the business plan, know exactly where the funds will be used. If you’re acquiring a new piece of equipment, make it explicit. If you’re hiring for sales and marketing, show how the funds will be used (what percentage on social media, what percentage on a sales team, etc.). Show as much detail as possible - this also serves to give you insight into your own business.

Step 4: Make a long-list

When looking to raise capital, it’s useful to keep in mind that you’re not the only one. Everybody wants more money. People who are providing it are typically overrun with requests for capital.

Most businesses will be trying to convince them that theirs is better than all the others, so don’t be surprised when the first ten companies don’t jump. The capital raising process can take a significant amount of time. Buckle up.

"From data storage and sharing to investor communication and progress reports, DealRoom helped readily execute Pax8’s entire investor management process." -- Jefferson Keith SVP, Corporate Development at Pax8

The process of raising funds is easier said than done, however.

Interested in learning more about the capital raising process? Utilize the Capital Raise Playbook tailored to outline and walk you through the process of raising capital for your specific business.

Why Do Companies Raise Capital?

Growth is, for all intents and purposes, the major reason why companies raise capital.

Whether it’s a younger firm looking to raise capital with a venture capital firm to hire more programmers, a mature industrial firm looking to acquire an industry rival, or a distressed company looking to restructure in some manner, the underlying motive in almost all cases for raising capital is growth.

Growth being the implicit motive, the explicit motives for raising capital are as follows:

Read also: Venture Capital Deal Structures: Complete Guide

Who Does the Capital Come From?

Traditionally, banks were the go-to destination for companies looking for debt, but the universal need to raise capital has led to a plethora of options for companies of all sizes.

Most of the following outlets for raising capital will cater to both debt and equity raising, with specifics depending on the institution in question.

Banks

Banks remain one of the most common sources of capital for companies, particularly when a company has a good track record with the bank. Equity raises can also occur with banks but tend to be far less common.

Private debt

Private debt - that is, debt funded by non-public financial institutions - has seen huge growth over the past decade, with the caveat for businesses that interest rates on loans usually begin at the 6-7% mark.

Listen to private equity podcasts to improve your understanding of how private equity firms operate.

Private equity

With private equity companies sitting on an estimated $2 trillion of ‘’dry powder’ (funds waiting to be used), private equity currently offers an excellent way for companies of all sizes to raise equity capital.

Angel Investors/Seed Investors/Venture Capital

These funds usually seek an equity share of a small, fast-growing business and can build in a debt component. A major advantage here is the ability to tap into their network and expertise. Learn more about how venture capital works here.

Public markets

The main reason that companies go public is to raise equity capital: Selling off slices of the company on a publicly traded index to fund the company’s expansion.

Small Business Association (SBA)

SBA loans are a hugely popular means for small companies to access significant amounts of capital at very attractive rates, the only drawback being the time it can take to access funds.

The table below provides an overview of the differences between public and private capital raising.

Ways of Capital Raise for Different Business Sizes

Depending on the size of your business, there are different ways you can raise capital. The process of raising capital for a private company will, for example, be different than for a public company.

Following are typical routes of capital raising for different business sizes:

Startups

- Friends and family

- Public or private business incubators

- Seed investors

- VC funds

Small and medium-sized enterprises (SMEs)

- Private equity investors (those aimed at SMEs)

- Family offices

Large Companies

- Initial Public Offering (IPO)

- Private equity investors (those aimed at larger companies)

- Family offices

- Wealth funds and asset managers

Alternative Capital Raising Methods

As companies seek innovative ways to fund their operations and growth, alternative capital raising methods have gained traction. These options may be more flexible and accessible than traditional financing methods, catering to a broad range of business needs.

Here are some of the noteworthy alternative capital raising methods:

Revenue-Based Financing

Revenue-based financing (RBF) is a funding model where investors provide capital to a company in exchange for a percentage of the company’s future revenue until a predetermined amount is repaid. This approach is particularly beneficial for startups and small businesses with consistent revenue but limited access to traditional loans.

Benefits:

- Payments align with revenue, reducing financial strain.

- Company retains full ownership and control (no equity stake).

- Faster access to capital with less due diligence.

Drawbacks:

- Higher overall cost of capital than fixed-interest loans.

- Seasonal revenue dips can create cash flow challenges.

- Investors may limit funding based on revenue potential.

- Existing RBF agreements may hinder additional financing.

Initial Coin Offerings (ICOs)

ICOs are a form of crowdfunding for cryptocurrency projects, where companies issue tokens to the public in exchange for digital currency (typically Bitcoin or Ethereum). ICOs allow startups to raise funds while also creating a potential user base for their tokens.

Benefits:

- Global reach attracts diverse investors.

- Faster fundraising than traditional methods.

- Build an engaged community around the project.

Drawbacks:

- Unclear regulations increase fraud risk.

- Token values can be highly volatile.

- Many ICOs lack a track record, making due diligence difficult.

- Limited investor protections compared to traditional markets.

Security Token Offerings (STOs)

STOs are similar to ICOs but involve the issuance of security tokens that comply with regulatory frameworks. Security tokens represent ownership and can provide rights similar to shares, such as dividends or a stake in future profits.

Benefits:

- Regulatory compliance enhances trust and investor protection.

- Attract institutional investors seeking legitimacy.

- Enables fractional ownership, increasing accessibility.

Drawbacks:

- Varying global regulations complicate international offerings.

- Limited investor awareness reduces participation.

- Often restricted to accredited investors, narrowing the pool.

- Low liquidity due to limited trading platforms.

Government Grants and Subsidies

Government grants and subsidies provide financial support to businesses and organizations, usually with specific conditions for usage. These funds don’t require repayment, making them an attractive option for companies looking to fund innovative projects or support growth initiatives.

Benefits:

- No repayment or equity dilution is required.

- Supports research, innovation, and technological growth.

- Enhances business credibility for further investment.

Drawbacks:

- Dependence on funding can hinder adaptability.

- Complex application and compliance processes divert resources.

- High competition makes securing grants challenging.

- Restrictions may limit creative business strategies.

Check out the table below for a comparison of these alternative capital raising methods and their suitability for different needs.

Common Pitfalls of Capital Raising

Raising capital is a critical process for any business aiming to grow and thrive. However, it comes with a number of challenges that can derail even the most well-prepared companies. Here, we explore some of the common pitfalls of capital raising and provide insights on how to navigate them.

Poor Financial Preparation

One of the most significant mistakes businesses make is failing to adequately prepare their financial documents. Investors expect transparency and clarity in a company's financial health, including profit and loss statements, cash flow projections, and balance sheets.

Inaccurate or incomplete financial data can lead to mistrust among potential investors. Investors may require financial metrics and forecasts to assess the viability of their investment. Without solid preparation, companies may struggle to respond confidently or accurately.

Consulting with financial professionals can help ensure that all financial documents are accurate and compliant. Providing realistic financial forecasts can demonstrate the potential growth and sustainability of the business.

Unrealistic Valuation

Another common pitfall is setting an unrealistic valuation for the company. Many entrepreneurs are emotionally attached to their businesses and may inflate their worth based on personal feelings rather than objective metrics.

Higher-than-reasonable valuations can scare off potential investors who seek a fair return on their investment. Overvaluation in initial rounds can lead to significant challenges in future funding rounds, possibly resulting in down rounds that can harm a company's reputation.

To avoid overvaluation, conduct thorough industry research to determine a fair market value based on comparable companies. Engaging with potential investors to understand their perspective on valuation can help set realistic expectations.

Choosing the Wrong Investors

Selecting the right investors is crucial for the success of a capital raise. Partnering with investors who don’t align with the company’s vision or values can lead to miscommunication and conflict down the line.

Investors who don’t understand the industry may not provide the guidance or resources necessary for the company's growth. Misaligned goals can also create friction in decision-making, ultimately hindering growth and progress.

To avoid choosing the wrong investors, establish clear criteria to identify the qualities and values essential in an investor for the company, such as industry experience or a shared vision. Research potential investors’ backgrounds and previous investments to ensure compatibility.

Over-Reliance on a Single Source of Funding

Depending too heavily on one source of capital is a significant risk. It can leave businesses vulnerable to changes in investor attitude or economic conditions that impact that funding source.

Losing a single investor can create significant cash flow problems and jeopardize the company's stability. Additionally, focusing on one funding source can stifle innovation and growth, particularly if the source has limited investment capabilities.

To mitigate risk, actively seek multiple funding avenues, such as angel investors, venture capital, crowdfunding, and grants, to establish a balanced portfolio. Create a network of potential investors to build a pipeline of funding opportunities beyond a single entity.

Tax Implications of Debt vs. Equity

When companies seek financing, they can choose between two primary forms of capital: debt and equity. Each option comes with distinct tax implications that can significantly impact a company’s financial health and decision-making processes.

Interest Payments on Debt

One of the most significant advantages of debt financing is that interest payments are tax-deductible. Companies can deduct the interest paid on their loans from their taxable income, which can lower their overall tax liability. This aspect makes debt a more attractive option, especially for companies looking to minimize their taxes while still obtaining the necessary capital.

For instance, if a company has $1 million in debt with an interest rate of 5%, it pays $50,000 in interest annually. This $50,000 can be deducted from its taxable income, effectively reducing the tax burden.

Equity Financing and Dividends

In contrast, equity financing involves raising capital by selling shares of the company. While equity does not require periodic payments in the same way as debt, dividends distributed to shareholders are not tax-deductible.

Instead, dividends are subject to taxation at the shareholder level, which can lead to double taxation: once at the corporate level and again at the individual level when shareholders receive dividends.

For example, if a corporation earns $100,000 and pays $30,000 in taxes, only $70,000 remains. If the company decides to pay out $30,000 in dividends, shareholders will then be taxed on that $30,000. This results in a reduced overall return for investors compared to what they might receive from interest payments on debt.

Tax Treatment of Gains

Another important consideration is the treatment of capital gains. When a company issues equity, any increase in the value of the stock may lead to capital gains for investors when they sell their shares.

Capital gains are usually taxed at a lower rate compared to ordinary income. However, this tax benefit doesn’t extend to the company itself - the company doesn’t receive any additional tax deduction based on capital gains.

Bankruptcy Considerations

In the unfortunate event that a company goes bankrupt, debt holders have a superior claim to the company’s assets compared to equity holders. While this is a clear example of the risks associated with leveraging through debt, there are also tax implications connected to bankruptcy.

In many jurisdictions, companies can obtain a tax shield when debt is canceled during bankruptcy, allowing them to potentially offset future taxable income.

Long-Term Considerations

The choice between debt and equity can also have long-term tax implications. Companies that aggressively utilize debt may face increasing interest expenses as they grow, potentially limiting future tax breaks if they can’t generate enough income to take full advantage of those deductions.

On the other hand, relying on equity can facilitate a more stable company structure, attracting long-term investors.

While debt can provide immediate tax benefits through interest deductions, companies must also weigh the risks associated with leveraging such financing. Equity avoids the burden of repayment but could result in higher overall taxation for both the company and its shareholders.

Ultimately, each company's unique situation, growth potential, and financial strategy will dictate the most suitable financing approach.

Investor Rights and Protections

Investing in financial markets carries inherent risks, and ensuring the rights and protections of investors is critical for fostering trust and maintaining market integrity.

Fundamental Investor Rights

Fundamental investor rights include the right to information, the right to vote, and the right to fair treatment. Investors have the fundamental right to access accurate and timely information regarding the companies in which they invest. This includes financial statements, shareholder meeting minutes, and disclosures about any material changes affecting the company.

Shareholders are entitled to vote on significant company matters, such as mergers, acquisitions, and the election of board members. This voting right allows investors to have a say in the management and direction of the company they own. The ability to participate in corporate decisions also helps ensure that shareholder interests are considered.

All investors should be treated equitably, regardless of the size of their investment. This principle protects against preferential treatment for certain investors, ensuring that all shareholders have equal access to profits and opportunities within the company.

Regulatory Frameworks

There are several regulatory frameworks to be aware of, including the SEC and FINRA, as well as international protections.

Securities and Exchange Commission (SEC)

In the United States, the SEC is the primary regulatory body that oversees securities markets. The SEC enforces laws designed to protect investors by requiring public companies to disclose critical information and adhere to fair trading practices. Investors can file complaints with the SEC about fraudulent activities or misconduct by companies or other investors.

Financial Industry Regulatory Authority (FINRA)

FINRA is a self-regulatory organization that focuses on ensuring fair practices among brokers and brokerage firms. It provides a platform for investors to report issues and disputes, offering resources for dispute resolution through mediation or arbitration.

International Protections

Globally, many countries have their own regulatory bodies that mirror the roles of the SEC and FINRA. Organizations like the International Organization of Securities Commissions (IOSCO) work to create standards for investor protection and promote cooperation among countries, enhancing the security of cross-border investments.

Protection Against Fraud and Misconduct

Investors also have protections against fraud and misconduct, including reporting mechanisms and whistleblower protections.

Reporting Mechanisms

Investors have the right to report suspicious activities or potential fraud to the appropriate regulatory bodies. Robust mechanisms for reporting ensure that investors can take action against unethical practices, which helps maintain market integrity.

Whistleblower Protections

In many jurisdictions, whistleblowers who report fraudulent activities are protected from retaliation. This encourages individuals with insider knowledge to come forward, contributing to a more transparent and fair market environment.

How To Prepare for the Capital Raising Process

The capital raising process can be complex and overwhelming, especially if it's your first time.

To raise capital, at the very least, a company will require a business acquisition plan or pitch deck.

The aim of these documents is to show investors that the cash flows generated by the company are sustainable enough to ensure that it will get its money back with interest (in the case of a debt raise) or achieve what they deem to be an attractive return on investment (in the case of an equity raise).

Offering Memorandum

Offering memorandums are used by companies seeking to raise equity capital. It has to comply with securities laws designated by the SEC.

This formal document provides registered investors with a detailed overview of the company’s financials and operations.

This process is called venture capital due diligence.

This document also invariably features a subscription agreement that defines the terms of the investor’s participation in the company’s equity offering.

To streamline this otherwise complex process, we put together a Capital Raising Playbook that helps you tick all the boxes. Grab your copy now!

Capital Raising Trends

Capital raising is evolving with technology, economic shifts, and investor preferences. Key trends shaping its future include AI-driven investment platforms, blockchain fundraising, and adaptive economic strategies.

AI-Driven Investment Platforms

Artificial Intelligence (AI) is revolutionizing various industries, and capital raising is no exception. AI-driven investment platforms are emerging that offer streamlined processes and enhanced decision-making. Here’s how:

Enhanced Due Diligence

AI can analyze vast datasets quickly and efficiently, enabling more thorough due diligence processes. This allows investors to assess potential opportunities with greater confidence and helps issuers present their value propositions more effectively.

Personalized Investment Experiences

With AI, investment platforms can analyze user behavior and preferences to deliver tailored investment opportunities. Personalization enhances user engagement and satisfaction, ultimately leading to more successful fundraising campaigns.

Predictive Analytics

Predictive analytics can identify trends and potential ROI on investments. Armed with this data, companies can better position their capital raising efforts. As they align their strategies with investor interests and market dynamics, they can secure the needed funding more efficiently.

The Role of Blockchain in Fundraising

Blockchain technology has the potential to fundamentally change how capital is raised, making the process more transparent, secure, and efficient. Here are some key aspects to consider:

Tokenization of Assets

Blockchain enables the tokenization of physical and intangible assets, allowing companies to raise capital by issuing digital tokens representing ownership. This innovation provides broader access to investment opportunities and can facilitate fractional ownership, making it possible for a wider range of investors to participate in funding rounds.

Increased Transparency and Security

Smart contracts on blockchain platforms automate transactions, ensuring compliance and reducing administrative costs. Blockchain’s increased transparency also builds trust among investors, who can independently verify the authenticity of projects or companies seeking funding.

Global Access to Capital

Blockchain’s decentralized nature breaks down geographical barriers, allowing companies to access global investors easily. As a result, entrepreneurs can tap into a larger pool of potential funding, leading to more diverse funding sources and increased competition among investors.

Impact of Economic Shifts on Fundraising Strategies

The economic landscape plays a crucial role in shaping fundraising strategies. Recession indicators, inflation rates, and changes in consumer behavior, among other economic factors, influence how companies approach capital raising.

Responsive Strategies

As economic conditions fluctuate, businesses must adapt their fundraising strategies accordingly. During economic downturns, companies may lean towards conservative funding options, such as debt financing or existing investor relationships, to minimize risks. In robust economic conditions, they may pursue aggressive equity financing to take advantage of growth opportunities.

Focus on Sustainability

Economic shifts have also fueled a growing focus on sustainability and social responsibility. Investors are increasingly drawn to companies that prioritize environmental, social, and governance (ESG) criteria. As a result, companies might emphasize their sustainability efforts in fundraising pitches to attract conscientious investors.

Innovative Funding Solutions

In response to economic challenges, innovative funding solutions—such as crowdfunding and peer-to-peer lending—are gaining traction. These alternative fundraising methods empower entrepreneurs to seek capital from individuals and communities, reducing dependence on traditional financial institutions.

The future of capital raising is bright, driven by advancements in technology and a keen understanding of evolving economic landscapes. Embracing these trends will be vital for companies looking to secure the capital they need for growth and success in the coming years.

Frequently Asked Questions

How long does the capital raising process take?

The timeline varies depending on factors like the type of funding, investor interest, and due diligence requirements. On average, it can take anywhere from a few months to over a year.

What are the costs associated with raising capital?

Costs may include legal and advisory fees, due diligence expenses, regulatory filings, marketing efforts, and potential equity dilution. The total expense depends on the complexity and structure of the capital raise.

How do I know if my business is ready to raise capital?

Your business should have a clear growth strategy, a solid financial model, a scalable product or service, and a compelling value proposition for investors. Strong leadership and market traction also increase readiness.

How much equity should I give up?

This depends on your funding needs, company valuation, and investor expectations. Many startups give up 10-30% in early funding rounds, but maintaining control while securing enough capital is key.

What happens if I can’t meet investor expectations?

Failing to meet expectations can lead to reputational damage, loss of investor confidence, or difficulty in securing future funding. Transparency, strategic pivots, and strong communication with investors can help mitigate risks.

What are the challenges of raising capital in emerging markets?

Challenges include limited access to investors, regulatory hurdles, economic instability, currency risks, and underdeveloped financial infrastructure. Building strong local networks and demonstrating resilience can improve chances of success.

How does capital raising differ for startups vs. established companies?

Startups often seek venture capital, angel investors, or crowdfunding with a focus on rapid growth, while established companies typically raise funds through debt, private equity, or public markets based on proven financial performance.

What are my responsibilities after raising capital?

Responsibilities include transparent financial reporting, executing growth plans, meeting investor expectations, managing risks, and maintaining strong investor relations. Effective capital deployment is critical for long-term success.

Conclusion

There have never been as many options for companies seeking to raise debt or equity capital.

At the time of writing, private equity funds hold around $2.1 trillion in ‘dry powder’ (capital ready to be distributed to companies either through debt or direct equity investments). But the fact that they’re not distributing it says something about companies - primarily, that they’re not adequately prepared in these investors’ eyes.

Talk to DealRoom today about the essential role that our lifecycle management tool plays in enabling companies to take this leap.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)