Every now and then, an investment banker should take time out to read some of the fantastic literature that exists on the field.

A frustration when looking for good books on investment banking is how many people consider books on trading to be investment banking.

And although there are some great books out there on trading, it’s all a long way from investment banking. With this in mind, we at DealRoom have put together the following list:

Best Books For Investment Bankers

- Barbarians at the Gate by Brian Burlough and John Helyar

- The Partnership: The Making of Goldman Sachs by Charles D. Ellis

- Buffett: The Making of an American Capitalist by Roger Lowenstein

- Principles by Ray Dalio

- The Essays of Warren Buffett: Lessons for Corporate America

- Silvio Berlusconi: Television, Power and Patrimony by Paul Ginsberg

- Hidden Champions of the Twenty-First Century by Hermann Simon

- The Accidental Investment Banker by Jonathan Knee

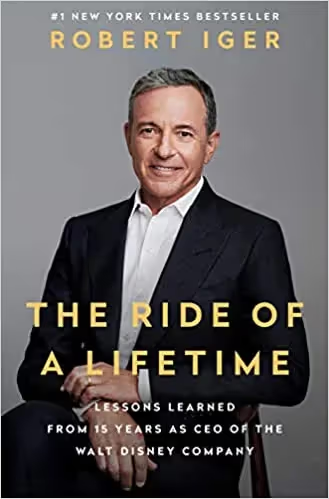

- The Ride of a Lifetime: Lessons Learned from 15 Years as the CEO of the Walt Disney Company by Rober Iger

- The Dark Side of Valuation by Aswath Damodaran

1. Barbarians at the Gate by Brian Burlough and John Helyar

This book is found on every list of recommended books for investment bankers. Now more than 30 years old, it says everything about its quality that it is still regarded as essential reading.

If you’re not familiar with the story by now, Borough and Helyar were two investigative journalists that went into some depths on the leveraged buyout of RJR Nabisco. The book provides valuable insights into fraught negotiations, valuations, egos getting in the way of decision making, and above all, the perils of too much leverage.

2. The Partnership: The Making of Goldman Sachs by Charles D. Ellis

It is difficult to believe now but Goldman Sachs was once the outsider on Wall Street. Author Charles D. Ellis follows its journey from here to the world’s undisputed leader of investment banking.

It never gets caught in the weeds and is replete with dozens of enlightening stories that emphasize the importance of serving the client, keeping egos in check, and creative solutions (such as paying the back of England to borrow its gold, so that GS could trade on it).

3. Buffett: The Making of an American Capitalist by Roger Lowenstein

No collection of books for investment bankers would be complete without a nod to the Sage of Omaha, Warren Buffett.

Although Lowenstein’s account predates Buffett’s autobiography by more than a decade, it is arguably an even better account of the Buffett story.

Lowenstein, for example, focuses far less on Buffett’s relationship with Bno and the Bill and Melinda Gates Foundation, and instead goes into the nitty gritty of how close the Coca-Cola Company came to going under in the 1980s.

4. Principles by Ray Dalio

Dalio is not an investment banker and nor is this a great book, so you would be forgiven for asking what it is doing on this list. It’s here because of Dalio’s ability to learn from every mistake to generate value.

Dalio took a ‘win or learn’ perspective to his work, which meant that even if he made damaging mistakes, he would at least come away in the knowledge that he would never make them again. His note taking process, outlined here in detail, is an example for everyone, investment bankers or not.

5. The Essays of Warren Buffett: Lessons for Corporate America

This is essentially a collection of Buffett’s writing from Berkshire Hathaway’s annual reports.

Some of the pieces of wisdom from the essays of Warren Buffett have been reprinted so many times that they have entered the popular lexicon (take “it’s only when the tide goes out that you learn who was swimming naked” as an example).

This is an enjoyable piece of writing that can be dipped into and out of at the reader’s leisure, every time providing a little piece of wisdom or two.

6. Silvio Berlusconi: Television, Power and Patrimony by Paul Ginsberg

Before disgraced former Italian Prime Minister Silvio Berlusconi became a figure of mirth, it is no exaggeration to say that the man was a business genius.

This warts and all account of his life looks at Berlusconi from all sides. What emerges is someone that was able to see obvious trends well before everyone else.

The deals that Berlusconi made in construction, media and sport, show what is possible when skillful negotiation meets thinking from a different perspective.

7. Hidden Champions of the Twenty-First Century by Hermann Simon

This is not a common book on investment bankers’ must-read lists. However, we have included it as Simon, a German management consultant, has looked at the ‘hidden champions’ of world industry:

Those companies that dominate certain industries, usually making billions of dollars in the process, without attracting any of the fanfare of more well-known names. Nobody will have heard of all the companies on his list, and the book changes how you think about winning companies.

8. The Accidental Investment Banker by Jonathan Knee

The Accidental Investment Banker is almost an anti-investment banker book (Knee, incidentally, is still an investment banker), so may not be popular with everyone.

That being said, anyone that has worked in investment banking is likely to find some of the stories highly entertaining and some will even remember some of the antics that surrounded the TMT side of the industry at the time of the turn of the century, that period being the major focus of this book.

9. The Ride of a Lifetime: Lessons Learned from 15 Years as the CEO of the Walt Disney Company by Rober Iger

One of the books on this list that isn’t about investment banking but does go through the thought process of the boss of Disney during its biggest deals over the past two decades.

One chapter, “Marvel and massive risks that make sense” captures the essence of this. Iger goes into some detail about how he saw the CEOs at the companies he acquired and how he approached them about acquisition. A fascinating insight into a master of the M&A craft.

10. The Dark Side of Valuation by Aswath Damodaran

Aswath Damodran is considered by many to be the father of modern valuation. In this book, the Stern School of Business professor of finance talks through approaches to the more challenging (‘the dark side’) valuations that we tend to come across: young, distressed and complex businesses.

Anyone familiar with Damodaran will know that he isn’t just a finance genius, he’s also a great communicator and this book is typical of his introducing complex themes to the reader in an easy-to-digest manner.

Frequently Asked Questions

What is the best investment banking book?

Many readers start with Investment Banking: Valuation, Leveraged Buyouts, and Mergers & Acquisitions by Joshua Rosenbaum and Joshua Pearl. It’s a clear, practical guide that walks through valuation techniques and deal structures used by professionals.

What do investment bankers read?

Investment bankers often read finance textbooks, market reports, and deal case studies. They also keep up with daily financial news from outlets like the Financial Times, The Wall Street Journal, and Bloomberg to stay informed on global markets.

Which books are best for beginners in investment banking?

Beginners often choose The Wall Street MBA by Reuben Advani and Investment Banking Explained by Michel Fleuriet. These books help readers understand the basics of valuation, deal-making, and industry roles.

How can I learn valuation for investment banking?

Valuation can be learned through guides like Investment Valuation by Aswath Damodaran and by practicing real-world financial modeling. Many analysts also use online valuation courses and practice with company case studies.

Are there books that explain mergers and acquisitions simply?

Yes. Mergers, Acquisitions, and Other Restructuring Activities by Donald DePamphilis simplifies the M&A process and gives examples from real transactions to help readers follow how deals are structured.

What are the most popular books among analysts at investment banks?

Analysts often refer to Investment Banking by Rosenbaum and Pearl, The Accidental Investment Banker by Jonathan A. Knee for insider stories, and Monkey Business by John Rolfe and Peter Troob for a lighter take on the culture.

Do investment bankers read about private equity too?

Yes. Many investment bankers read Private Equity at Work by Eileen Appelbaum and Rosemary Batt, or King of Capital by David Carey and John E. Morris to understand how deals move from banking to buyouts.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)