Legal Due Diligence Playbook

Legal due diligence is one of the most important steps in closing the deal. Collect the right information in order to successfully assess the legal risks during your M&A transaction with our legal diligence template. Book a playbook demo to explore — schedule a call with us and we will reach out to help you get started.

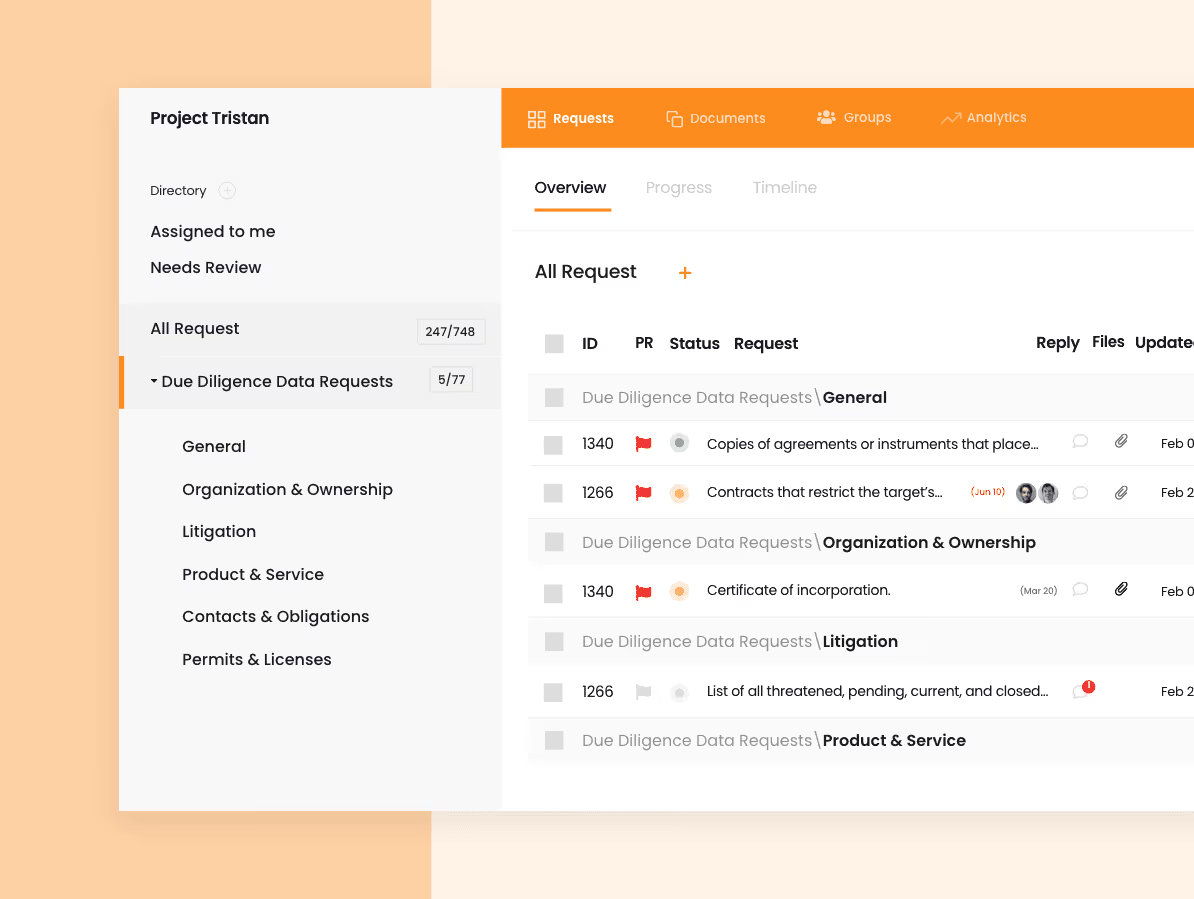

- Comprehensive legal review

Inspect corporate structure, contracts, litigation, regulatory exposures and compliance programs—so you uncover hidden legal risks before signing. - Ownership & obligation clarity

Validate equity assignments, subsidiaries, change-of-control triggers, indemnities and hidden contingencies—ensuring you know exactly what you’re assuming. - Unified team collaboration

Bring legal, finance and deal-teams into one shared workspace—flag issues, attach source documents, assign follow-ups and track progress in real-time. - Audit-ready document trail

Every contract review, signature, comment and version history is logged and linked—giving you full traceability and smoother hand-off into post-close operations.

Hand off into integration with the Legal M&A Integration Checklist for post-closing tasks, and formalise your deal agreement using the Business Acquisition Agreement Template.

.png)

.png)

.png)

.svg)

.svg)

.avif)