Due Diligence Definition (Types, Examples, & More)

People frequently ask, “what does due diligence mean?”

Due diligence is often expressed in situations involving investments, real estate, mergers and acquisitions (M&A) deals, transactions, law, as well as everyday life. However, very few people know the true meaning behind the phrase, as the definition of “do your due diligence” differs, depending on a particular use case.

This guide takes you through all you need to know about due diligence - like its meaning across different use cases, synonyms, examples, types, scenarios where you are to “do due diligence.”

The term due diligence is generally used in two senses, both of which involve taking reasonable, well-informed steps to avoid a bad outcome.

What is Due Diligence?

In everyday life, the meaning of due diligence stands for an exercise in risk mitigation, i.e. there may be many bad outcomes to be avoided through the action taken, including acting unlawfully.

In a financial setting, due diligence means an investigation or audit of a potential investment conducted by a prospective buyer. The objective is to confirm the accuracy of the seller’s information and appraise its value.These investigations are typically undertaken by investors and companies considering M&A deals.

Other situations may be buyers and sellers seeking to determine whether the other party has substantial assets to complete the purchase. It may be a legal obligation or voluntary. The breadth and magnitude of investigation varies from situation to situation. Generally, the legal terms in a contract or other purchase agreements express specifics of the transaction. These may include the length of the investigation period, items to be examined, and the expiration date.

Audit tasks are subject to various situational contingencies. They typically include auditing financial records, evaluating assets and liabilities, and assessing operations or business practices. Due diligence undertaken in mergers and acquisitions is vigorous, time consuming, and complex. Incomplete or improper background checks is actually one of the major culprits of why even the biggest M&A deals fail. Therefore, it is critical for firms to closely investigate potential investments and understand the business’s true value. A firm may otherwise waste a great deal of their valuable assets and time completing the transaction.

Due Diligence Meaning in Law

In today’s age, the meaning of due diligence in law involves taking prudent, well informed decisions, that may amount to a legal standard, to avoid a bad outcome. Legal, or law definition of due diligence was formulated 4 years after the stock market crash of 1929, with the enactment of the Securities Act of 1933. This was to induce transparency in financial markets. As a result, security brokers and dealers became liable for fully releasing data and information concerning the instruments they were selling. They are now obligated to audit companies before auctioning their securities to assure that their instruments are healthy.

Ultimately, this is to protect and reduce the risk of parties participating in the offerings.

Example of due diligence in law

- In domestic law, the exercise of due diligence by an individual or corporation may be a standard of conduct to defend an allegation of negligence in tort, or as a statutory defense, eg. to allegations of tax evasion.

What is Contingent Due Diligence in Real Estate?

Contingent due diligence means that a company or buyer has shown and confirmed interest in the seller and represents one of the several protections to a buyer when undertaking a new investment or initiating a contract.

Example of contingent due diligence

- The buyer conducting site visits and property inspections checks whether the deal will close depending on the outcome of this assessment is called contingent due diligence.

However, the final details of the decision making on moving forward are contingent on the buyer’s findings from investigation. This means that a company or individual may withdraw if they are not satisfied with their findings.

What is Due Diligence in Business?

The due diligence in business circumstances refers to organizations practicing prudence by carefully assessing associated costs and risks prior to completing transactions.

Example of due diligence in business

- In a corporate finance setting, the due diligence investigation is designed to provide a basis for reasonable investigation defense to parties (other than the issuer) who may have liability under Section 11 of the Securities Act of 1933

- Examples include purchasing new property or equipment, implementing new business information systems, or integrating with another firm.

Business audits often help surface and avert potential issues in the future. The process will also provide the basis and backup for any legal opinion the firm may be required to issue in connection with the transaction.

Organizations exercise due diligence by:

- Researching customer reviews and the seller’s reputation

- Considering the environmental impact of the due diligence transaction

- Supplementing purchases with insurances or warranties

- Evaluating price in comparison to competitors

What is Financial Due Diligence?

The meaning of financial due diligence refers to an in-depth analysis of another company’s financial records. Firms undertake financial investigation prior to entering an agreement with another entity. This ultimately helps appraise its value and calculate potential risks. Common circumstances that require financial investigation include initiating a substantial investment, merging, or acquiring a firm.

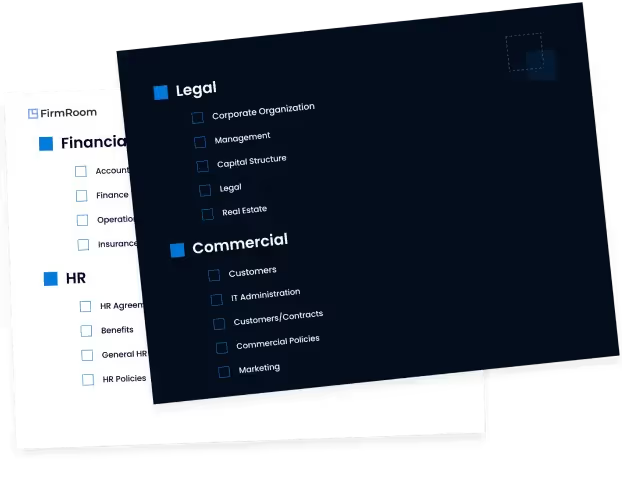

Many people ask, what are the due diligence documents that should be collected? Here’s a list of a few of the materials and documents analyzed during the financial due diligence:

- Revenue, profit, and growth trends

- Stock history and options

- Short and long-term debts

- Valuation multiples and ratios in comparison to competitors and industry benchmarks

- Balance sheets, income statements, and the statement of cash flows

The ideal way to determine the market's attitude to your company's strengths and weaknesses is to answer financial due diligence questions and analyze the documents above using a financial due diligence checklist - playbook. With financial due diligence checklists, companies can make sure no oversights come back to haunt them once the deal is final. Check out what this checklist consists of here.

What is Due Diligence for Startups?

When we talk about due diligence for startups, it's like taking a closer look before diving in. Imagine you're considering investing in a friend's new business. Before handing over your money, you'd want to know if the business has a solid plan, a good team, and a promising future. That's exactly what due diligence for startups is about. Investors carefully examine a startup's business model, finances, market potential, and the people running the show.

For example, they might check if the startup has a unique product or service, if there's demand for it, and if the team has the skills to make it happen. This helps investors decide if the startup is worth betting on.

What is Due Diligence for Stocks?

When it comes to stocks, due diligence means doing your homework before buying shares of a company. Think of it as investigating before investing. Let's say you're thinking about buying stock in a tech company. Before you do, you'd want to know if the company is making money, if its products are popular, and if its management team is strong. That's what due diligence for stocks is all about. Investors analyze things like the company's financial reports, its competitors, and industry trends.

For instance, they might look at how much money the company is making, if it's growing faster than its competitors, and if it's staying ahead of technological changes. Doing this research and coming up with their own due diligence report helps investors make smart decisions about which stocks to buy.

What Happens when Due Diligence Expires?

Often times, the Letter of Intent (LOI) includes a Due Diligence Clause. This often defines the conduct and rights during the investigation, the parties involved, and what happens after commercial due diligence.

However, the exhaustive and intensive nature of an audit may cause issues for firms. Some cannot assemble all pertinent information while abiding by a definitive deadline. If this happens, the buyer can only use the information uncovered during investigation to decide whether to close the deal.

In some cases, if the buyer feels that their investigation was inadequate, they may request an extension from the seller. Extensions may or may not be granted. In turn, this could even frustrate the seller.

The biggest takeaway here is that efficiency, productivity, and effectiveness are critical.

Areas of Due Diligence

Due diligence is typically undertaken in business due to two main types of transactions. This includes the sale or purchase of goods and services or when merging with or acquiring another corporate entity. Within each transaction, it is generally conducted in a number of areas.

The goal of investigation in general transactions is to substantiate whether the purchase is a sound decision. Items examined may include:

- Warranties

- Inventories

- Customer reviews of the seller

Enhanced due diligence in mergers and acquisitions is considerably more extensive.

It audits areas such as:

- Financial records

- Business plans and practices

- The target company’s customer base

- Products or services in their pipeline

- Human resources statistics

- Sustainability and environmental impact

One high-vitality area that many businesses fail to accomplish in its entirety or even at all is a self-assessment. In a self-assessment, organizations ask themselves what their corporate needs are and what they hope to glean from the transaction. When executed properly, a self-assessment will commence integration down the right path.

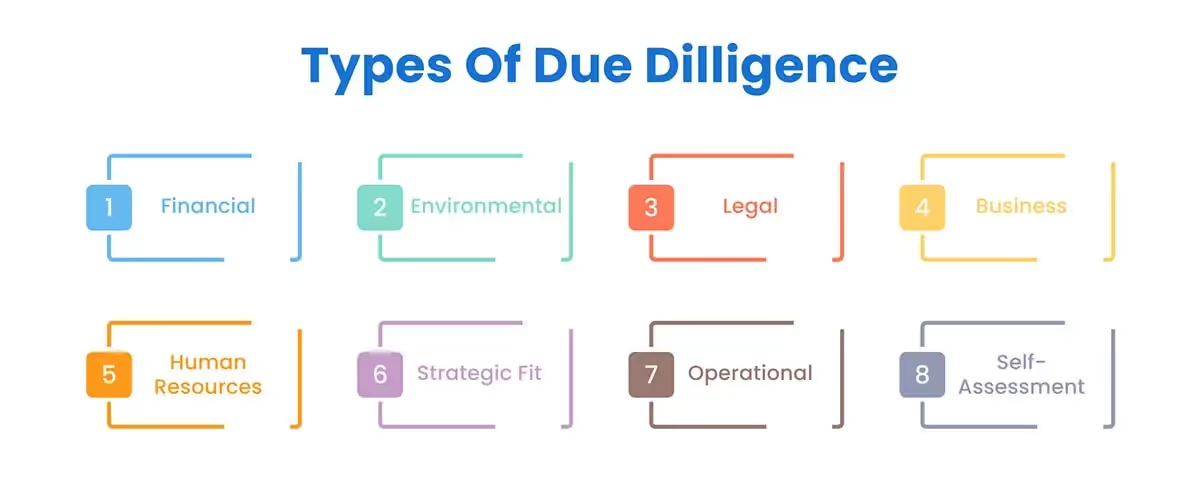

Types of Due Diligence

Audits should be all-encompassing, which makes it difficult to even know where to begin or what to look at. Detailed are 8 types of investigations that should be undertaken to ensure comprehensive coverage of risks and pressure points.

Financial — Financial due diligence is one of the most critical and renowned forms. In financial audit, firms investigate the accuracy of the financial records in the Confidentiality Information Memorandum (CIM). The target is gaining an understanding of overall financial performance and stability and detecting any other underlying issues. Items audited may include:

- Financial statements

- The company’s forecasts and projections

- Inventory schedules.

Legal — Legal due diligence helps determine whether the target company is legally subservient or embroiled in issues. Items assessed include:

- Contracts

- Corporate documents

- Board meeting minutes

- Compliance doctrine

Human Resources — Human Resources (HR) due diligence focuses on the company’s most vital asset: their employees. HR investigation aims to understand:

- The company's organizational structure

- Compensation and benefits

- Vacancies

- Union contracts (if applicable)

- Any types of harassment disputes or wrongful terminations

Operational — Operational due diligence involves an examination of all the elements of a company’s operations. The objective is to evaluate the condition of technology, assets, and facilities and unearth any hidden risks or liabilities.

Environmental — Environmental due diligence verifies that the company’s processes, equipment, and facilities are in compliance with environmental regulations. The purpose is to negate the possibility of penalties down the line. These may span from small fines to more severe penalties such as plant closures.

Customer - Customer Due Diligence (CDD), sometimes referred to as Know Your Customer (KYC) is the process in which a bank or financial institution conducts an audit or analysis of a customer or organization, with the aim of assessing the potential risks that they pose to the company.

At its core, CDD is banks being compliant with anti- money launder regulations, but the process also allows them to avoid money used to finance terrorism, stop criminals exploiting the financial system, and to distance itself from corrupt practices in general.

Business — Business due diligence identifies who the company’s customers are and pinpoints its industry. It helps forecast the impact and associated risks that the transaction may pose on the acquiring firm’s current customers.

Strategic Fit — Strategic fit due diligence assesses whether the target company will be suitable with respect to their goals and objectives. This requires the buyer to assess:

- Potential synergies

- Benefits of the transaction

- How well the two entities would merge together

Self-Assessment — Self-assessment due diligence is often overlooked by firms. However, it is one of the most important. It should be enacted at the onset of merely considering an investment or integration.

It is an inward-looking approach where firms collectively ask themselves, “what do we want or need from this transaction?” Essentially, a self-assessment is like writing a grocery list before heading to the store.

Utilize Due Diligence Templates/Checklists

DealRoom's Playbooks help team efficiently manage due diligence from the start. Diligence incorporates many moving parts and it is critical to a deal's success.

Our library of pre-built ready to use playbooks enables teams to thoroughly and effectively collect necessary diligence information.

Click here to access the templates gallery

Due Diligence Examples

Listed are several diligence examples of usage:

- Conducting thorough inspections on a property before buying it in order to make sure that it is a good investment.

- An underwriter auditing an issuer’s business and operations prior to selling it.

- A business exhaustively examining another to determine whether it is a sound investment prior to initiating a merger.

How to use Due Diligence in a Sentence (Examples)?

Listed below are several examples using due diligence in a sentence:

- The acquiring firm exercised due diligence on the target company prior to finalizing the contract.

- After completing due diligence, the firm discovered that they initially greatly overvalued the investment and therefore terminated the contract.

- Due to the size and complexity of the target company, due diligence lasted longer than the buyout group originally intend

Due Diligence Synonyms

Analysis, assessment, audit, examination, review, survey, verification, investigation.

Due Diligence Fees and Costs

Firms incur due diligence costs from the time and labor of internal employees and third-party groups executing the audits. Third-party professionals hired include lawyers, consultants, and accountants. These costs are heavily contingent upon the scope and intensity of the process, and complexity of the target company. Third party due diligence teams are typically hired and paid for by both sides to complete investigation.

Cases may occur where the buyer bills the seller for their associated costs after executing and completing the transaction.

Also read : Overview of Costs in M&A and How to Reduce Them

How to Conduct Due Diligence with DealRoom

Historically, individuals and firms conduct investigations utilizing different software platforms, long email threads, and limited communication between distinctive parties. Unfortunately, these various mechanisms provoke inefficiencies and disorganization, causing miscommunications, missed deadlines, and headaches throughout an already painstaking process.

To combat this, DealRoom M&A Platform allows everyone involved in the deal to bid farewell to endless hours of managing disparate tools with a unified product for tracking all diligence requests and documents.

DealRoom Diligence helps in:

- Driving diligence efficiency

- Unify all diligence requests & documents into one intuitive tool eliminating the potential for error created by working between disparate tools.

- Cutting 25+ manual hours

- Accelerate your due diligence timelines with automated workflows and streamlined communication.

- Eliminating misalignment

- Foster collaboration between buyers and sellers with integrated communication channels and document management throughout the entire due diligence process.

To learn more click here

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)