The recent SPAC boom brings to mind the reverse merger boom that occurred early in the 21st century, when hundreds of American companies were acquired by Chinese companies.

Despite the reputational damage caused at the time, reverse mergers are a wholly legitimate means to bring a company public.

On the M&A Science podcast, we cover them and every other conceivable aspect of M&A.

In this article, we delve a little further into reverse mergers, how they work, and what you need to know about this type of merger.

What is a Reverse Merger?

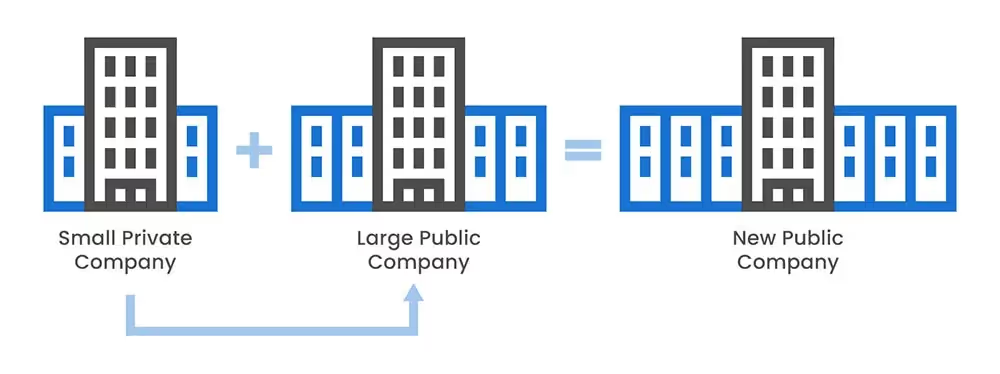

A reverse merger, sometimes referred to as a ‘reverse acquisition’, is a transaction that involves a private company acquiring a majority stake in a dormant public company in order to bypass the IPO process and gain access to the capital markets.

How Does a Reverse Merger Work?

A reverse merger is similar to IPOs and SPACs in the sense that the ultimate aim of all three is for the company to gain a stock market listing and the increased access to capital that comes with that.

There are some distinct differences, however. An IPO involves the company directly listing on the stock market index, going through the 18-24 month process of SEC oversight, investor roadshows and corporate governance preparation.

SPACs are a less administratively cumbersome method of accessing the stock market than an IPO. A SPAC is similar to, and often confused with reverse mergers. In a SPAC deal, a listed shell company led by a management team looking for an acquisition raises funds to acquire a private firm and bring it public. Being a shell company, the SPAC has no previous history.

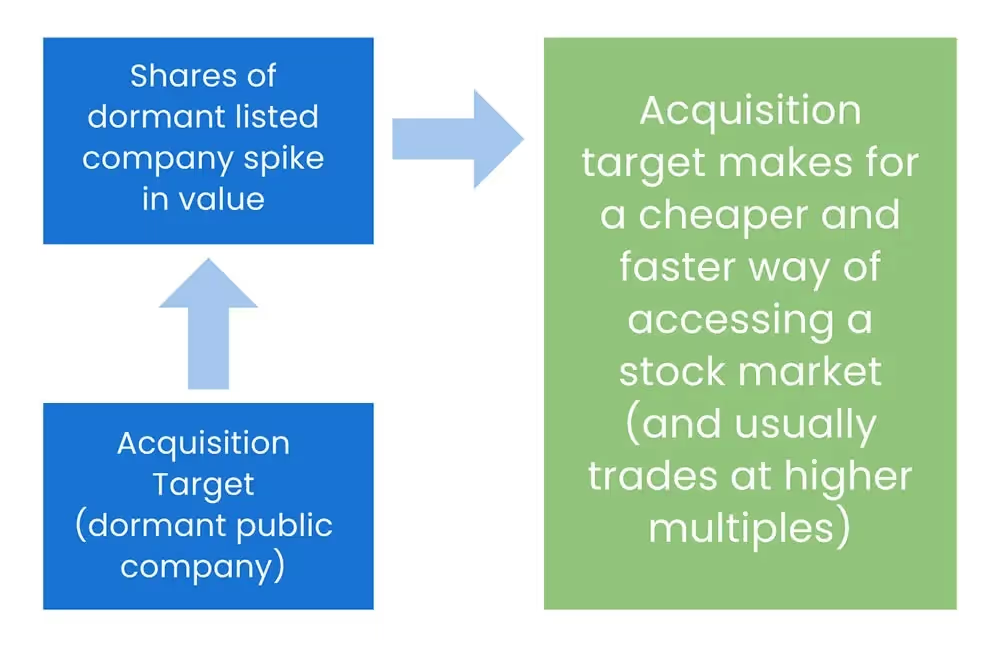

With reverse mergers on the other hand, the private company is acquiring a dormant listed company - i.e. a publicly listed company that has almost no assets to speak of, is thinly traded, and still files annual reports that for the most part, go unread by almost anybody. When the reverse merger occurs, the shares of these thinly traded companies that haven’t received any capital in years spike in value.

This last point, about what a reverse merger does to the price of a stock, is important to understand. It underlines why there was such a crackdown on reverse mergers by the SEC at the beginning of the last decade.

The low cost of the thinly-traded dormant listed companies being acquired in the reverse merger makes them liable for ‘pump an dump schemes’ (the practice of artifically ‘pumping up’ the price of stocks and then selling them for the inflated price to make extraordinary profit).

Advantages of Reverse Mergers

As mentioned at the outset, despite attracting negative publicity over a decade ago, a reverse merger can be a legitimate way of publicly listing a company.

Benefits and advantages of reverse mergers include:

1. Cheaper access to stock market

The original motivation for a reverse merger and still the strongest reason.The reverse merger offers a cheaper and faster way of accessing a stock market - no investor roadshows or looking for an IPO underwriter; simply acquire an under traded (and hopefully, by extension, undervalued) company and hey presto - you’ve got a stock market-listed company.

2. Ownership of a public company

If the complexity of regulatory and compliance requirements isn’t too much of a burden, there are significant benefits to holding a public company. Aside from the ability to access liquidity faster (in theory), it should also raise the profile of the company, increase its ability to make other acquisitions (by using its shares as consideration), and the fact that public companies usually trade at higher multiples than their private counterparts.

Disadvantages of Reverse Mergers

Pump and dump scheme are just one of the disadvantages typically associated with reverse mergers.

The disadvantages of reverse mergers include:

1. Lack of transparency

There is no getting around due diligence. It has to be done, regardless of the kind of transaction. With a reverse merger, investors in the public company are effectively being asked to conduct due diligence into the acquirer - a private company. This is possible, but far less easy than with a public company.

2. Share price inefficiencies

The lack of transparency fees into the stock price. How are investors supposed to value a company now owned by a company they usually have no information on? Is the stock underpriced or overpriced? At least with transparency, good investors have enough access to make informed decisions on a price.

3. Management inexperience

The requirements for management in a public company are far more demanding - at least from a regulatory and compliance standpoint - than in a private company. Many private company managers simply aren’t experienced in these issues, and as a result, the reverse merger is dogged with compliance issues.

4. A public listing is not a guarantee of access to capital

This is the most important point of all. The idea of anybody involved in a reverse merger is that they’ll have instant access to the liquidity afforded to most companies on the stock market. But there is zero guarantee of this - particularly when acquiring a company that was virtually untraded before the reverse merger.

Reverse Merger Example

It is a little known fact that the inflection point for Ted Turner’s empire came when his billboard advertising company, Turner Advertising, raised the cash to acquire a relatively cheap and under traded television company, the RiceBroadcasting Company in 1970.

By acquiring the television company, Turner not only generated good synergies between his advertising company and thetelevision broadcaster, but was also able to find a much larger audience for his corporate vision. That vision later yielded TNN, TBS, and CNN.

Conclusion

Although reverse mergers have taken a back seat to SPACs over the last half decade, they still offer an effective means of publicly listing a company if the right acquisition target can be found.

If you’re interested in effective M&A strategies, take some time to listen to the M&A Science podcast, where transactions experts cast a critical eye over reverse mergers and every other corner of M&A transactions.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)