Disney provides one of the clearest examples of acquisition as a growth strategy.

Bob Iger transformed Disney through M&A. Instead of growing purely organically, Disney acquired new capabilities that were too big or too slow to develop internally.

Pixar brought world-class animation. Marvel and Lucasfilm brought global franchises and long-term IP monetization. 20th Century Fox gave Disney a substantial volume of content and distribution muscle.

These deals weren’t isolated transactions. They were guided by a clear strategy.

Disney made acquisitions to fill capability gaps, accelerate time-to-market, and unlock new growth engines through content, merchandising, and platforms.

This is Buyer-Led M&A™. Targets are aligned with strategic themes, not opportunistic availability.

Disney didn’t acquire companies for scale alone. It acquired capabilities that unlocked new growth engines.

This logic defines modern M&A in 2026. Today’s acquirers target AI capabilities, proprietary data, cloud platforms, cybersecurity expertise, and automation tools.

The objective is the same as Disney’s strategy: secure critical capabilities before competitors do.

Strategic vs. Financial M&A

M&A usually falls into two categories: strategic and financial.

This is not to say that strategic M&A does not generate revenue: A large part of the success of Disney’s strategic M&A play has been the financial growth that it generated. The two work hand in hand.

The Primary Goal of Acquisition

Investment in growth has always been, and remains, the primary driver of corporate acquisitions. However, in 2026 and beyond, growth takes on a new dimension beyond revenue growth.

Today, organizations are turning to M&A to acquire capabilities that would take too long to develop internally. Enterprises are acquiring AI technology, data access, cloud/nex-tech infrastructure, cybersecurity, and automation expertise.

Organic growth initiatives often lack the scale or speed required by modern markets. When faced with that choice, many companies choose to buy rather than build.

By leveraging M&A, companies that lack an inherent competitive edge can gain a significant advantage over competitors. We’re seeing this trend among both larger corporations and mid-market firms.

That’s why M&A activity remains resilient, even when markets are volatile. When organic growth slows, companies turn to acquisitions to accelerate growth and fill strategic gaps.

We’ve noticed this trend while helping hundreds of companies grow through M&A. The companies that have the best acquisition outcomes view M&A as a repeatable process.

In this guide, we’ll cover how M&A can serve as a growth strategy and how corporate development teams can architect M&A programs to deliver repeatable results.

How Can a Merger or Acquisition Help a Company Expand?

Every company is limited to a large extent by external factors: the market, the industry, and the country or countries in which it operates.

Remarkably few companies can remove themselves from these constraints for sustained periods.

Of those that can, many do so through mergers and acquisitions. In an industry with an average annual growth rate of 5%, most companies are expected to achieve sales growth close to this.

By contrast, all things being equal, a merger of two equals will double the revenue of both.

Beyond growth, M&A delivers several strategic advantages.

Quickly Enter New Markets

Historically, gaining entry into a market has been known to take years (consider the networking, sales pitching, etc.). However, acquiring a company can achieve this goal relatively quickly and easily.

Enter a Marketplace with Credibility

Piggybacking on the previous benefit, gaining access to a marketplace alone does not equal success. Gaining credibility in a marketplace yields real results, especially when the market is oversaturated; true financial gain comes from being a recognizable, trusted service or product.

Diversify Products or Services

Expanding the services and products your company offers can lead to sustainability and revenue. In fact, larger companies will diversify to prepare for the future and protect themselves.

This trend is common in the food industry. Take, for example, Mars's acquisition of Chappell Brothers years ago, or Coca-Cola's acquisition of Odwalla, as Americans became more health-conscious.

Acquire Intellectual Property

Intellectual property refers to nonphysical assets such as copyrights, patents, and trademarks. Ideas can be turned into money-making services, products, and technology.

Acquire Top Talent

Mergers and acquisitions are a prime way of obtaining strong talent. It’s essential that change management practices be implemented from the top down to retain these strong employees, thereby protecting the value of the deal.

That said, when a strategic move is made, many employees understand the benefits of the decision, as M&A is part of today’s business landscape.

Reduce Competition

The assets that come with mergers and acquisitions can help your company operate at lower costs. A direct consequence of operating at lower costs is the ability to lower prices and, therefore, reduce competition.

Surprise Competitors

Some practitioners believe M&A moves can help companies surprise competitors, thus giving them an advantage.

More Value for Shareholders

M&A activity can create greater value for company stakeholders, and diversification through mergers or acquisitions can also ease their concerns.

Innovation through Acquisition

Large tech companies like Google and Microsoft are widely recognized as leaders in innovation, but less discussed is how they acquire many of their most valuable innovations, bringing them into their portfolios to improve their existing offerings. They have shown that M&A is a valuable strategy for developing a company’s innovation capabilities.

How Do Companies Drive Growth by Acquisitions?

The consolidation of two or more companies and their operations is a faster way to achieve growth than almost any other approach.

The world’s largest companies - all of which, without exception, have used acquisitions as a growth strategy - are testament to this.

To learn more about these, see our overview of 17 Powerful Acquisition Examples and what we learned from them.

Of course, this growth doesn’t happen by itself. A solid acquisition policy assesses the fit between the two companies.

Even when companies appear to be a good fit, a thorough due diligence process is paramount to ensure the merged entity's growth is sustainable.

When Does M&A Work for Business Growth?

As Disney's example shows, a well-planned M&A strategy can be a highly effective way to drive business growth.

Most companies cannot be expected to stay ahead of the pack in every department (who would have thought that The Walt Disney Company would need to acquire another company for its animation capabilities?), so it makes sense to acquire key capabilities through acquisitions, particularly at a time when technology is changing so quickly.

Furthermore, when acquiring a company, the buyer usually gains access to pre-existing (and often successful) clients and contracts, human capital, workflows, products, physical assets, and even intellectual property.

Finally, M&A drives business growth when companies are aligned with synergies. Synergies are of the utmost importance when utilizing M&A, specifically acquisitions, to generate growth.

Growth through Acquisition vs. Organic Growth

Disney provides a case study in the power of M&A over organic growth.

In January 2006, it announced the acquisition of Pixar, followed by the acquisition of Marvel in December 2009.

In anecdotal terms, we could assume that the addition of two such complementary businesses would contribute significantly to Disney’s growth.

Stock market returns over the period following both deals confirm this. The graph below shows Disney’s performance between 2006 and 2016 (dark blue line) vs. the S&P 500 index (light blue line).

Fig 1. Performance of Disney Stock vs. S&P 500, 2006-2016

As the chart shows, Disney stock gained 350+% over the period, compared with just 61% for the overall market.

Or to put it in another way, Disney’s compounded annual growth exceeded 14%, while the overall market growth rate compounded was a little under 5%.

It’s also worth bearing in mind that this takes in a period during which the stock market was considered to be bullish. Another statistic underscores the impact of acquisitions: In 2005, Disney’s revenue was $31 billion. By the end of 2016, it had jumped to $55 billion.

Top Acquisition Drivers Today: AI, Data, and Tech

Buyers are purchasing AI capabilities, technology, and data sets at record levels. These assets are drivers of growth and acquisition today, not just support functions.

The M&A landscape has changed, and technology assets are the new currency of acquisition. Companies are doing more deals to acquire technology assets and talent than for traditional expansion strategies.

Here are four technology-related acquisition trends.

1. Acquiring AI vs. Building AI

Organizations are acquiring AI capabilities instead of developing them in-house. AI development is time-consuming and requires infrastructure and talent. By acquiring AI capabilities, companies can shorten the learning curve and reduce risk.

Enterprise buyers gain immediate access to AI technology through acquisitions. Big Tech firms like Microsoft, Google, and Salesforce acquire AI startups rather than building new tech teams from scratch.

In many situations, companies are really after the data scientists and engineers. It’s difficult to find teams with proven models that have shipped in production.

2. Access to Data

Access to unique datasets is another reason companies are buying smaller firms. It’s no longer secondary to the acquisition - data is the main reason.

Acquirers are seeking to acquire proprietary data, customer intelligence, and consumer behavior data. These data sets can be used to improve AI algorithms and drive product innovation.

We’ve seen larger companies pay a premium for firms with large data volumes. Fintech, healthcare, retail, and SaaS companies have been bought for their data. Companies like Nvidia and Palo Alto purchase firms with large datasets to improve their platform and security intelligence.

3. Cloud, Cyber, and Automation

Cloud migration has accelerated M&A activity. Companies are acquiring cloud-native businesses to gain an edge in digital transformation.

Cybersecurity companies are also acquirers. As cyber threats continue to grow more sophisticated, companies are acquiring cybersecurity firms rather than building in-house teams.

Automation tools are another reason companies are doing deals today. From workflow automation and DevOps tools to AI automation, companies are reducing friction by buying these capabilities.

Across sectors, technology-driven deals share the same logic: buy capabilities that are too slow, too complex, or too strategic to build internally.

When Should Companies Choose Acquisition Over Other Growth Options?

Every growth team eventually faces this decision: Do we acquire, build, partner, or invest?

There’s no single right answer. Instead, the right choice balances speed, risk, and control. Here’s when we recommend each option.

When to Acquire

Acquisition is often the right strategy when:

- Accelerated time to value is critical. Building takes time. Months, maybe years. But markets don’t care about product roadmaps.

- Capabilities already exist outside the company. It’s often less expensive to buy talent, technology, or market access than build it yourself.

- Scale is needed before internal teams can achieve market scale. Acquisition is usually the fastest way to go big.

- Control is necessary. Acquiring a business gives you ownership of the product, data, and roadmap. That alone can tip the scale if the capability is central to your long-term strategy.

When to Partner or Invest

Investing or partnering with another company often makes sense when:

- Risk and uncertainty are high. Partnerships allow companies to enter a market with less risk.

- Integration costs would be too high. Some businesses are easier to partner with than fully integrate.

- The goal is optionality. Minority investments allow companies to gain exposure to a market or technology with less risk.

- Valuations are too high. If so, investing now allows you to buy later at a potentially lower price.

- Control over the capability is not a priority. Sacrificing control is easier if the capability is not core to your business.

When to Build

Building internally often makes sense when:

- The capability is core to your product or strategy. Internal teams understand the product deeply. That makes it easier to design features that align with your roadmap and customer needs.

- Differentiation is the goal. If competitive advantage comes from unique workflows, data, or IP, building keeps that advantage in-house.

- Timelines are flexible. If speed is not the primary driver, building allows teams to iterate and learn without acquisition pressure.

- The cost of acquisition outweighs development. Some capabilities are simply cheaper to build than to buy.

- The right talent already exists in-house. If your team has the skills and capacity, building avoids integration risk and organizational disruption.

For many companies, building is a way to learn before buying. It clarifies what to acquire later and why.

How to Develop a Growth through Acquisition Strategy

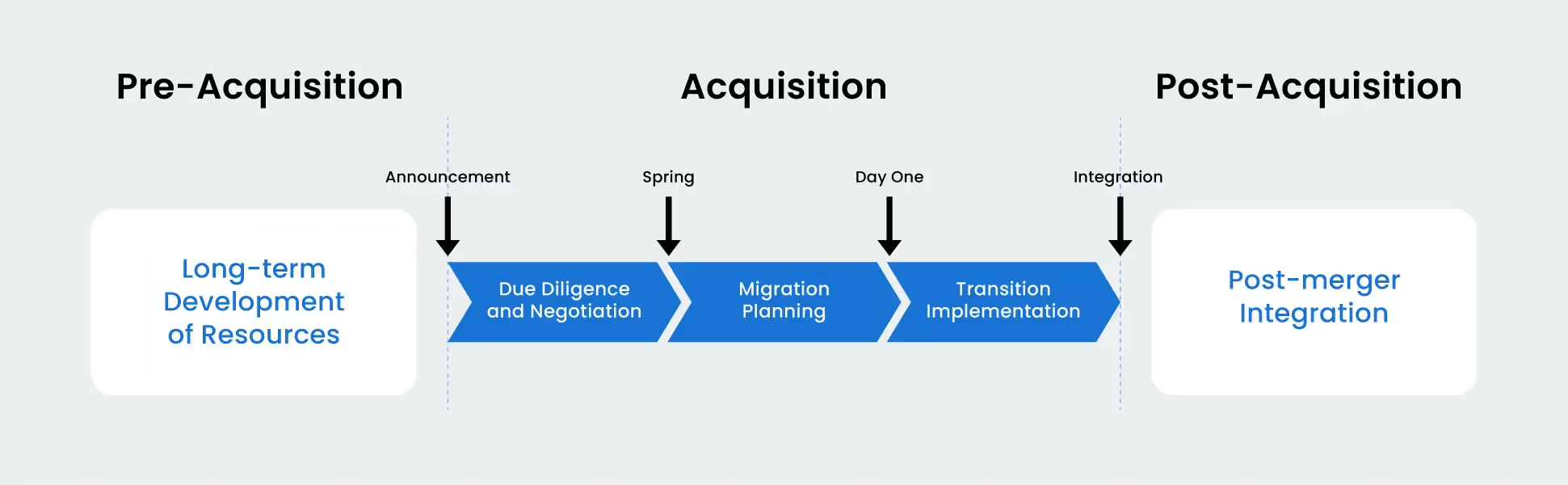

When developing a business growth strategy, the following roadmap can help you get started.

Again, just as with M&A playbooks, each company and each deal are different - you’ll need to tailor the guidelines and advice to your company’s individual situation.

In general, however, the process of growing your business through acquisition should look similar to this:

.avif)

Having a roadmap can certainly help you get started.

But it's not enough.

So..what do you do next?

You can use our 7-step checklist to develop a powerful growth through acquisition strategy for your business:

- Fully analyze and evaluate your needs and goals.

- On a related note, you will need to perform a comprehensive evaluation of the current market and business world. It means considering the economy, customers, competitors, and your current business and its operations. Be sure to question each aspect of your evaluation to make sure your information is accurate and not idealized.

- Consider why a combined company would breed more success from M&A (and be specific here as you answer this question).

- Clearly identify the synergies you’re looking to capture. Is this (M&A) the only way to capture them?

- Do you have a diligence team and diligence tools ready to go?

- How do you plan to successfully integrate the new company? How will you retain key employees (remember, they are the ones currently driving the company's success)? How will you focus on culture, and what change management practices will you put into place?

- Examine how you will align your M&A practices with your growth strategy.

“We’re not acquiring for the sake of acquiring. M&A isn’t our strategy—it accelerates our strategy.”

- Keith Crawford

Shared at The Buyer-Led M&A™ Summit (watch the entire summit for free here)

Critical and Strategic Factors in a Growth by Acquisition Strategy

The focus of this article thus far has been on how acquisition strategies drive growth.

But this, in itself, assumes that the acquisitions are conducted properly. Experience shows that acquisitions can destroy value as much as create it, with the difference usually in transaction execution.

The critical and strategic factors that underpin successful acquisitions are as follows:

- Addressing strategic fit: Acquiring for the sake of acquiring is little more than management hubris. The target companies should fit the requirements of the buyer’s corporate strategy in some way (i.e., product or service line, geographic reach, etc.).

- Addressing cultural fit: Some of the largest transactions in history have failed due to cultural differences between the two merging companies. Culture - or how a company gets stuff done - is fundamental to the company’s value creation, so it needs to be considered.

- Conducting due diligence: Thorough due diligence ensures that the buyer ‘looks under the hood’ of the business they’re acquiring, and that the price they’re looking to pay for the business reflects its intrinsic value.

- Integration: The deal isn’t done when the ink dries on the share purchase agreement. At this stage, the two companies must begin an integration process to ensure they become more than the sum of their parts.

Benefits of Growth by Acquisition

In addition to the benefits, such as gaining access to new customers and geographic markets, growing by acquisition has several additional benefits when compared to organic growth:

- Speed: A well-executed M&A strategy can deliver growth much faster than through organic means, as shown by many of the historic growth trajectories of some of the industry’s largest companies.

- Benefits of experience: As more and more acquisitions are made by a company, each additional acquisition should become less risky and, all things being equal, more straightforward to execute.

- Benefits of scale: While strongly discouraging ‘empire building,’ there are almost no drawbacks to being a larger firm. Financiers, suppliers, customers, employees, and shareholders all stand to benefit from the scale increase enabled by M&A.

"Fortunately for us, we're narrow in terms of what we do - asset management and investment services. Someone like JP Morgan who's in corporate advisory has a lot of businesses to figure out. We're very concentrated in where we play, so it's easier. But we did enter the fintech world with the Charles River transaction - that's the wild west, not an easy market to get your arms around."

Speaker: Keith Crawford, Global Head of Corporate Development, State Street Corporation

Shared at The Buyer-Led M&A™ Summit (watch the entire summit for free here)

What to Look Out for in Acquisition from Start to Finish

The purpose of the due diligence process is to investigate issues within the target company that aren’t immediately obvious.

This includes everything from soon-to-expire contracts with large customers to potential litigation arising from the company’s past actions.

However, at a strategic level, there are several issues the buyer should monitor.

These include the following:

- Culture: This word comes up again and again, but its importance to M&A success cannot be overemphasized. Buyers should keep their eyes and ears open, gather all the information they can about the target company culture, and get a feel for what they’re buying into.

- Competitive Advantage: Is there anything that the target company does that gives it a competitive advantage (which we’ll define as the ability to generate above-market value for a sustained period of time), or is it a ‘plain vanilla’ company?

- Leadership: Could the leadership of the target company make a valuable addition to your own company’s leadership team? Spend time with them during the due diligence process to determine whether this is the case.

- Opportunities: Are there any opportunities on the horizon for the target company that it can exploit, but your company can’t, in the near future? Say, because of a service or product line that’s set to undergo significant growth.

- Synergies: Where are the synergies between your two firms? Are they truly complementary to each other, or does buying the target company actually risk leading to cannibalism of some of your company’s revenue streams?

Frequently Asked Questions

What are the most common strategic reasons for a growth acquisition?

Key reasons include:

- Market Entry - Quickly and credibly entering a new geographic or customer market.

- Product/Service Diversification - Adding new offerings to the portfolio (e.g., Coca-Cola buying Odwalla).

- Acquiring Technology or IP - Gaining innovation and proprietary assets without the time and risk of internal R&D.

- Acquiring Talent ("Acqui-hiring") - Bringing in an entire team with specialized expertise.

- Eliminating or Reducing Competition - Consolidating the market to gain pricing power and market share.

- Achieving Synergies - Combining operations to reduce costs (cost synergies) or increase revenue (revenue synergies).

What’s the difference between strategic and financial M&A?

Strategic M&A focuses on long-term business value creation through synergies, such as expanding product lines, entering new geographies, or acquiring key technologies or talent. The buyer aims to integrate the target into their core operations to enhance competitive advantage. Disney's acquisitions are classic examples.

Financial M&A (like many private equity deals) primarily focuses on generating a financial return on investment. The goal is often to improve the target's operations and sell it later for a profit, rather than deep strategic integration with an existing parent company.

How does growth through acquisition differ from organic growth?

Organic growth is internally generated through activities such as increasing sales, developing new products in-house, or expanding marketing. It's typically slower, carries less upfront risk, but may not provide the leaps needed to outpace competitors in fast-moving markets.

Growth through acquisition is externally driven. It delivers immediate scale, assets, and capabilities, dramatically accelerating growth timelines. As the Disney case shows, it can propel a company's value and revenue far beyond market averages. However, it comes with a higher upfront cost, integration complexity, and cultural risks.

What are the most critical factors for a successful growth acquisition?

Success hinges on:

- Strategic & Cultural Fit - The target must align with your core strategy and have a compatible company culture.

- Thorough Due Diligence - Going beyond finances to examine operations, technology, legal issues, and cultural health.

- Meticulous Integration Planning - A clear, post-close plan to merge systems, processes, and teams while retaining key talent and capturing synergies.

- Clear Synergy Realization - Having specific, measurable plans to capture the value (cost savings, revenue boosts) identified as the deal's rationale.

When does M&A not work for business growth?

M&A is likely to fail as a growth strategy when:

- The deal does not align with the company's strategic or financial logic.

- The company is too small to handle the complexities of the M&A process or lacks sufficient M&A experience.

- The company is not financially stable / faces a funding shortfall.

- The potential deal has too many red flags and M&A risk factors.

- Members of the M&A team are only pursuing deals for reward programs.

Key Takeaways

- Acquisitions are one of the fastest and most effective ways to achieve scale, capabilities, and market access that organic growth rarely delivers.

- Growth through acquisition only creates value when strategic fit, due diligence, and integration are executed with discipline and clear synergy goals.

When executed well, M&A remains one of the most powerful drivers of long-term value creation. The world’s most successful companies recognize this.

They invest in dedicated corporate development teams and structured M&A processes because deal execution is too complex to rely on ad hoc approaches.

To deliver the growth they’re aiming for, companies need to conduct effective company searches, due diligence, and integrations. Having done so, they stand to reap the rewards of an acquisition for growth strategy.

The DealRoom M&A Platform helps corporate development teams manage the entire M&A process on a single platform, from pipeline building and diligence to integration tracking and value realization.

If your team is serious about using acquisition as a growth strategy, see how DealRoom can support your M&A workflow. Book a demo to learn more.

.png)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)