Private Equity Due Diligence Playbook

You’ve decided to either invest in or buy a privately held company. In this template you'll find the list of areas that every business buyer and investor should investigate before signing a deal. Minimize and allocate risks while maximizing value with our PE template. Book a playbook demo to explore — schedule a call with us and we will reach out to help you get started.

- Investment-grade transaction review

Cover every critical domain for private-equity buys—from market, strategy and financials to operational, legal and exit planning. - Deep asset & liability assessment

Examine target business models, growth drivers, contract strength and degradation risks so you invest with full clarity. - Streamlined team collaboration

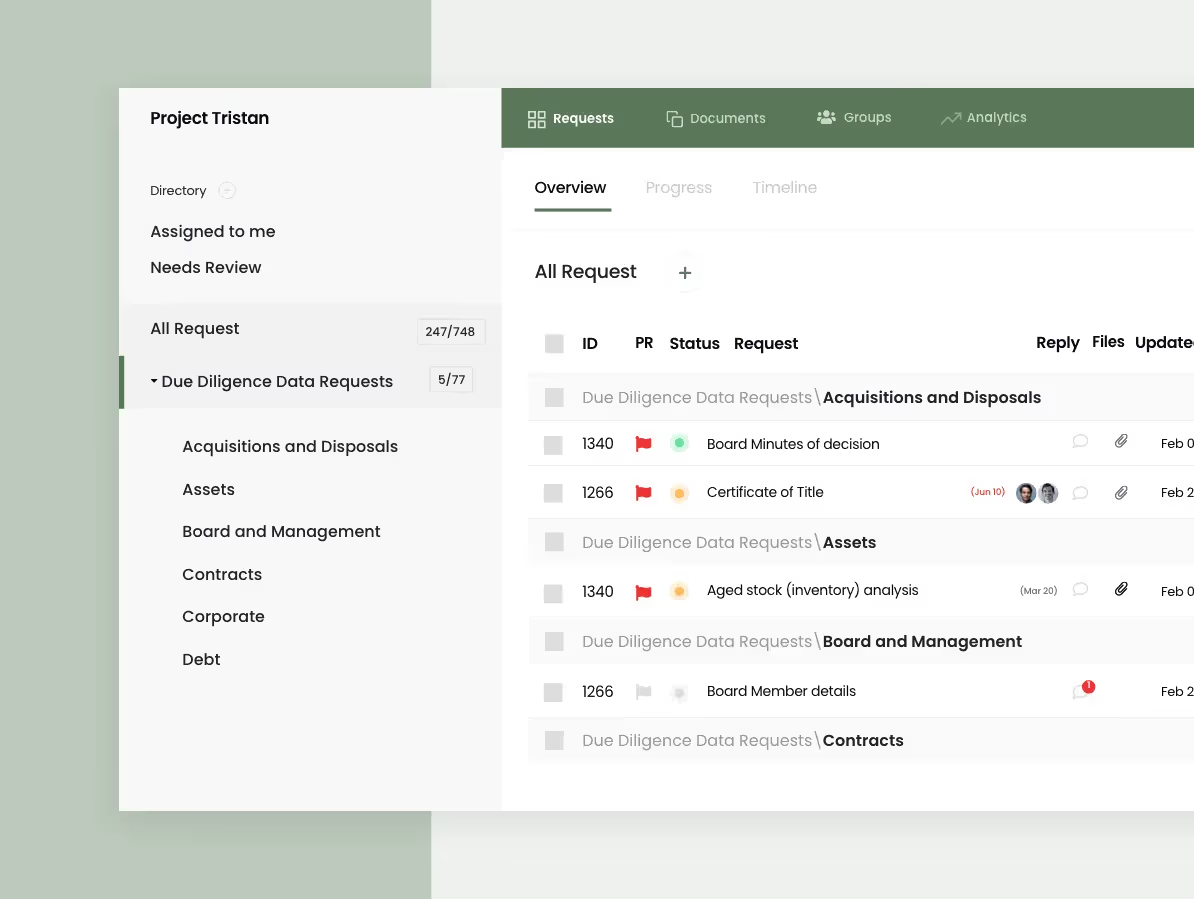

Coordinate your PE deal team, advisors and operating partners in one secure workspace—track items, attach evidence and monitor progress. - Transparent audit trail

Log every decision, comment and attachment to each request for full traceability and better stakeholder alignment.

Support your review with the Asset Purchase Due Diligence Checklist for asset-level insight, or prepare your integration plans using the Post Merger Integration Synergy Tracking Template.

.png)

.png)

.png)

.svg)

.svg)

.avif)