In M&A, most buyers claim to be strategic to some extent. It’s far easier to sell the benefits of a deal to the employees of a recently acquired company if they believe they’re part of a strategic vision rather than just pawns in a financial transaction. But there is a clear distinction to be drawn when talking of strategic transactions. This is the DealRoom guide to strategic buyers.

What is a Strategic Buyer?

A strategic buyer is a company or investor that seeks to acquire companies or assets, whose acquisition will add synergistic value to their existing portfolio. It is often claimed that strategic buyers are in the same industry as the target companies, but this isn’t necessarily true.

A food retailer could acquire a trucking company for its distribution or a farm to supply meats, grains, and fruits. In both cases, the target company would be a strategic acquisition, but not in the same industry.

Characteristics of a Strategic Buyer

Strategic buyers in the same industry will differ, essentially depending on where they see the industry’s future value being generated. The most common characteristics of strategic buyers are as follows:

Industry Knowledge

The strategic buyer should know about an industry, its value chain, and where industry dynamics are headed.

Long-Term Strategic Vision

The industry dynamics will enable the strategic buyer to gain a long-term strategic vision for his or her company, of which organic and inorganic growth should be both components.

Looking for Synergy Potential

The strategic buyer is looking for synergy potential in an acquisition - not just a financial return.

Money is not the primary motivator: The strategic buyer is ultimately looking for financial gains, but money is a secondary motive, at least in the short-term, to strategic goals.

Types of Strategic Buyers

Broadly speaking, there are three types of strategic buyers: horizontal, vertical, and conglomerate.

Below, each type is examined in more detail:

- Horizontal: A strategic buyer focused on horizontal acquisitions seeks to achieve value by acquiring companies at the same point of the value chain, in the same industry. Often the companies are competing in some of the same geographies or for the same clients. An example would be a distributor acquiring a distributor.

- Vertical: A vertical strategic buyer focused on vertical acquisitions seeks to achieve value by acquiring companies at different points of the value chain, not necessarily in the same industry. This could be a computer manufacturer that acquires a chipmaker (same industry) or a chip maker that acquires a lithium mine (different industries).

- Conglomerate: A conglomerate buyer often takes a part-financial and part-strategic perspective. They’re looking for value in size and synergies with existing portfolio companies, usually gained from cross-selling to existing clients. Examples of conglomerates include Nestlé, Proctor and Gamble, and the Mars Company.

Advantages of Strategic Buyers

Strategic buyers’ principle advantage over non-strategic buyers is insider knowledge.

Through constant discussion with internal and external stakeholders in an industry, strategic buyers usually know who their targets are well in advance of making bids for them.

They will know what the strengths and weaknesses of each company in the industry are, who their biggest clients are, and possibly even details about those companies’ strategies. If applied properly, this information can be converted into value.

Example of a Strategic Buyer Transaction

The acquisition of YouTube in 2006 for $1.6 billion by Google provides an excellent example of a strategic transaction.

YouTube was the world’s fastest-growing online video community, and gave Google access to video advertising - an area in which it was weak. These days, YouTube’s sign-in is synched with that of Google, ensuring that the company can manage a user’s complete online experience.

It’s also worth pointing out that, as a company that was making little or no money at the time of the acquisition, YouTube was less likely to be considered a financial acquisition.

Challenges of Strategic Buyers

The challenges for strategic buyers are similar to those faced by most acquirers. They include:

Finding Suitable Acquisitions

Even buyers that know their industries well can find it difficult to identify suitable acquisitions. The challenge then becomes: ‘do we acquire something which isn’t the acquisition we want and try to make it work, or do we wait and risk a different set of market circumstances?’

Generating Value (part 1: synergies)

Synergies can be nebulous - great on paper but difficult to achieve in practice. Sales synergies in particular - the idea that new products and services can be sold to the same customers - often turn out to be far more challenging than they appeared before the deal was struck.

Generating Value (part 2: culture)

Culture is a massive component of strategy, so it should be top of mind for strategic buyers. As many large deals in the past allude to, it’s not always easy to achieve a meeting of minds. A failure to do so will lead to overnight value destruction for the strategic buyer.

Adequate Valuations

A company can be worth different prices to two different acquirers. For example, Marvel was worth far more to Disney than it was to ExxonMobil. But how much more? A challenge for strategic buyers is not overpaying for an asset, thereby destroying value, even if the strategic fit is undeniable.

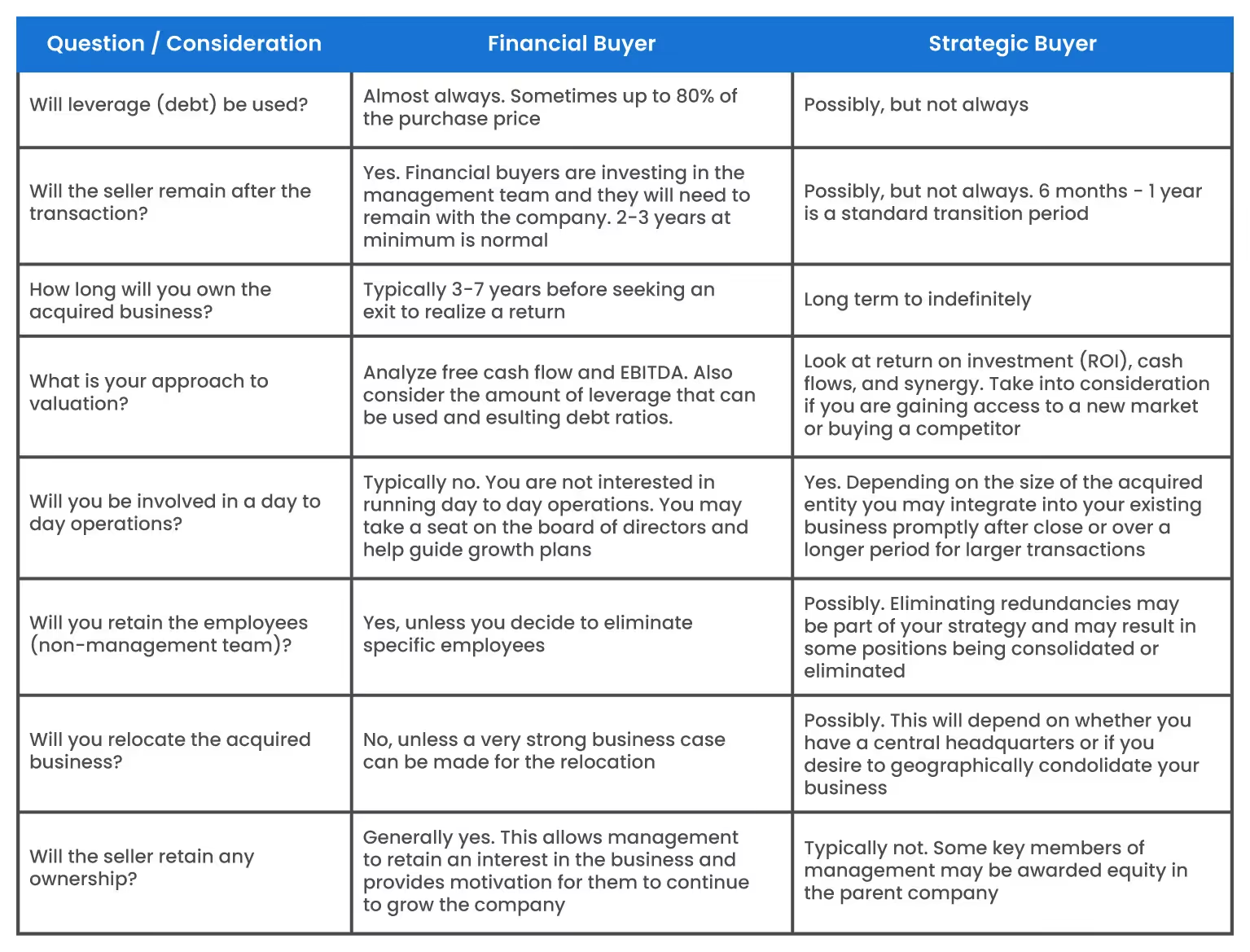

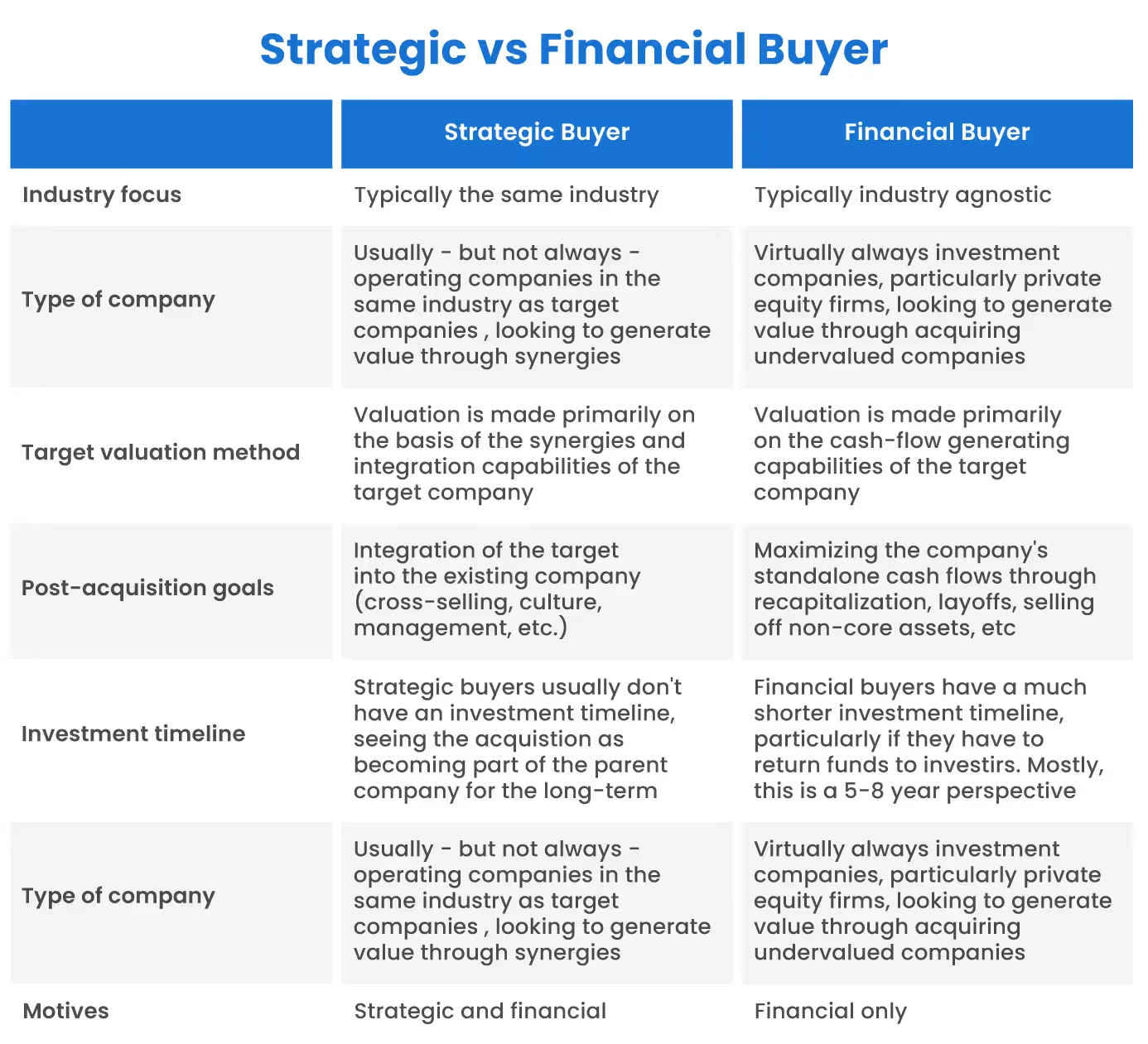

Strategic Buyers vs. Financial Buyers Comparison

There are a number of differences between strategic buyers and financial buyers.

Some of these are outlined in the table below:

Finding a Strategic Buyer

If your company is looking for a strategic buyer, the best way to find them is to reverse engineer the process.

Ask yourself:

“What is the buyer profile of someone that would be interested in my company?”

Make a list of the types of companies that fit the bill (and you shouldn’t rule out financial buyers), and look for them.

A good place to start looking for strategic buyers is Capital lQ, which provides a useful breakdown of transactions in each industry, enabling sellers to see where the strategic buyers are in their respective industries.

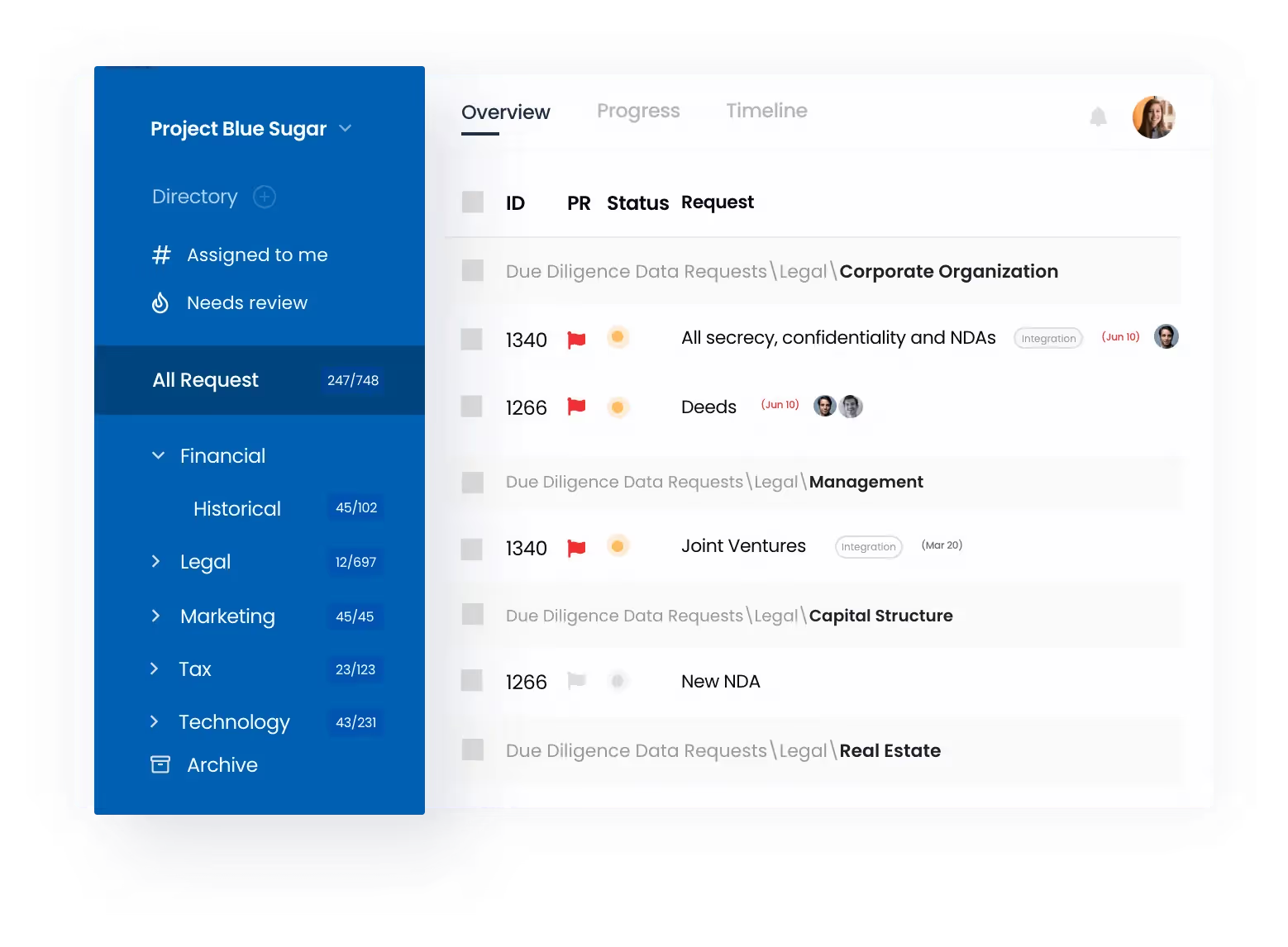

Due Diligence for Strategic Buyers

As is always the case, due diligence is of the utmost importance to strategic buyers. Arguably even more than it is for financial buyers.

This is a slightly controversial statement but there’s a logic behind it: While there’s no denying that a financial buyer certainly needs to conduct due diligence, if the investment is a standalone entity, there are certain issues - synergies and culture among them, that need virtually no attention.

This isn’t the case for strategic buyers.

DealRoom has worked with hundreds of strategic buyers over the past decade and has witnessed the great lengths that they go to in their acquisition due diligence.

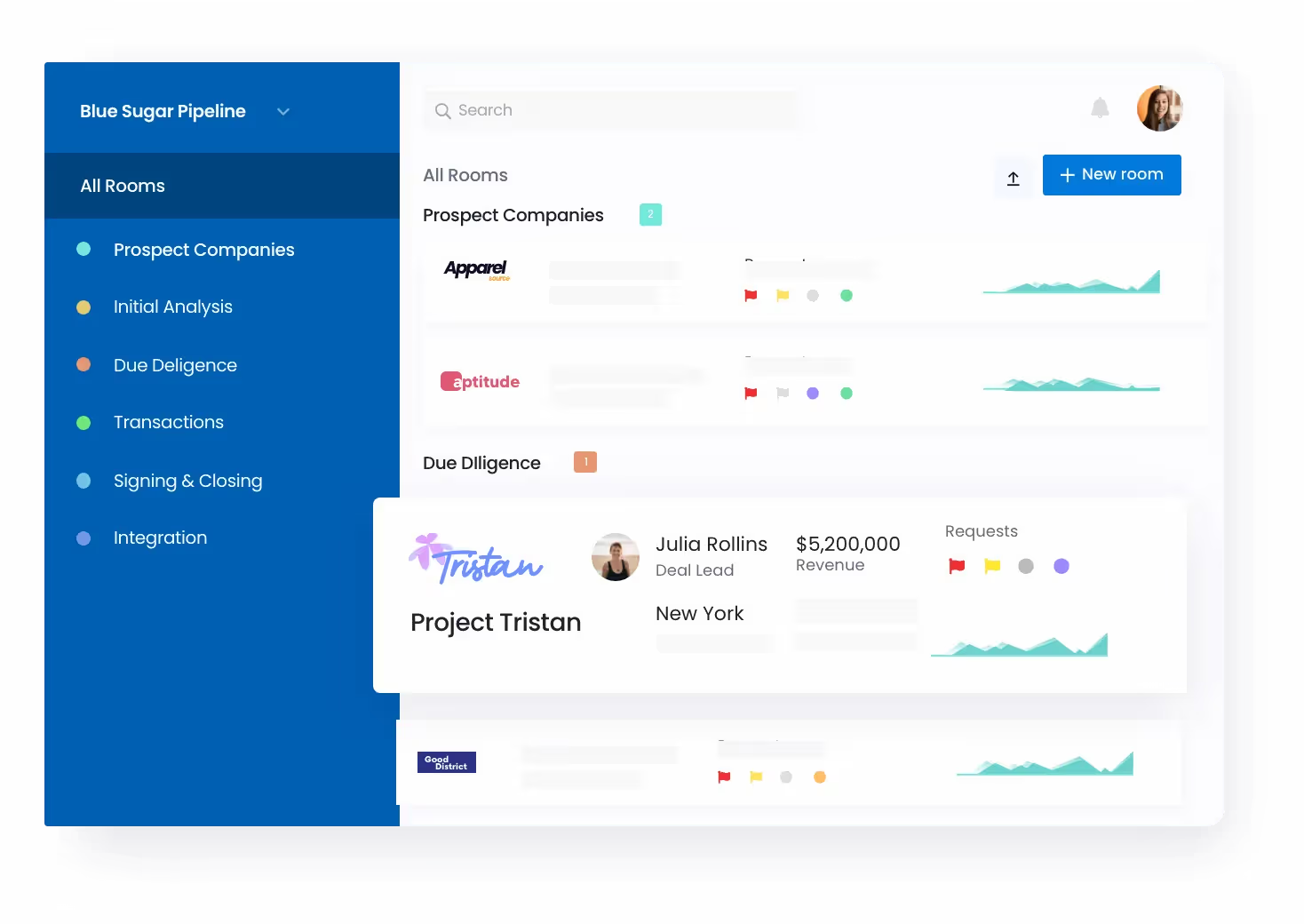

Our platform has been designed for the intricacies of this process, even enabling buyers to compare the merits of one potential target against another.

The M&A project management platform we’ve developed is efficient, streamlined, and easy to use, maximizing your chances of generating value from a strategic acquisition.

Strategies for Effective Acquisitions for Strategic Buyers

The best strategy for effective acquisitions for strategic buyers is to always be on the lookout for new companies to acquire.

While some companies treat acquisitions like an opportunistic event - something that occurs when a company is offered to them for sale - inorganic acquisitions are a proven way to generate value and should become part of the company’s value-generating strategy.

In practice, this means constantly being on the lookout for companies that fit the bill. In the same way that sales and marketing department managers are always looking to develop and capitalize on new sales deals, a company’s leadership should always be looking to develop leads for acquisitions.

Like the marketing or sales manager, gather information over time about those targets, becoming more informed when the time comes to approach them.

Keeping this information is key to effective strategic acquisitions. Use KPIs (Key Performance Indicators) to ensure that you’re identifying suitable industry targets on a regular basis. Use industry journals and conferences to become more informed about what’s out there.

Develop a database of potential targets, and record material information. Maintaining this strategy will ensure that your company has the ability to become a competent strategic buyer.

In conclusion, understanding the concept of a strategic buyer and the benefits they offer can be crucial for any business, whether looking to buy or sell.

And when it comes to managing the complex process of a business sale, DealRoom's advanced platform can be a game changer. With its powerful collaboration tools, advanced security features, and intuitive interface, DealRoom helps streamline the process and keep all parties informed and organized.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)