Compliance Due Diligence Playbook

When evaluating external growth opportunities, compliance due diligence is quickly becoming an integral part of the workstream process. Properly understand and identify the compliance risks related to the target company with our compliance due diligence playbook. Book a playbook demo to explore — schedule a call with us and we will reach out to help you get started.

- Regulatory risk made visible

Review policies, licenses, audits and enforcement history to identify compliance gaps that could derail the deal or integration. - Vendor & third-party scrutiny

Evaluate counter-party compliance (e.g., anti-corruption, sanctions, ESG) so you understand external dependencies and hidden liability. - Process & control audit

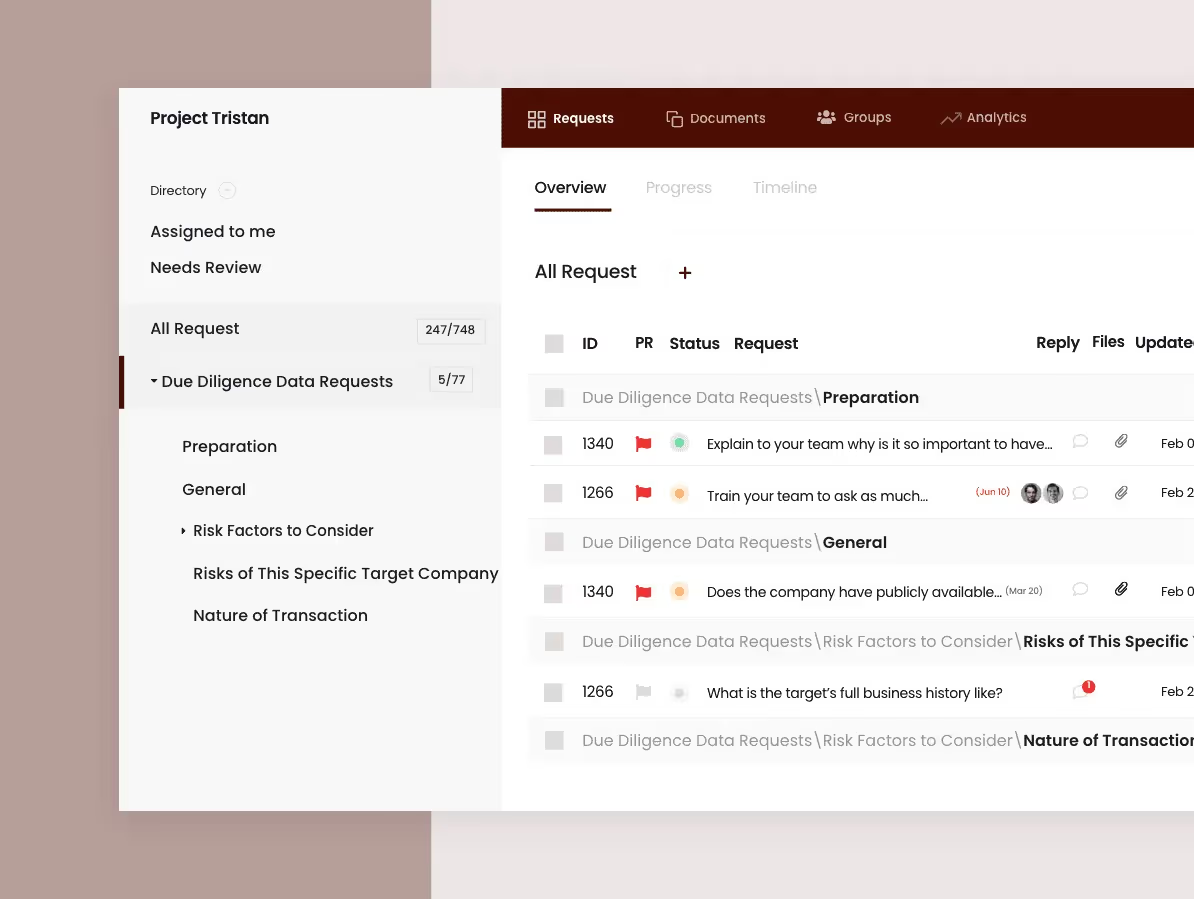

Deep-dive into internal controls, incident logs, and governance processes—ensuring the target meets the standards of your acquisition or expansion strategy. - Platform for team collaboration

Coordinate legal, compliance, procurement and integration teams in one shared workspace—tag findings, attach documentation and assign next steps effortlessly.

Complement your review with the Technology Due Diligence Checklist for systems and architecture analysis, and align your team with the M&A Communication Plan to manage internal and external messaging across stakeholders.

.png)

.png)

.png)

.svg)

.svg)

.avif)