IPO Due Diligence Playbook

When planning an IPO, you want to ensure the sustainability of the business model. This requires a detailed due diligence process. Our due diligence template assures you’re looking in the right places. Book a playbook demo to explore — schedule a call with us and we will reach out to help you get started.

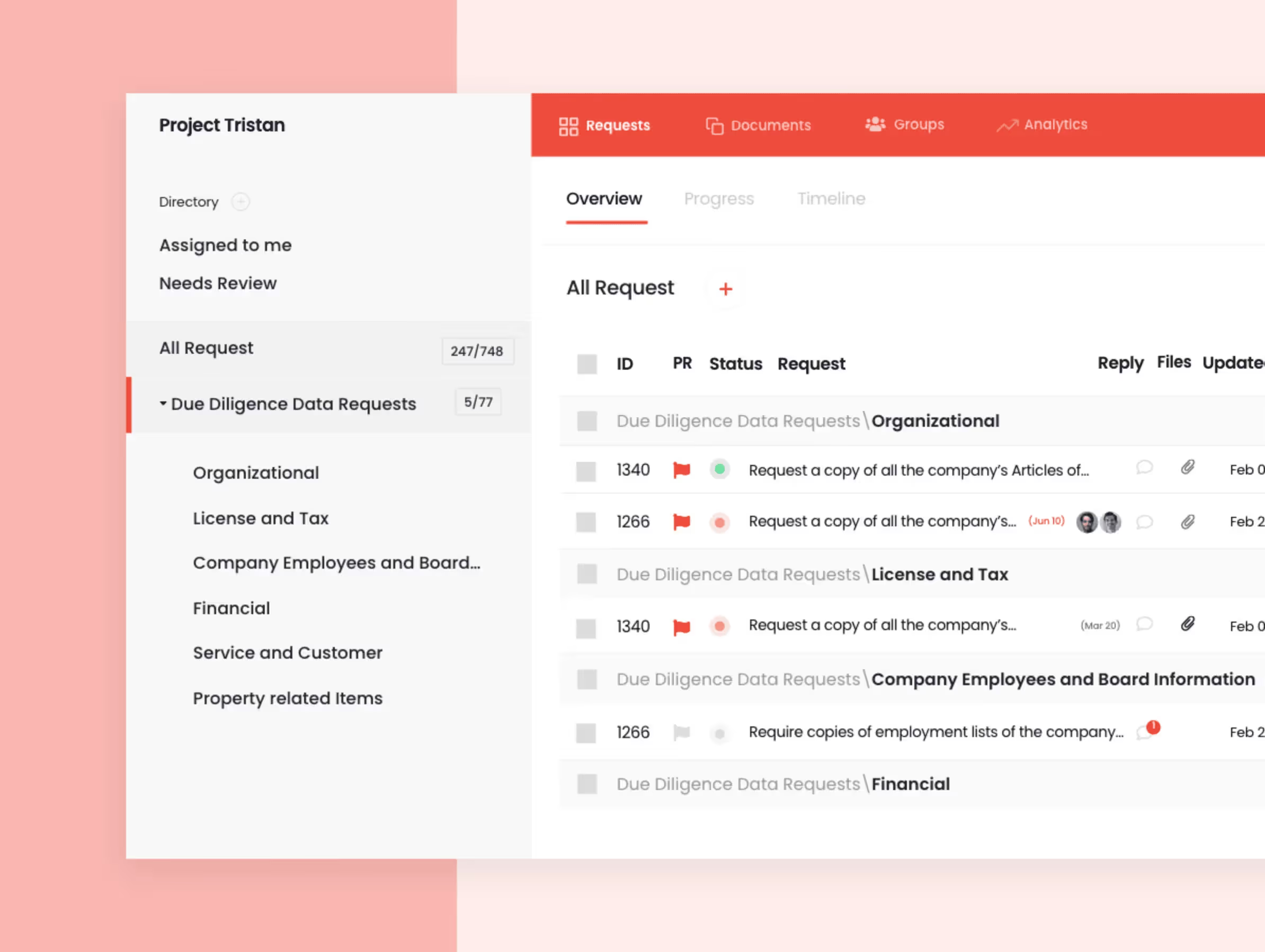

- Comprehensive IPO preparation

Manage every disclosure, filing, and compliance task required for a successful public offering—all in one secure workspace. - Regulatory readiness

Organize SEC filings, financial statements, and corporate records to ensure full transparency before your S-1 submission. - Cross-department coordination

Align finance, legal, and investor-relations teams with clear ownership and status tracking on every diligence item. - Version control and auditability

Keep all edits, approvals, and supporting documents linked to each request for complete traceability and faster reviews.

If your company operates in the life-sciences sector, see the Biotechnology Due Diligence Checklist, or strengthen your reporting foundation with the Financial Due Diligence Checklist.

.png)

.png)

.png)

.svg)

.svg)

.avif)