Commercial Due Diligence: What it is & How to conduct it

Commercial Due Diligence (CDD) is the process in which a prospective buyer audits a target company’s commercial activity, long-term viability, and potential. The commercial due diligence report provides detailed insight into market demand, commercial position, revenue, and competitive dynamics. It is this report that establishes the foundation for a deal.

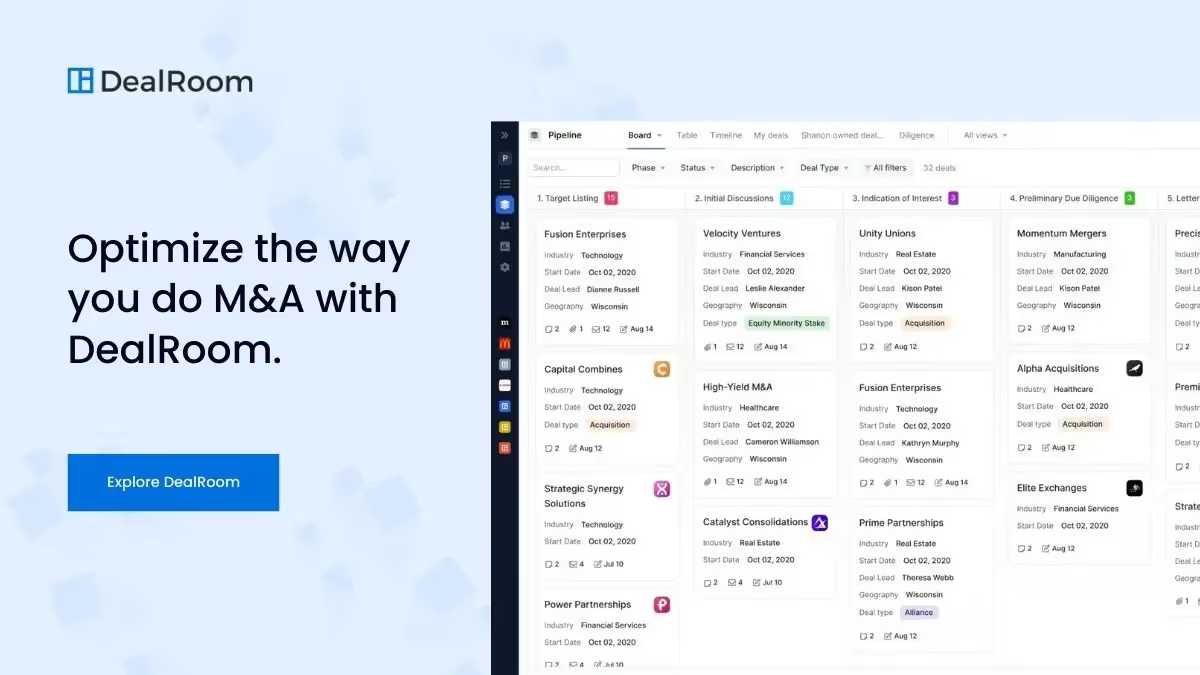

Dozens of deals are performed annually on DealRoom’s M&A Platform, many with their own commercial due diligence requirements. This article outlines the information our clients generally acquire during this process and the importance of thoroughly completing it for decision-making in M&A.

What is Commercial Due Diligence?

Commercial due diligence is the detailed evaluation process in which a buyer assesses a target company from a commercial point of view. It provides a comprehensive overview of the target company’s current market position and growth potential.

Commercial due diligence aims to provide the buying entity with an overarching view of the company based on its market positioning and future growth potential.

Types of Commercial Due Diligence

There are many different types of due diligence, all dependent on the nature of the business and the concerns of stakeholders involved in the deal. Although each type of commercial due diligence plays a unique role in the overall diligence process, it serves a distinct purpose.

Below, we highlight four of the most common:

Buyer-initiated Commercial Due Diligence

Just like it sounds, this kind of commercial due diligence is conducted by potential buyers to understand the target company holistically before proceeding with a transaction. Buyer-initiated Commercial Due Diligence provides an all-encompassing overview of the prospective target company to provide the potential buyer with all of the relevant information to proceed with the acquisition.

It should focus on business operations, financial performance, and market dynamics in order to provide the buyer with a clear understanding of the target company.

Vendor-initiated CDD

Opposite to buyer-initiated, vendor-initiated commercial due diligence is conducted by the seller of the business prior to the sale. Conducting due diligence on your own business on the sell-side of the transaction allows companies to prepare for the potential sale and anticipate any questions or issues that may arise when the buyer conducts their own due diligence.

If completed early enough, vendor-initiated commercial due diligence allows the selling company to address any red flags or fix organizational risks, confront buyer concerns proactively, and potentially increase the value of the business.

Red Flag CDD

Red Flag commercial due diligence is the expedited, high-level assessment of a target company performed by the buyer. This identifies any “red flags” that would pose significant risks to the deal's execution prior to an in-depth analysis of the target company, saving resources and mitigating risks.

This kind of commercial due diligence primarily focuses on the segments of a target company with the highest risk, such as legal issues, financial discrepancies, or substantial market risk indicators.

Red Flag commercial due diligence serves as a general basis, uncovering potential risks and liabilities at a high level and assisting a buyer in deciding whether to proceed with a deal.

Top-up CDD

Top-up commercial due diligence is applied in deals to supplement the existing due diligence process when additional information in specific areas is needed. This type of commercial due diligence ensures that all risks are flagged to be evaluated at a later stage of the deal.

Commercial Due Diligence Process

The due diligence process provides an understanding of potential liabilities and risks to the business and gives the acquirer an overall sense of the current state and performance of the target business.

That being said, commercial due diligence is often a long and complex process requiring exhaustive, in-depth research into a potential target.

.avif)

The due diligence process involved in conducting a thorough and informative report includes the following stages:

1. Liaising Process

Commercial Due Diligence kicks off with the liaising process. This process starts when a third-party firm is introduced. Members of this external firm conduct in-depth diligence reports on behalf of the prospective buyer or private equity firm.The addition of a third-party firm decreases bias or potential influence by both parties in the transaction and provides a reliable source of information to make investment decisions upon.

2. Preparation of a Genuine Report

The third-party executes the commercial due diligence report, which provides an analysis of the organization’s potential and current market value. Once finalized, this report is compiled and delivered to the prospective buyer. Compiling a report of the core functionality of the target company’s business model while outlining all risks, business operations, and financial performance in a digestible way assists teams in making educated, risk-aware investment decisions.When gathering information, it is important to take note of further diligence items and questions for the selling party. Initial diligence findings will provide a better understanding of the business aspects of which diligence should be expanded upon.

3. Due Diligence Report Review

In the final step of commercial due diligence, the prospective buyer reviews and assesses the third party’s findings. The investigations and respective reports of due diligence are all-encompassing in order to hit every division of the target company.Due diligence unearths revenue margins, business plans or performance, market positioning, any real estate, and overall success of operations post-merger.The information within the reports forms a perspective and overall understanding of the business value, the sustainability of financials, forward growth projections, revenue margins, and more. The buying party reviews the diligence reports, analyzes, and synthesizes the findings to see if the initial synergy thesis is still valid.

What to Include in a Commercial Due Diligence Report

A commercial due diligence report analyzes the comprehensive findings uncovered throughout the due diligence process. It should be thought of as a highly detailed situational analysis of the company, critically examining the target company’s activities.

For the buyer, the commercial due diligence report acts as an objective version of the target company’s own business plan. Many pieces of the commercial diligence report are essential to any deal, while the importance of others may vary situationally.

Listed below are the core items most commercial due diligence processes require:

Company Overview

The company overview is a general explanation of the target company’s history, mission statement, and critical operations. This part of the report generally includes the company's name, legal structure, value proposition, revenue model, and go-to-market strategy.

Management Structure and Employee Agreements

This information relates to the company's owner, including management and other employees. This part of the report details how the company is contractually obligated to its customers. Ensuring that the company can withstand organizational change and market downturns while still maintaining revenue growth is important when evaluating whether a deal should go forward.

Legal Matters

This includes items such as proper legal documentation, outstanding contracts, litigation, and certificates of occupancy. A lawyer within a third-party firm usually handles all statutory matters and helps ensure proper compliance. These lawyers can also lend legal advice regarding the company following jurisdictional laws.

Products and Services

This encompasses all data and history on the company’s different products sold and completed transactions. This includes an in-depth overview of the product attributes, a description of services, regulatory constraints, pricing models, supply chain operations, and more.

Financial Model

Understanding the historical financials and growth strategy of the target company is essential to commercial due diligence. This includes the historical and future financial performance, previous acquisition history, and sustainability of growth, as well as potential synergies both financially and operationally.

Marketing Analysis

This includes information about the company’s marketing strategy, customer base, and competitive advantages. Other items often included in this section of the report - go-to-market strategy, plans for future growth and customer acquisition strategy.

Competition

This section of the report details the target's current or potential competitors in the market and how they compare to these competitors’ market share.

Commercial Due Diligence Checklist

The extent of commercial due diligence to be undertaken largely depends on how many products and services, markets, and customers that the company has.

The following represents a broad overview of what a commercial due diligence checklist should include:

1. Market size for the company (TAM, SAM, and SOM).

- What are the key drivers in the market?

- How is the market likely to grow or change in the future?

- Is the market online or in-person? B2C or B2B?

- What is the sustainability of current industry margins?

2. Competitive Landscape

- Who are the main competitors?

- What advantages/disadvantages do they have relative to the target?

- How do their products/services differ?

- What are the barriers to entry for new competitors?

3. Review of the company’s business plan

- Does it provide a clear path for revenue growth?

- Is the plan for future business realistic and attainable?

- How does the current business generate revenue?

- How does the investment thesis relate to the current business operations?

- How does the business plan fit with the buyer’s own strategic objectives?

- What is the go-to-market strategy?

4. Customers

- What are the psychographic and demographic characteristics of the company’s customers?

- What is the average lifetime value of a customer?

- What is the customer retention rate?

- What is the company’s customer churn level?

- When speaking directly with customers, what are they looking for in the market?

5. Sales and Marketing

- How much of the annual budget is spent on sales and marketing?

- How could the sales and marketing be improved?

- What is the average customer acquisition cost? Is it higher/lower than the market average?

- How are customer relationships managed?

6. Financial Health

- Has revenue been growing in the past few years?

- What are the profitability margins of the business?

- How much free cash flow is the business generating?

- Are costs increasing or decreasing?

- What types of costs does the business incur?

- What financial synergies will be achieved after the business is acquired?

Benefits of Commercial Due Diligence

Having a clear understanding of the risks and business operations of a potential target provides the prospective buyer with the ability to make an informed investment decision while limiting overall risk. The benefits include:

1. The Benefits of Informed Negotiation

The investigative aspect of purchasing a company can give an investor the edge over the seller during negotiations. Being aware of all the necessary information will help the buyer establish a more accurate negotiation price and defend their position.

Additionally, the commercial audit helps the seller develop a clear understanding of the position of the seller and negotiate accordingly.

2. Assurance of a Good Investment

You may need to secure loans from financial institutions for the company or commercial property you want to purchase. This report can help you convince these institutions that the investment is worth it. In the end, it will present reassurance that the business will perform in the future.

3. Future Market Performance

Commercial due diligence provides an overall understanding of the market in which the target company competes. This knowledge provides the potential buyer with a forward-looking view of the performance of the target company and future market performance.

4. Influence of Competitive Landscape

A complete understanding of the competitive landscape for the target company is important for assessing future growth potential. Commercial due diligence will provide the buyer with a comprehensive view of the competitive advantage or lack thereof for the target company prior to the acquisition.

How can DealRoom Help with Commercial Due Diligence

Commercial due diligence is a complex process that requires organization, collaboration, and careful analysis.

Teams collect extensive amounts of sensitive documents, collaborate with various outside parties, and work together to analyze the information received. All these activities are essential to a successful deal but are also extremely difficult and complex.

DealRoom’s leading due diligence - product can help.

DealRoom M&A Platform enables team collaboration, secure and organized document collection, and the examination of important analytics to enable informed decisions.

Close deals faster, more efficiently, and more equitably by streamlining diligence with DealRoom’s intuitive, innovative platform.

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)