Although hedge funds rose to prominence in the 1990s, their history dates back nearly fifty years earlier. In 1949, economist Alfred Winslow Jones created a market-neutral portfolio that separated two risks: market (economy-wide) risk and idiosyncratic (industry-specific) risk.This enabled him to go long on equities that he predicted would rise with the market while also going short on stocks that he believed would move in the opposite direction. This “hedging” strategy became the foundation for the first hedge fund.

In 2023, the global hedge fund market was valued at approximately $5 trillion and is expected to grow by more than 3.5% between 2024 and 2032. Despite having a reputation as a “closed corner” of the finance industry, it employs nearly 80,000 people in the US alone, making it one of the field’s largest employers.

If you want to join those ranks, keep reading! We’ll go through what working in the hedge fund sector is like and the potential roles and career growth opportunities.

Looking to learn more about finance, M&A, and corporate development? Subscribe to the M&A Science podcast.

What are hedge funds and how do they work?

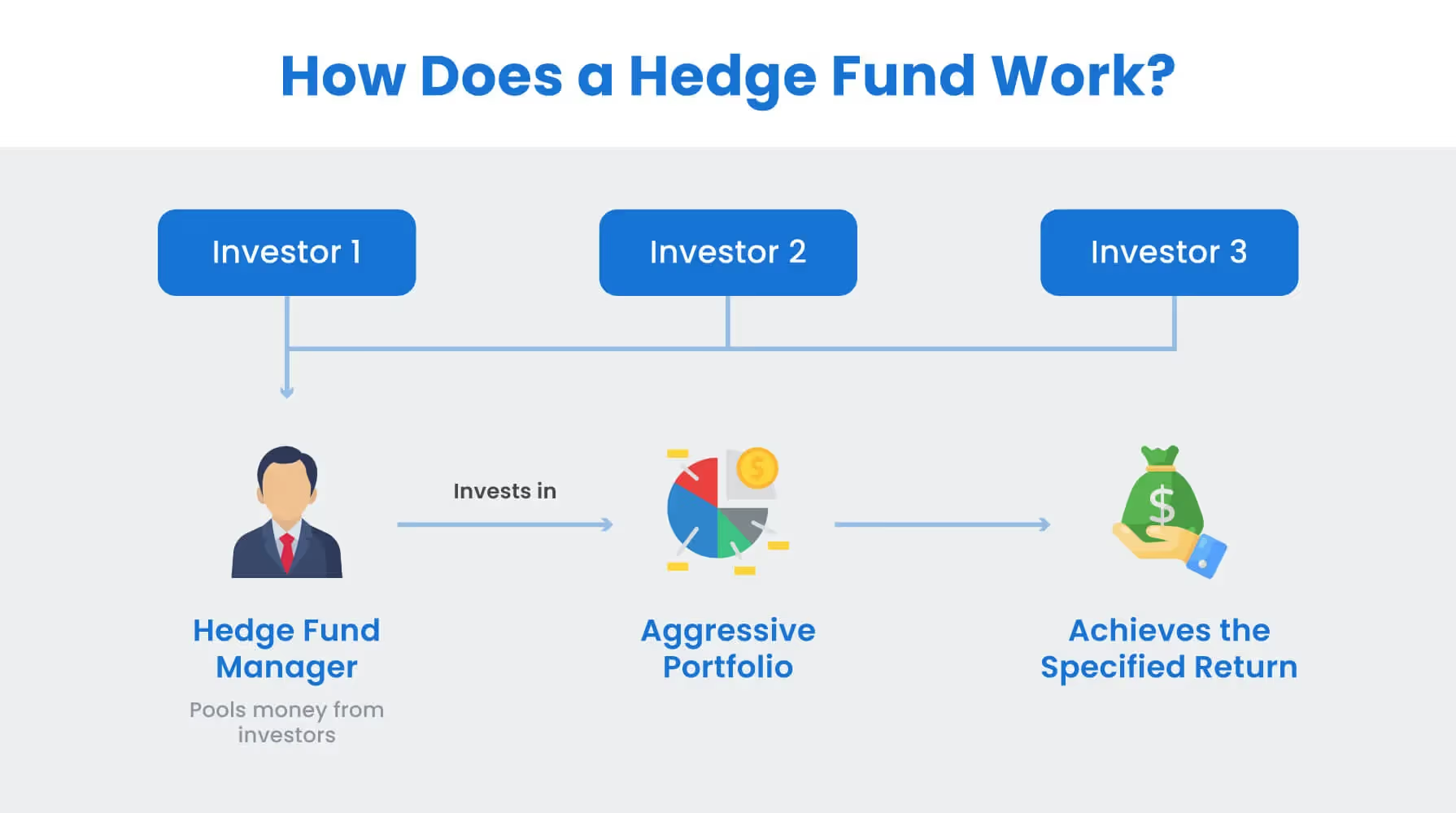

A hedge fund is a pooled investment fund that invests cash and other liquid assets to maximize returns. The emphasis is on eliminating risk to arrive at arbitrate (“risk-free”) profits. To do this, hedge funds go long on some assets and short on others while also employing investment strategies like leverage and derivative instruments.

Despite the goal of minimizing risk, these methods are still a risky way of generating profit. Individual fund performance can vary; however, the average growth of US hedge funds has been more than 6% per year over the past decade.

How hedge funds are structured

Hedge funds are typically set up as limited partnerships, with the manager of the fund serving as the general partner (GP) and the investors as limited partners (LPs). The GP/hedge fund manager is responsible for investing the assets in the fund and managing the fund portfolio. To participate, investors must meet the fund’s eligibility requirements (usually via qualified purchaser status) and pay annual and management fees.

Skills required to work at a hedge fund

Hedge fund professionals, even those in entry-level roles, need strong quantitative skills. They should also possess deep knowledge of the following:

Market fluctuations

It’s one thing to be quantitative—it’s another to know how markets may react to specific economic changes, as they don’t always react rationally. If your colleagues say a market is going up, but you think otherwise and can prove it, this can be a huge asset to you and the fund.

Financial instruments

Hedge fund employees must understand the differences between futures and forwards, derivatives and options, debt and equity, CDOs and ETFs, to effectively choose positions on events using various asset classes and financial products.

Portfolios

Portfolio construction involves understanding how risk functions. This skill set includes knowing how assets correlate to each other, how they behave under different conditions, and determining the appropriate allocation of each asset within the portfolio. While it may seem straightforward in theory, it can be hard in practice!

Hedge fund career path and roles

As you may have guessed, hedge funds draw most of their talent from quant backgrounds. The industry is full of individuals with bachelor’s degrees in fields like mathematics and physics, which is reflected in the kind of roles that fill the ranks of the typical hedge fund. Many hedge fund employees also have experience working in closely related fields such as asset management, mutual funds, equity research, investment banking, valuation, and business administration.

The most common hedge fund roles include:

Junior/Investment/Research Analyst

Like the junior/research/investment analyst position in other parts of the finance industry, this role is most frequently filled by new entrants to the field or recent graduates. Generally, the job requires a bachelor’s degree in a quantitative field, and advanced degrees are often preferred. In addition, candidates need to have a few years of experience under their belt.

Job duties include financial modeling, data analysis, and in-depth industry research. Research analysts also collaborate with portfolio managers, communicate findings and recommendations, monitor fund performance, and conduct due diligence.

Hedge Fund Analyst

The next step up the hedge fund career ladder is the hedge fund analyst position. This role comes with more independence and greater capacity to work on independent investment theses (e.g. in the event of extreme weather conditions, crops and flights will be adversely affected, but heating oil sales may benefit).

Analyst roles require strong quantitative and research skills. Like just about every other role in the hedge fund industry, it also requires at least a bachelor’s degree in a quant-heavy field. Excellent communication skills are also expected. The main duties of a hedge fund analyst include conducting heavy research into investment opportunities, monitoring risk, making recommendations to portfolio managers, and studying market factors and fluctuations.

Hedge Fund Senior Analyst/Associate

Once you reach the senior analyst level, you’re now responsible for creating arbitrage-generating investment theses. Most likely, you’ll specialize in a certain area (fixed income or private equity, or an industry specialization, for example), and pitch your ideas to portfolio managers (PMs).

The senior analyst/associate role serves as the bridge between the back-office research team and the PMs. Their findings and recommendations serve as the basis for investment decisions and trading strategies.

Portfolio Manager

The PM at a hedge fund has the final say on how funds are invested. In almost all cases, the PM will be a general partner (GP), whose own funds are also invested, enabling them to show outside investors that they have “skin in the game.”

Unlike other senior areas of finance, the role is not entirely customer-facing. The hedge fund portfolio manager has to possess serious quantitative analysis chops and spends most of their time managing daily asset trading, reporting on performance to investors, cultivating client relationships, and evaluating investment ideas.

Risk Manager

Depending on the structure and investment strategy of a hedge fund, the firm may have several risk management positions. However, almost all hedge funds will have at least one risk manager.

As the name suggests, their role involves assessing the risks involved with strategies developed by analysts and portfolio managers. If everyone on a hedge fund team is expected to have quantitative ability, the risk manager should have the most of all. Their responsibilities include implementing risk systems, conducting what-if analyses and stress testing, managing risk analytics, and working with PMs on investment strategies.

How to get a job at a hedge fund

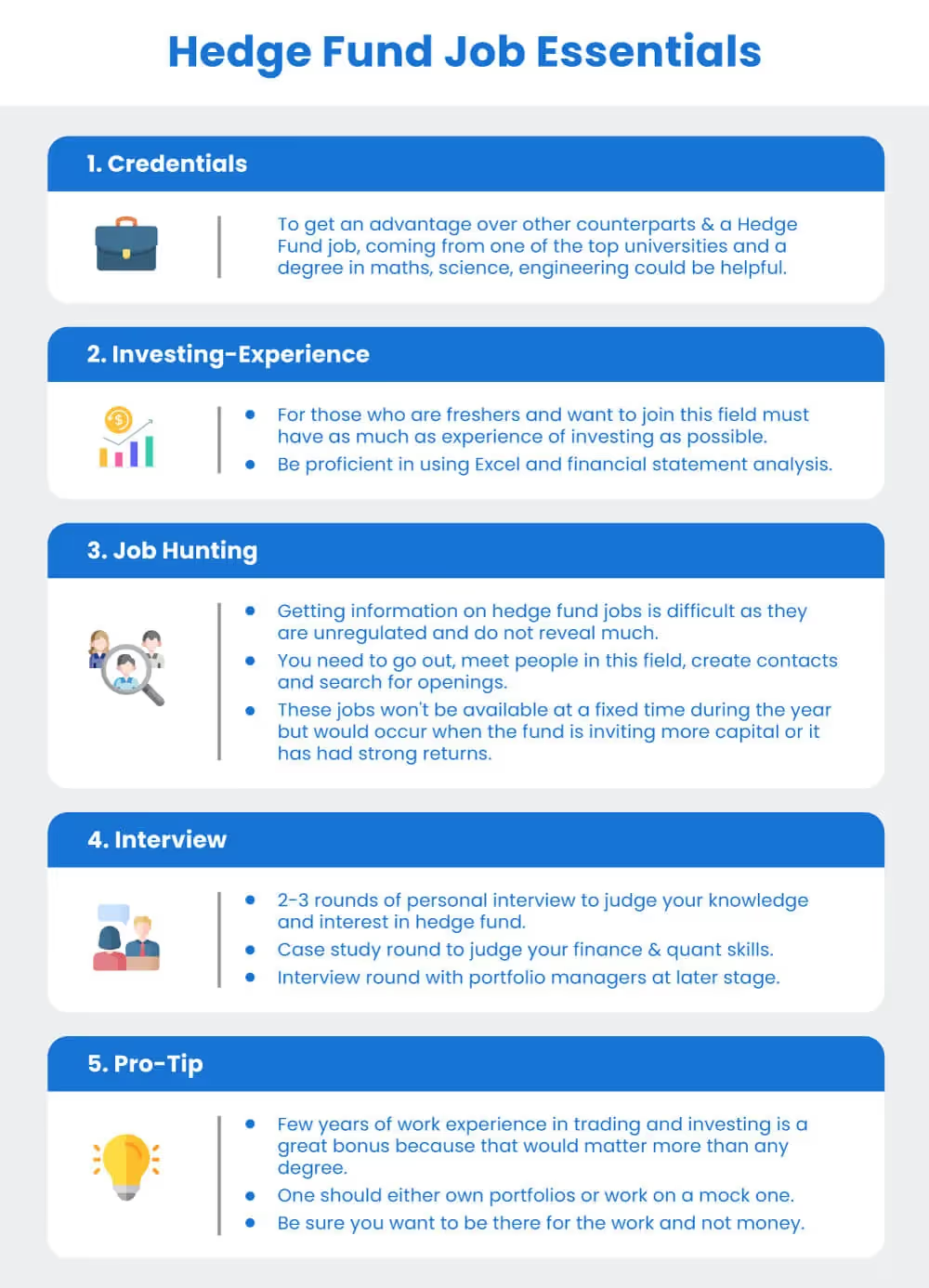

This is the million-dollar question! The first step to a hedge fund job is earning a bachelor’s degree in a quant-heavy field, ideally from a top-tier university. You might also consider pursuing a master’s degree or a chartered financial analyst (CFA) designation.

Because hedge funds don’t typically hire directly out of undergrad universities or MBA courses, your next step will be finding a job in a related field. You could work on the sales and trading floor of a major bank or mutual fund, become an equity research analyst, find a position on Wall Street, or work in investment banking.

Essentially, if you have a proven track record of successfully trading millions of dollars in assets, you’ve got an excellent chance of being headhunted by a hedge fund, or at least gaining an interview if you apply. To up your chances of finding your dream hedge fund job, seek out a mentor already working in the field. Many positions at these funds come via referrals and word-of-mouth.

How much do hedge fund employees earn?

Even entry-level hedge fund positions tend to pay well. For example, junior analysts receive an average of $81K annually. Hedge fund analysts earn between $75K and $120K in base salary and approximately $19K-35K in performance bonuses. Risk managers can expect to earn an annual salary of over $100K.

Senior analysts typically make over half a million dollars per year, and bonuses can bring their total compensation to twice that amount. At the peak of the career ladder sit portfolio managers, whose earnings come almost entirely from bonuses and are often in the millions of dollars, especially at top hedge funds.

Working at a hedge fund

Being an employee at a hedge fund comes with both pros and cons. A major pro is the high level of compensation. Others are the opportunity to work in an exciting industry and manage assets that value in the millions. You’ll get to solve exciting problems, advise clients, and develop hedge fund strategies. However, cons include long hours, high levels of stress, lack of work-life balance, and low job security.

A growing and competitive field

Not unlike other parts of the finance industry that have shown massive growth over the past twenty years, roles in the hedge fund industry are now highly sought after. Getting your foot in the door means you need to have serious quantitative capabilities and good intuition about where the markets are headed. But for those that can fit these criteria, the rewards are outstanding.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.png)

.png)

.png)

.svg)

.svg)

.avif)