Venture Capital Due Diligence Playbook

Be market ready with our venture capital diligence template! Know what investors will be looking for to show up at the negotiating table with an accurate valuation. Book a playbook demo to explore — schedule a call with us and we will reach out to help you get started.

- Startup deal-readiness checklist

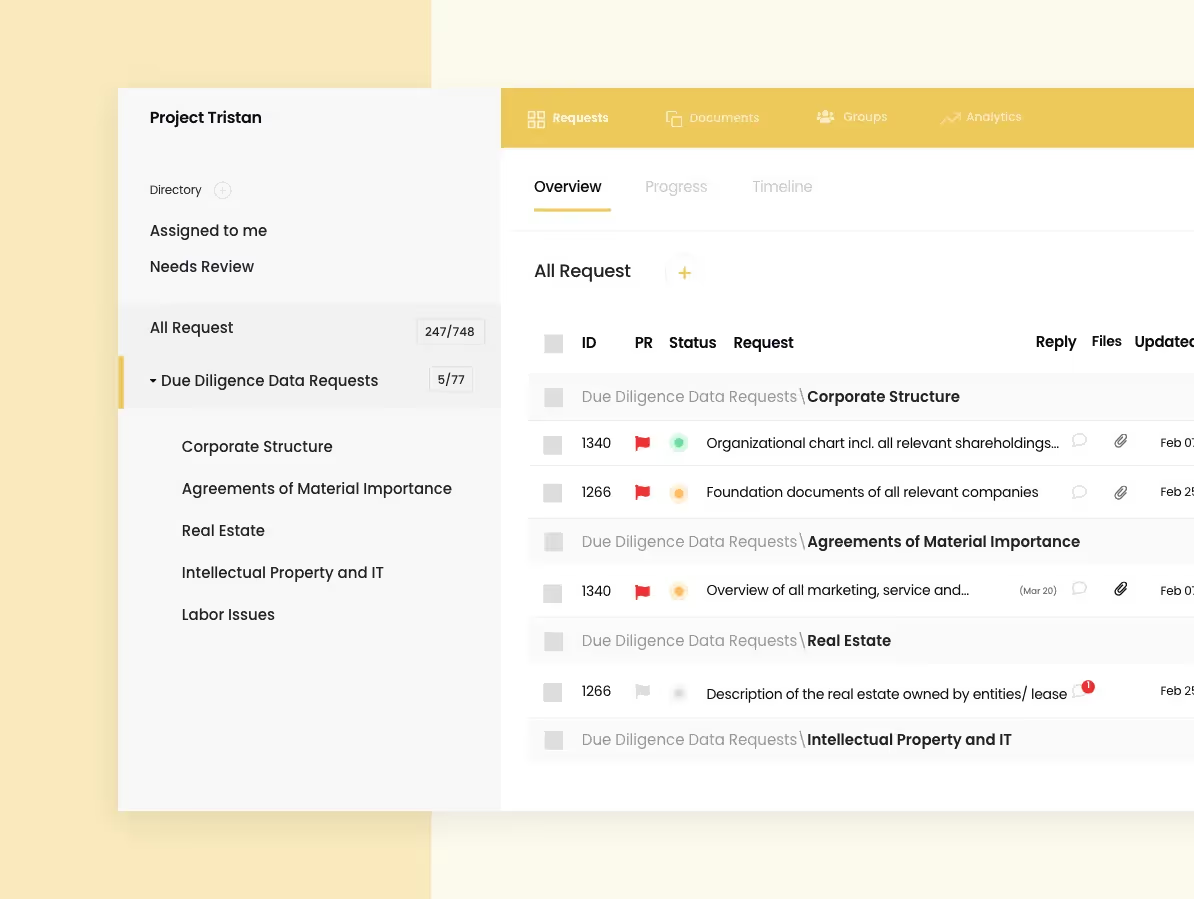

Equip your team for early-stage diligence with targeted requests covering founders, funding rounds, market traction and business model validation. - Investor-focussed documentation

Organise cap-tables, term sheets, growth metrics and governance materials so you’re prepared to surface risks and accelerate investor conversations. - Collaborative review workflow

Designate owners for each section, attach documents, enable comments—and keep your entire deal-team aligned in one unified workspace. - Audit-ready traceability

Every data point, attachment and comment is logged and linked to its checklist item—making investor reviews streamlined and transparent.

After building your proposal, move into acquisition planning with the Business Acquisition Proposal Template, or switch focus to asset-level review using the Asset Purchase Due Diligence Checklist.

.png)

.png)

.png)

.svg)

.svg)

.avif)