Sell-Side Due Diligence Playbook

Being able to identify and correct risks associated with your own business eases the negotiation process and closes faster. Our sell-side due diligence playbook can help you get started on the right foot. Book a playbook demo to explore — schedule a call with us and we will reach out to help you get started.

What are the benefits of using this template?

Excel Export/Import

Export this template to Excel with just one click. Also, Import your Excel spreadsheet easily - turn it into a nice dealroom.net board.

Integrated with Data Room

The tasks tracker is integrated with the virtual data room, so you can start collecting documents right away.

Easy Tracking

Track your projects progress from start to finish, know if a task is stuck or behind schedule.

Eliminate Excel trackers, emails and disconnected tools with DealRoom

What Tasks does the

Sell-Side Due Diligence Playbook

Include

Legal

- Collect all information about the company’s structure, including: an organizational chart, Governing and constitutional documents of the corporation, a list of jurisdictions in which the business is permitted to do business, minutes of any board, shareholder, and managerial meetings

- List all related party transactions

- Include the firm’s policies with respect to related party transactions

- Compile the CVs for all board members, managers, and vital employees

- Compile all information about the capital structure of the company that is not included on the Statement of Shareholder Equity

- Compile a list of all of the firm’s permits, licenses, and authorizations

- Describe the firm’s compliance policies and provide any related documentation

- Disclose if any officers or persons holding substantial numbers of shares qualify as Bad Actors

- Disclose if the firm is currently restricted from doing business under any regulatory or legal provision

- Collect any communications with a regulatory agency

- Include a list of all previous product recalls and significant warranty claims

Tax

- Summary of the results of all tax audits conducted in the past 5 years, including the resolution of any findings.

- Summary of all property taxes paid by the Target in the past 5 years.

- Copies of all federal, state and local tax returns of the Target for the past 5 years.

- Copies of all material communications and agreements between the Target and any taxing authority for the preceding 5 years.

- Copies of any tax sharing, tax allocation or related inter-company agreements.

- Summary of all deferred tax assets, valuation allowances and deferred tax liabilities.

- Summary of all policies regarding taxes, including transfer pricing policies and any present or past transfer pricing audits.

- Summary of any loss surrenders made in return for R&D tax credits paid by the relevant tax authority.

- Summary of any tax assets (e.g. carried forward trading or capital losses, excess management expenses), including details of how they are reflected in the statutory accounts.

- Summary of any sale and leaseback transactions.

- Summary of any overseas activities and the tax filing position in respect thereto, including a Summary of any matters under investigation by a relevant taxing authority.

- Please details regarding the tax base cost of major assets where their base cost is other than original cost.

Marketing

- Please provide copies of any strategic plans prepared for the Target.

- Please provide copies of any marketing/advertising plans prepared for the Target.

- Please provide a summary of anticipated new products and/or product improvements.

- Please provide copies of all brochures, presentations, sales sheet, and other advertising and/or marketing materials.

- Please provide product descriptions for all material products and product lines.

- Please provide a summary of all ongoing R&D projects, including an estimated timeline for completion thereof.

- Please provide a summary of all marketing risks and opportunities identified by the Target.

Commercial

- List of the top 25 customers for each of the past 3 years, including revenue.

- List of all material customers that have ceased doing business with the Target in the past 12 months.

- List of all material sales channel partners for each of the past 3 years.

- Breakdown of sales and gross profits by: Product Type; Geography; Sales Channel.

- Copies of all material customer contracts.

- Copies of all contracts with material sales channel partners

- Copies of all contracts with government customers.

- Copies of all material contracts that have remaining terms longer than one year.

- Copies of policies and procedures related to credits, returns, warranty claims, etc.

- Copies of policies and procedures related to pricing.

- Copies of any strategic plans.

- Copies of any marketing/advertising plans.

- Summary of anticipated new products and/or product improvements.

- Copies of all brochures, presentations, sales sheet, and other advertising and/or marketing materials.

- Product descriptions for all material products and product lines.

- Summary of all ongoing R&D projects, including an estimated timeline for completion thereof.

- Summary of all marketing risks and opportunities.

Financial

- Copies of audited financial statements and each subsidiary and affiliates.

- Copies of unaudited financial statements.

- Detailed description of any off-balance sheet/statement of financial position items, liabilities or obligations of any nature.

- Schedule and description of any contingent liabilities not disclosed or referred to in the financial statements.

- Detailed schedule of the components of all prepaid expenses and deposits.

- Copies of any letters issued by the Target’s auditors during the last 5 years regarding the Target’s accounting controls, method of accounting and other procedures, including all Management Representation Letters.

- Summary of all material changes to accounting policies adopted.

- Copies of all budgets and operating plans.

- Copies of all financial projections.

- Summary of any cash management controls and practices.

- Summary of the Target's investment policies.

- Summary of the Target's hedging policies.

- Report reflecting all aged accounts receivable trial balances.

- Summary of the Target’s inventory costing system and other procedures and policies related to inventory.

- Schedule and detailed description of any reserves/contingency funds established for specific risk situations.

Information Technology (IT)

- Details of any current and planned IT initiatives/key projects.

- Summary of all key IT resources.

- Summary of the Target's policies and practices regarding the purchase and maintenance of software.

- Summary of all material software utilized by the Target.

- Summary of the Target's policies and practices regarding the purchase and maintenance of IT hardware.

- Summary of all material hardware utilized by the Target, including the physical location thereof.

- Diagram of the Target's technical architecture including servers, storage devices, operating systems and databases.

- Description of the networking systems utilized by the Target.

- Summary of any specific hardware configurations utilized.

- Summary of any vendor support or other support services to which the Target is entitled.

- Summary of annual costs associated with maintenance of IT hardware for the past 3 years.

- Copies of all material contracts related to software and/or IT services obtained by the Company.

- Summary of services provided by all external IT contractors/consultants.

- Describe the capacity for growth in the Target's current IT environment.

- Summary of how technology acquired by the Target.

- Summary of the Target's support/help desk effectiveness and approach.

- Summary of the role of technology/IT in the Target's strategic plan.

- Describe the level of automation made possible via the Target's IT systems.

- Description of any web-based or internet facing applications hosted.

- Description of the key security protocols adopted by the Target.

- Description of the Target's policies and procedures related to backups and/or disaster recovery.

- Description of the Target's data privacy policies and procedures.

- Summary of all personal and/or sensitive information held and/or processed by the Target.

- Results of any stress test analysis undertaken by the Target.

- Summary of all monitoring measures/tests conducted.

Intellectual Property (IP)

- Compile a summary of all of the firm’s trademarks, patents, copyrights, and web domains and sites

- List all agreements and contracts under which the firm is granted the use of a third party’s intellectual property

- List all agreements and contracts under which a third party is granted the use of the firm’s intellectual property

- List all intellectual property used by the firm that is not solely owned by the firm

- Create a summary of all intellectual property litigation involving the firm that is either concluded, ongoing, or reasonably foreseeable

- List all instances in which a third party has infringed on the firm’s intellectual property (even if it did not result in litigation)

- Describe the company’s process for developing and protecting its intellectual property

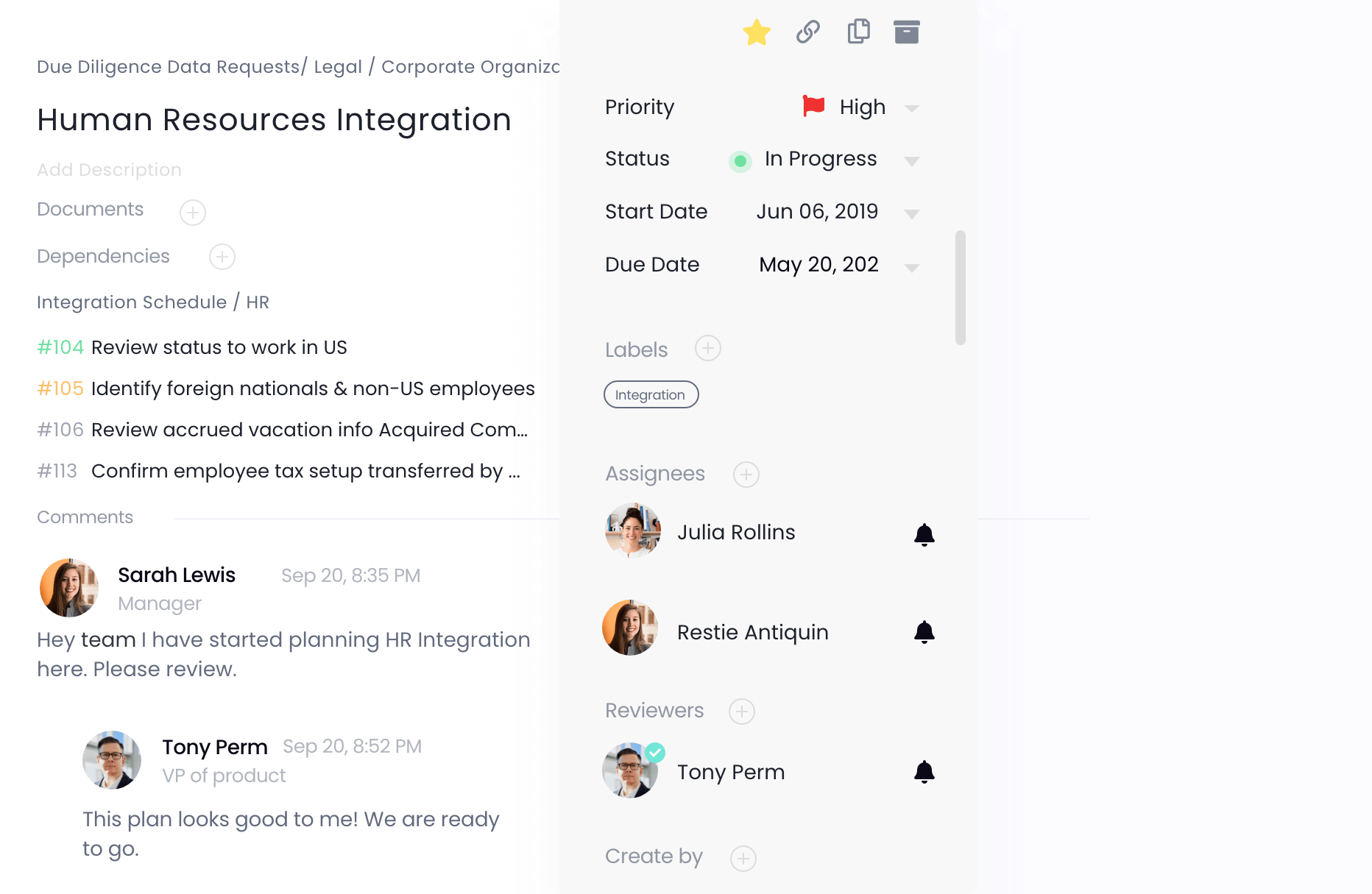

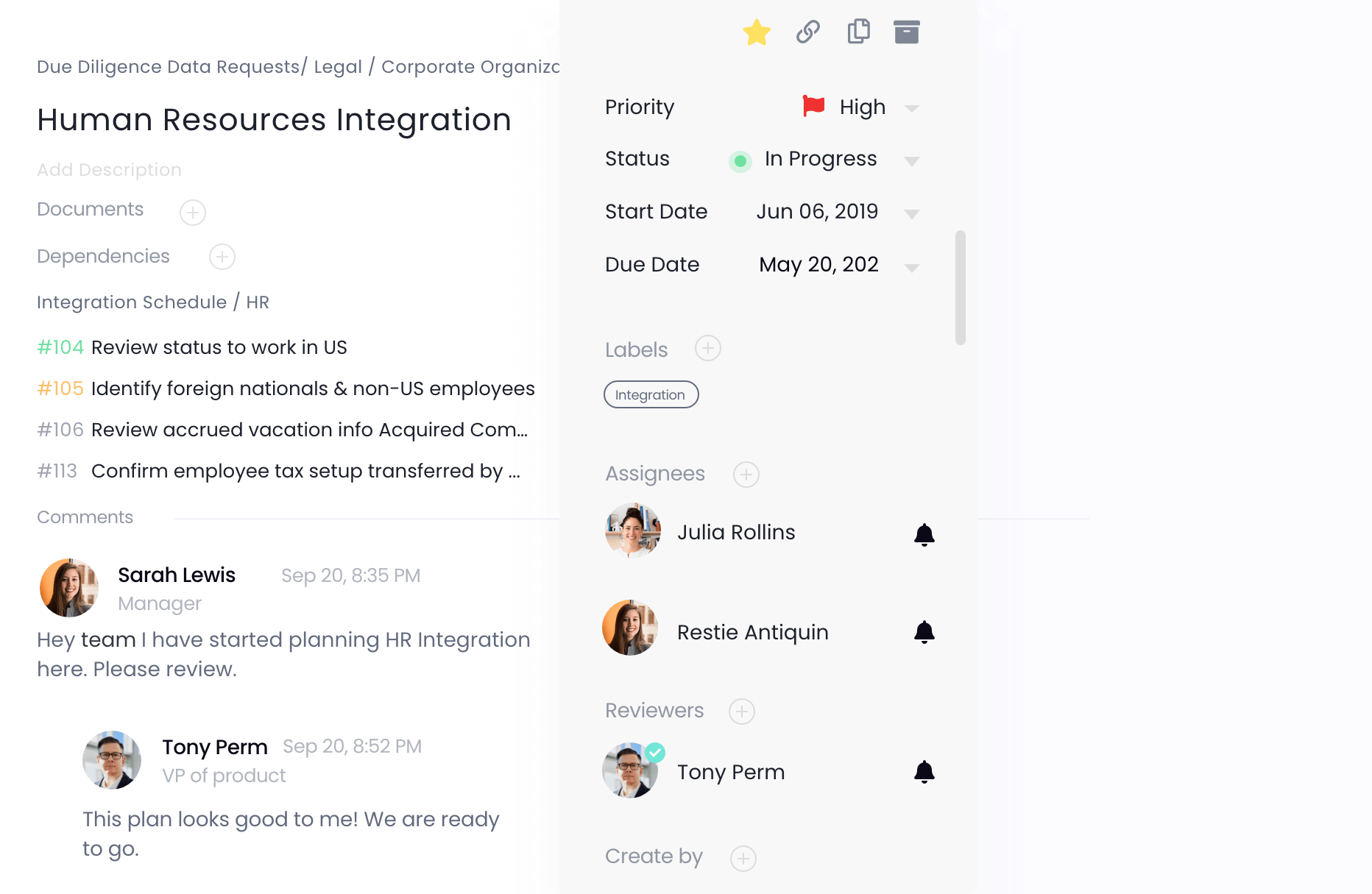

Human Resources

- Obtain a list of current employees and/or independent contractors

- Obtain employee rules of conduct handbooks and safety policies

- Determine which employees should stay with the company

- Review past employee disputes and future problems

- Review employee and/or independent contractor agreements

- Review employee health insurance and retirement plans

- Obtain a list of employee grievances and complaints

- Evaluate policies about labor unions

- Check for pending labor disputes or lawsuits

- Review workplace accidents and/or worker's compensation claims in the past five years

- Obtain documents and/or videos of new hire orientation and training sessions

- Review policies about sick days, paid holidays, paid vacations and overtime pay

- Review policies about bonuses, incentives, commissions and deferred compensation

- Evaluate emergency training and recovery plans

FAQ

What Is Due Diligence?

Due diligence is a critical aspect of any deal that begins very early in the process and can continue right up until closing. During due diligence, the potential buyer asks questions and requests documentation from the seller that helps the buyer understand the target company and its business. These requests are usually general to start and become more specific as the buyer develops a greater understanding of the target. Buyers use the information provided by the seller to evaluate the opportunities and risks associated with the potential transaction. It is important for sellers to stay organized throughout the process. Buyers often submit thorough, detailed request lists that require input from numerous members of the seller’s deal team.

What is a due diligence checklist?

As the name implies, a due diligence request list is a list of questions and requests for information and documentation that a buyer submits to a seller in order to learn about the target company, its business and its operations. The initial diligence request list tends to be broad and typically includes an extensive list of questions covering a wide range of subjects. This allows the buyer to gain a broad understanding of the target company and identify key issues that can be investigated and considered more closely. Because every deal is different, due diligence request lists have to be tailored to meet the needs of the buyer and address the unique circumstances of your transaction.

However, there is a variety of fundamental requests that are relevant in most deals. These are the types of requests that our templates are designed to address.

What Questions Does the Master Due Diligence Questionnaire Include?

As the name implies, a due diligence request list is a list of questions and requests for information and documentation that a buyer submits to a seller in order to learn about the target company, its business and its operations. The initial diligence request list tends to be broad and typically includes an extensive list of questions covering a wide range of subjects. This allows the buyer to gain a broad understanding of the target company and identify key issues that can be investigated and considered more closely. Because every deal is different, due diligence request lists have to be tailored to meet the needs of the buyer and address the unique circumstances of your transaction.

However, there is a variety of fundamental requests that are relevant in most deals. These are the types of requests that our templates are designed to address.

Key considerations when using our m&a due diligence template

Our templates are drafted to provide an inclusive and wide-ranging list of initial due diligence requests. However, the templates, as well as the information contained therein, are not legal advice. They are not complete, and they are not specific to your transaction. The templates are designed to elicit general information from the seller that will provide the buyer with a broad overview of the target and it’s business and operations. You should review any template before using it, and it may need to be modified to ensure that it is suitable and relevant to your circumstances. Information provided by the seller will likely trigger additional questions that focus on specific aspects of the target’s business and issues identified during the due diligence process.

Are the requests in the template comprehensive?

No. Our Due Diligence Checklist is drafted to include typical requests that are relevant in most transactions. However, every deal and every target company is unique. Before utilizing any template, it is important that you review it with the help of your legal and other professional advisors to ensure that the requests are complete and tailored to the specific circumstances of your deal.

How to use the template with Dealroom

- Start 14-day Free Trial of DealRoom and sign-up

- Select a Master Due Diligence Template while creating a new room

- Start assigning, adding to, and completing due diligence requests with needed documents by uploading them into the built-in virtual data room. The Requests tab is automatically populated with the requests from the due diligence template.

Can I change requests in this checklist or add new?

Every M&A process is different. Downloaders are urged to make these checklists their own by changing the providing information to better fit their needs.

Does this questionnaire provide all the necessary integration information?

This checklist was created by and for M&A professionals. It includes a comprehensive starting point for the integration process. However, every deal is different and may require additional requirements and tasks.

How to use this template with DealRoom?

- Start 14-day Free Trial of DealRoom and sign-up

- Select an Integration Template while creating a new workspace

- Start planning, assigning, adding to, and completing integration tasks. The Requests tab is automatically populated with the tasks from the integration template.

Key considerations when using our m&a due diligence template

Our templates are drafted to provide an inclusive and wide-ranging list of initial due diligence requests. However, the templates, as well as the information contained therein, are not legal advice. They are not complete, and they are not specific to your transaction. The templates are designed to elicit general information from the seller that will provide the buyer with a broad overview of the target and it’s business and operations. You should review any template before using it, and it may need to be modified to ensure that it is suitable and relevant to your circumstances. Information provided by the seller will likely trigger additional questions that focus on specific aspects of the target’s business and issues identified during the due diligence process.

Are the requests in the template comprehensive?

No. Our Due Diligence Checklist is drafted to include typical requests that are relevant in most transactions. However, every deal and every target company is unique. Before utilizing any template, it is important that you review it with the help of your legal and other professional advisors to ensure that the requests are complete and tailored to the specific circumstances of your deal.

How to use the template with Dealroom

- Start 14-day Free Trial of DealRoom and sign-up

- Select a Master Due Diligence Template while creating a new room

- Start assigning, adding to, and completing due diligence requests with needed documents by uploading them into the built-in virtual data room. The Requests tab is automatically populated with the requests from the due diligence template.

Sell-Side Due Diligence Playbook

Being able to identify and correct risks associated with your own business eases the negotiation process and closes faster. Our sell-side due diligence playbook can help you get started on the right foot. Book a playbook demo to explore — schedule a call with us and we will reach out to help you get started.

Sell-Side Due Diligence Playbook

Being able to identify and correct risks associated with your own business eases the negotiation process and closes faster. Our sell-side due diligence playbook can help you get started on the right foot. Book a playbook demo to explore — schedule a call with us and we will reach out to help you get started.

Utilizing a checklist is just step one. In order to have a seamless process, M&A checklists need to be utilized with the proper deal workflow tool.

Request a demo to learn how you can turn a checklist into an automated process and workflow with the DealRoom platform. With DealRoom, you can tackle any type of due diligence.

- Collect all information about the company’s structure, including: an organizational chart, Governing and constitutional documents of the corporation, a list of jurisdictions in which the business is permitted to do business, minutes of any board, shareholder, and managerial meetings

- List all related party transactions

- Include the firm’s policies with respect to related party transactions

- Compile the CVs for all board members, managers, and vital employees

- Compile all information about the capital structure of the company that is not included on the Statement of Shareholder Equity

- Compile a list of all of the firm’s permits, licenses, and authorizations

- Describe the firm’s compliance policies and provide any related documentation

- Disclose if any officers or persons holding substantial numbers of shares qualify as Bad Actors

- Disclose if the firm is currently restricted from doing business under any regulatory or legal provision

- Collect any communications with a regulatory agency

- Include a list of all previous product recalls and significant warranty claims

- Summary of the results of all tax audits conducted in the past 5 years, including the resolution of any findings.

- Summary of all property taxes paid by the Target in the past 5 years.

- Copies of all federal, state and local tax returns of the Target for the past 5 years.

- Copies of all material communications and agreements between the Target and any taxing authority for the preceding 5 years.

- Copies of any tax sharing, tax allocation or related inter-company agreements.

- Summary of all deferred tax assets, valuation allowances and deferred tax liabilities.

- Summary of all policies regarding taxes, including transfer pricing policies and any present or past transfer pricing audits.

- Summary of any loss surrenders made in return for R&D tax credits paid by the relevant tax authority.

- Summary of any tax assets (e.g. carried forward trading or capital losses, excess management expenses), including details of how they are reflected in the statutory accounts.

- Summary of any sale and leaseback transactions.

- Summary of any overseas activities and the tax filing position in respect thereto, including a Summary of any matters under investigation by a relevant taxing authority.

- Please details regarding the tax base cost of major assets where their base cost is other than original cost.

- Please provide copies of any strategic plans prepared for the Target.

- Please provide copies of any marketing/advertising plans prepared for the Target.

- Please provide a summary of anticipated new products and/or product improvements.

- Please provide copies of all brochures, presentations, sales sheet, and other advertising and/or marketing materials.

- Please provide product descriptions for all material products and product lines.

- Please provide a summary of all ongoing R&D projects, including an estimated timeline for completion thereof.

- Please provide a summary of all marketing risks and opportunities identified by the Target.

- List of the top 25 customers for each of the past 3 years, including revenue.

- List of all material customers that have ceased doing business with the Target in the past 12 months.

- List of all material sales channel partners for each of the past 3 years.

- Breakdown of sales and gross profits by: Product Type; Geography; Sales Channel.

- Copies of all material customer contracts.

- Copies of all contracts with material sales channel partners

- Copies of all contracts with government customers.

- Copies of all material contracts that have remaining terms longer than one year.

- Copies of policies and procedures related to credits, returns, warranty claims, etc.

- Copies of policies and procedures related to pricing.

- Copies of any strategic plans.

- Copies of any marketing/advertising plans.

- Summary of anticipated new products and/or product improvements.

- Copies of all brochures, presentations, sales sheet, and other advertising and/or marketing materials.

- Product descriptions for all material products and product lines.

- Summary of all ongoing R&D projects, including an estimated timeline for completion thereof.

- Summary of all marketing risks and opportunities.

- Copies of audited financial statements and each subsidiary and affiliates.

- Copies of unaudited financial statements.

- Detailed description of any off-balance sheet/statement of financial position items, liabilities or obligations of any nature.

- Schedule and description of any contingent liabilities not disclosed or referred to in the financial statements.

- Detailed schedule of the components of all prepaid expenses and deposits.

- Copies of any letters issued by the Target’s auditors during the last 5 years regarding the Target’s accounting controls, method of accounting and other procedures, including all Management Representation Letters.

- Summary of all material changes to accounting policies adopted.

- Copies of all budgets and operating plans.

- Copies of all financial projections.

- Summary of any cash management controls and practices.

- Summary of the Target's investment policies.

- Summary of the Target's hedging policies.

- Report reflecting all aged accounts receivable trial balances.

- Summary of the Target’s inventory costing system and other procedures and policies related to inventory.

- Schedule and detailed description of any reserves/contingency funds established for specific risk situations.

- Details of any current and planned IT initiatives/key projects.

- Summary of all key IT resources.

- Summary of the Target's policies and practices regarding the purchase and maintenance of software.

- Summary of all material software utilized by the Target.

- Summary of the Target's policies and practices regarding the purchase and maintenance of IT hardware.

- Summary of all material hardware utilized by the Target, including the physical location thereof.

- Diagram of the Target's technical architecture including servers, storage devices, operating systems and databases.

- Description of the networking systems utilized by the Target.

- Summary of any specific hardware configurations utilized.

- Summary of any vendor support or other support services to which the Target is entitled.

- Summary of annual costs associated with maintenance of IT hardware for the past 3 years.

- Copies of all material contracts related to software and/or IT services obtained by the Company.

- Summary of services provided by all external IT contractors/consultants.

- Describe the capacity for growth in the Target's current IT environment.

- Summary of how technology acquired by the Target.

- Summary of the Target's support/help desk effectiveness and approach.

- Summary of the role of technology/IT in the Target's strategic plan.

- Describe the level of automation made possible via the Target's IT systems.

- Description of any web-based or internet facing applications hosted.

- Description of the key security protocols adopted by the Target.

- Description of the Target's policies and procedures related to backups and/or disaster recovery.

- Description of the Target's data privacy policies and procedures.

- Summary of all personal and/or sensitive information held and/or processed by the Target.

- Results of any stress test analysis undertaken by the Target.

- Summary of all monitoring measures/tests conducted.

- Compile a summary of all of the firm’s trademarks, patents, copyrights, and web domains and sites

- List all agreements and contracts under which the firm is granted the use of a third party’s intellectual property

- List all agreements and contracts under which a third party is granted the use of the firm’s intellectual property

- List all intellectual property used by the firm that is not solely owned by the firm

- Create a summary of all intellectual property litigation involving the firm that is either concluded, ongoing, or reasonably foreseeable

- List all instances in which a third party has infringed on the firm’s intellectual property (even if it did not result in litigation)

- Describe the company’s process for developing and protecting its intellectual property

- Obtain a list of current employees and/or independent contractors

- Obtain employee rules of conduct handbooks and safety policies

- Determine which employees should stay with the company

- Review past employee disputes and future problems

- Review employee and/or independent contractor agreements

- Review employee health insurance and retirement plans

- Obtain a list of employee grievances and complaints

- Evaluate policies about labor unions

- Check for pending labor disputes or lawsuits

- Review workplace accidents and/or worker's compensation claims in the past five years

- Obtain documents and/or videos of new hire orientation and training sessions

- Review policies about sick days, paid holidays, paid vacations and overtime pay

- Review policies about bonuses, incentives, commissions and deferred compensation

- Evaluate emergency training and recovery plans

Prepare for your due diligence

DealRoom’s due diligence template for selling a business is designed to help teams have an efficient due diligence process from the beginning. By providing your team with a pre-made professional template, you can get a jump start on fulfilling diligence requests.

The template can act as a guide for common diligence requests categories such as finance, HR, marketing, legal, tax and more. And when you use a diligence tracker inside DealRoom, everything will be in one centralized space.

Legal

- Collect all information about the company’s structure, including: an organizational chart, Governing and constitutional documents of the corporation, a list of jurisdictions in which the business is permitted to do business, minutes of any board, shareholder, and managerial meetings

- List all related party transactions

- Include the firm’s policies with respect to related party transactions

- Compile the CVs for all board members, managers, and vital employees

- Compile all information about the capital structure of the company that is not included on the Statement of Shareholder Equity

- Compile a list of all of the firm’s permits, licenses, and authorizations

- Describe the firm’s compliance policies and provide any related documentation

- Disclose if any officers or persons holding substantial numbers of shares qualify as Bad Actors

- Disclose if the firm is currently restricted from doing business under any regulatory or legal provision

- Collect any communications with a regulatory agency

- Include a list of all previous product recalls and significant warranty claims

Tax

- Summary of the results of all tax audits conducted in the past 5 years, including the resolution of any findings.

- Summary of all property taxes paid by the Target in the past 5 years.

- Copies of all federal, state and local tax returns of the Target for the past 5 years.

- Copies of all material communications and agreements between the Target and any taxing authority for the preceding 5 years.

- Copies of any tax sharing, tax allocation or related inter-company agreements.

- Summary of all deferred tax assets, valuation allowances and deferred tax liabilities.

- Summary of all policies regarding taxes, including transfer pricing policies and any present or past transfer pricing audits.

- Summary of any loss surrenders made in return for R&D tax credits paid by the relevant tax authority.

- Summary of any tax assets (e.g. carried forward trading or capital losses, excess management expenses), including details of how they are reflected in the statutory accounts.

- Summary of any sale and leaseback transactions.

- Summary of any overseas activities and the tax filing position in respect thereto, including a Summary of any matters under investigation by a relevant taxing authority.

- Please details regarding the tax base cost of major assets where their base cost is other than original cost.

Marketing

- Please provide copies of any strategic plans prepared for the Target.

- Please provide copies of any marketing/advertising plans prepared for the Target.

- Please provide a summary of anticipated new products and/or product improvements.

- Please provide copies of all brochures, presentations, sales sheet, and other advertising and/or marketing materials.

- Please provide product descriptions for all material products and product lines.

- Please provide a summary of all ongoing R&D projects, including an estimated timeline for completion thereof.

- Please provide a summary of all marketing risks and opportunities identified by the Target.

Commercial

- List of the top 25 customers for each of the past 3 years, including revenue.

- List of all material customers that have ceased doing business with the Target in the past 12 months.

- List of all material sales channel partners for each of the past 3 years.

- Breakdown of sales and gross profits by: Product Type; Geography; Sales Channel.

- Copies of all material customer contracts.

- Copies of all contracts with material sales channel partners

- Copies of all contracts with government customers.

- Copies of all material contracts that have remaining terms longer than one year.

- Copies of policies and procedures related to credits, returns, warranty claims, etc.

- Copies of policies and procedures related to pricing.

- Copies of any strategic plans.

- Copies of any marketing/advertising plans.

- Summary of anticipated new products and/or product improvements.

- Copies of all brochures, presentations, sales sheet, and other advertising and/or marketing materials.

- Product descriptions for all material products and product lines.

- Summary of all ongoing R&D projects, including an estimated timeline for completion thereof.

- Summary of all marketing risks and opportunities.

Financial

- Copies of audited financial statements and each subsidiary and affiliates.

- Copies of unaudited financial statements.

- Detailed description of any off-balance sheet/statement of financial position items, liabilities or obligations of any nature.

- Schedule and description of any contingent liabilities not disclosed or referred to in the financial statements.

- Detailed schedule of the components of all prepaid expenses and deposits.

- Copies of any letters issued by the Target’s auditors during the last 5 years regarding the Target’s accounting controls, method of accounting and other procedures, including all Management Representation Letters.

- Summary of all material changes to accounting policies adopted.

- Copies of all budgets and operating plans.

- Copies of all financial projections.

- Summary of any cash management controls and practices.

- Summary of the Target's investment policies.

- Summary of the Target's hedging policies.

- Report reflecting all aged accounts receivable trial balances.

- Summary of the Target’s inventory costing system and other procedures and policies related to inventory.

- Schedule and detailed description of any reserves/contingency funds established for specific risk situations.

Information Technology (IT)

- Details of any current and planned IT initiatives/key projects.

- Summary of all key IT resources.

- Summary of the Target's policies and practices regarding the purchase and maintenance of software.

- Summary of all material software utilized by the Target.

- Summary of the Target's policies and practices regarding the purchase and maintenance of IT hardware.

- Summary of all material hardware utilized by the Target, including the physical location thereof.

- Diagram of the Target's technical architecture including servers, storage devices, operating systems and databases.

- Description of the networking systems utilized by the Target.

- Summary of any specific hardware configurations utilized.

- Summary of any vendor support or other support services to which the Target is entitled.

- Summary of annual costs associated with maintenance of IT hardware for the past 3 years.

- Copies of all material contracts related to software and/or IT services obtained by the Company.

- Summary of services provided by all external IT contractors/consultants.

- Describe the capacity for growth in the Target's current IT environment.

- Summary of how technology acquired by the Target.

- Summary of the Target's support/help desk effectiveness and approach.

- Summary of the role of technology/IT in the Target's strategic plan.

- Describe the level of automation made possible via the Target's IT systems.

- Description of any web-based or internet facing applications hosted.

- Description of the key security protocols adopted by the Target.

- Description of the Target's policies and procedures related to backups and/or disaster recovery.

- Description of the Target's data privacy policies and procedures.

- Summary of all personal and/or sensitive information held and/or processed by the Target.

- Results of any stress test analysis undertaken by the Target.

- Summary of all monitoring measures/tests conducted.

Intellectual Property (IP)

- Compile a summary of all of the firm’s trademarks, patents, copyrights, and web domains and sites

- List all agreements and contracts under which the firm is granted the use of a third party’s intellectual property

- List all agreements and contracts under which a third party is granted the use of the firm’s intellectual property

- List all intellectual property used by the firm that is not solely owned by the firm

- Create a summary of all intellectual property litigation involving the firm that is either concluded, ongoing, or reasonably foreseeable

- List all instances in which a third party has infringed on the firm’s intellectual property (even if it did not result in litigation)

- Describe the company’s process for developing and protecting its intellectual property

Human Resources

- Obtain a list of current employees and/or independent contractors

- Obtain employee rules of conduct handbooks and safety policies

- Determine which employees should stay with the company

- Review past employee disputes and future problems

- Review employee and/or independent contractor agreements

- Review employee health insurance and retirement plans

- Obtain a list of employee grievances and complaints

- Evaluate policies about labor unions

- Check for pending labor disputes or lawsuits

- Review workplace accidents and/or worker's compensation claims in the past five years

- Obtain documents and/or videos of new hire orientation and training sessions

- Review policies about sick days, paid holidays, paid vacations and overtime pay

- Review policies about bonuses, incentives, commissions and deferred compensation

- Evaluate emergency training and recovery plans

How DealRoom can help you execute due diligence

By using our master due diligence template, alongside DealRoom’s M&A lifecycle management software, you can create a smooth diligence process.

How DealRoom can help you execute integration

By using our integration template, alongside DealRoom's M&A lifecycle management software, you can create a smooth integration process

With this solution you’ll receive:

Professional template

A built-in data room

Project management capabilities

Collaboration tools

More Templates

Hedge Fund Investment Due Diligence Playbook

Information Technology M&A Integration Checklist

Deliverables Chart Template for M&A

.png)

.png)

.png)

.svg)

.png)