A good place to understand why recapitalizations happen is that debt is usually cheaper than equity.

In addition to being tax deductible, lenders’ return expectations are invariably low than the company’s shareholders. If there are clear benefits and drawbacks to each, companies should be able to find an optimum debt-equity mixture. Hence the need for recapitalizations.

DealRoom often helps companies with the process of raising funds and optimizing capital structures and this is our insight to company recapitalizations.

What is Recapitalization?

A recapitalization is the process through which companies seek to optimize their capital structure for their current strategic situation. The rationale for undertaking the recapitalization could be internal - for example, when a company wants to take on more debt to fund an acquisition, or external - an example being when a company’s current capital structure makes it a potential target for an unwanted takeover.

How does Recapitalization Work?

Recapitalization is a rearrangement of the company’s debt and equity structure. The balance sheet equation, assets are equal to the sum of the company’s debt and equity, indicates that all of the company’s assets are paid for by one of debt or equity.

In a recapitalization, the company seeks to change how much of the assets are paid for by debt or equity, in order to reach a desired capital structure.

There are several ways that this can be achieved, including:

- Issuing debt in the form of long-term loans, exercising an overdraft facility, or issuing corporate bonds.

- Reducing debt through using cash to pay off outstanding debt

- Selling additional company equity on the stock market

- Issuing company equity on the stock market or to existing shareholders

Motives for Recapitalization

There are a number of motives for recapitalization. The following list is exhaustive but not exclusive:

.avif)

Cheap debt

At the time of writing, Apple has $202 billion in cash but $84 billion in long-term debt. Why is that? It’s because the debt is cheap (although becoming more expensive), and it pays for Apple to use somebody else’s money when it’s cheap.

Tax reason

The debt that a company like Apple takes on gives it a tax shield. While equity is taxable, debt is not. Thus, the more debt that a company holds on its balance sheet, the less tax it should pay.

Share price

Analysts usually take a negative view of companies with large debt piles on their balance sheets, viewing them as higher risk. This can lead to depressed stock prices, which companies try to pump up by paying down some of their debt.

Covenants

Debt holders or investors in a company can sometimes include covenants in their debt/investment which stipulate that a company can only hold a certain amount of debt. Approaching this level of debt should encourage them to reduce it.

Protection against hostile takeovers

Companies with lower levels of debt on their balance sheet tend to be more prone to hostile takeover attempts. To fight off the unwanted bids, management will sometimes load up on debt, in turn making the company unattractive to outsiders.

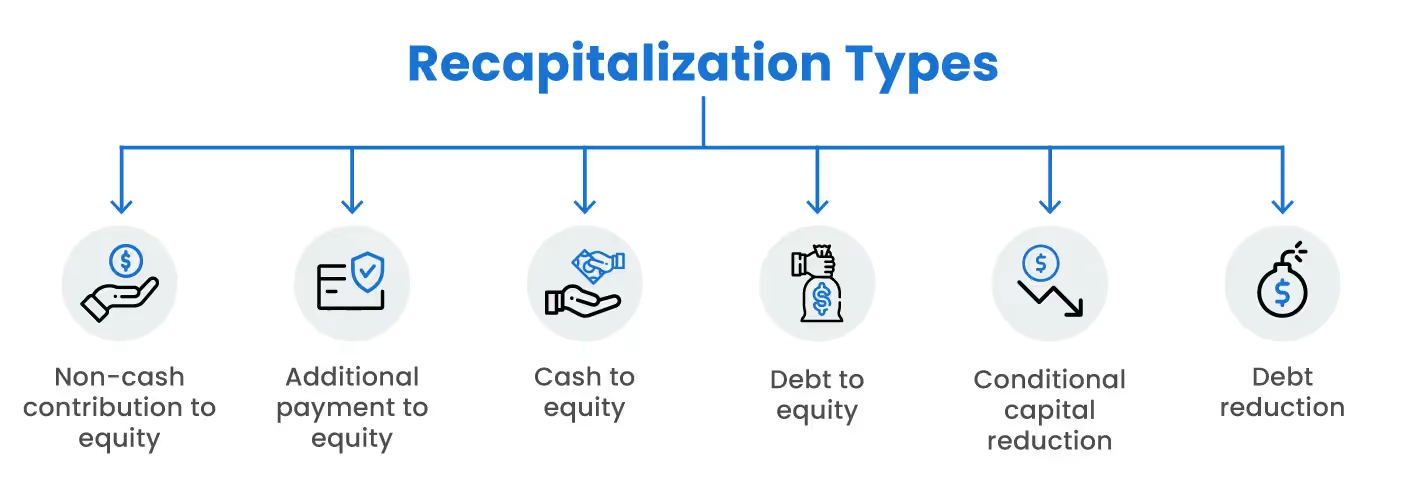

Recapitalization Types

There are several recapitalization types. These include:

- Non-cash contribution to equity: A complex operation wherein equity is issued, not for cash, but for non-cash assets such as real estate, business units, or subsidiaries.

- Additional payment to equity: Whereby existing stockholders give the company cash and add additional equity as a buffer for a period of time.

- Cash to equity: Whereby the company uses its own cash to purchase equity from outside sources, usually the stock market.

- Debt to equity: Whereby an outstanding loan is converted to equity. This is achieved with convertible debt.

- Conditional capital reduction: Whereby the company’s capital (land, buildings, etc.) is divested and the cash received is converted to equity.

- Debt reduction: Whereby the company’s debt is paid down using its cash.

Example of Recapitalization

A good example of recapitalization is provided by perhaps the biggest recapitalization of any company in the world in 2022, that of Credit Suisse.

Credit Suisse, the world famous banking corporation decided during the year that it needed to restructure its operations, and that it would be largely withdrawing from investment banking. Its investment management practice will be spun off into Credit Suisse First Boston.

However, as part of the restructuring, Credit Suisse also intends to recapitalize.

At the end of October 2022, it announced that it would raise $4 billion in equity - $1.5 billion of which had already been committed by the Saudi Arabian government - to shore up its balance sheet and enabling the company to reduce its debt relative to equity.

A classic case of using a recapitalization to try to pump up the company’s stock price.

Ending Note

For more information on some of the issues raised in this article, see:

Hostile Takeovers: The dark side of M&A

The Ultimate Guide to Debt Financing

Equity Financing Guide: Pros, Cons, How It Works

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)