“Don’t mistake a sale pitch for due diligence”

The purpose of due diligence is, in general terms, to sort the detail from the sales pitch.

The sale pitch will tell you that the company is growing at 10% annually, while due diligence will tell you that this growth has been achieved through overtrading; the sale pitch will tell you that the product is patented, while due diligence will tell you that it’s not protectable; and while the sales pitch may tell you about a motivated workforce, due diligence may reveal they’re demoralized.

And so on. The message is clear. To paraphrase the famous Warren Buffett quote, a sales pitch gives you the price, while due diligence gives you the value.

And if the goal of M&A is ultimately to generate value, then it follows that you should conduct due diligence to achieve it.

In this article, we look at some of the key issues of this topic, referring back to previous DealRoom articles which provide more detail on each of the issues.

Dozens of companies conduct M&A with DealRoom and here we begin by formally outlining the role of due diligence in the M&A process.

The Role of Due Diligence in M&A

Due diligence allows the buyer in the M&A process to confirm hitherto undisclosed details about the selling company’s financials, contracts, personnel and customers. In other words, it allows the buyer to obtain a complete picture of the business being acquired.

Preparing for Due Diligence

Jordan Lampos, director of M&A at Duff & Phelps, is firm that the sooner the due diligence phase of your transaction starts, the better.

This means creating a comprehensive checklist of the documents that will be required from both sides of the transaction (see below) and coordinating who is accountable for each element of due diligence.

Read also

Tips for Preparing and Conducting Successful Due Diligence

Typical Questions that Arise in M&A Due Diligence

There are no stupid questions when it comes to due diligence.

Everything you want to know about the company can be asked, and everything that you should know about the company should be asked.

A good way to arrive at questions to ask is to think of those questions which you would be uncomfortable if someone were to ask you about your company.

Asking these questions will inevitably lead to your due diligence checklist. So here it is:

1. Financial Information

Ask for:

- Balance sheets

- Accounts payable information/policies

- Accounts receivable information/policies

- Income statements

- Tax returns (usually the last three years)

- Credit reports

- Reports demonstrating the value of all products

- Data on gross profit margins

- List of expenses (both fixed and variable).

- Credit reports

- Tax returns

- Audit and revenue reports

- List of all physical assets

- List of expenses (fixed and variable)

- Gross profit margins

- Information related to any debt

2. Company Information

Ask for:

- A detailed overview of the structure of the company (diagrams and charts are valuable here)

- The company’s by-laws

- Ownership information

- List of security holders

- Information on stockholders

- List of outsourced work/workers - freelancers, consultants, etc.

- Overview of major competitors

- Copies of annual reports from the last three to five years

3. Product Information

Ask for:

- Lists of services and products

- Explanations of the above services and products

- Overview of production costs and margins

- Past and predicted growth rates

4. Customer Information

Ask for:

- Database of customers

- Overview of customer communication practices

- Copies of purchasing agreements

- Refund policies

- Past and present marketing strategies and campaigns

- Information on any litigation

5. Employee Information

Ask for:

- A list of all employees, with key players noted

- Detailed job descriptions for each role in the company

- Copies of contracts and benefits

- Overview of HR and its policies

- Copies of HR complaints

- Data related to turn-over and hiring practices over the last (approximately) three years

6. Legalities

Ask for:

- Copies of permits

- All licensing information

- Insurance policies

7. Intellectual Property

Ask for:

- Clarification of who owns the Intellectual Property (IT)

- Confirmation of who controls the rights to the IT (if another group owns the information)

- Information regarding patenting

- Overview of work that stems from the IP

- The type of income that streams from the IP (fixed income or variable income)

8. Physical Asset

Ask for:

- Comprehensive overview of all forms of real estate - offices, data centers, warehouses and storage centers (including furniture in the aforementioned)

- List of equipment used for production

9. Miscellaneous

The following will depend upon the deal/company, but other items to ask for include:

- Information regarding health and safety notices

- information related to any hazardous substances and/or underground storage tanks

- New product development and benefits / risks of new product

To utilize the complete due diligence template click on banner below.

M&A Due Diligence Checklist

If you are looking for a due diligence checklist for mergers and acquisitions which you can download and use then visit our M&A templates collection.

If you are looking for specific checklists, then check:

- Financial Due Diligence Checklist

- Operational Due Diligence Checklist

- Legal Due Diligence Checklist

- More M&A Due Diligence Checklists

What Documents are Required

The documents required will differ by transaction but in general terms, you should expect some documents from each of the following categories:

- Legal due diligence documents

- Financial due diligence documents

- Sales and marketing due diligence documents

- Human resources due diligence documents

- PP&E due diligence documents

- Contract due diligence documents

- Intellectual property due diligence documents

- Company's Good Standing and Organization Due Diligence Document

Read the article

Typical Due Diligence Documents Required for M&A

“Diligence always comes with tight deadlines. We pull people from their day jobs, so balancing speed and risk means deciding what financial risks you’re ready to carry post-close.”

- Kholoud Cheriqi

Shared at The Buyer-Led M&A™ Summit (watch the entire summit for free here)

The Specifics of Legal Due Diligence

Perhaps more than any other element of due diligence, legal due diligence will require you hire outside help. The bigger the transaction being undertaken, the more true this maxim becomes: Size tends to bring complexity and an increased volume of documents in terms of scale and scope beyond the capacity of even those medium-sized firms with in-house legal teams.

Read the article

The Ins and Outs of Legal Due Diligence

Conducting Sell-Side Due Diligence

As the previous sections outline, due diligence is a detailed process and this inevitably takes time; depending on the size and scope of the business being acquired, three to six months.

It will benefit your company to have prepared some of the documents required in advance, which will simultaneously help speed up the process but also to allow enable you to identify aspects of your business which may require some attention.

This will demand that you obtain those documents (outlined above) that require more time to process. You may well find that some of these documents – for example, the quality of earnings report for your business – can generate value for your company in your ongoing operations, outside the scope of an acquisition.

While the focus of in-house due diligence should be on encountering risks inherent in your business for the buyer, bear in mind that these are risks you should be aware of anyway.

If they’re relevant to the buyer, they should be relevant to you. Due diligence is not document retrieval for its own sake, but rather a process of retrieving relevant information on the company.

Related article

How to Efficiently Conduct Sell-Side Due Diligence

Conducting Buy-Side Due Diligence

A thorough investigation into, and understanding of, a company during due diligence is essential to a deal’s success.

The buy-side will collect, review, and analyze information related to the target’s overall organization, employees, products, customers, competitors, marketing strategies, and assets (such as real estate and intellectual property). Furthermore, the bulk of the buy-side’s diligence will revolve around the target’s financials.

As the buy-side collects this information it keeps an eye out for potential risks and red flags. The buy-side also must keep an eye towards integration during the diligence process as the most successful deals begin integration planning early.

Related article

How to Efficiently Conduct Buy-Side Due Diligence

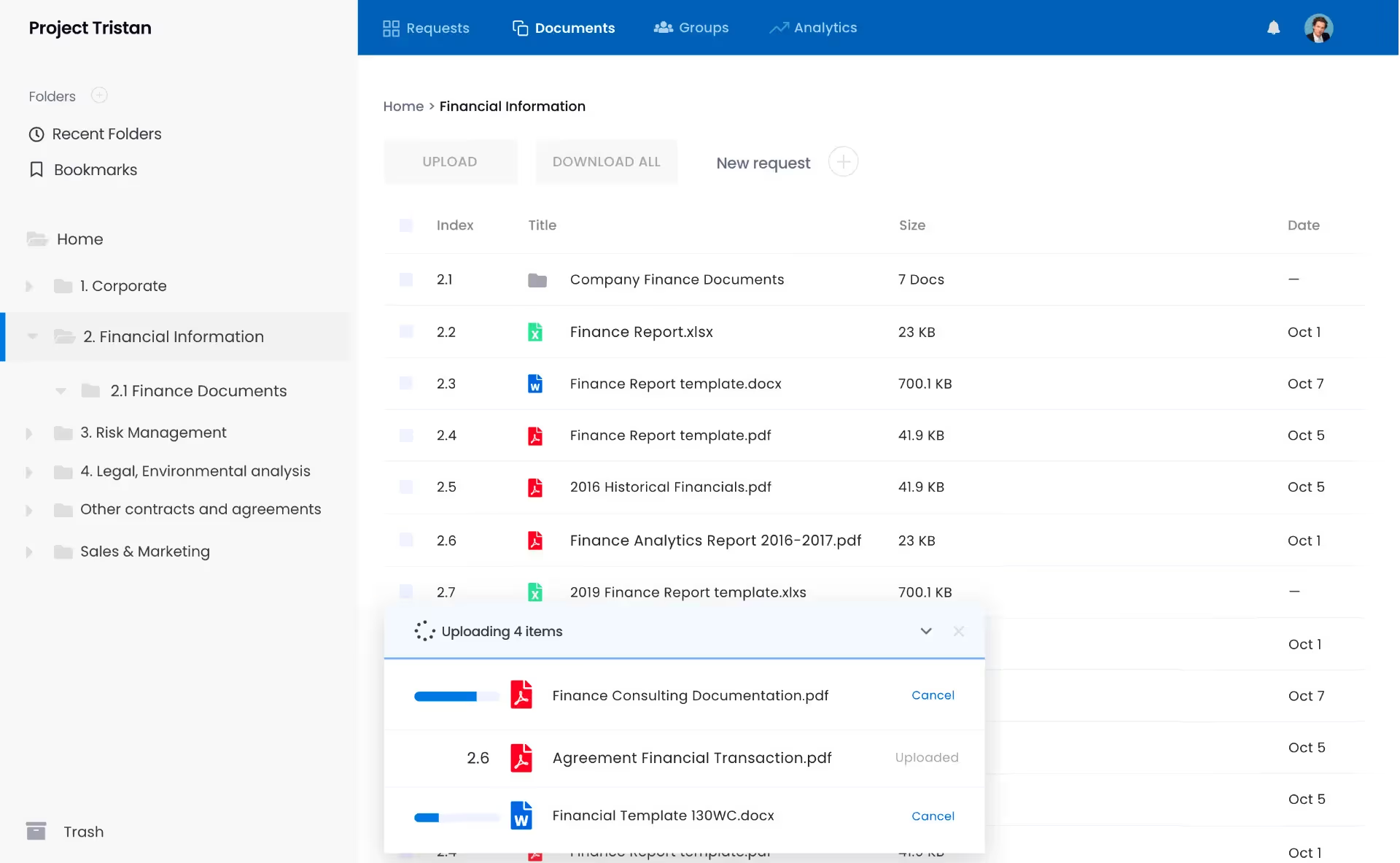

The Value of a Virtual Data Room in M&A Due Diligence

Bringing all this together is the legal virtual data room (VDR), an integral part of due diligence. The best VDRs have been shown to add considerable value by providing more organization, transparency and speed to the process.

Anybody undertaking due diligence would be strongly advised to make investing in a virtual data room their first step.

Check also

Virtual Data Room for Legal Due Diligence

Final Due Diligence Report

When every aspect of due diligence has been completed, the findings of the due diligence team (or teams) will be compiled in a final due diligence report and shared with the management of the acquiring company.

Read also

Download due diligence report template

The document outlines all of the checks which were undertaken, summarizes any current or potential issues that warrant attention, as well as outlining which parts of the business are in rude health. Ultimately, this is not entirely different from an auditor’s report in that the due diligence team conducts an in-depth analysis before providing a recommendation based on their findings.

In general terms, the recommendations will be one of the following:

- All aspects of due diligence indicate that the business represents a good investment

- Some issues were revealed by due diligence which need to be addressed before the acquisition can proceed

- Some information remains undisclosed and the due diligence team cannot make an informed recommendation without obtaining this information

- The deal should be abandoned based on issues encountered during due diligence

Common Due Diligence Challenges

Nothing valuable comes easy.

That’s the logic behind due diligence. In a sense, an in-depth due diligence process should bring challenges. It comes with the territory.

Below, we look at some of the challenges that DealRoom has witnessed across hundreds of M&A transactions over the years.

Common due diligence challenges

- Not knowing what questions to ask

- Inadequate technology

- Poor communication

- Slowness of execution

- Unplanned costs

- Lack of expertise

- Team buy-in

- Incomplete information

- Sunk Costs

- Using information gathered to make an accurate valuation

Key Takeaways

Look for due diligence failures in the literature on mergers and acquisitions and the same 10 to 15 deals are mentioned over and over: Nextel and Sprint, Quaker Oats and Snapple, Daimler and Chrysler… all the usual suspects.

How does an industry of almost US$80 trillion spread across almost 1 million deals in the past 20 years have so few due diligence failures?

The likely answer to the question is that nobody wants to admit their due diligence failure when it’s easier to blame other factors such as slow integration, complicated market environments or issues of culture.

The reality is that good due diligence would have identified and highlighted these issues before the transaction had even reached the negotiation phase.

This is in a nutshell why the due diligence process - and by extension, due diligence enhanced by a virtual data room - is so necessary. Any managers even thinking about an M&A transaction should make it an integral part of the process.

If the goal of M&A is to create value for your business, then the due diligence process maximizes the chances of this outcome.

%20(1).avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)