When a company is deciding on a corporate development strategy, the type of acquisitions it is looking to make will often determine the strategy even before a long list of potential targets is developed.

DealRoom has worked with companies on every manner of deal, so we decided to provide readers with a brief overview of each of the different types of acquisition, along with an indicative example.

The 7 Types of Mergers and Acquisitions

- Horizontal Acquisition

- Market Extension Acquisition

- Vertical Acquisition

- Conglomerate Acquisition

- Congeneric Acquisition

- Reverse Takeover (SPAC)

- Acqui-Hire

Below is a more in-depth look at each of the 7 M&A types, along with specific examples of each.

1. Horizontal Acquisition

Horizontal acquisitions (often called ‘horizontal mergers’) involve gaining market share through consolidation. Both companies should be operating in the same space, providing more or less the same products and services. The increased scale of the new company should give it increased bargaining power and a better competitive position than the two companies previously had when they were on their own. In most industries, the largest players either obtained or maintained their leadership position through horizontal acquisitions.

How does it create value?

A horizontal merger leads to greater economies of scale in the market(s) that the company operates. It is also likely to lead to lower operating costs, as the companies can share production facilities, distribution channels, and human capital.

Horizontal Merger Example

The merger of Exxon and Mobil to create ExxonMobil in 1999 could be seen as the textbook case of a horizontal merger. Two companies with the exact same output (very rare, given that all consumer products are at least a little different). The combined firm was the largest in the world at the time of the merger, creating an undisputed leader in the oil and gas industry, and creating hundreds of millions of dollars in cost and revenue synergies.

2. Market Extension Acquisition

A market extension acquisition is a variation of a horizontal acquisition, whereby the companies in question are in different geographic locations. Ultimately, the aim is still consolidation, but within a wider geography.

Cross-border acquisitions are the most commonly seen form of the market extension acquisition, and are particularly common in industries like food retail and retail banking.

In these industries, the typically high levels of consolidation that exist incentivize new companies entering the market to undertake acquisitions rather than starting greenfield operations in the new geography

How does it create value?

The market extension merger creates value primarily through revenue synergies. There may also be some technology synergies that can be shared within the countries. Cost synergies tend to be lower here, as companies will retain most of the operations in each country even after the merger occurs.

Market Extension Merger Example

In early 2022, two innovative shipbuilders, Wight Shipyard from the UK, and OCEA, from France combined in an all-share merger that gave both increased access to both markets, as well as enhanced resources to take on larger players. The market extension merger enabled both companies to double their size.

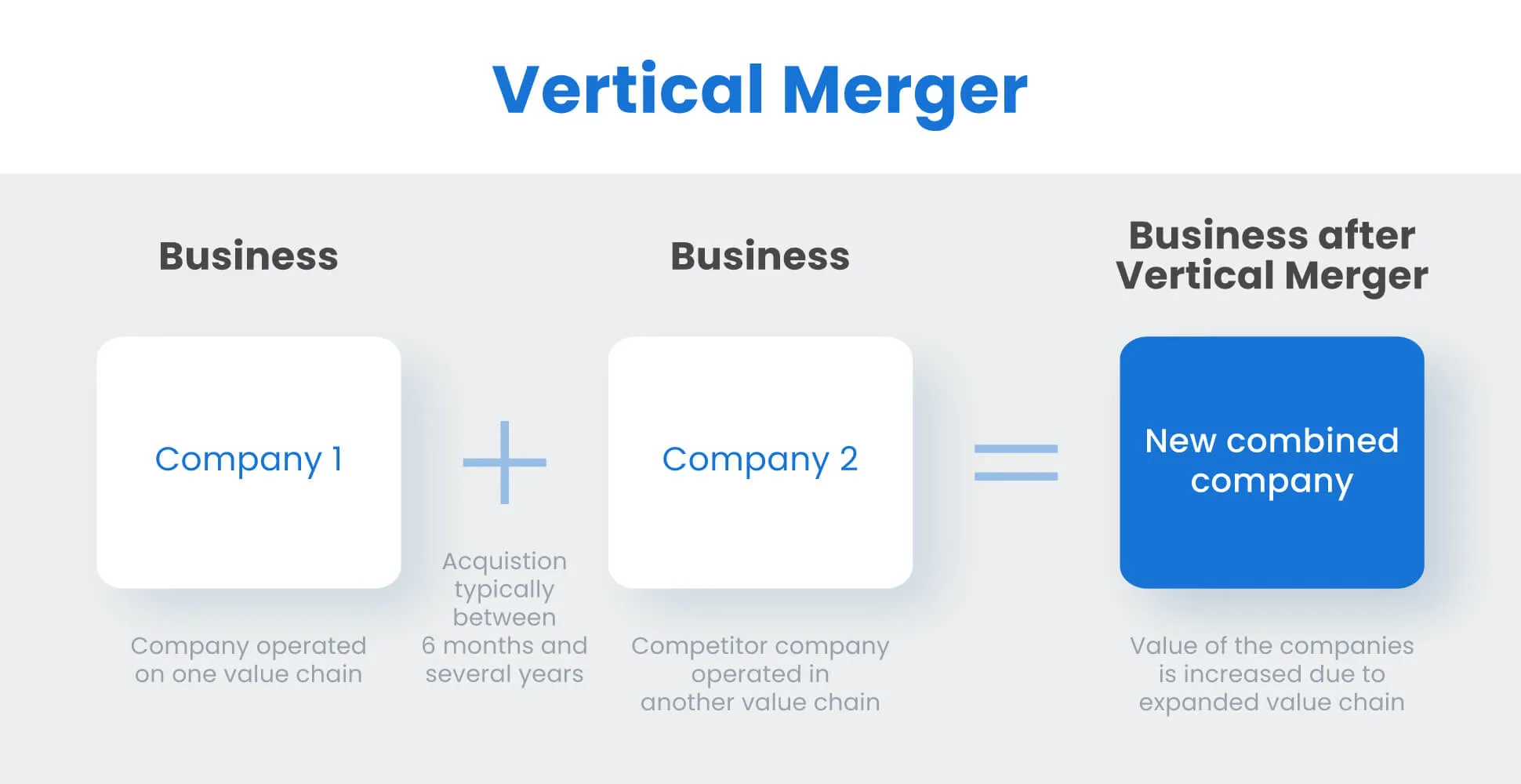

3. Vertical Acquisition

If a horizontal acquisition describes a company buying a competitor operating on the same level of the production chain, a vertical acquisition describes what happens when one company acquires another at a different level of the production or value chain. A vertical acquisition occurs when a company focusing on any one of these areas acquires another with a focus on one of the others.

How does it create value?

A vertical merger creates value by lowering costs (thereby creating value) in the value chain, which can then be passed on to consumers, creating a more competitive value proposition, or to shareholders, enhancing shareholder returns.

Vertical Merger Example

In the strictest sense of the term ‘merger’, vertical mergers are extremely rare: The reality is that vertical transactions are usually acquisitions, as a much larger company buys one of its partners or suppliers, enabling it to ensure better control of its value chain. An example of this occurred when UK frozen food retailer Iceland acquired Loxton Foods in 2012, allowing it to gain control of one of the many producers it worked with to bring food production in-house.

4. Conglomerate Acquisition

Our consumption patterns increasingly revolve around conglomerates, who have become experts in acquisitions. The conglomerate acquisition occurs when a large company has grown through a series of bolt-on acquisitions, usually with a diverse range of product and service lines, geographies, and industry outlooks. Everybody is familiar with the names of the world’s largest consumer product conglomerates such as Proctor & Gamble, Nestle, GlaxoSmithKline, and others. When we think of their product lines, they can include anything from pet food to detergent, dairy products to frozen foods.

Related: Examples of Conglomerate Mergers

How does it create value?

Whisper it, but the consensus now among academics is that there isn’t much value created from the merger itself - the value generation comes from each of the companies being managed well, which would have happened without the merger. It is possible that both can gain from a larger consolidated balance sheet and the greater benefits that brings.

Conglomerate Merger Example

Although the deals were strictly acquisitions because more cash than shares was exchanged in the deals, Pepsico’s acquisitions of companies like Wendy’s, Burger King, and Pizza Hut in the 1970s and 1980s represent good examples of conglomerate ‘mergers’ with the selling of soft drinks having little relevance to the selling of pizzas (although, it should be noted that all of these restaurants still only have Pepsi on tap, decades after the original transactions).

Related: Examples of Conglomerate Mergers

5. Congeneric Acquisition

A congeneric acquisition (also referred to as a ‘concentric acquisition’ or 'product extension merger') is a twist on the horizontal acquisition, where, rather than having the same products or service lines, the two companies involved in the deal have different product lines and service, even if they broadly serve the same market. This overlap between the companies creates synergies (whereby the two companies become greater than the sum of their parts). A typical example usually given by corporate finance textbooks which exhibits this distinction in a simple fashion is an ice-cream manufacturer buying a wafer manufacturer.

How does it create value?

The product extension merger primarily creates value through revenue synergies, although cost synergies are a secondary benefit. The principal idea for value generation here is that both companies can create significant cross-selling opportunities through the merger.

Congeneric Acquisition Example

The $90 billion all-share merger between mining firm Xstrata and commodities trader Glencore in 2012 provides an interesting example of a product extension merger. Under the deal, the players said that they would create a ‘natural resources group’ that would be able to trade the commodities as soon as they were mined. In this respect, it could also be seen as a vertical merger, in that one was upstream of the value chain of the other.

Related: Acquisition Examples

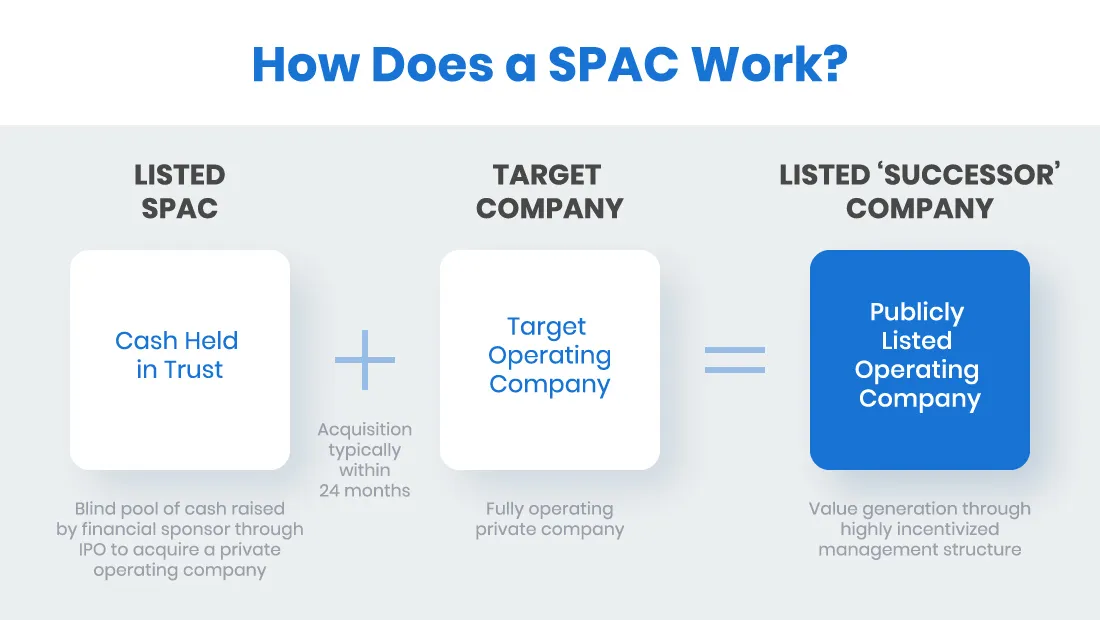

6. Reverse Takeover (SPAC)

Reverse takeovers or ´SPAC´(Special Purpose Acquisition Company) deals have spiked over the past five years. In this form of acquisition, a private company acquires a public company with the intention of using it to go public, and avoid the usually costly IPO process. Depending on how the deal is structured, a reverse takeover can also involve the public company acquiring the private company. However, the ultimate aim is always for the private company to take control of the newly merged company and for it to be publicly listed.

Example: The acquisition of US Airways by America West in 2015.

7. Acqui-hire

At a time when the biggest companies in the world are defined as much by their talent and intellectual property as their capital assets, the acquire form of acquisition is a proven way for companies to ensure that they’re winning the talent race in their industry.

This is most commonly seen in the technology sector, where a shortage of programmers at the very highest levels means that the big tech companies will do almost anything to get their hands on value adding talent - including buying their company.

Example: Facebook’s acquisition of Drop.io in 2010, with the explicit goal of bringing Drop.io CEO Sam Lessin onto the Facebook roster.

Frequently Asked Questions

What are the different types of M&A?

The main types of mergers and acquisitions are horizontal, vertical, conglomerate, and market-extension deals. Each serves a unique purpose, from increasing market share to expanding supply chains or diversifying operations.

What is a horizontal merger?

A horizontal merger happens when two companies in the same industry and stage of production combine. It helps reduce competition and often creates cost advantages through shared resources.

What is a vertical merger?

A vertical merger occurs between companies at different stages of the supply chain. For example, a manufacturer may merge with a supplier to gain better control over production and pricing.

What is a conglomerate merger?

A conglomerate merger involves companies in unrelated industries. These deals aim to diversify business risk and build broader corporate portfolios.

What is a market-extension merger?

A market-extension merger happens when companies selling similar products in different regions join forces. This helps them reach new markets and grow their customer base.

What is the difference between a merger and an acquisition?

In a merger, two firms agree to form a new entity. In an acquisition, one company purchases another and assumes control of its operations, assets, and management.

Why do companies pursue mergers and acquisitions?

Companies pursue M&A deals to grow faster, gain market share, enter new regions, or access technology and talent. M&A can also improve efficiency by combining complementary strengths.

Key Takeaways

In the most basic terms, an acquisition is simply a transaction wherein one company buys another company. But as this article shows, that transaction can have many different forms and underlying motivations.

Understanding these will enable you to think about whether your corporate development strategy adequately addresses your company’s long-term goals. If you want to dive deeper, check out this video on M&A best practices:

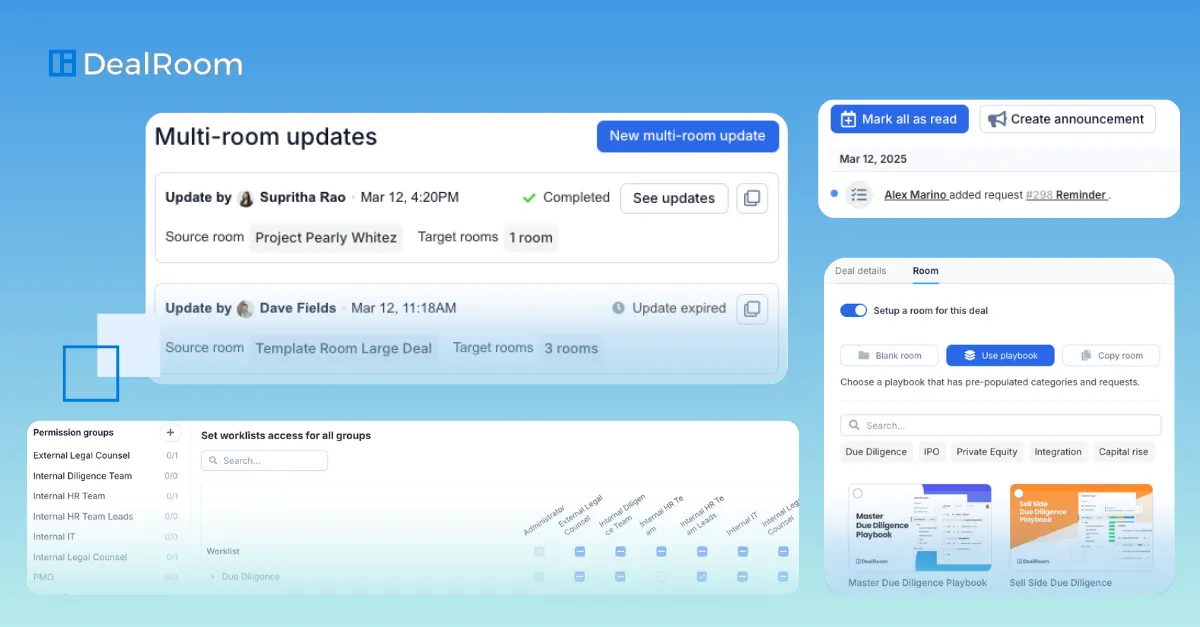

Or talk to us at DealRoom about how we can help you in this process.

Definition of Merger and Acquisition

A merger is a transaction of two companies, usually of similar size, in which the shareholders of each of the two separate companies, jointly own the shares of the company that arises after the merger. This is distinct from an acquisition, where one company (the buyer) buys the outstanding shares of a target company, and the target company’s shareholders receive the proceeds from selling those shares.

.png)

.webp)

.webp)

.webp)

.webp)

.png)

.png)

.png)

.svg)

.svg)

.png)