Capital Structure: Importance, Examples, & Optimal Structure (2023)

Outside of issues around off-balance sheet transactions, capital structure may be the most controversial aspect of a company’s balance sheet.

Depending on which investor you speak to, it can be considered extremely important (Michael Milken) or of no importance at all (Warren Buffet).

As always, a firm understanding is the best way to decide on its importance.

DealRoom helps companies manage and optimize M&A processes and this is our guide to capital structure.

What is Capital Structure?

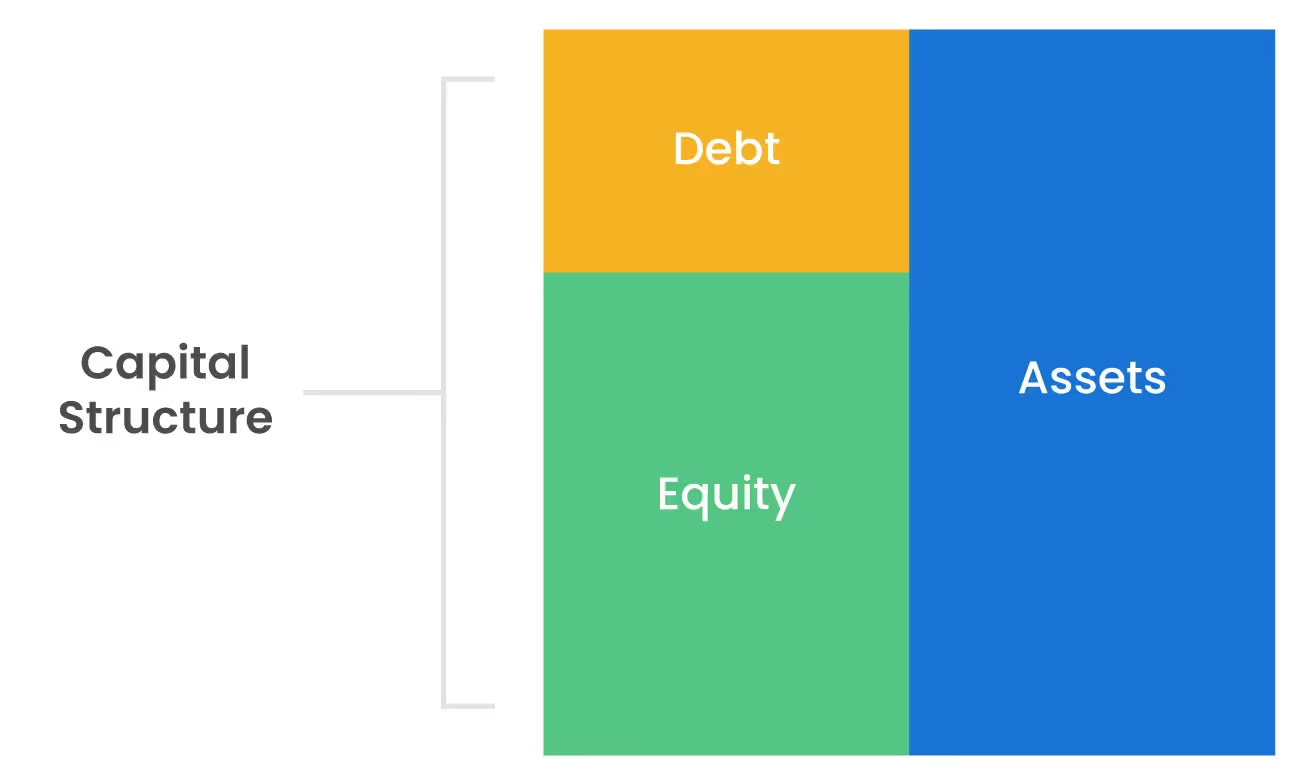

Capital structure refers to the combination of debt and equity that is used to finance a company’s assets. Thus, in the balance sheet equation:

Assets = Liabilities + Shareholder Equity

The right-hand side of the equation refers to the capital structure. But as this article will show, the composition of this simple equation can change radically from company to company.

Understanding Capital Structure

To understand capital structure, it first pays to understand the three components of the balance sheet equation; assets, liabilities, and shareholder equity.

Each is explained below:

Assets

Any resource owned by a company, which can be used to produce positive economic value. Assets are typically divided into short-term assets (e.g. inventories), and long-term or fixed asset (e.g., buildings and machinery).

Liabilities

The future sacrificing of economic benefits that a company is committed to making as a result of previous transactions. As with assets, liabilities can be divided into short-term liabilities (e.g., accounts payable) or long-term liabilities (e.g., term loans).

Shareholder equity

The ownership interest in the company’s assets by its shareholders. Unlike liabilities, shareholder equity does not need to be repaid. More on the differences between the two can be found in this DealRoom article.

With this understanding, the question then becomes:

What determines a firm’s capital structure?

The first place to answer this question is the value of the assets. This makes intuitive sense: The higher the value of the assets required for a business to function, the higher the value of the debt and equity used to fund these assets.

As a general rule, when assets cost more, it’s more likely that external funds (debt) will be introduced to pay for them.

An example of this can be seen with infrastructure, telecoms, and utilities companies.

The massive one-off capital costs that are required to bring their projects to reality often require loans running into hundreds of millions of dollars. Clearly, this impacts the liabilities component of the company’s capital structure.

At the other end of the spectrum, companies with little debt tend to be from areas such as services and distribution.

Why Companies Prefer Debt and Others Equity

Debt is the cheapest form of funding, significantly cheaper than equity.

This in itself explains why even companies that appear not to require funding still issue corporate bonds.

The order of funding, from cheapest to most expensive is as follows:

- Creditors with a fixed charge.

- Creditors with a floating charge.

- Unsecured creditors.

- Preference shareholders.

- Common shareholders.

Debt can generally also provide a tax shield, making it particularly attractive to those companies with high tax liabilities. The drawback, of course, is that debt needs to be repaid.

Equity doesn’t.

Equity may also be faster to raise than debt, which is important for companies looking for quick access to capital.

The famous Pecking Order Theory shines some light on this relationship.

It states that, all being equal, a company will fund itself from internal funds (i.e., retained earnings). Assuming these are depleted, the company will then seek to fund itself through debt.

Only once the debt option has been exhausted, will the company seek to fund itself using equity.

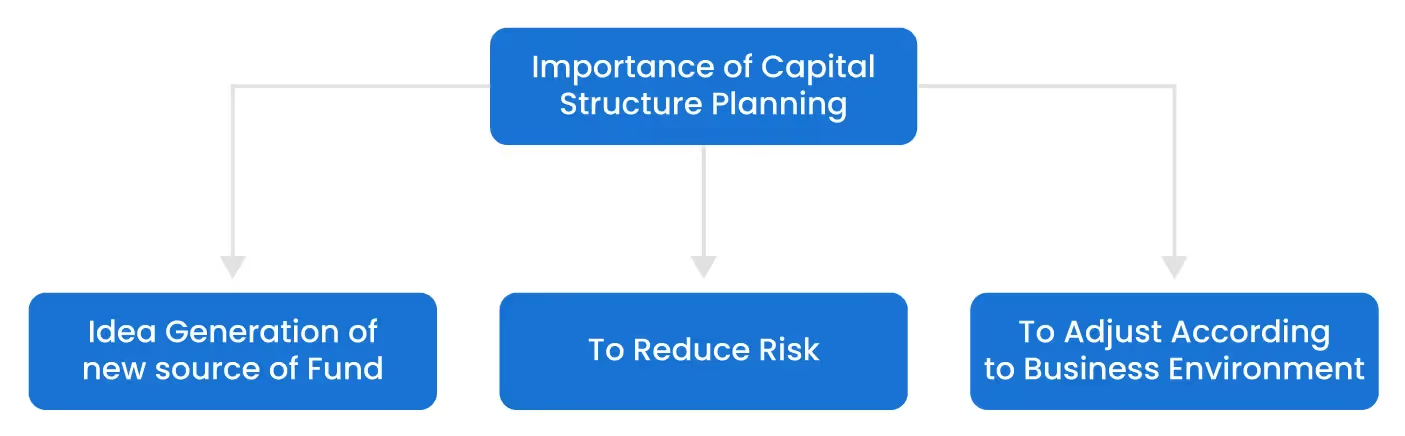

Which factors does a company’s capital structure influence?

The two most obvious areas that capital structure influences are: A company’s ability to raise new debt, and company valuation.

Raising new debt

Too much debt in the capital structure, and new creditors may justifiably be unwilling to provide more. This makes intuitive sense given the seniority of mature debt over new debt.

Company valuation

Although Modligiani and Miller would disagree, most finance academics and practitioners agree that capital structure affects valuation, with an optimal level being possible (see below).

Recapitalization

When companies wish to change their capital structure, the process they undertake is known as recapitalization.

Recapitalization is used to stablize a company’s capital structure, typically meaning that the share of debt in the capital mix is reduced.

However, this could also involve removing preferred shares from the capital mix and replacing them with forms of debt, thereby removing the obligation to pay dividends to those preferred shareholders.

Typical reasons for considering a recapitalization include:

- As defense against hostile takeovers

- Falls in the company share price

- As a tax shield (by using more debt)

- Bankruptcy (i.e., where debt cannot be repaid)

The Determinants of Capital Structure

Although there are multiple determinants of capital structure, the most common are the following:

Company size

As mentioned, larger companies tend to have larger portions of debt. There are several reasons for this, but they include larger asset bases as well as easier and cheaper access to debt than smaller companies.

Company industry

The industry that a company operates in will dictate to a great extent the level of debt that they access. Investors use debt ratios to compare companies’ debt levels in the same industry before making the investment decision.

Asset tangibility

Companies with large asset requirements tend to have larger debt loads. Another reason for these companies to have more debt is that their capital stock can be used as collateral against the debt.

Growth opportunities

All things being equal, a company will be more willing to take on debt when it is growing quickly, and investors will be more willing to provide the debt, relatively safe in the knowledge that the funds are lower risk.

Tax rates

When tax rates are high, the incentive to use more debt to offset the tax liability rises. A 2016 paper in the Journal of Financial Economics found that countries with higher levels of corporate tax also have companies with higher levels of debt.

Existing investors

Existing investors, who often include early-stage seed or venture capital investors, will determine to a great extent how the capital structure of a company will evolve over time.

Capital market conditions

Perhaps the biggest condition of all for capital structure considerations are the prevailing conditions in capital markets; when debt is cheap, it becomes attractive. When interest rates rise, as is now the case, this paradigm reverses.

Optimal capital structure

There optimal capital structure for each company is the mix of debt and equity which maximizes that company’s value, and minimizes its cost of capital.

There is a trade off between debt and equity that the optimal capital structure seeks to address: Too much equity and a company is missing out on the tax-shielding benefits and lower costs of debt; too much debt, and the financial risk begins to rise, pushing down the company’s ability to raise new funds.

The cost of capital, as measured by the Weighted Average Cost of Capital (WACC) is the most important consideration here.

Financial theory tells us that the lower this cost for a company, the higher the company value (as all company investments are discounted by this value or ‘hurdle rate’). This enables companies to find the marginal benefits and costs of debt and equity.

The equation looks as follows:

Where:

E is total equity

D is total debt

RE is the cost of equity

RD is the cost of debt

T is the corporate tax rate

It’s important to note at this point that there are limitations to the optimal capital structure.

Cash flows are constantly changing, the nature of floating rate debt means debt piles can change quickly, and finding a company’s cost of equity is an imprecise science.

For this reason, financial analysts usually suggest a range which is acceptable, rather than an absolute number. This is why investors will often use the debt to equity ratio as an information proxy.

Importance of optimal capital structure

Most financial theory is important in theory and less important in practice. In optimal capital structure, the opposite may be said: It’s important in practice but less important in theory.

Let’s explain what we mean by this:

There is no doubt that optimal capital structure should be a consideration for CFOs and investors.

In practice, a company cannot have too much debt.

This is borne out by the thousands of bankruptcies that happen every year - even to previously large and successful companies. Again, there are also benefits to bringing debt onto a balance sheet, as outlined above. So companies do need to find a balance.

On the other hand, the theory around optimal capital structure is far less applicable to real-life situations than most financial theory.

Theories such as the M&M Theory of Capital Structure or Proposition 1 are not practical for companies operating in the real world. Almost all companies at some stage face a combination of taxes, agency costs, bankruptcy costs, and asymmetrical information, underlining the impracticality of these theories.

Capital Structure in M&A with Example

Capital structure is an extremely important consideration in M&A transactions where debt is being used to fund the transaction.

Recall from above that bringing on debt increases financial risk, even if it can be a cheaper option than equity in the short run.

There are several examples from over the years of companies that went on M&A buying sprees, before their share price (i.e. their equity value) fell, leaving them with unsustainable capital structures.

Plenty of examples of companies that fall into this category can be found in oil and gas, where prices collapsed at the beginning of the Covid-19 pandemic.

In November 2020, Natural gas producer Gulfport Energy Corp. filed for bankruptcy, as it became clear that it could no longer fulfill its nearly $3 billion debt obligations. Nearly all of these obligations were the results of debt used to fund M&A acquisitions over the previous five years.

The example case of Gulfport Energy Corp, is also interesting because its shows how public companies are particularly vulnerable to dramatic changes in capital structure (once more underlining the lack of practical application of the optimal capital structure). When its share priced dipped during the recession, so did its equity.

This pushed up the debt share of the capital structure, leading to a vicious cycle the company never recovered from.

Ending Words

When considering capital structure, the byword is ‘prudence’.

Companies should consider debt as part of their growth strategy but should proceed with caution.

A good way to think about the optimal capital structure for your company is that the optimal level of debt is actually a limit, not a target (as many CFOs apparently believe).

Follow these maxims, and your company will maximize its chances of avoiding the fate of Gulfport Energy and others.

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

.png)

.png)

.png)

.svg)

.svg)

.avif)