As the "state of M&A" DealRoom whitepaper outlined in some detail, technology-driven M&A solutions like M&A software are the only way for dealmakers to be effective.

Although industry feedback suggests most M&A participants are leveraging technology tools in their activities, there remains a cohort - we estimated over 50% of the total - who still use generalist tools that fail to maximize their dealmaking potential.

Below, we look at some of these solutions and the gaps that they’re failing to address for dealmakers.

1. Project Management

In project management in 2023, the big players are:

- Slack

- Wrike

- Zendesk

- Zoho Projects

- Monday.com

Each of these is a fantastic addition to the project management efforts of companies outside the realm of M&A.

While some of them go as far as providing case studies on how their tools are digitizing the customer journey, it’s notable that none mention investment banks or other participants in M&A.

There are several good reasons for this.

First, as good as these tools are, they’ve been designed to be generic. That means no specific features for deal management.

Likewise, deal participants can’t de-risk the deal by logging and collaborating on findings during diligence, compared to the simplicity of doing so on an M&A-specific deal management platform like DealRoom.

With DealRoom, where risk is identified during due diligence, they can easily be captured, logged, and resolved

%2520(2).avif)

2. Communications Platforms

For communications, the 4 main big platforms & software used by corporate development are:

- Slack

- Zoom

- Microsoft Teams

- Google Meet

Slack makes another appearance on the communications platforms, which also include well-known names like Microsoft Teams, Zoom, and Google Meet.

All three are outstanding contributions to one-off communications.

But most are, to a greater or lesser extent, communications silos. There cannot be communication silos in effective M&A.

The outlined platforms cannot tie and save the conversation, including emails to a particular pipeline or task within a due diligence workstream.

They’re also unable to efficiently collaborate with a broker or a seller.

By contrast, with corporate development software, they can request info, communicate, and view all previous conversations and requests, and their respective due dates.

The result is far more coherent communication and a much smoother transaction process.

3. Data Rooms

The main data rooms in 2023 are:

- Intralinks

- Diligent

- FirmRoom

- Box

- Google Drive

What’s notable about the data rooms is that most - Intralinks, Diligent, and FirmRoom - are actually specifically aimed at the finance industry, and helping intermediaries with their document-sharing requirements.

And in this, they do a fine job. But once more, feedback from DealRoom clients shows them lacking in several areas.

None of these data rooms provide a fully holistic view of the deal process.

While they offer collaboration on documents, but don’t give M&A deal participants an immediate visibility into work streams, due dates, percentage of completion of tasks, complete deal pipeline view, statuses, and more.

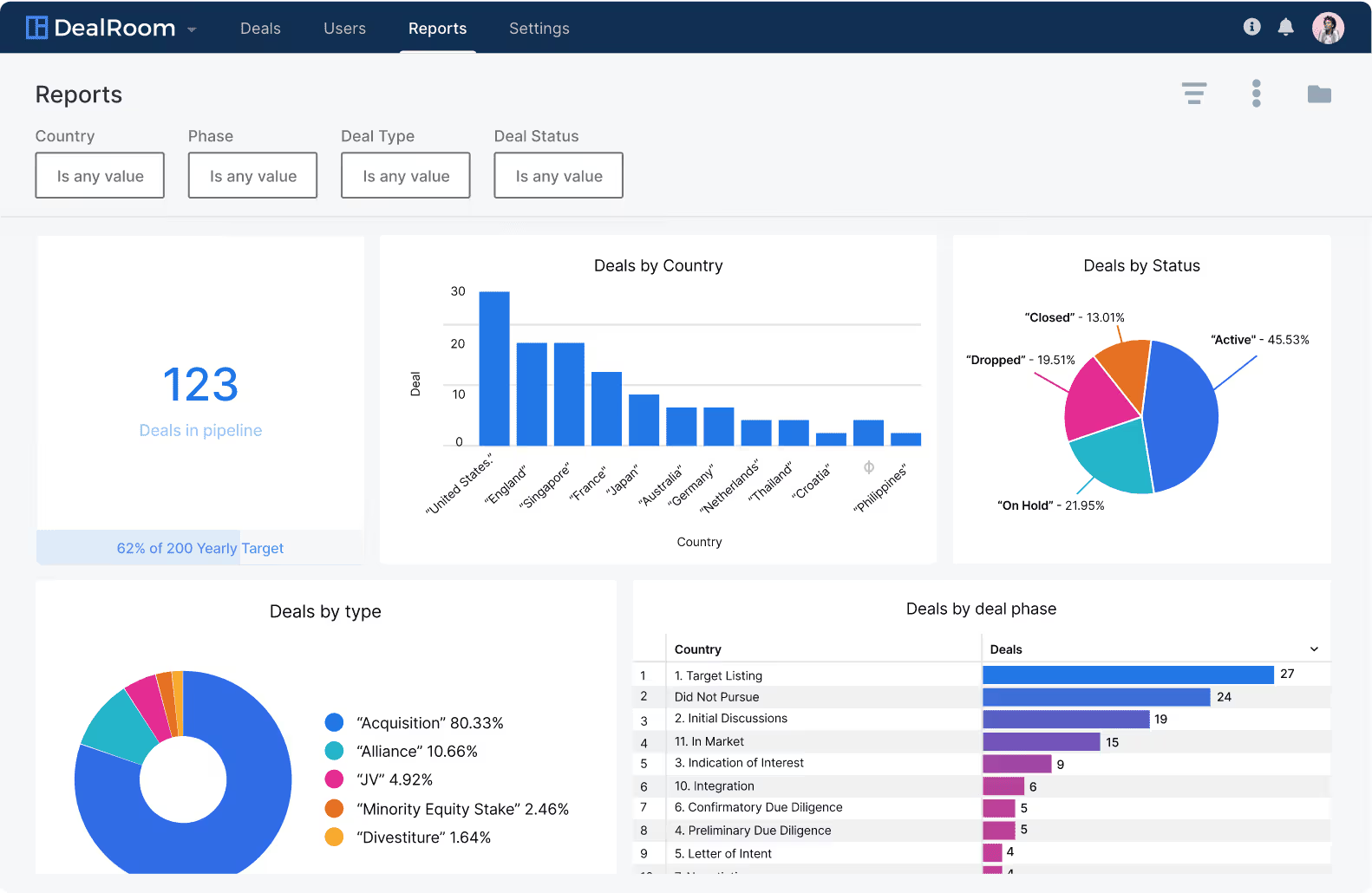

For tools like these, you’ll need end-to-end and purpose-built corporate development software - see an example view of DealRoom's deal pipeline management.

This capability allows corporate development professionals to assess deal pipeline statuses at a glance and also gives them complete visibility into the pipeline's health at any given time.

.avif)

What is Corporate Development Software?

Corporate development software needs to serve as a single source of truth, offering an end-to-end unified platform for corporate development teams to manage their deals.

With so many participants involved in the typical M&A transaction, so much information being exchanged, and so many workflows happening at once during due diligence, there is huge value in bringing everything together.

That is the value brought by corporate development software.

We estimate that by bringing extra tools and capabilities onto the same platform, as with DealRoom (see next section), deal participants can save time on back-and-forth, follow-ups, and workshops that can cumulatively extend to several weeks.

In money terms, several weeks means thousands of dollars.

The lesson?

You can no longer afford to overlook the need for real corporate development software.

Introducing DealRoom

DealRoom is an agile tool, which was designed by M&A practitioners and agile developers.

On this basis, it incorporates elements from both. Agile M&A is in the platform’s DNA.

Several of its users recently provided commentary for a DealRoom overview, giving testament to the difference that it has made to the quality of its dealmaking.

And unlike many of the other platforms listed above, it is future-proofed and constantly evolving, ensuring that its users are always ahead of the pack.

Conclusion

Data provided by Pitchbook shows that in 2000, there were slightly under 1,500 private equity deals.

By 2022, that number had jumped to slightly under 10,000. This is just to talk about private equity; it doesn’t include deals involving publicly listed companies, VC fundraising, or joint ventures.

The moral of the story?

The space for closing deals has never been more competitive.

It follows that dealmakers cannot afford to be second best with the technology that underpins their dealmaking.

While the solutions we mentioned at the outset of this document are all highly respectable and competent platforms in their own right, none of them are made especially for the specifics required by corporate transitions.

For that, there is one platform: DealRoom, the choice of the world’s most successful dealmakers.

%2520(2).avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)