Growth is at the core of every equity investment, so the term ‘growth equity’ has the potential to confuse.

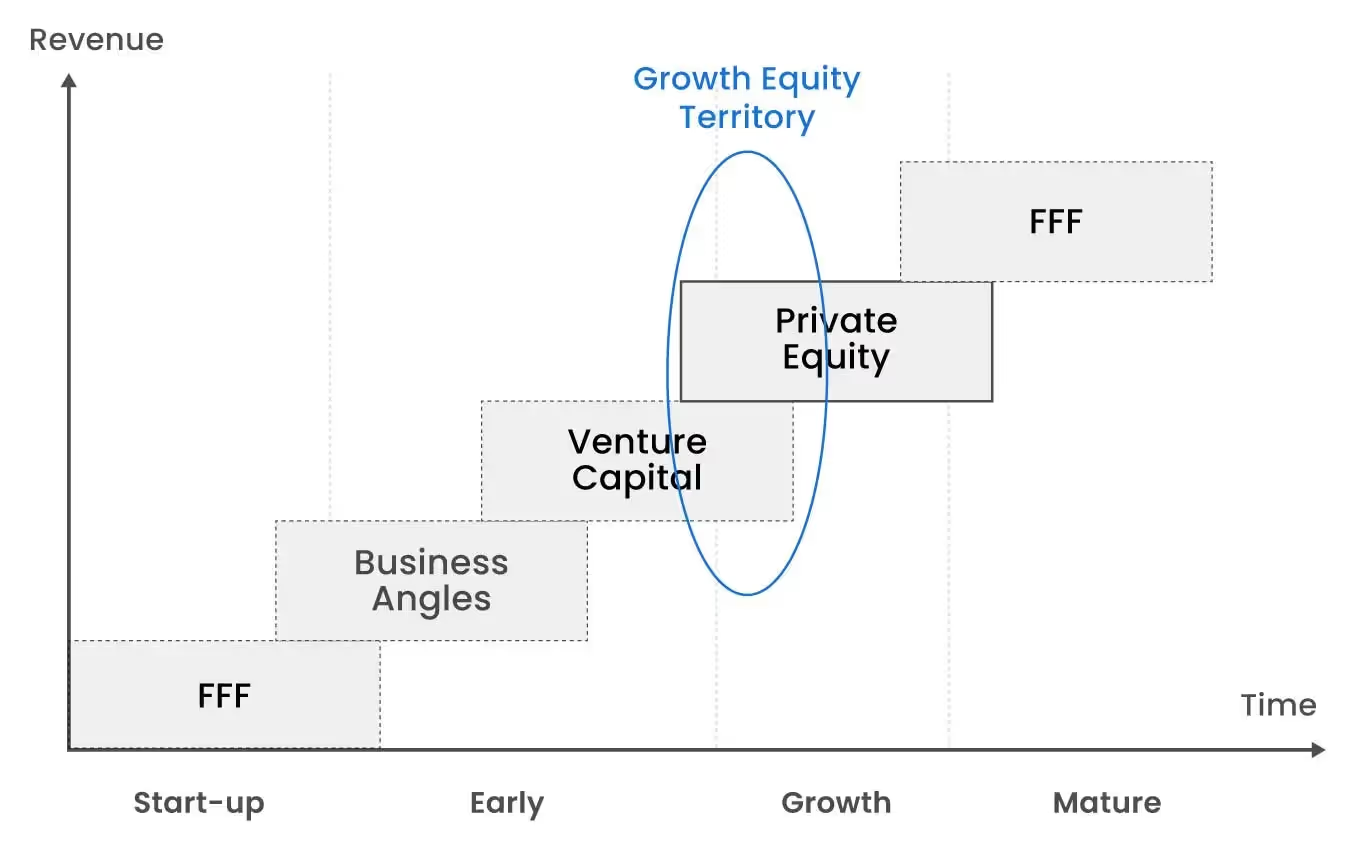

Located on the spectrum between venture capital and private equity buyout, growth equity offers a proven formula for investors to create value.

DealRoom's virtual data room solution help investors with secure deal data storage and important investment decisions. This is our guide to growth equity.

What is Growth Equity?

Growth equity is a term used to describe minority investments in young and mature companies to help them implement their growth strategies. The growth strategies could include investing in new sales and marketing teams, expansion into new markets, and M&A transactions.

The companies seeking out growth equity are usually stable and profitable, with the main investment risk coming from the growth strategy rather than the existing business model.

Understanding Growth Equity

Not all companies, particularly successful companies, are willing to sell out to private equity investors. At the same time, there’s a large cohort of successful companies whose founders wish to accelerate their growth. This area, which straddles successful, profitable companies and the desire to obtain growth capital is where growth equity lies.

The characteristics of these companies seeking growth capital usually include some of the following:

- Business of at least five years old with limited, if any, institutional capital raised to date

- Proven business model and consistently positive EBITDA

- Double digit revenue growth

- Low levels of leverage

- Focused growth strategy underpinning the growth capital request

Aside from the prospect of relatively low-risk returns (compared to venture capital, for example), investors in growth equity also tend to share some characteristics, including:

- Seeking significant minority stake (typically 15-30%)

- Seeking a hold period of 3-5 years

- Seeking investments with downside protection and preferred shares

- Investments are usually made based on at least some management input

Listen to the best private equity podcasts to learn the ins and outs of private equity from the professionals.

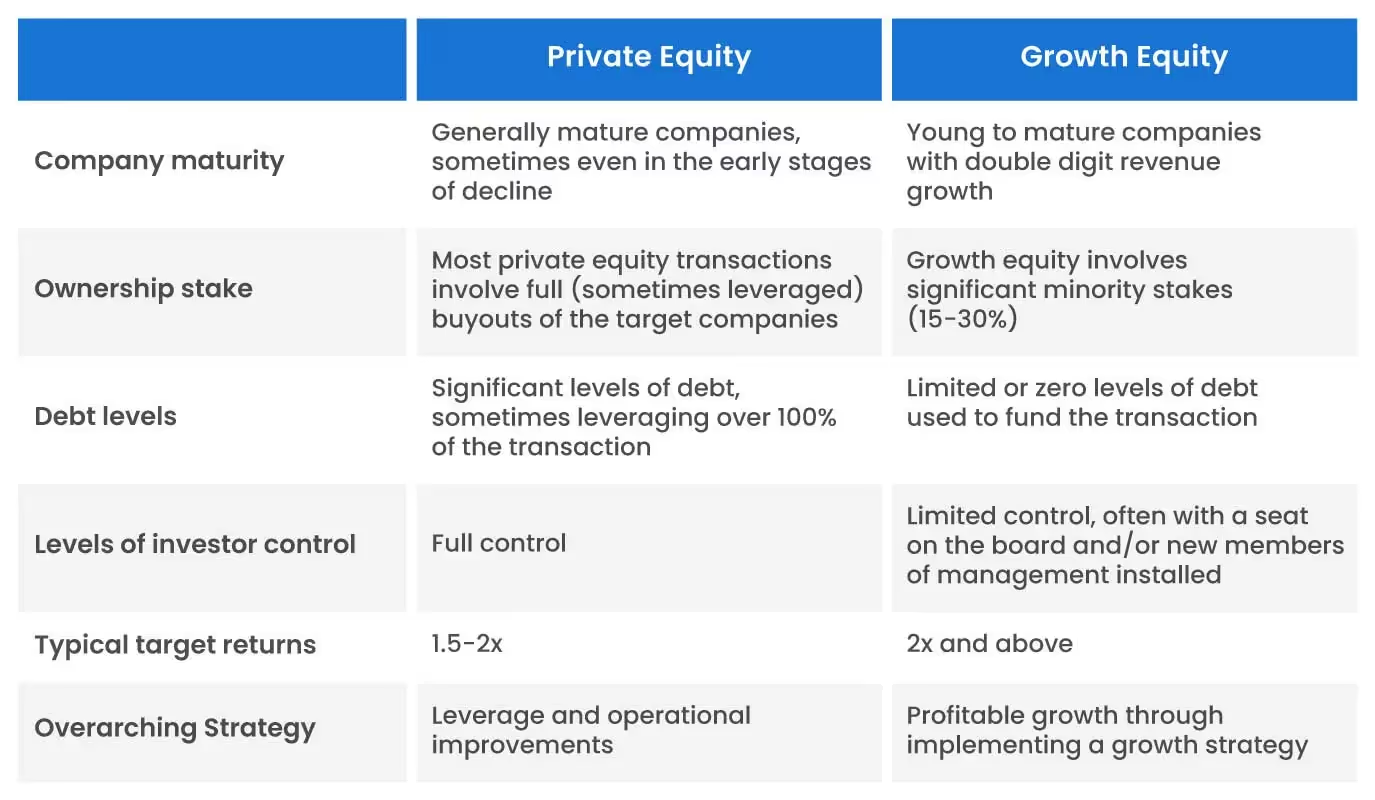

Difference Between Growth Equity and Private Equity

Private equity is now commonly used as a catch-all term for all private investments, across the scale from venture capital to private capital buyout.

However, there are distinctions to be made. The differences between growth equity and private equity are seen below:

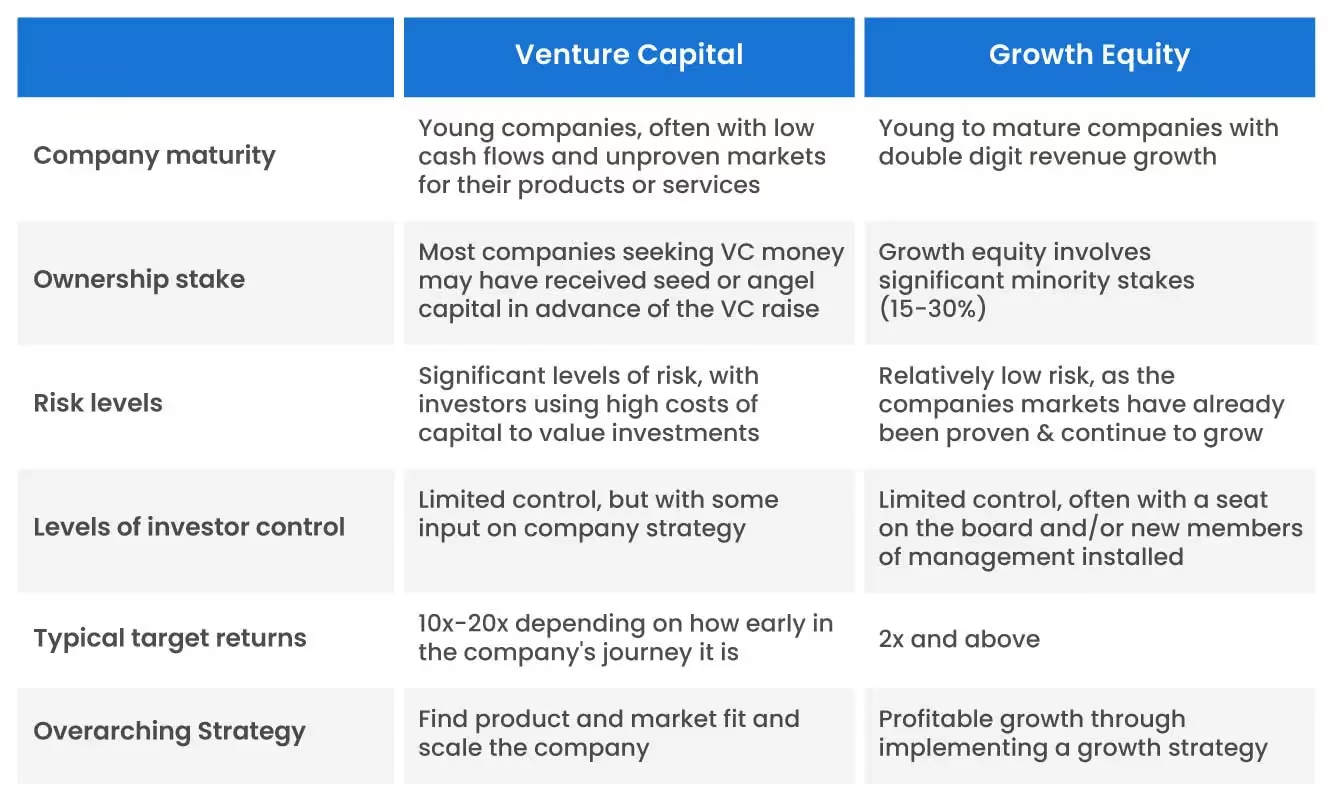

Growth Equity vs. Venture Capital

Venture capital is based on high growth too, you might point out. While this is correct, again there are distinct differences between the two. Below, we look at these differences under different headings:

Growth Equity Providers

Growth equity is, well, growing. Data provided by Pitchbook shows that there were at least 1,508 growth equity transactions in the United States in 2021 with a total investment value of $125 billion. This figure was up over 60% on the same metric in 2020. Furthermore, the opportunities that arose in growth equity made 2022 a record year for funds looking to raise growth equity capital.

Understanding the scale of the opportunity, the large private equity firms - more accustomed to leveraged buyouts (LBOs) than growth equity investing, have entered the sphere. In 2021, Blackstone launched its Blackstone Growth fund focusing on growth equity. It joins competitors already operating in the field, such as KKR’s tech growth fund and TPG’s TPG Growth fund.

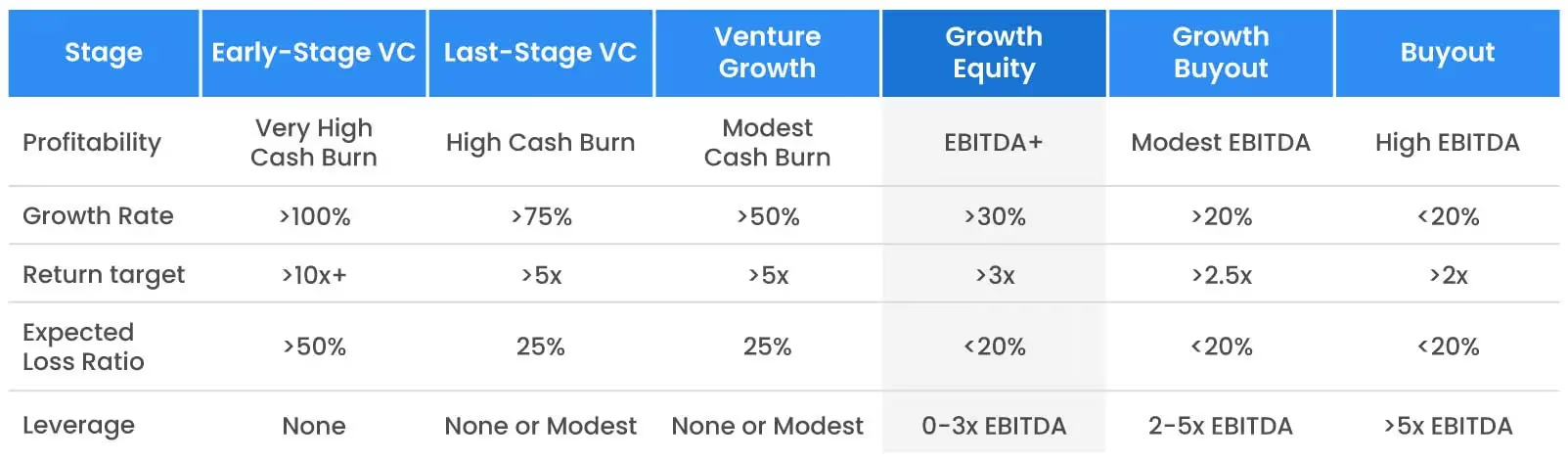

Risk-return Profile Summary

In the most general terms, growth strategy is usually considered the best option for investors looking for solid a risk-return profile from their investments. In addition to having a proven business model and high growth rates, growth equity offers investors preferred stock and good downside protection.

The table below summarizes some of the risk-return characteristics that are typical at each stage of the spectrum.

These numbers come with a health warning, however. The only true way to establish the risk-return profile of an investment is an in-depth due diligence process. Tables like Figure 3 are useful only in as much as they are indicative.

Users of DealRoom have reported low risk venture capital deals and high risk growth equity transactions. Many only knew the difference having gone through due diligence.

Summary

Growth equity offers an excellent opportunity for investors to partake in a company’s growth, often at relatively low risk. But establishing where the growth is, where the risk is, and how the opportunity stacks up against others is a challenge.

%2520(1).avif)

DealRoom has been designed to help overcome this challenge, providing support for the entire investment cycle from fundraising through value creation and eventually, to exit.

Talk to the team at DealRoom today about how we can put the growth in your growth equity strategy.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)