As transactions, mergers and acquisitions (M&A), come in many forms.

Practitioners conduct transactions for a variety of reasons, depending on the strategic objectives and development stage of their organization.

A vertical merger is one form of transaction that holds a lot of strategic value for organizations looking to grow their presence in the marketplace.

Learn about tools that help proceed with this kind of transactions and M&A software here.

But what is a vertical merger and how do organizations decide to conduct these unique transactions?

Let's take a look at vertical mergers definition.

What is a Vertical Merger?

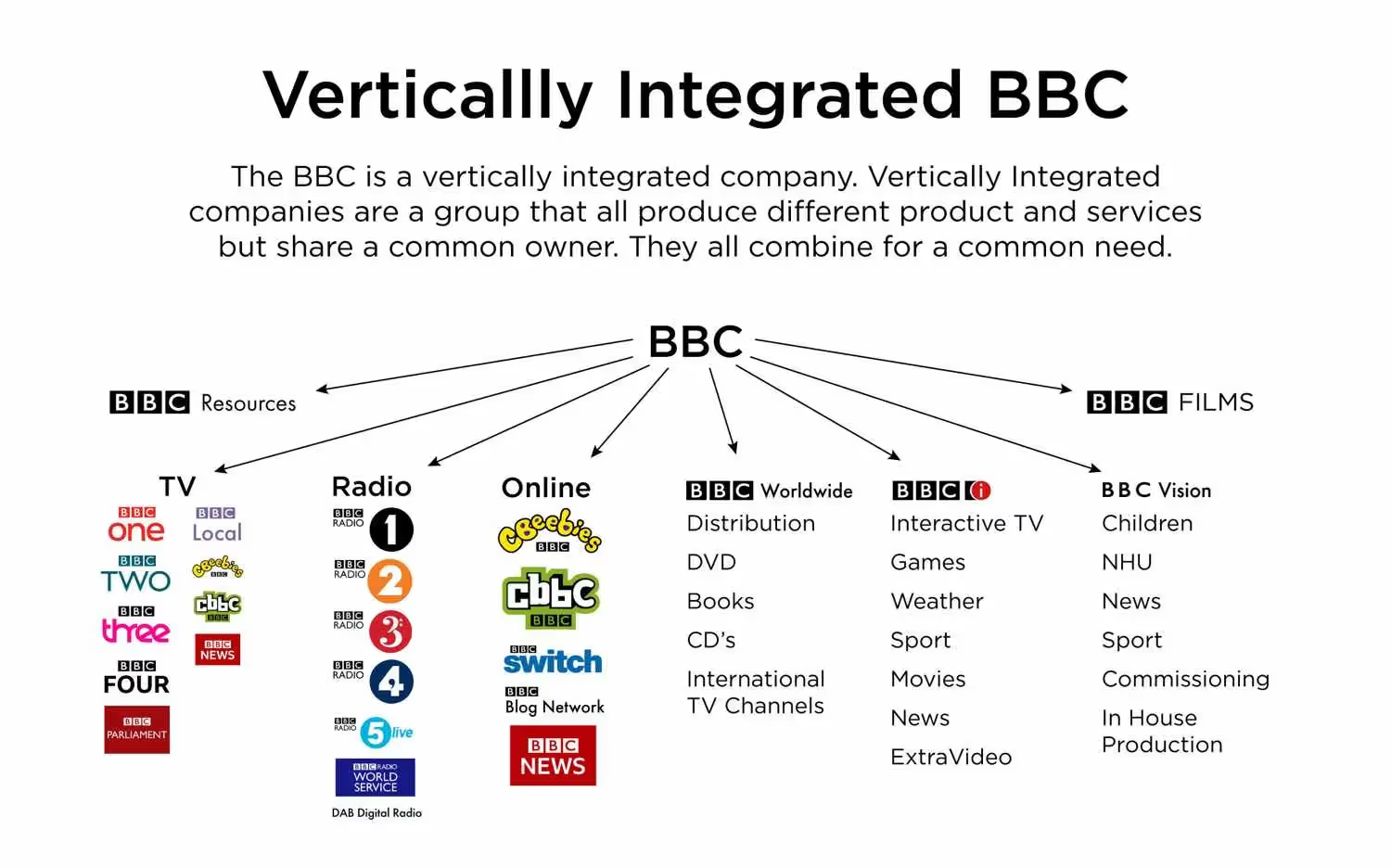

A vertical merger is a merger between two or more companies involved at different stages in the supply chain process for a common good or service. Unlike a conglomerate merger, vertical M&A mergers take place between companies that produce separate services or products along a similar value chain.

Vertical mergers often take place between a manufacturer and a supplier, typically, in an attempt to increase efficiency and gain business.

They are, in a sense, a strategic tool. Each company produces similar services or goods.

The vertical merger is a way for each company to capitalize on efficiency in terms of business profits and expansions.

.avif)

Knowing the Difference Between Horizontal and Vertical

It is important to know that a vertical merger is not the same as a horizontal merger. They are essentially two completely different types of mergers.

Vertical mergers take place between a manufacturer and a supplier, whereas horizontal mergers take place when one company acquires a competitor.

Vertical mergers hope to increase shared market value while increasing profits, expanding business, and cutting costs.

Meanwhile, horizontal mergers aim to reduce competition by acquiring large competitors, which in turn expands the company’s product range and increases revenue.

Which Merger is Best For You?

If you have a business, it is vital to know which type of merger would benefit you the most.

Since vertical and horizontal mergers have entirely different goals, you’ll need to evaluate your goals to make the best decision for your business.

If your goal is to increase the revenue of your business significantly, then a horizontal merger may be the best decision.

However, if you want to become a higher competitor while cutting costs and expanding business success, then a vertical merger would be the best choice to better the future of your business.

Read more about due diligence software in this article.

Synergies Created by Vertical Mergers

Vertical mergers are known to create many synergies, which enable organizations to decrease costs while increasing internal workflow efficiency. The following are the three largest synergies typically produced through vertical mergers:

- Financial Synergy: Vertical mergers help reduce financial constraints by using funds to help the merging company expand, grow debit capacity, reduce costs, and increase credit.

- Managerial Synergy: Vertical mergers help to eliminate any poor management team members by replacing them with more efficient management.

- Operating Synergy: Vertical mergers help to create better administration and operation supply chain by combining the successes of each company while replacing any trouble areas.

How Does a Company Benefit from a Vertical Merger?

Organization’s pursue vertical mergers to gain greater control over their supply chain. This control provides many strategic benefits, making companies more competitive and increasing their market power.

One obvious benefit is that vertical mergers allow organizations to lower prices because they now control the supply chain. The ability to lower prices gives organizations a huge leg up over competitors.

Independence from suppliers also provides the opportunity to offer higher-quality products while eliminating the risks associated with relying on third-party developers.

Vertical mergers also benefit companies by increasing their knowledge of their product and its marketability.

When markets and consumer preferences shift, organizations that have a greater understanding of the product and its production will be able to better evolve and more quickly innovate their offerings.

When acquiring supply chains, organizations also often acquire their patents, resources and developing technologies. This makes organizations incredibly more competitive and increases their future viability and growth.

Why Vertical Mergers Matter?

Vertical mergers matter because they are a way for manufacturers to take control of their business. By acquiring the suppliers, the manufacturers can increase their profits while focusing on exceptional expansion.

Vertical mergers help to create a substantial amount of value for all stakeholders and parties involved.

Where each individual company may experience success on their own, a vertical merger can help each business come together, combine their resources, and create a larger hold on the market.

Vertical mergers also enable each business to focus on other ventures in an attempt to expand their reach.

Other ways in which vertical mergers can foster growth and long-term success:

1. Better Management: Vertical mergers can greatly improve an organization’s management structure. Companies are able to restructure and take the most influential leaders from each company then place them together to work as one. If integrated properly, this management restructuring can further increase business success by strengthening those in charge.

2. Higher profits: Higher profits are another benefit to vertical mergers. When companies merge, they increase their grasp on the market, which can, in turn, greatly increase profits.

3. Cost Control: Vertical mergers also allow companies the ability to cut out excess production and distribution steps which help to save on costs. Production is moved in house, giving these organizations greater control over cost.

4. Quality Control: Companies have the ability to gain more control when they merge. For example, a retail company can combine with a manufacturing business which will allow them more control over the quality of their production and distribution.

.avif)

Challenges of Vertical Mergers

Vertical mergers do not come without challenges, however. The following are a list of common challenges practitioners face while undergoing a vertical merger:

1. Additional Costs

In some cases, costs can actually increase when two companies merge. While the strategy is to cut out production costs, there can be many bureaucratic costs involved.

Sometimes these additional costs can outweigh the benefits of the overall merger.

When this occurs, it can put a strain on the merged companies, which can result in their failure to thrive as one successful entity. To address this challenge, create a strong integration plan that considers such costs and eliminates excess employees or processes.

2. Key Personnel Loss

When two companies merge, there can be a loss of crucial personnel members.

Not everyone will be able or willing to keep their positions once the organizations merge. While most mergers try to retain key personnel members, it is ultimately a question of who will work best within the merged company and unfortunately valuable personnel can be lost in the process.

Increasing communication and transparency during a merger can address this challenge by keeping key personnel on the same page.

3. Disparate Corporate Cultures

Mergers can fail when two companies cannot successfully integrate their distinct corporate cultures into one harmonious unit.

There are several reasons why two or more companies decide to merge, and when they do, they bring together a lot of unique individuals and processes which must now work together as one.

In order for a merger to be successful, operational and management styles must be accounted for and integrated thoughtfully.

Are Vertical Mergers Legal?

While vertical mergers are legal, they require government approval, like any merger, through the Federal Trade Commission (FTC) and the Antitrust Division of the Department of Justice (DOJ).

Historically, vertical mergers have received their fair amount of scrutiny due to Anti-trust violations as they can sometimes significantly reduce market competition and block democratic access to raw materials.

These mergers can enable organizations to gain large control over supply chains, bringing in legal restrictions.

However, when done correctly with the appropriate approvals, vertical mergers are legal and can greatly improve market innovation and growth.

What is an Example of a Vertical Merger?

Vertical mergers have been successfully conducted since the early 1990s, providing the industry with many examples of their strategic sense, value, and outcomes.

Vertical Mergers Examples

As previously mentioned, a vertical merger is when two or more companies who are in different stages of a supply chain in the production of common products or services.

For example, Company A is a manufacturer of handbags and Company B supplies the leather that is used to make these handbags.

Company B has been providing Company A with leather for years, so in an attempt to increase efficiency and cut costs, both companies will merge together.

eBay and PayPal vertical merger

An example of a real vertical merger is the 2002 transaction between eBay and PayPal.

In an attempt to help eBay further purchases made on their online marketplace, they acquired PayPal to help their online users transfer money more easily.

PayPal provides the ability to transfer payments online from one user to another, so when eBay and PayPal merged, the simple way to conduct a transaction helped increase the profits and success of not just eBay, but also PayPal.

Such big transactions are usually conducted with help of M&A VDRs. You can read about M&A data rooms here.

More Examples of Vertical Mergers

Some of the largest and most notable transactions have been vertical mergers. Here are a few examples of famous M&A deals:

IKEA acquires Romanian and Baltic Forests, 2015

Few companies are dependent on wood as a raw material as the Swedish flatpack furniture manufacturer and distributor, IKEA. In 2015, it announced that it was acquiring substantial forestland in Romania and the Baltics to ensure its raw material.

There may have been a few motives behind the transaction. First, the previous year, it had been banned from logging at its Russian forests by the Forestry Stewardship Council (FSC). Second, Russia’s first political instability with Ukraine began in 2014, perhaps encouraging IKEA to find more politically stable environments. Third, and perhaps, most important, the acquisition allowed IKEA to ensure that it was logging sustainably.

Outcome

Thanks to the transaction, IKEA can now prove that the raw material it uses comes from its own sustainably logged forests, as well as being insured against any geopolitical issues (which subsequently emerged in Russia).

Iceland acquires Loxton Foods, 2012

Iceland is a UK food retailer specializing in a wide range of frozen foods. In 2012, it acquired Loxton Foods, one of its largest suppliers. The acquisition of Loxton Foods enabled it to secure the future of an important supplier (Loxton was threatened with bankruptcy at the time) of chilled and frozen foods, enabling it to avoid any short-term supply issues.

Outcome

As its biggest buyer, it can be assumed that most of Loxton foods margins were attributable to Iceland, and the acquisition also enabled Iceland to acquire its ‘raw materials’ - convenience and frozen foods - at a lower cost than before.

The reason Iceland gave for the acquisition was most interesting of all: Product innovation. By acquiring a food producer, Iceland could make changes to products more efficiently, using information that it was receiving from its physical stores to drive that innovation.

Inditex acquires Indipunt, 2017

Inditex is one of the world’s largest fashion retailers, with over 2,000 physical stores spread across the globe distributing its clothes through brands such as Zara, Bershka, Resto, Pull&Bear, and Massimo Dutti.

As a pioneer in fast fashion, Inditex has always kept tightly controlled supply chains. It’s largely because of Inditex that the fashion cycle (i.e. the time it takes to change styles on store hangers) has been reduced from months to just a few weeks. In 2017, it acquired its largest textile supplier, Indigent, following a trend that has already been underway for several years at large fashion brands.

Outcome

By acquiring the textile manufacturer, Inditex can now work on developing more sustainable textiles - something that it has come under increasing pressure to achieve - increase the increasingly slender margins that mass fashion retailers face, and reduce the chain of command between its 2,000 stores and textile manufacturer’s factory floor.

FedEx acquires Mupa, 2011

For anyone looking to understand how vertical integration works, the history of FedEx and its acquisitions is a good place to start. The FedEx business model arguably depends more than any other on closely linked supply chains, so the company is always looking forr effective vertical integration.

In 2011, it acquired the operations of Multipack (Mupa) in Mexico, giving it control of the company’s pick-up and delivery network, warehousing and logistics services, 48 distribution centers, 13 warehouses and more than 500retail outlets, all of which were subsequently rebranded as FedEx.

Outcome

The acquisition enabled FedEx to enter a new market, to offer its services to private individuals and customers, and to offer an end-to-end service to any of its international clients looking to get a package sent to Mexico. Further more, by rebranding Mupa as FedEx, the company was able to create visibility in a country, where previously it would have had to start from the ground up with limited brand recognition.

Boeing acquires EnCore Group, 2019

The acquisition of EnCore Group by Boeing in 2019 was the latest in a range of acquisitions that took in a series of airplane parts manufacturers, at a time most of the big aerospace manufacturers were looking to bring parts of their production process in house, moving away from the traditional outsourcing model.

Acknowledging this deal as being part of their vertical integration strategy,. Boeing said through a statement at the time: “ Boeing’s cabin vertical is one of a series of targeted vertical integration efforts to provide more options and value to customers by developing and building in-house capabilities in key areas, including those that strengthen Boeing’s support of the customer, even beyond the airplane through Boeing Global Services.”

Outcome

Despite being in dramatically different industries, the benefits to Boeing of this vertical acquisition were similar to those of Iceland and Inditex: product innovation. Boeing was the company that kept direct links with end clients (i.e. airlines) and it wanted to offer the man enhanced range of interiors for the planes that they were going to manufacture.

Summary

Vertical mergers definition is the merger between two or more companies that produce separate services or components along the same supply chain.

Vertical mergers are a way for companies to significantly cut costs, increase profits, expand their market, and turn their focus on bigger goals of improving their company.

Vertical mergers exist as a strategic tool which allows manufacturers to take control of their business. There are different types of mergers, such as a vertical merger and a horizontal merger.

Each merger helps to benefit the company differently.

As a business owner, it is crucial to know the difference to understand which merger is best for your specific needs.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)