Why would anyone with disposable income or savings on the side choose to invest their hard-earned money in startups?

New companies are notoriously unpredictable before they become respectable businesses – no matter the sector or industry, about 90% of all startups fail.

However, if you invest in the proper startup, that's an entirely different story.

The 10% of startups that succeed usually make their founders and investors very rich. Here, at DealRoom, we look at 5 things you need to know before embracing that risk.

1. Startups Go Through Different Stages of Investment

Every young company goes through different stages of development and financing.

Because the future of startups is always uncertain, and to prevent investors from taking over a lucrative seed idea from new founders for cheap, each of these stages is reserved for another type of investment:

- FF&F – FF&F stands for founder, family, and friends because these are the individuals most typically involved in funding the new business idea. At this “seed stage,” the company is not yet listed under the Initial Public Offering. Technically speaking, it’s not yet a company at all because it doesn’t have a product, customers, or revenue. The only other way to invest in a startup this early on – in case you’re neither a founder, a family member, or a friend, is through seed money in return for an equity stake. Seed money is usually a small sum used for research.

- Angel investors – Angel investors are wealthy individuals specializing in investing in startups. It’s not rare for angel investors to come from the founder’s inner circle, too, but the money in play is more considerable than seed money. In return for their financial support, angel investors usually get ownership equity., which is why accredited investors are rarely accepted as angel investors.

- Venture capital – Venture capital comes last once the company has established its operations and acquired its first customers. Aside from venture capital firms, private individuals are eligible for investing at this stage only if they go through private equity funds. VC investors traditionally receive a seat on the board and continue to actively participate in the new company’s future.

Related: Data room for Startups by DealRoom.

2. Investing in a Startup Is a Big Risk with Big Rewards

As every financial advisor will tell you, most startups fail.

There’s significant risk associated with investing in companies at the early stages of development, even when they are founded by respectable entrepreneurs.

Getting a startup into an operational shape that would be lucrative enough to start making returns on investments often takes decades.

Until that happens, your equity remains illiquid, locked in the startup.

On the other hand, startups that succeed make a lot of money. Google is one of the most frequently cited examples of how a million-dollar idea can turn into a giant worth billions.

Less than a decade after its first seed money in 1997, Google was delivering an ROI of almost 1,700%.

3. An Easy Way to Invest Is to Focus on Equity Startups

Equity startups are very young companies that have not yet officially joined the markets through an IPO – Initial Public Offering listing.

Investing in equity startups is very popular, mainly because it’s the most straightforward investment available to individuals and businesses.

With this type of investment, you receive shares in return for your money.

4. Data Can Help You Discover Promising New Startups

- How can you find promising startup companies to invest in?

- Is it possible to minimize risk by knowing where to look?

The answer is yes.

One of the best ways to find early-stage startups is through trusty data providers that scrape the internet in search of new small businesses.

It is always better to identify startups with data insights because data empowers investors to make informed decisions. This initial data is half of your due diligence, as data providers allow you to search for promising startups based on their size, location, founder, and more.

5. The Importance of Due Diligence Can’t Be Overstated

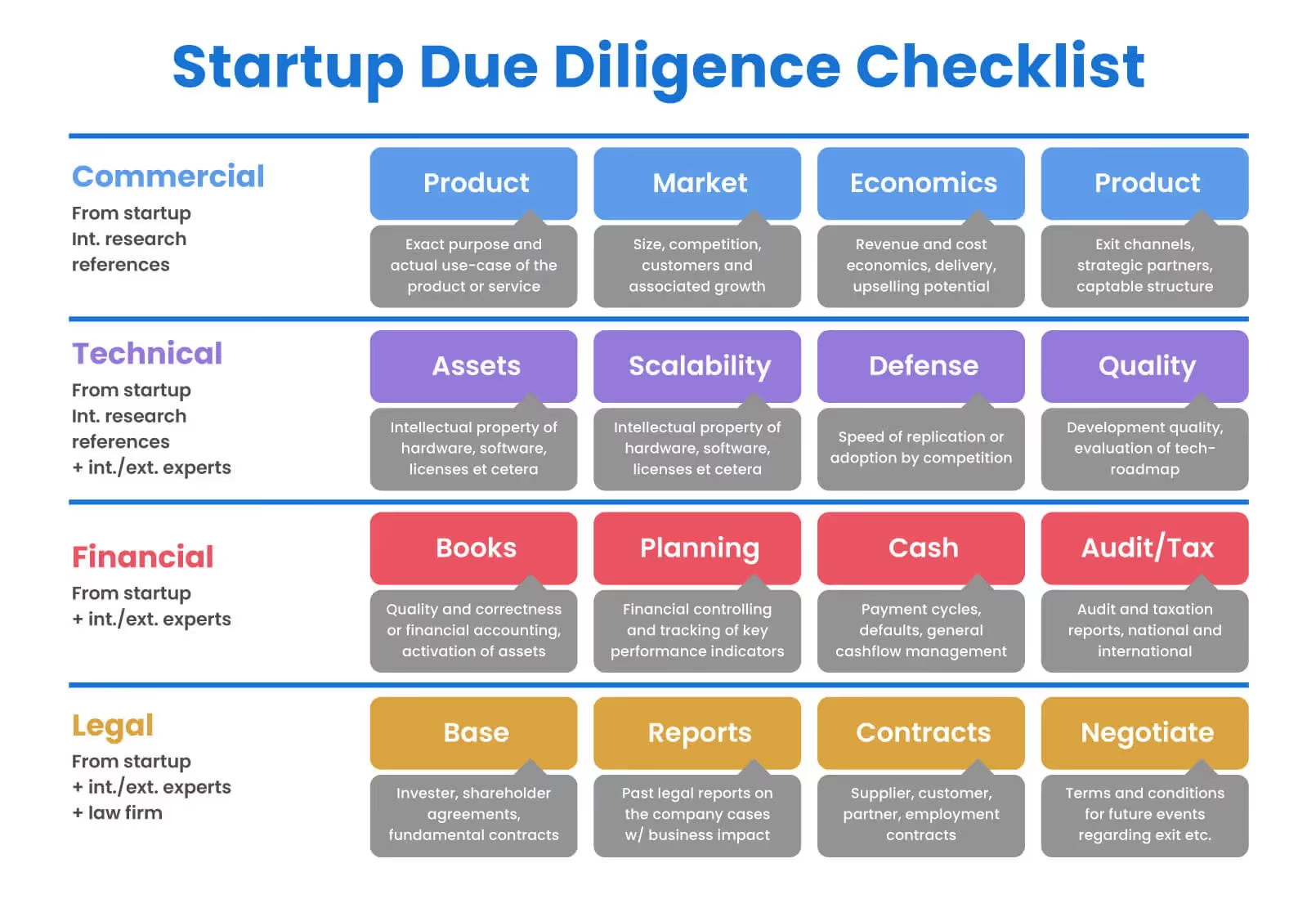

When you decide to invest in a startup, doing your startup due diligence becomes more crucial than ever.

Though consulting a financial advisor is recommendable, too, the wisest thing to do is conduct your own research. A few points to consider before you invest in a startup are:

- What makes the new company competitive? Will it be able to attract customers?

- What is the size of the market? The bigger the market, the higher the returns.

- Management-wise, Is the new company prepared to compete in the market?

- Are the company’s own financial projections attainable, accurate, and realistic?

When thorough, due diligence can protect you from losing money.

Conclusion

Investing in startups is risky, but your winning chances are significantly higher when you base your decisions on data insights.

Data providers, DIY research, and due diligence are typically enough to get you covered, but if you can get more information than this, even better.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)