Mergers and acquisitions can be an excellent way of adding to the human capital of a business.

When Goldman Sachs acquired J. Aron & Co., a small trading company, in the early 1980s, one of the traders they took on ended up being the company’s CEO. This isn’t uncommon.

Other examples include the Walt Disney Company hiring future CEO Bob Iger in the acquisition of ABC, and even JP Morgan bringing future CEO Jamie Dimon on board after acquiring Bank One in 2000.

These examples - and their success - underline the value of conducting HR due diligence in M&A.

We at DealRoom help many companies conducting due diligence and in this article, we look at how to successfully implement good HR due diligence to ensure that your company unlocks the value of the human capital belonging to the target company.

What is HR due diligence?

HR due diligence is the process by which an acquiring company analyzes the human capital within a company as well as all of its procedures and policies surrounding the human capital of the company.

Good procedures in HR have the effect of maximizing employees’ potential, so in some regards, an acquirer will often be pleasantly surprised to learn that a target company’s staff are not reaching their full potential, possibly opening the way for them to find ‘quick wins’ with the employees after the transaction has taken place.

Why is HR due diligence important?

Even if a company’s financials look sustainable, its operations are the best-in-class, and its tax returns are all up to date and in order, if the company has a human capital problem, the deal will not be a success.

In a previous article about change management, we talked about the myriad human capital issues that need to be handled carefully in the M&A process.

Just as human capital can generate massive value for companies (see the examples of Blankfein et al), a poorly managed transition of human capital can be disastrous for any deal.

Useful resources for HR due diligence

We have some very useful resources at M&A Science related to the HR due diligence and M&A. This podcast is must-have for anyone working in HR and involved in M&A.

A Guide to M&A Due Diligence from HR's Perspective

A Comprehensive Guide to HR's Role In Divestitures

How to Deal with Cultural Issues in M&A - by HR at Microsoft

The Human Aspect of M&A Integration

The HR due diligence checklist

Experience accumulated across thousands of deals shows us that attention to financial, commercial and operational data is only truly valuable when complemented by an understanding of an organization’s people and its culture.

If we accept that the people are different in every company, the next question becomes how are they different?

What are their capabilities?

What has made one team more motivated than another?

Through working with hundreds of companies in their due diligence process, DealRoom has gained insight into these questions, and put together the following checklist for those beginning their HR due diligence process:

1. Current staff overview

- List of all employees, their salaries, responsibilities, and time at the company

- Ongoing and/or finished training and education paid for by company.

- Audit of HRIS system

- Operational expense breakdown for HR department

2. Review of target company HR policy

- Policies surrounding absenteeism, discipline, sick leave, maternity leave, etc.

- Code of ethics/conduct

- Copy of employee handbook (if applicable)

3. Review of HR legal and compliance issues

- Employment contracts of all current employees

- Details of any informal workers, contractors or freelancers working for company

- Details of non-compete contracts

- Confidentiality agreements in place

4. Review of HR benefits

- Details of all monetary and non-monetary compensation

- Details of all employee health insurance plans and policies

- Details of all commissions and bonuses (including share options)

- Severance plans and packages

- Details of all pension, retirement and savings plans

Conducting HR due diligence with DealRoom

As the list above illustrates, far from being a part of due diligence whose focus is the ‘soft’ side of the company, the information garnered in HR due diligence can become unwieldy very quickly, calling for diligence software designed especially for the process.

With this in mind:

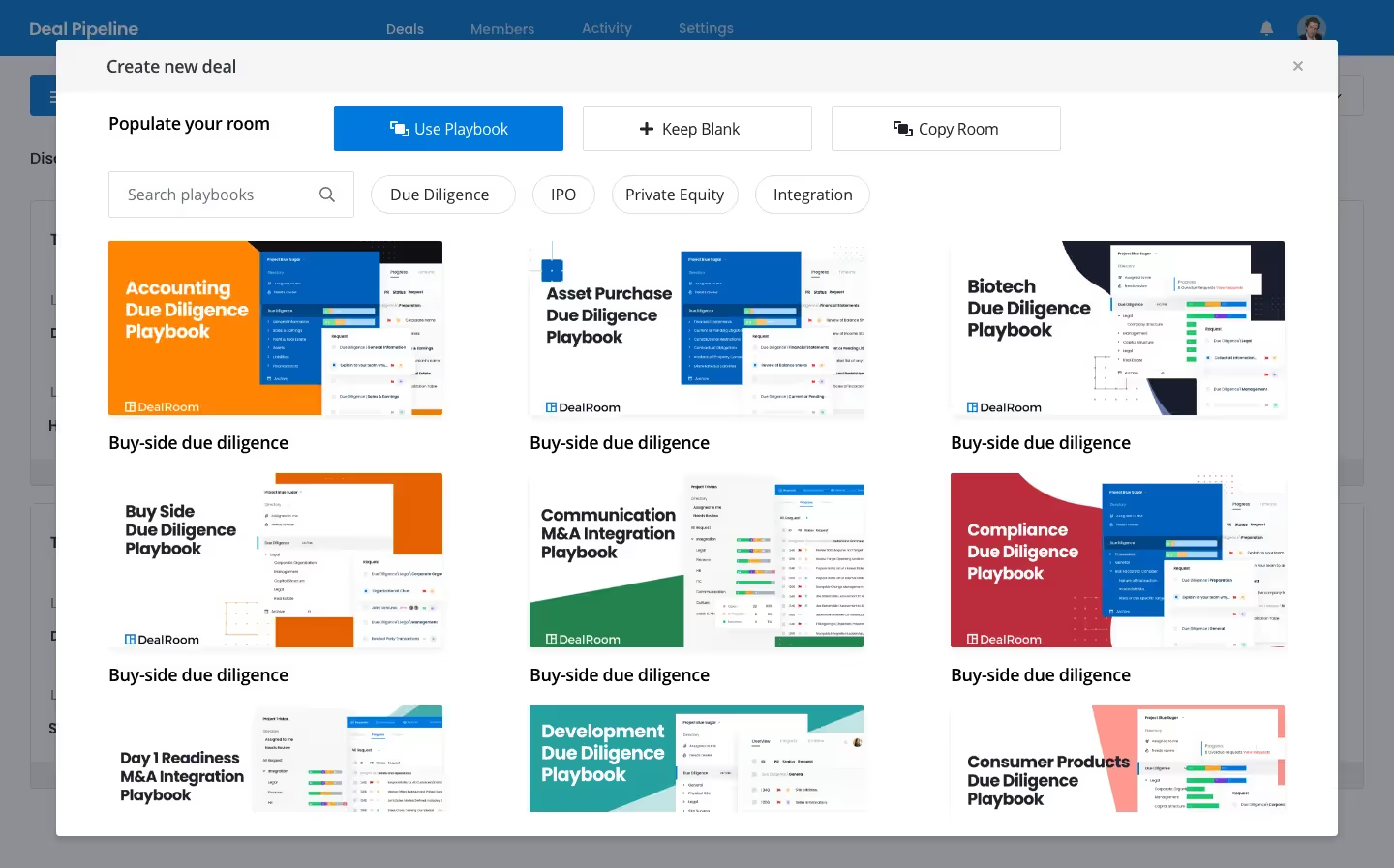

1. Request a demo and setup an account

2. Choose a template from the templates gallery

DealRoom has a range of templates for different due diligence functions - each one created based on feedback from experts in the field, and specially tailored to a particular kind of due diligence.

3. Start diligence process by utilizing unique requests feature.

The uploaded documents are then stored in a safe environment and linked to the relevant requests.

Conclusion

HR due diligence may be the broadest in the scope of all areas of due diligence.

The people of a company effectively represent tens, hundreds, or even thousands of important moving parts that can make or break a transaction.

This is true regardless of where they are in the company’s organizational chart.

Understanding this dynamic, DealRoom has put together an extensive HR due diligence function for M&A practitioners that dramatically enhances their ability to perform the best possible HR due diligence.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)