Built with ideas and feedback from hundreds of M&A professionals

Why Choose Dealroom?

By eliminating the tedious, manual operations and inefficient communication that typically plagues M&A due diligence, teams can focus on the kind of high-value activity that really moves the needle.

Request a demoThe Eight Ways DealRoom Disrupts the Industry

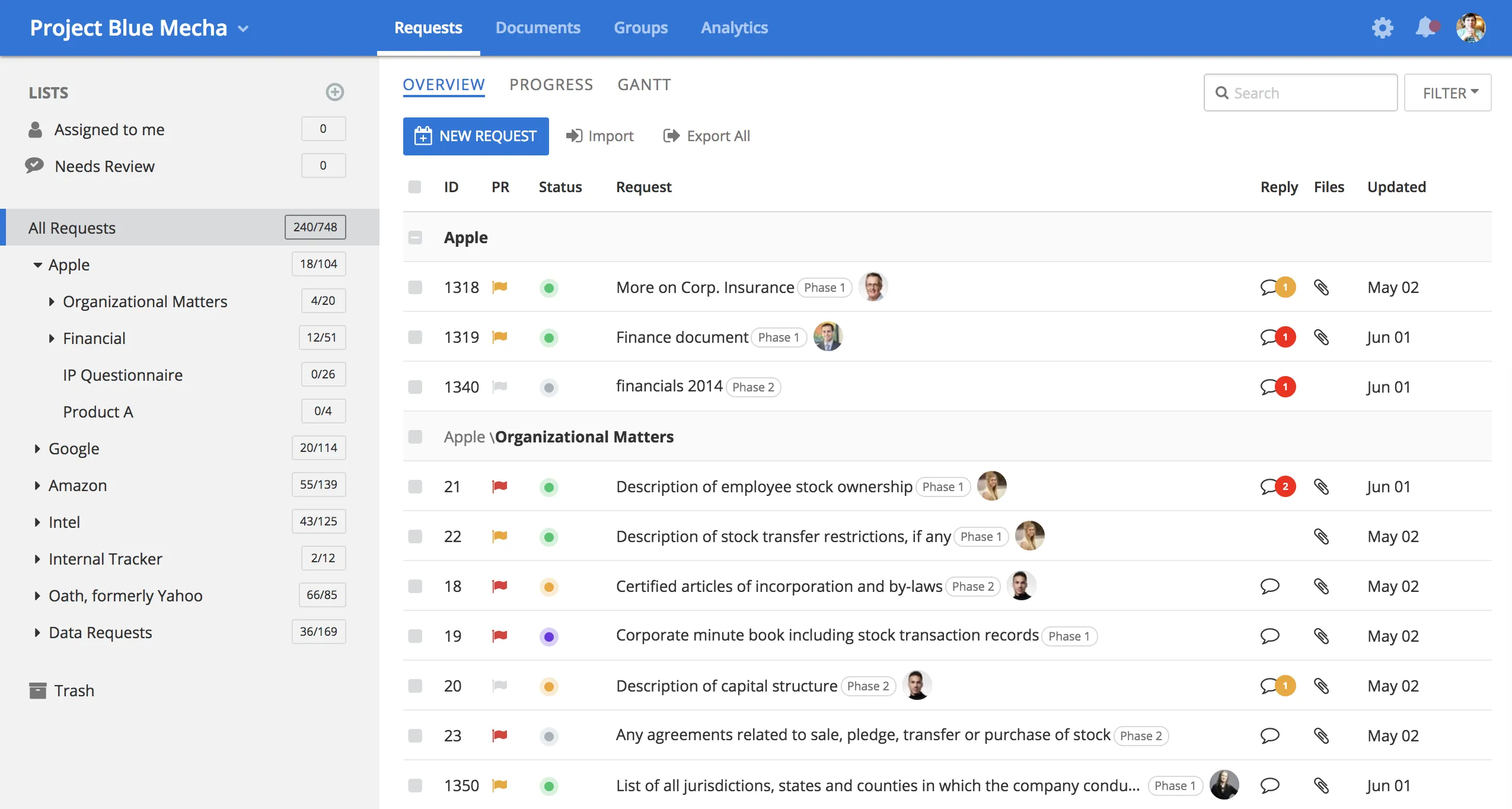

1. Simplified Process

The deal gets done faster by using one process management tools instead of spreadsheet trackers, emails and a data room due diligence. Communication is seamless and centralized within the system, and no external communication is required.

2. Reduced Cost

Per-page pricing is extremely expensive; this antiquated model was logical 20 years ago when vendors would come on-site and scan documents onto expensive servers. Today, costs are reduced significantly as cloud storage is 2.3 cents per G or 10,000 pages per month.

3. Faster Entry

It takes 20 minutes to train a person to set up a company profile, and then to get started with DealRoom's financial due diligence software.

4. Eliminate Work

Today’s team needs to work in sync so they can conduct comprehensive diligence with less redundancy. This reduces errors and shortens timelines by 40%, creating better results and reduces extra work.

5. Increased Collaboration

Integration starts very early in the process, as Integration leads should be in early conversations with the deal team as validators when value drivers are identified. Items during diligence should be tagged for integration consideration.

6. Focused Analytics

Analytics around diligence is much more valuable than just document tracking. Software for M&A management shows the precise activity on specific diligence issues. This identifies concerns and bottlenecks, and can help make better decisions when advising clients. Because all diligence functions are under the same application, information is captured that is otherwise missed when separate apps are used.

7. Reduced Distraction

The due diligence process can be distracting for the management teams during an M&A process. Duplicate requests, late requests and email overload can inundate the management team. They can lose focus on the business, and any loss of performance during the transaction can create concerns and possible renegotiation terms from the buyer.

8. Smarter System

The M&A software learns and automates the process, reducing work effort. The process is repeatable and consistent, adapting to surprises, changes and complexity.

.png)

.png)

.png)

.svg)

.svg)

.avif)