Post Merger Integration: Checklist, Frameworks, Examples & More

.avif)

An old adage compares the process of mergers and acquisitions to trying to complete a large puzzle when your right hand and your left hand have never worked together.

To put it mildly, mergers and acquisitions revolve around a plethora of moving parts.

Further complicating matters is the fact that there are suddenly two companies and additional stakeholders that now need to fairly and seamlessly work and communicate together in order to bring the deal to completion.

But what happens after the deal has (seemingly) crossed the finish line? Furthermore, what is post-merger integration, and how do you get it right?

As dozens of companies conduct their PMI projects with DealRoom, we've been able to gather valuable insights on this matter.

In this guide, we'll look at the importance of M&A Integration, processes, best practices, post-merger integration software, and the true post-merger integration meaning.

Last but not least, DealRoom also provides helpful integration checklists you can try for free. More on that later.

But let's first look at the M&A integration definition.

What is M&A Post-Merger Integration (PMI)?

M&A integration or Post-merger Integration (PMI) is the process of bringing two or more companies together with the aim of maximizing synergies to ensure that the deal lives up to its predicted value. The same process is sometimes referred to as post-acquisition integration.

Importance of Post-Merger Integration

PMI is critical for realizing the synergies and value propositions that initially motivated an M&A transaction.

Analysis has consistently shown that only by aligning strategic objectives, integrating technologies, and reducing divergences in corporate culture, can deals bring long-term shareholder value.

In essence, dealmakers can only hope to maximize deal value by delivering successful PMI.

More specifically, problems in mergers and acquisitions often cause deals to fail, or, at the very least, result in the inability to extract true value from deals - no one wants a deal that looks good only on paper or results in a semi-integrated company. This is further supported by research done by McKinsey in 2016:

"Companies that deliver integration will achieve growth of 6-12% higher than those that don’t"

Most companies enter the M&A process with the best intentions, but ultimately succumb to common traps that derail the deal. It is important to note that over 60% of mergers and acquisitions fail to return the intended value.

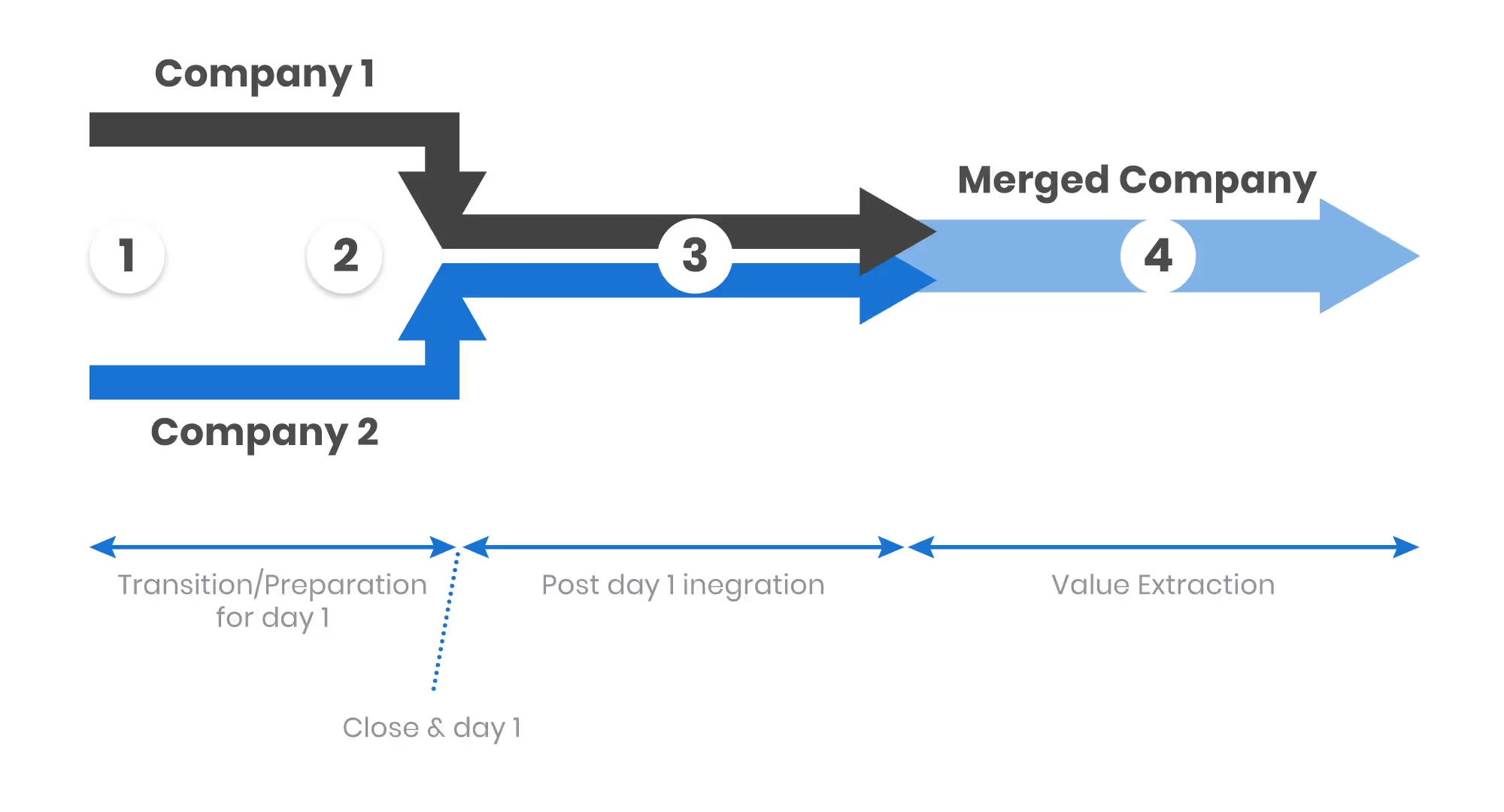

The M&A Spectrum below highlights how difficult it is to successfully realize the value targeted at the beginning of the M&A process.

With this in mind, post-acquisition merger planning must begin at the beginning of the deal, and best practices, integral team members, and M&A integration plans must be established before the deal closes.

With this in mind, post-acquisition merger planning must begin at the beginning of the deal, and best practices, integral team members, and M&A integration plans must be established before the deal closes.

Types of Post-Merger Integration

Broadly speaking, there are four different categories of post-merger integrations. We look at each of these in more detail below.

Preservation

As the name suggests, this form of PMI involves the acquired company retaining its pre-merger state after the transaction has closed. The integration efforts here are minimal, with the acquired company continuing to operate independently of the buyer.

Holding

Like a preservation strategy, the holding strategy means that the acquirer effectively becomes a holding company for the target company. A conglomerate typically uses this strategy. The target company retains some autonomy, but its culture will slowly merge with that of the holding company.

Symbiosis

Symbiosis is all but a full absorption of the target company. Generally, this strategy is employed where some aspects of the target company generate value, despite not being entirely aligned with the holding company culture. An example here would be a large tech company allowing a ‘move fast and break things’ start-up culture at a young tech company it has acquired.

Absorption

Absorption is the full integration of an acquired company into the acquirer’s operations. As such, it is also the most difficult to execute. It involves significant changes, with the end goal being a new entity where the lines between the target and buyer have disappeared.

Strategies for a Successful Post-Merger Acquisition Approach

As mentioned, a strong PMI phase is a pivotal phase for value extraction in M&A transactions.

Leveraging technology and making the process as scientific as possible - while not forgetting the significant human component - offers a formula for realizing all of the synergies inherent in a deal.

Below, we discuss some strategies companies involved in the PMI process can leverage to build deal value.

Technology Enablement

This underpins the entire strategy. There are too many processes, too many details, and too many pitfalls for PMI to be navigated without technology, which we summarize below.

Learn more: How Post-Merger Integration Software Enables Deal Success

Early engagement and planning

The sooner that PMI begins, the better. Good practice is to begin as soon as due diligence has finished. Set about identifying key stakeholders, setting clear objectives, and creating an integration roadmap.

Proactive integration and stakeholder engagement

By being proactive rather than reactive, the PMI team can enhance employee morale and engagement, improving communication and ultimately identifying synergies.

Learn more: How Proactive Integration Engagement Can Differentiate Value in Deals

Streamline decision making

Even PMI teams with detailed road maps will be called on to make important decisions. For these to be made efficiently, create small teams where the decision-makers are well defined and accountable for their decisions.

Learn more: M&A Integration Team Structure and Its Responsibilities

Prioritize talent

Focus on retaining and effectively managing human resources. Identify talent and ensure that it is pinned down as soon as possible so that the company’s operations suffer minimum impact due to the PMI process.

Learn more: The Impact of Mergers and Acquisitions on Companies & Employees

Look outward as well as inward

In all the inward focus involved in PMI, the company’s external environment cannot be overlooked. Communicate with clients about the PMI, and ensure the company’s interactions with them continue as before.

DealRoom's M&A Platform has been designed by and for M&A practitioners with the aim of enabling these strategies.

In addition to providing enhanced project management features, such as the ability to set specific requests for activities and documents, it provides an ultimate source of truth for all collaboration, communication, analytics, and data. Four components, without which every PMI process is doomed for failure.

Focus areas for Post Merger Integration

Data and Knowledge

This area includes a plan on integrating knowledge such as customer, product, and service data.

Technology and Systems

The integrating companies need a strategy for combining their technology and systems. For example, if both companies use different CRMS, which CRM will they use in the future?

Internal Policies

How will the two integrating companies handle internal policies such as new employee training, salary changes, employee exits, etc.?

Business Procedures

This area includes the strategy behind future business operations, such as sourcing new businesses and mergers.

Company Culture

Company culture is the backbone of any business. If one company is an 8 AM - 5 PM Monday through Friday, and the other company has flexible hours and work-from-home days, there will surely be clashes. Before M&A integration is complete, the two companies need to decide on the company culture that will emerge post-close.

This survey of M&A executives by Jabian resulted in most respondents saying culture – far more than other factors – is most important to an integration team working to combine two organizations.

Organizational Structures

This area includes organizing department structures. For example, will the two human resources departments become one, or will each one take on different responsibilities?

Products/Services

Before integration, each company had its own set of products and/or services. During integration, they will need to decide whether to continue, combine, or eliminate the products and/or services offered, as well as the branding associated with them.

“Most buyers wait until after close to start planning integration—that’s how synergies evaporate. Buyer-led flips that by running diligence and integration in parallel.”

- Kison Patel

Shared at The Buyer-Led M&A™ Summit (watch the entire summit for free here)

Key Steps in M&A Integration Process

The post-merger integration process (or M&A integration process) is greatly affected by the planning or lack thereof that takes place at the start of the deal’s lifecycle.

Ongoing research by consulting firm KPMG suggests that 70% of the value erosion for deals that fail occurs at the post-integration phase.

Putting this in different terms: Billions of dollars are lost every year because companies fail to properly implement integration after an M&A transaction. This is why integration is so important to M&A.

Here is an outline of the process - to aid you in your M&A integration plan:

1. Start Planning Right From the Get-Go

M&A Integration planning must begin at the beginning of the deal, and goals must be re-evaluated regularly throughout the integration.

Teams are also assembled around aligned cross-functional goals. This enables everyone to have a big-picture view and eliminate common cross-functional dependency issues.

2. Hold a Kick-Off Meeting

A kick-off meeting should be held at the commencement of the deal. At this meeting, a list of people to be included in this phase must be generated. During this stage, it is critical to clarify governance and determine the operating post-merger integration framework for how teams will work together, such as setting up meetings, managing dependencies, and sharing info.

3. Due Diligence

While due diligence is not historically categorized as a part of PMI, successful M&A integrations keep a sharp eye during diligence.

Tools such as DealRoom’s M&A software help companies, including VALTA and many others, plan for PMI before the deal closes.

4. Pre-Close Review

Pre-close (again not technically part of PMI, but essential to a positive outcome) - synergies should be reviewed and confirmed and teams and team leaders should be established.

5. Hold a Post-Merger Kick-Off Meeting

The post-merger kick-off meeting is an opportunity to introduce and align all key stakeholders in the PMI process on the strategic goals, integration plan, and timelines, ensuring everyone understands their roles and responsibilities.

6. Establish Communication Channels

Communication should be ongoing during the PMI process, but daily and weekly timelines should be set for team meetings to provide updates and to ensure that all channels are on schedule.

7. Post-Close Review

Teams review and evaluate the post-acquisition integration throughout constant short iterations. This makes it easier to realign a team and its goals as new information arises.

To accomplish a successful merger and avoid common risks, a thorough plan has to be in place before the deal closes.

Teams need to create a game plan and M&A integration checklist for the employees, set goals, track progress, and have open communication.

As mentioned above, DealRoom offers numerous proven post-integration checklists and templates that you can see in action in our roadmap tool for free right now.

Who is Responsible for PMI and Other Post-Merger Activities?

1. Top Executives & Stakeholders

One of the top post-merger success factors is placing value around mergers from the top down.

At the commencement of the M&A process, a company’s executives should gather all of the potential stakeholders involved in a deal’s due diligence process — bankers, lawyers, consultants, etc, and begin communicating about the details of the post-merger integration.

2. Diligence of Team Members

Post-merger integration best practices prove that the people doing diligence should become part of the team to retain and revise the information without redoing work or engaging in redundant tasks.

When using the same individuals for diligence and integration, there is continuity, which is invaluable during the often chaotic time of deal closing and post-acquisition integration.

The benefits of this continuity are numerous.

Consider, for instance, the time it would take for the diligence team members to do a full data transfer to the team.

- Would every bit of information really get transferred?

- What about the overlooked notes on notepads that do not get passed on?

Clearly, even the best-intended data hand-offs would end with some gaps and oversights.

In addition, let’s say that in the best-case scenario all of the information from the diligence team does get to the integration team - will the members really go over all of this work?

Importance of Communication

Most likely not because they will be under the gun and strapped for time, which, again, will result in gaps of knowledge and oversights.

Hence the importance of eliminating disconnected communication.

This is why M&A teams use DealRoom to centralize all communication, tasks, and files in one place, which leads to improved collaboration and efficiency amongst all teams.

Consequently, the best and most efficient way of integrating is to have an overlap between the diligence and the integration team.

This model also increases the likelihood that the team will maintain its momentum and capture synergies, or “low hanging fruit,” of the deal that are found within the first 120 days, thus making it a key M&A integration strategy.

3. Human Resources

More and more M&A practitioners understand the importance of M&A integration planning, but operations (even those at major acquirers) still often miss the mark because the all too important “people” factor can get lost in the shuffle of modern business life.

This misstep can lead to the loss of employees and clients during the very critical early days of integration when competitors tend to go after both employees and clients of the target company.

With this in mind, practitioners need to be ready to execute and communicate on day one important information about targets, employees’ positions and benefits, and the future of the company - obviously, Human Resources plays a vital role in the “human” piece of integration.

4. A Change Management Expert

HR cannot do it all, however; your acquisition transition plan will not be successful if it doesn’t take into account change management. The first rule related to change management best practices is to make change management its own role.

Some of the benefits of having a change management expert on your PMI M&A team are: the buyer gains valuable information about the target company (which can help maximize potential deal value), the target company feels cared for and employee morale/buy-in improves, and secrets are revealed (i.e. information comes to light that current leadership may be totally unaware of ) - all of which will help avoid major and costly problems.

One final note when it comes to putting together an M&A integration team and acquisition merger plan: when selecting a leader, recommendations should come from members of the diligence team - remember, strong practices and the valuing of post-acquisition integration come from the top-down.

What is a Post-Merger Integration 100-Day Plan?

An M&A integration 100-day plan goes along with the traditional approach to integration. It is with the mindset that teams can follow an integration playbook and that after 100 days of post-merger integration activities, the integration should be at a certain point.

However, many teams no longer follow the traditional methodology of integration playbooks.

Why manage Post-Deal Integrations the same way you did 20 years ago?

They deliver value to the deal by continuously improving value delivery processes following the Agile strategy methodology instead.

How Long Does Post-Deal Integration Take?

There is no set time frame for how long should post-merger or acquisition integration last.

Every deal is different; therefore, every post-deal merger has its own rhythm.

It can take months, if not years, to fully complete.

However, no matter what type of deal is taking place, planning should begin early, alongside diligence, and before the deal closes.

How Technology Enables Value Realization in Post-Merger Integration

The end goal of a well-planned PMI process rarely alters from how the PMI team first envisages it.

What does change, however, is the path to get there.

In PMI, the landscape constantly shifts, even if the goal remains the same. If due diligence can be considered complex but relatively linear, PMI is complex and multilinear.

In layman’s terms, post-merger integration can be a massive headache for managers if the proper structures aren’t in place.

Structure, both in the planning, productivity, and execution of PMI, is brought by technology.

In a process characterized by multiple and disparate moving parts, PMI teams diminish their efficacy by not leveraging technology.

Using DealRoom as our template - because this is the tool we’re most familiar with and not the only one that you can use - below, we break down the tangible benefits that come from leveraging technology in post-merger integrations.

Real-time communication

A typical PMI process involves team members spread across different departments and locations.

In this context, real-time communication tools are vital to facilitate instant and transparent dialogue between team members (from both companies), intermediaries, and other third parties.

Effective technology tools offer a platform for quick decision-making, addressing concerns, and sharing updates, ensuring that everybody is aligned and informed throughout the process.

Collaboration

Collaboration builds on communication.

PMI delivers value only when several people at once are working together towards the end goal. This means creating a shared workspace for them to manage projects and workflows.

Crucially, M&A platforms such as DealRoom facilitate this by allowing coordination across different team members and tasks. Furthermore, by creating open channels of communication, it breaks down the silos that sometimes exist between merging entities.

Document sharing

It’s remarkable how many novices believe that Box, Google Drive, or even Dropbox are sufficient for document sharing.

These tools were primarily developed for sharing holiday photos among family members and college professors to share class notes. They are not sufficient for corporate M&A purposes, where stakeholders have to have access to necessary documents, policies, and procedures on demand.

Furthermore, modern M&A software guarantees a secure environment, whose importance is amplified when different IT systems and data repositories.

Risk management

DealRoom helps in identifying, assessing, and mitigating risks associated with post-merger integrations.

And there are many of them, usually spread across each of the merging entities’ business functions. Purpose-built M&A platforms provide a framework for tracking compliance, operational, financial, and reputational risks, ensuring a smoother integration whose negative impacts can be minimized.

Everything in one place

Platforms increasingly use third-party APIs to bring different services under one roof.

This is problematic from an M&A perspective, as it opens up data compliance risks. Post-merger integration software integrates all functions in a single interface, which is beneficial to PMIs, where managing many tasks and data sources in a coherent fashion is critical.

Progress tracking

Our post-merger integration software allows teams to monitor how integration activities advance against set milestones and goals.

It alerts PMI team members to tasks that are falling behind schedule, as well as highlighting task dependencies (i.e., tasks that can only be initiated once others are finished.

An example would be data cleaning and preparation before system integration and data migration.). By enabling this progress tracking, DealRoom also empowers managers to identify delays or issues early and to adjust plans (or resources) accordingly.

Learn more about DealRoom's progress-tracking features here.

Data Compliance

Despite almost a decade of warnings, most companies still aren’t grasping the gravity of data compliance.

If you’re the manager of a company, can you put your hand on your heart and say that you know you are fully data compliant? Answering honestly, most will say ‘no’.

It is incumbent on the team leading the PMI process to ensure that data management adheres to legal and regulatory standards. You need a tried and tested solution for data protection, privacy, and security.

In the recent spike in commentary around Artificial Intelligence (AI), one insight stands out: Artificial intelligence will not be the end of your company.

But it will be the end of your company if you’re not using it. The same could be said about the use of technology in post-merger integrations.

Just as mathematicians no longer use abacuses, PMI professionals should no longer look at PMI as ‘part art, part science.’ PMI is a science, so use technology.

Reasons Why Post-Merger Integrations Fail

PMIs can fail for a myriad of different reasons.

To paraphrase Tolstoy, all unsuccessful PMI processes are unsuccessful in their own way.

However, analysis of multiple deals that failed to deliver value because of poorly executed PMI does reveal boxes into which the types of failure can be categorized.

These are: Lack of big-picture alignment, poor planning, poor execution, poorly executed due diligence, and cultural issues.

More on the nature of these failures can be read in DealRoom's guide to top 5 reasons of M&A integration failures & how to prevent them.

Challenges of Post-Merger Integration

Anybody about to undertake a post-merger integration process should be prepared for challenges. The scale of the challenges of achieving a successful integration largely depends on the merging companies’ industrial vertical(s), the stage of the business cycle, and the personalities of the key internal and external stakeholders.

The overriding challenge - and the one responsible for most PMI failures - is corporate culture, or put in another way, ‘how things are done around here.’ DealRoom addressed cultural integration with a detailed guide on the 8 biggest PMI challenges & how to overcome them.

We summarize each one in turn below, offering brief advice on how they can be overcome.

Challenge 1: Maintaining Momentum

The first challenge for the integration team, which underpins all others, is to integrate the organizations without losing momentum.

By momentum, we mean business growth. If the goal of M&A is to generate growth, an integration process that hinders growth is counterproductive. Integration teams therefore have to fuse the companies with minimum negative impact on day-to-day operations of both.

This is achieved through acquiring a deep understanding of the operations of how each company functions. This lets the integration team know where and when interventions can be made with minimum negative impact.

Challenge 2: Employee Engagement

Challenge 1 directly impacts Challenge 2, employee engagement. If employees are not fully engaged with integration, the integration will almost certainly lose momentum and begin to destroy value.

The most widely accepted way of overcoming this challenge is to implement a change management program. By minimizing the negative impact of change on your employees, you also stand to maximize the value extracted from the transaction.

Challenge 3: Senior Management Issues

Senior management issues are ultimately a subset of the employee engagement challenge. The good news is that inadequate managers are usually easier to identify in the integration process; the bad news is that if this isn’t done quickly, the damage could be lasting.

Communication is key to overcoming this challenge. To some degree, the integration team oversees management - not a dynamic that high-level managers are accustomed to - so it’s vital that the actions they’re made responsible for are monitored throughout the process.

Challenge 4: The Culture Shift

Culture may not be tangible, but it is real. Just ask any one of the failed megamergers over the past thirty years that failed to address it as part of their post-merger integration. The role of the integration team is to make the fusion of two companies as seamless as possible.

Addressing the culture challenge that is the direct responsibility of the change manager - usually a hired specialist, accustomed to the cultural issues that arise as part of a merger. The sooner culture is addressed in the integration, the more impactful the work of the change manager.

Challenge 5: Technology Integration

Nowadays, SMEs can have a technology stack of up to 15 separate programs and integrations. In corporations, on occasion, this number can sometimes run to three figures. It’s not difficult to see how technology integration could quickly create headaches if it is not dealt with quickly.

The first step in overcoming this challenge doesn’t usually require a specialist: It’s about writing down the technology stack of each company. From there, the respective technology teams, perhaps with an outside specialist, can begin to establish commonalities and areas where systems integrations will be more complex.

Challenge 6: Synergy Implementation

Identifying synergies that are realistically achievable from a transaction is one issue; extracting them is quite another. The challenge for CEOs, many of whom justified a transaction based on its synergies, is to turn these from a concept to cash flow.

Achieving synergies involves a deep understanding of the cost and revenue drivers at each company. For example, cutting staff numbers to reduce payroll may diminish productivity and employee engagement. Finding the right balance is often key to extracting synergies.

Challenge 7: Customer Engagement

M&A transactions affect internal and external stakeholders. The motives and impacts of a transaction need to be communicated to a company’s customers. The botched communication to its external stakeholders after the acquisition of Gillette by Procter & Gamble in 2005 is an example of the importance of customer engagement.

As with most integration challenges, customer engagement is all about maintaining strong lines of communication. Repeat customers are the most valuable asset a company has, and by definition, they like routine. The integration will bring changes for them, and they’ve got to be informed in as delicate a fashion as possible.

Challenge 8: Communication Challenges

There isn’t a transaction on record that failed because of too much communication. By contrast, the annals are littered with M&A deals that destroyed value because communication was poor.

The integration team should prioritize communication as part of the integration process. This communication should be informative, honest, and transparent. Above all, it should be frequent. If the deal is worth doing, let everybody know why and how they will benefit from it.

The Agile methodology is specifically designed to eliminate many of the risks associated with contemporary mergers & acquisition initiatives. A new model for M&A comes with a new mindset: rather than focus on pre-planned cost synergies, Agile M&A is based on continuously discovering and capturing value.

When complemented by the right toolset, the Agile M&A approach enables sellers and buyers to manage highly unpredictable M&A processes with maximum efficiency and accuracy.

DealRoom's Agile M&A Principles

DealRoom agile M&A principles, adapted from the 2001 Agile Manifesto for software development, were developed to foster a new mindset in M&A incorporating technological advances. Its five core principles are:

- Individuals and interactions over processes and tools

- Meaningful progress over comprehensive documentation

- Real-time collaboration over batch work

- Responding to change over following a playbook

Transparency over implicit assumptions

Post-Merger Integration Checklist

A post-merger integration checklist (or M&A integration checklist) is a step-by-step agenda to keep teams on track in preparation for a merger or acquisition. You can also think of the PMI checklist as the backbone for the entire company merging plan since it will include all departments and personnel and goes way beyond the typical post-merger integration 100-day plan.

The checklist needs to include plans for the following: hiring processes for short and long-term needs, redundancies, turnover, employee retention, M&A IT integration, technology, systems merging, tracking employee performance, and more.

It is also important for those in key roles to take a post-merger integration questionnaire to help them understand and align goals.

A post-merger integration plan includes:

1. Hiring process

The integration process forces a company to rethink its hiring needs. The hiring process needs to balance the short-term - retaining key talent from both companies to ensure business continuity - with the long-term - hiring new talent that aligns with the strategic goals of the newly merged company. Benefits and compensation are key considerations when mapping out the plan as the company looks to add new employees to an environment already in a state of tumult.

2. Overlap/redundancies

Staff redundancies are often pinpointed as part of a transaction’s inherent synergies. Identifying staff overlaps and sitting across from a loyal employee are two distinct situations. As such, the plan must be designed to be equitable and compassionate. The valued employees you hope to retain to drive the company’s growth will be taking note.

3. Technology

As with the human capital issues encountered in post-merger integrations, technology can be divided into the short-term (CRM and ERP systems) and the long-term (core IT infrastructure issues such as cybersecurity). The role of the integration plan is, therefore, not just to unravel the maze of different systems in the newly merged entity’s technology stack but to create a timeline that enables each system to be integrated with minimum friction.

4. Employee Performance

Training plans, employment review procedures, and HR systems must adapt to the newly merged company. There is a large overlap between company culture and employee engagement, as incentives set the tone for company culture. This section of the integration plan should therefore seek to rhyme with corporate strategy and culture.

Additionally, we've put together this PMI framework, which can be further helpful in setting your company up for post-close integration success.

From production to culture, replicate and use this framework as your go-to reference point and ease your integration with our integration planning framework.

M&A Integration Checklist Templates

This is the most complete Post-Merger Integration checklist on the internet.

The best part?

Everything on these lists is based on DealRoom's vast experience and works GREAT.

We’ve broken this checklist down into sections that cover the main focus areas of post-merger (or post-acquisition) integration.

Let’s dive right in…

- Post Merger Integration Checklist

- Integration Plan Day 1 Readiness Checklist

- Legal Integration checklist

- Information Technology M&A Integration Checklist

- Communication M&A Integration Checklist

- Finance M&A Integration Checklist

You don’t need to implement everything on these checklists, as planning for integration means being specific.

In general, however, you’ll need to consider all of the above for a holistic post-integration strategy.

The more effort you put into practice, the higher the chance of successful integration you’ll get.

More on integration planning is below.

How to Use This Post-Merger Integration Checklist

DealRoom is regularly asked by companies that have recently conducted M&A transactions about integrating an acquired company, as this process demands good planning.

As an answer, we see dealmakers use these exact checklists to successfully plan and prepare for their integration processes.

DealRoom provides checklists that are packed with many helpful features, such as:

- Expert-developed and complete integration playbooks

- Ensures that nothing is missed during the integration process

- Integration workstream progress tracking

- Analytics and reporting that matters

- Easily accessible knowledge transfers

- Many more...

Post-Merger Integration Best Practices

Ongoing research by consulting firm KPMG suggests that 70% of the value erosion for failed deals occurs at the post-integration phase.

There are many different strategy types, but here are some general post-merger integration steps and best practices to follow for a successful outcome:

1. Eliminate friction through effective communication and budgeting

The post-merger integration phase is underpinned by effective communication and budgeting. A PMI process that doesn’t feature both from the outset is doomed to failure.

By making communication a cornerstone of the PMI process, the integration team can identify issues early, fueling a more efficient integration of the two companies.

Likewise, regular updates and feedback loops foster an environment of continuous improvement and ensure that all stakeholders remain informed about progress and expectations.

On the budgeting side, as a one-off project, the costs involved in a post-merger integration phase can quickly spiral if effective budgeting isn’t in place.

A well-structured budget provides the integration team with a clear financial roadmap, setting realistic cost expectations and anticipating and mitigating financial risks.

2. Use Agile-inspired practices & sequencing

- Establish clear expectations

A lack of clear expectations can bring chaos and negative emotions to mergers and acquisitions. Luckily, expectations can be set by prioritizing tasks for the business integration plan, which leads back to the key objective.

More specifically, the power to ask the right questions at the right time can be harnessed through daily, or almost daily, sequencing and prioritizing with the target company. This will be scary at first for the target company and perhaps for you, too, but the benefits are immense.

Most importantly, this style of sequencing keeps the focus on the objective and only the tasks related to that objective; unnecessary work is also eliminated, thus reducing deal fatigue.

Although the target company might initially be weary of the daily contact, they will ultimately reap the benefits of focused practices and experience the mental joy of seeing the list of tasks become smaller and smaller.

- Bring important topics to the forefront earlier

Another advantage of sequencing, stemming directly from the above points, is that the increased contact with the target company about priorities will allow critical conversations to come to the floor earlier in the life-cycle of the deal.

Limiting priorities (everything cannot be a high priority) allows stakeholders to see the reality of the deal (what will and will not happen in the future) and reduces churn because it becomes clear early on that not everyone will get what he/she wants out of the deal.

- Save company morale

Just as individuals react with various emotions to shifts in their personal lives, they also follow a pattern of emotional responses to variations in their work lives.

Although models of the change curve use slightly different terms, experts agree when workers are faced with major changes at work, they often travel from denial to anger to depression and then, hopefully, move to stages of acceptance, hope, and commitment.

In simpler terms, when changes are implemented or mergers and acquisitions occur, morale often tanks, workers become preoccupied with fears and doubts, and productive work suffers.

Agile can help with this as seen through post-merger integration examples, namely the Disney-Pixar acquisition.

This M&A integration was especially successful because employees did not feel as though their entire worlds were changing in a short period of time; rather, changes were implemented slowly and methodically based on their priority ranking.

Strong company morale is vital to any PMI framework.

3. Take advantage of full-spectrum M&A

While a tool is never the cure-all for any team’s M&A problems, the right tool and M&A software can speed up the M&A integration process and produce valuable data for teams.

VDRs and project management platforms designed specifically for M&A, such as DealRoom (for deals 50M and greater) and FirmRoom (for deals under the 50M mark) can literally keep all parties, and new coworkers, on the same page. Executives can no longer simply rely on Microsoft Excel when there are more efficient tools and technologies.

In fact, DealRoom’s PMI tools can be used to super-charge your merger needs as it is a process management tool with an overlay for due diligence management. When the buy-side or banks use DealRoom, they see increased collaboration and a massive cut-down of emails.

When DealRoom’s use is continued to post-closing activities, its data can be reused and the tool itself can help avoid duplicate work - a common pitfall that slows the entire process and wastes valuable employees’ time. More specifically, items can be tagged during the diligence process for M&A integration.

4. Set up one-on-one interviews with target company employees

One-on-one interviews with target company employees lead to first-hand insights that can generate significant value in the PMI process.

These interactions are often the most effective method to understand the target company’s culture. By framing questions around their work environment and the internal dynamics of the target company, the integration team can gain a better understanding of the cultural issues that can accelerate and/or impede integration between the two companies

Furthermore, employees are often aware of the inefficiencies or risks that exist within a company, and the arrival of the integration team can offer them an opportunity to voice their concerns in a way that the previous management team did not.

5. Conduct a semesterly PMI questionnaire and present findings to executives

Many stakeholders overlook the power of strong change management and integration practices.

Indeed, sometimes when conducting smaller deals, the buy-side can get away with sloppier methods and disregard the important leg work related to proper change management.

However, as deals get larger, ignoring change management will certainly lead to post-acquisition problems.

The crux of the matter is big deals demand robust change management practices. Experts recommend that around the six-month mark, employees should be given a climate survey. Again, the data collected should be analyzed and the feedback should be delivered in a report to upper-level management.

This will allow the company’s leadership to take a look at what is going well and what still needs to be addressed or worked on further in order for the integration process to continue to move in the right direction.

6. Avoid overreliance on M&A Post Merger Integration “playbooks:”

While there has been a growing desire for deal “playbooks” over the last few years, the notion of playbooks has begun to take on a more negative connotation in the industry since no two deals are exactly alike.

It is impossible to have a PMI template for every aspect of a deal because all deals involve different people, emotions, products, and risks. Even if your target company looks very similar to a past target company, you must consider that a current deal could be different because you, as the acquiring company, may have changed - this could impact post-merger integration success.

One could even go as far as to say that the desire to follow an M&A integration playbook is dangerous to the deal itself as it can cause tunnel vision, hurting big-picture alignment and customer relations and failing to recognize the uniqueness of each deal - all of which will jeopardize maximizing the value of the deal. Instead of turning to playbooks, shift your mindset to being more Agile or flexible and consider frameworks and other PMI tools.

While playbooks are not ideal for the fluctuating/irregular world of M&A, basic game plans and frameworks are relevant. It is both practical and human nature to want to look at past deals and see what may or may not apply to your current deal.

Within this post-merger integration framework, you will generally want to know how you will begin the M&A process and who will be involved, but all players need to acknowledge that the exact approach is what everyone will be working together in an Agile manner to uncover.

Through discovery and analysis, the post-merger integration framework must allow for taking time to understand the customer and the target company, a major benefit of Agile - teams become efficient and much more customer/people-focused.

Post Merger Integration Optimization

Life moves quickly for managers in the PMI phase. The day-to-day operations of larger companies are inherently more demanding than their smaller counterparts, and this transition sometimes surprises management. For this reason, PMI progress assessments should be conducted as regularly as possible.

Post-merger integration optimization thrives on a constant flow of information: financial and operational metrics, performance against benchmarks, and employee and customer feedback. The more frequent the updates, the more likely it is that issues can be anticipated and the process can be optimized. Above all, constant communication ensures that the integration stays on track and maximizes the value extracted from the merger.

M&A Integrated Solutions and DealRoom as a Post-Merger Integration Tool

Poor post-deal integration practices are the number one cause of PMI failure. DealRoom helps you avoid common post-acquisition mistakes and increases the chance of successful post-merger integration.

The platform enables users to plan properly from day one to the beginning of the diligence process. Teams have access to all the files and data before the deal closing, allowing them to spot areas of concern and plan accordingly.

DealRoom also allows users to set cross-stream dependencies across multiple functions. All deal team members can see the deal's progress as it unfolds in real time.

This enables employees in key roles, such as managers, department heads, and human resources, to have access to information and updates regularly.

DealRoom also has a PMI plan template for users to download. Ready for a better process that helps maximize deal value? Request our M&A integration software today.

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

%25201.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)