Best for

Tailored for roll-ups and serial acquirers handling concurrent M&A deals. DealRoom also offers a top-tier virtual data room combined with a diligence tracker and project management tools, which can be purchased separately for single-deal use, providing flexibility for diverse deal types.

Overview

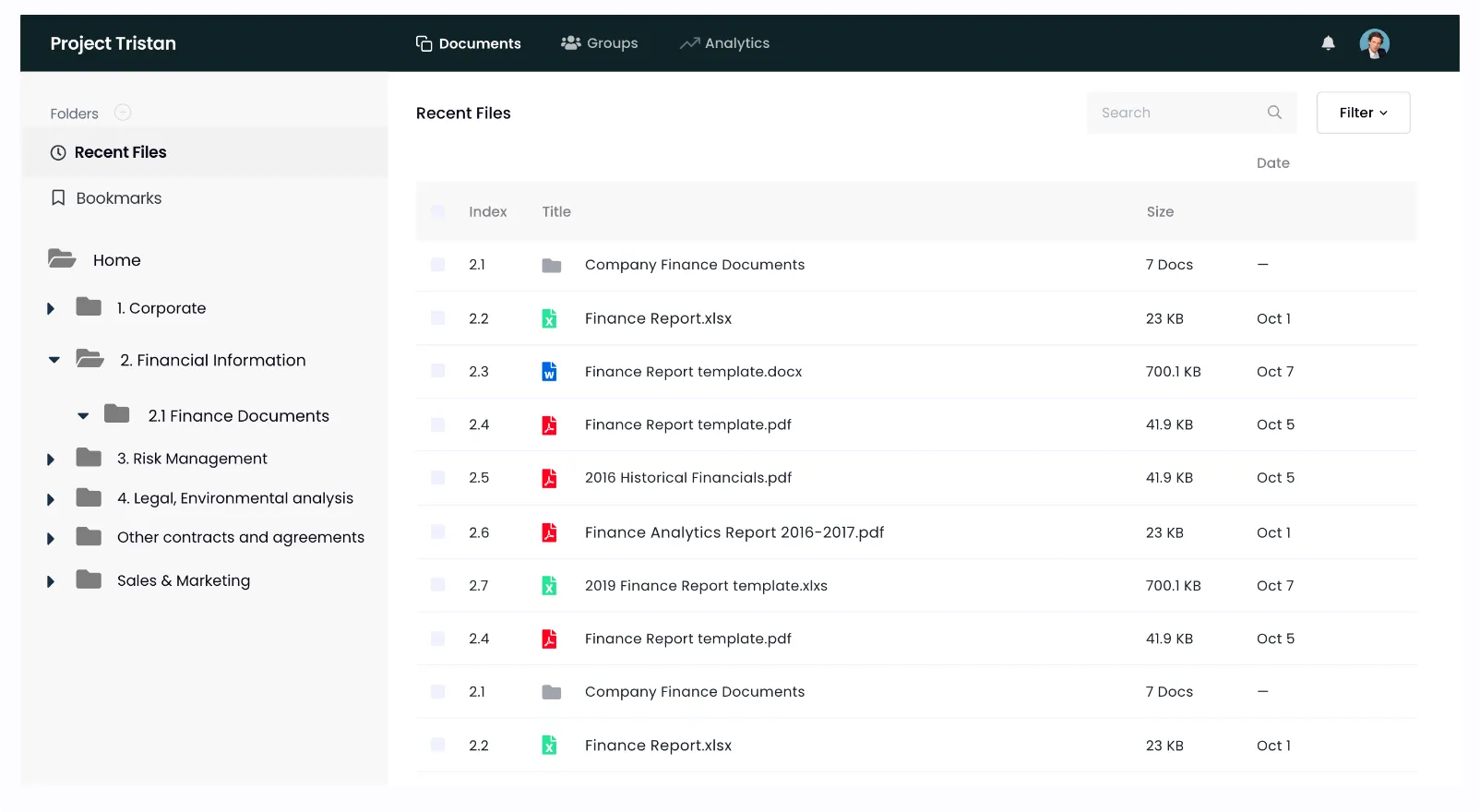

DealRoom is the only software platform purpose-built for Buyer-Led M&A. It is designed to streamline the entire M&A process by integrating key deal management stages, such as pipeline, diligence, and integration, into a single platform. It empowers corporate development teams with AI-driven tools for document analysis, redaction, and summary generation, speeding up due diligence and reducing manual tasks. With a strong focus on collaboration and transparency, DealRoom keeps all stakeholders aligned, ensuring deals move faster and more efficiently.

Key Features

AI-Powered Data Room:

Analyze and extract key information from deal documents and generate summaries across multiple documents with a single click.Diligence requests:

Centralized and customizable request management system for due diligence.4-Level Permissions:

Control access with detailed permission settings for different stakeholders.Risks & Issues Tracker:

Centralized and customizable request management system for due diligence.

With DealRoom, all stages of the M&A lifecycle are covered in one intuitive platform, providing visibility and alignment from pipeline to diligence to integration.

Pricing

Pricing for the DealRoom M&A Platform starts at $25,000 annually, which includes pipeline management, diligence, integration, and the AI-powered VDR.

Pros

- Complete M&A lifecycle management integrated with an AI-powered VDR.

- Advanced AI tools for document analysis, including redaction and summarization.

- Streamlined deal collaboration through customizable workflows.

- 24/7 customer support with dedicated M&A experts.

- Secure and efficient handling of large deal volumes.

Cons

- Can be overkill for non-M&A use cases.

What Customers Say

What I love about DealRoom is the data room. You can post whatever artifacts you want and add appropriate permissions. This is where role-based access control really comes into play. You can assign various stakeholders to a group and give that group access to files through file permissions.

Partnering with DealRoom changed the game for us. Now we can really plan and see where we're falling behind, where you're on track, and what are things that are missing. That's really hard to do without the right tools. Invest in the right tools, like DealRoom, and your deals will flow a lot quicker and a lot easier

FirmRoom

FirmRoom is an easy-to-use Virtual Data Room (VDR) built to simplify M&A transactions, secure document management, and due diligence processes. While best suited for mid-market transactions, its scalability has also earned the trust of larger companies like Pfizer, Baird, and J.P. Morgan. It caters to corporate development teams, private equity firms, and investment banks, offering secure document sharing and real-time collaboration, making it ideal for teams handling sensitive information.

Key Features

Efficient Document Management:

FirmRoom simplifies file uploads with drag-and-drop functionality, automatic indexing, and powerful full-text search, so users can quickly find what they need.Robust Security:

SOC 2-certified, FirmRoom ensures your data is secure with features such as advanced user permissions, watermarks, and two-factor authentication.Seamless Collaboration:

Manage permissions at granular levels, track activity in real-time, and collaborate effortlessly with teams and external partners using built-in audit logs and Q&A tools.Integrations:

Connect with the tools your team already uses, such as Salesforce, Slack, and Office 365, for a streamlined experience.

Pricing & Free Trial

Pricing:

Starts at $395/month (billed annually), with unlimited users included.Free Trial:

A 14-day trial is available, allowing users to explore the platform without sales involvement.

Pros

- Simple setup and user-friendly interface make it accessible for teams of all sizes.

- Unlimited users included in pricing, making it cost-effective for growing businesses.

- 24/7 support through live chat, email, and phone ensures help is always available.

Cons

- Limited storage (2GB) in the base plan, with extra charges for additional storage needs.

Intralinks

Overview

Intralinks provides secure document-sharing and collaboration solutions for M&A, fundraising, and capital markets. Known for its pioneering technology, Intralinks serves global clients. Intralinks is trusted by major corporations such as Credit Suisse, Stanley Black & Decker, and Carrefour for its robust features and security.

Key Features

AI-Powered Document Redaction:

Automatically redact sensitive information, such as PII, from documents to ensure compliance.Real-Time Analytics:

Get detailed insights and activity tracking to monitor deal progress and performance.Seamless Collaboration:

Advanced Q&A workflows, dynamic indexing, and secure mobile access keep your team in sync.Bank-Grade Security:

ISO 27701 certified, offering unparalleled data privacy controls, custom watermarking, and detailed audit logs.

Pricing & Free Trial

Pricing:

Available upon request, typically positioned for enterprise-level deals.Free Trial:

No free trial

Pros

- Advanced AI tools for document management and redaction.

- 24/7 support and dedicated teams to assist throughout the deal lifecycle.

Cons

- Pricing is higher compared to some competitors, making it more suitable for large enterprises.

- The platform may have a steeper learning curve for smaller teams or first-time users.

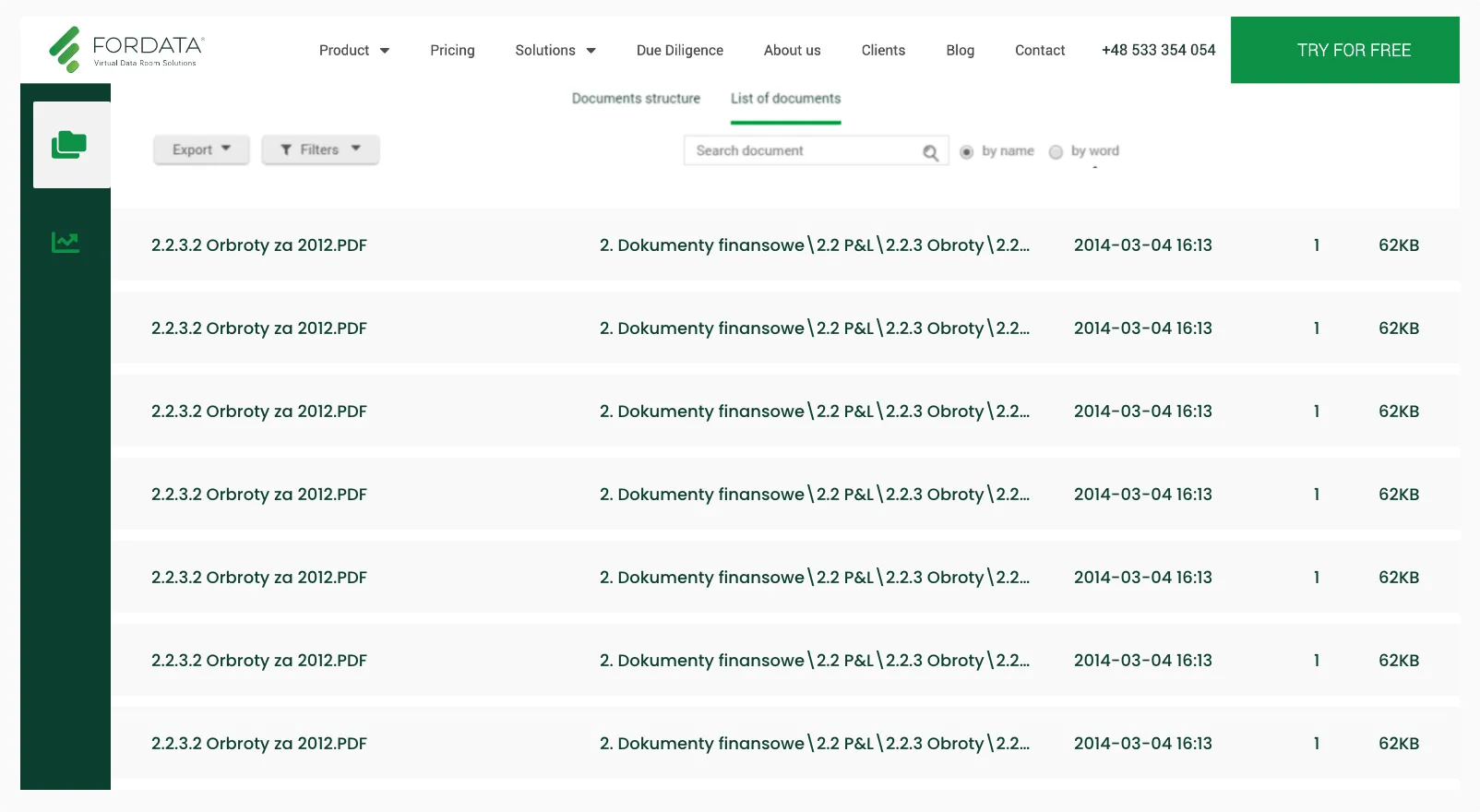

Fordata

Overview

FORDATA is a leading European VDR platform, designed to support due diligence, M&A, audits, and other sensitive document-sharing processes. It is widely used across industries such as finance, healthcare, and real estate. Key clients, including Grant Thornton, MCI Capital, and Sarantis Group, trust FORDATA for secure, efficient transaction management, particularly for cross-border deals.

Key Features

AI-Powered Redaction Tool:

Allows users to quickly anonymize sensitive information across various document formats, including PDF, Word, and Excel.Advanced Permissions:

Offers flexible control over file access, ensuring confidentiality with features such as read-only mode and dynamic watermarks.Real-Time Reporting:

Provides detailed activity reports to track document views and investor engagement, enabling better preparation for negotiations.Automated Translation:

Enables instant document translation into 59 languages for cross-border transactions, enhancing global collaboration.

Pricing & Free Trial

Pricing:

Pricing starts at €275 ($323) per month for the VDR Lite version, with scalable options such as VDR Basic and VDR Pro for more advanced features and support.Free Trial:

Free 14-day trial on request.

Pros

- Strong security features, including GDPR compliance and 256-bit encryption.

- AI-powered tools for document redaction and translation.

- Comprehensive 24/7 support tailored to the M&A process.

Cons

- Pricing may be higher for small businesses compared to other VDR providers.

- Some advanced features are available only in higher-tier plans.

Datasite

Overview

Datasite is a Virtual Data Room tool that supports the entire M&A lifecycle, from initial due diligence to post-merger integration. Known for its reliability in handling complex financial transactions, Datasite is trusted by Goldman Sachs, Blackstone, and Johnson & Johnson.

Key Features

AI-Powered Document Redaction:

Automatically removes sensitive information with high precision.Granular Permissions Control:

Manage access at the user and document levels to ensure secure collaboration.Optical Character Recognition (OCR):

Enables full-text search within documents in multiple languages.Comprehensive Security Certifications:

ISO 27001, SOC 2, and GDPR compliance for top-tier data protection.

Pricing & Free Trial

Pricing:

Datasite offers a custom pricing model based on the complexity and size of the project, typically tailored for enterprise deals.Free Trial:

No free trial, but a demo is available upon request.

Pros

- Trusted by global enterprises for handling large-scale, complex M&A transactions.

- Strong AI and automation tools that significantly reduce manual efforts during the due diligence process.

- Excellent 24/7 customer support in over 20 languages.

Cons

- Pricing is higher than most competitors, and the usage-based model can result in significant overage fees.

- Some users report that the interface can be a bit outdated and less intuitive compared to newer platforms.

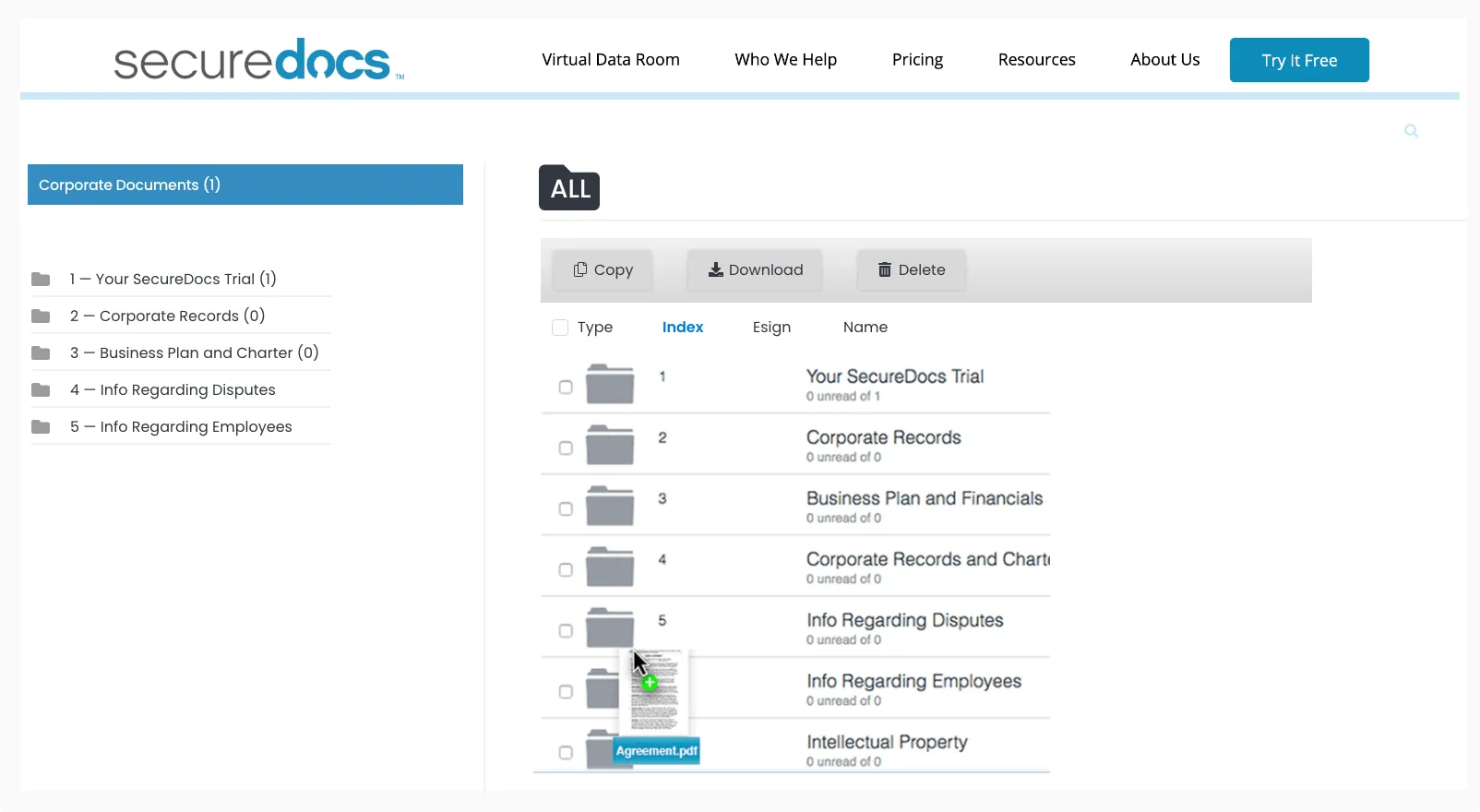

Securedocs

Overview

SecureDocs is designed for fast, secure, and simple document sharing, making it a favorite for startups, law firms, investment banking, and life sciences. SecureDocs allows companies to set up and start using the data room within 10 minutes. Trusted by companies like Immunomic Therapeutics and StabiLux Biosciences, SecureDocs provides secure document sharing for M&A, fundraising, and intellectual property protection.

Key Features

Advanced Security:

Multi-factor authentication, watermarking, and role-based permissions to control document access and ensure data privacy.Audit Trail & Reporting:

Track every action with comprehensive audit logs, providing complete visibility over user activity.Electronic Signature:

Built-in e-signature functionality simplifies deal documentation, allowing for quick, secure sign-offs on NDAs and contracts.Quick Setup:

Ready-to-use in less than 10 minutes, with no training required.

Pricing & Free Trial

Pricing:

Offers flat-rate pricing, starting at $250/month for annual plans or $400/month for shorter 3-month projects.Free Trial:

Provides a 14-day free trial.

Pros

- Transparent, flat-rate pricing with no hidden fees.

- Easy-to-use interface, suitable even for first-time VDR users.

- Unlimited users and data storage at no extra cost.

- 24/7 customer support with a 99.9% uptime guarantee.

Cons

- Lacks advanced customization options for industries requiring highly specialized tools.

- Fewer integrations with CRM or project management software compared to other VDR providers.

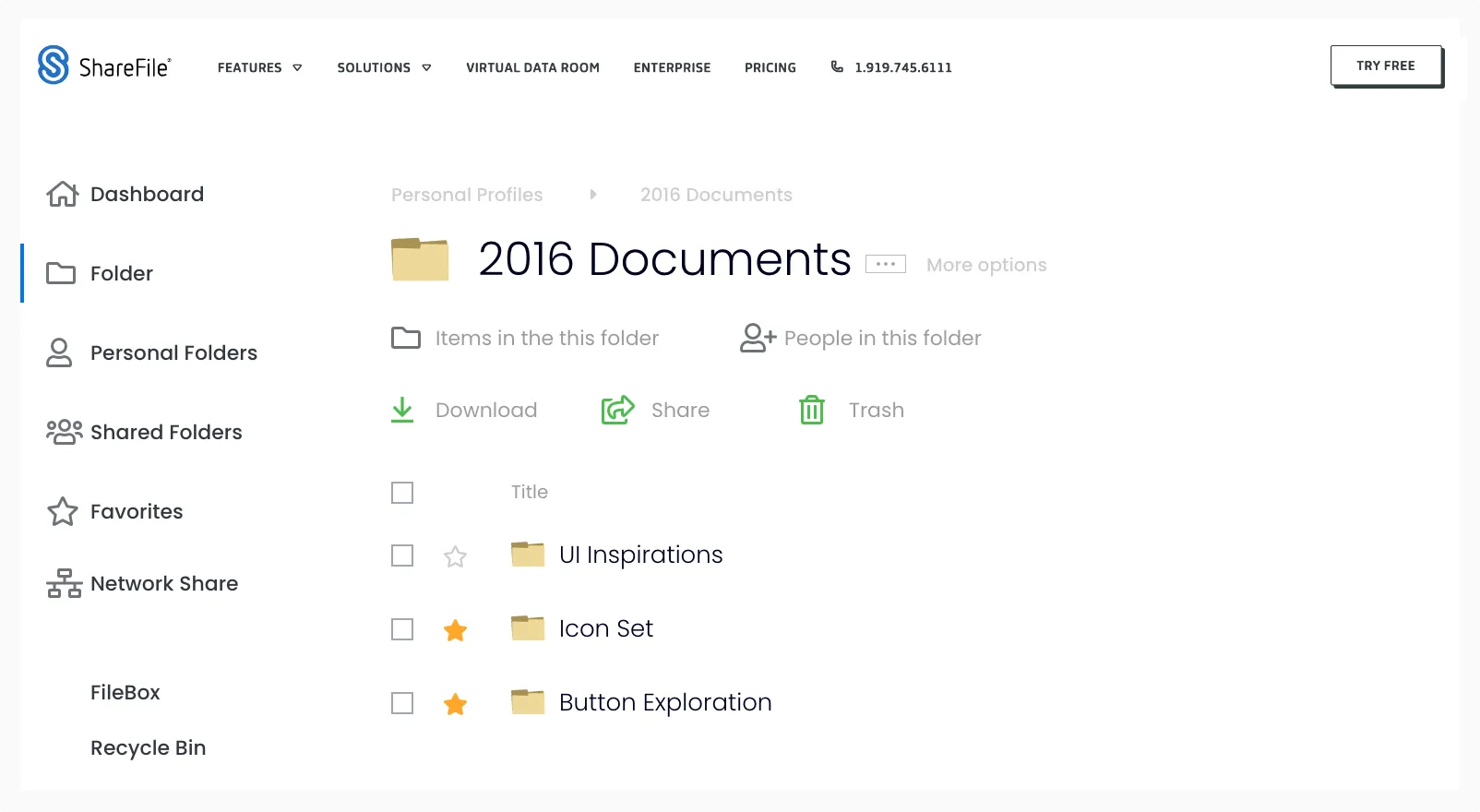

ShareFile

Overview

ShareFile is a reliable, affordable VDR designed for small to medium-sized businesses that need secure document sharing and collaboration. It’s widely used across industries like real estate and finance for deals and transactions. ShareFile is known for its HIPAA and FINRA compliance, making it ideal for handling sensitive data in industries with stringent regulatory requirements.

Key Features

Document Tracking:

Secure file sharing with audit trails and notifications.Custom Branding:

Add your company's branding to the VDR for professional presentation.File Encryption:

Ensures documents are protected both in storage and during transfer.

Pricing & Free Trial

Pricing:

Pricing starts at $75 per user per month, with a minimum of 5 users.Free Trial:

30-day free trial available.

Pros

- Easy integration with cloud platforms like Google Drive and Dropbox.

- Simple setup with custom branding options.

- Affordable pricing, particularly for small businesses.

Cons

- Limited advanced features compared to higher-end VDRs.

- Some users find the interface less customizable for larger deals.

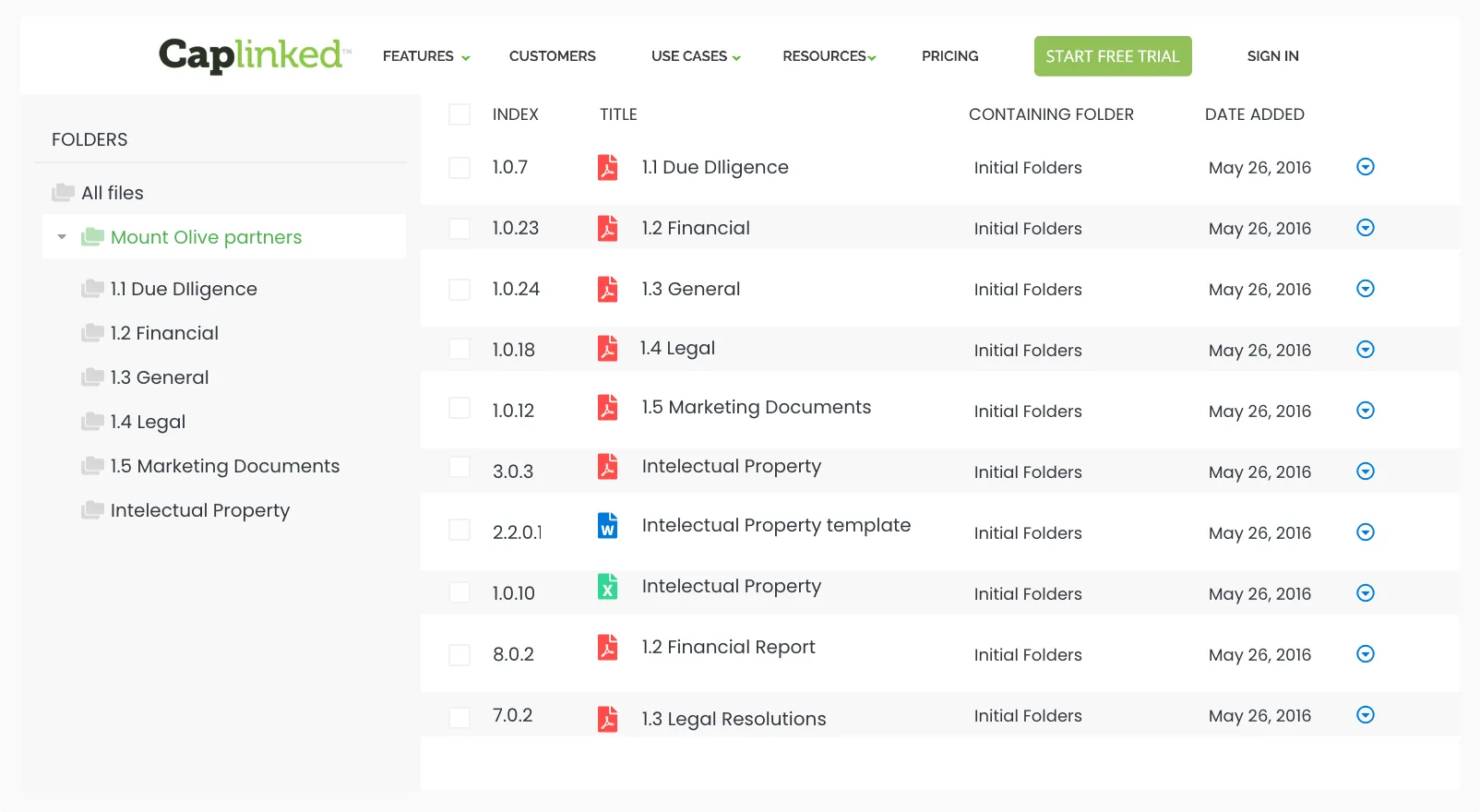

CapLinked

Overview

CapLinked’s Virtual Data Room platform is designed for businesses involved in M&A transactions, fundraising, legal compliance, and due diligence. This VDR is known for its seamless collaboration tools, real-time tracking, and customizable permissions, making it a go-to choice for industries like investment banking, legal, and life sciences. Trusted by Ernst & Young, KPMG, and more.

Key Features

Secure File Sharing:

Advanced encryption and DRM ensure your sensitive documents are safe at all times.Collaboration Tools:

Real-time tracking, Q&A features, and secure messaging support seamless internal and external communication.Custom Branding & Permissions:

Add your company’s branding and set detailed, customizable user permissions.Audit Trails:

Full audit logs to track document activity, including views, downloads, & edits.

Pricing & Free Trial

Pricing:

Starts at $399/month, depending on storage and administrative needs.Free Trial:

14-day free trial

Pros

- Affordable, flat-rate pricing for small and medium businesses.

- Easy setup and intuitive interface.

Cons

- Lacks deep integration with CRM or project management tools that large enterprise organizations require.

- Limited customization options compared to high-end VDRs.

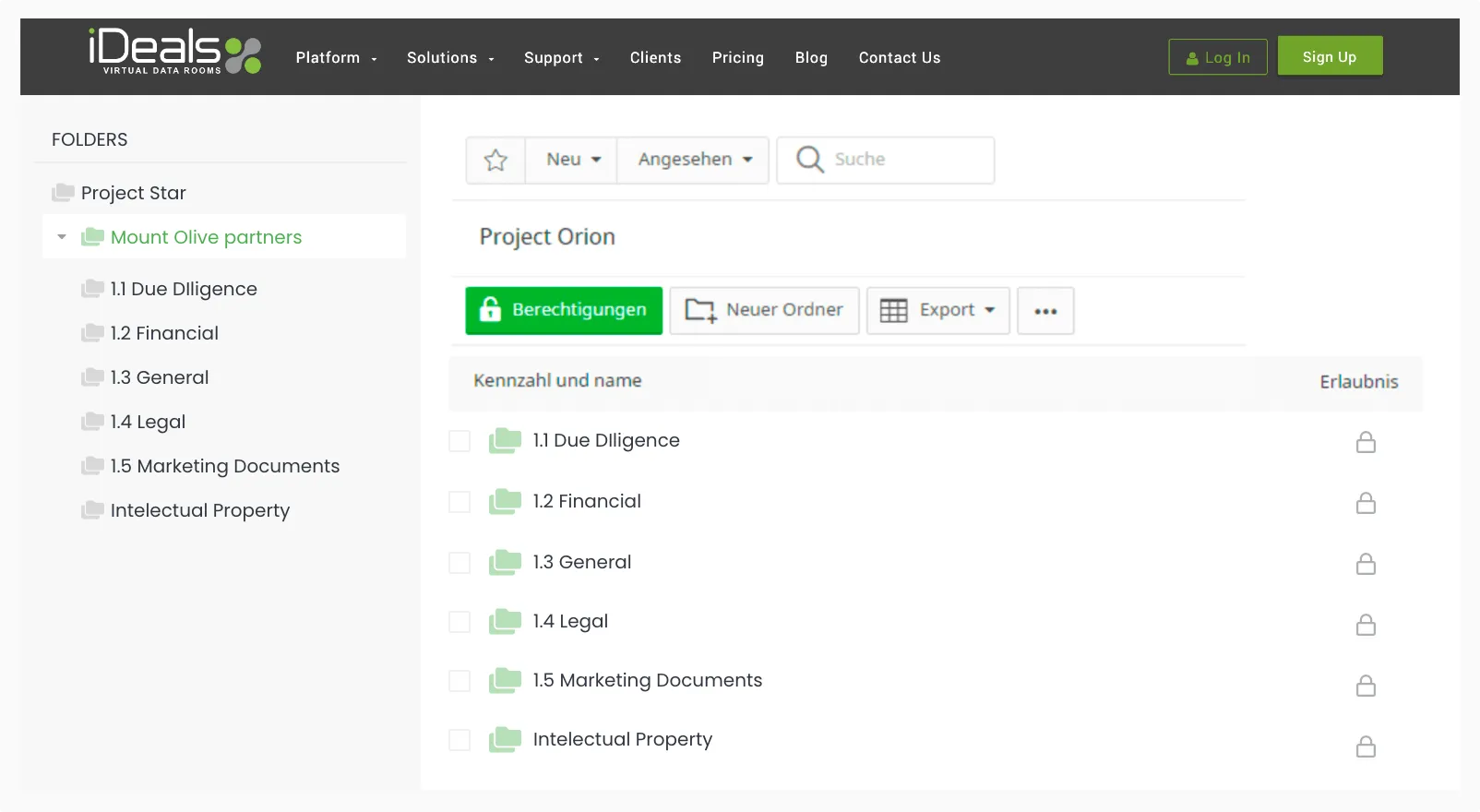

Overview

iDeals Virtual Data Room is a widely trusted solution for secure document management, designed to support industries such as M&A, private equity, biotech, and legal services. iDeals is renowned for its user-friendly interface and quick setup. Companies such as Aquila Capital and EY frequently use iDeals for secure data sharing.

Key Features

Document Security:

256-bit encryption, dynamic watermarks, secure fence view, and remote document shredding.Granular Permissions:

Offers fine-tuned control over who can view, download, and print files.Collaboration Tools:

Built-in Q&A features, real-time audit trails, and multilingual document support.Mobile Access:

Available for iOS and Android, with full synchronization across cloud and desktop platforms.

Pricing & Free Trial

Pricing:

Available on request, depending on project size, storage, and user needs.Free Trial:

30-day free trial with full feature access.

Pros

- Quick setup and user-friendly interface with deployment in under 15 minutes.

- High-level security and compliance with ISO and SOC standards.

- Multilingual support and full mobile access, ideal for international teams.

Cons

- Pricing details available only upon request, and usage-based fees can add up quickly, especially at scale or with extended use.

- Some advanced features, such as API integrations, are locked behind higher-tier pricing plans.

Firmex

Overview

Firmex is a Virtual Data Room solution known for simplifying mid-market M&A transactions, due diligence, compliance, and more. With over 20,000 new data rooms created annually, Firmex supports industries ranging from investment banking to legal services and renewable energy. Clients like Canada Post, Bruce Power, and Savion rely on Firmex for its easy setup, robust security, and exceptional customer support.

Key Features

Advanced Permissions:

Customize access levels with granular permissions for documents and users.Built-in Q&A Module:

Simplifies communication during due diligence or compliance checks.Top-Tier Security:

Complies with global standards like ISO 27001, SOC 2, and HIPAA for secure document sharing.

Pricing & Free Trial

Pricing:

Available upon request, with options for both subscription-based models for ongoing use and single-use plans for one-time transactions.Free Trial:

14-day free trial on request.

Pros

- User-friendly and intuitive interface.

- Cost-effective for mid-market businesses and smaller projects.

- 24/7/365 customer support across multiple languages.

- Secure storage with flexible access permissions.

Cons

- Some advanced features may be unnecessary for small-scale transactions.

- Limited customization for specific industries like biotech or real estate.

Ansarada

Overview

Ansarada is a deal-focused Virtual Data Room built to support M&A, capital raises, audits, and strategic transactions. The platform goes beyond basic file sharing by guiding teams through each stage of the deal with structured workflows and readiness tools. It is commonly used by investment banks, corporate development teams, and advisors managing complex high-stakes transactions.

Key Features

AI Deal Readiness Tools:

Built-in checklists and risk insights help teams prepare faster and avoid common diligence gaps.Granular Access Controls:

Detailed permission settings protect sensitive documents and determine exactly who can see what.Advanced Audit Reporting:

Real-time activity tracking shows buyer engagement and document interest throughout the process.Secure Q&A Management:

Centralized Q&A keeps buyer questions organized and reduces back-and-forth during diligence.

Pricing & Free Trial

Pricing:

Starts around $479/month and typically reflects deal size, duration, and feature requirements.Free Trial:

14-day free trial on request.

Pros

- Strong focus on deal preparation and execution rather than simple storage.

- Helpful guidance for first-time sellers and complex transactions.

- Enterprise-grade security suitable for regulated deals.

Cons

- Pricing can be higher than basic VDRs.

- Feature depth may feel heavy for very small or simple transactions.

Drooms

Overview

Drooms is a European Virtual Data Room designed for confidential business processes such as M&A, due diligence, fundraising, and asset lifecycle management. The platform combines security compliance and AI tools with flexible options for straightforward or complex deals. Its infrastructure is designed to meet GDPR and ISO 27001 standards, with servers located in Germany and Switzerland.

Key Features

AI Assistant and Chat:

AI-driven search and assistant tools (available as separate add-ons or included in certain plans) help reduce time spent on document review and due diligence.Granular Permissions and Security:

Advanced permission controls, encryption, two-factor authentication, and strong compliance are core security features; supports compliance with European data protection laws.Live Reporting and Activity Tracking:

Track user actions and document use with real-time reports (available with FLEX and Enterprise plans).OCR and Indexing Tools:

Full-text search and smarter document sorting speed up navigation through large data sets.Document Translation and Redaction:

Optional AI-enhanced tools (some of which are add-ons) assist with cross-language review and the hiding of sensitive information.

Pricing & Free Trial

Pricing:

Drooms FLEX starts at around €17.90 ($21) per user/month, with limited storage and a set of included features; additional features and higher-tier Enterprise plans with unlimited users and storage are available upon request. A 30-day free trial is offered for the FLEX tier.Free Trial:

30-day free trial available with basic features and limited users.

Pros

- Flexible pricing with a low entry point for smaller teams.

- Strong compliance focus for European data protection standards.

- AI tools and reporting help reduce time spent on due diligence.

Cons

- Feature add-ons can increase costs beyond base pricing.

- Advanced support and enterprise plans require contacting sales.

EthosData

Overview

EthosData is a simple, secure Virtual Data Room focused on M&A, due diligence, IPOs, and other sensitive deals. The platform launches data rooms quickly with no extra software or plug-ins and pairs intuitive tools with dedicated support to keep document workflows moving. It serves investment banks, law firms, private equity, and mid-market teams worldwide.

Key Features

Easy Setup and Bulk Upload:

Get a data room live in minutes and drag and drop many files at once.Security and Permissions:

Enterprise-grade encryption and detailed access controls protect sensitive documents.Real-Time Activity Notifications:

Track user actions and document views with activity alerts and audit logs.Dedicated Support:

Plans include access to data room specialists and 24/7 support via phone chat and email.Multilingual Platform:

The interface is available in multiple languages, helping global teams collaborate.

Pricing & Free Trial

Pricing:

EthosData has tiered plans: Basic for small deals with limited users and data; Professional with unlimited users and dedicated support; and Enterprise for multiple rooms and custom options. Custom quotes are required for Professional and Enterprise plans, while Basic plans start at $199 per month with a 6-month minimum, 10 third-party users, and 500MB of data.Free Trial:

Offers a 30-day free trial or demo to test features before committing.

Pros

- Quick setup with no plug-ins and intuitive interface.

- Strong support from dedicated specialists (limited to 10 hours on the Basic plan).

- Secure platform with real-time activity tracking.

Cons

- Professional and Enterprise pricing requires contacting sales.

- Fewer high-end automation features than some larger VDR platforms.

Comparison table

General

Pricing

Features

Unlock the Power of Virtual Data Rooms for Enhancing Efficiency

From M&A deals in finance to regulatory compliance in biotech, VDRs offer a secure, centralized platform for document storage, sharing, and collaboration. Industries such as legal, real estate, and private equity rely on VDRs to enhance operational efficiency, ensure data privacy, and streamline project management, making them essential for organizations handling large volumes of confidential information. Below are the key industries where VDRs play a vital role in managing sensitive data and critical transactions.

Consulting and Advisory Services

Corporate Development

Investment Banking

Business Brokers

Life Sciences

Accounting

Private Equity and Venture Capital

IT and Telecommunications

Manufacturing

Healthcare

Real Estate

Legal

Best Virtual Data Rooms for M&A

In M&A, securely managing large volumes of sensitive documents is crucial. Virtual Data Rooms provide the ideal solution by offering a secure, centralized platform for storing, sharing, and accessing critical deal documents. These tools help buyers, sellers, and advisors collaborate to streamline due diligence, reduce risk, and ensure smooth transactions.

Here are some of the best VDRs specifically designed to support M&A, known for their reliability, security, and efficiency:

Best Virtual Data Rooms for Due Diligence

During the due diligence process, precision and speed are key. Virtual Data Rooms are designed to help teams securely organize, track, and analyze large volumes of documents in real-time. These VDRs offer tools that simplify document review, manage requests efficiently, and maintain a clear audit trail.

Here are some of the top VDRs optimized for due diligence, offering robust features for secure and streamlined document management:

Free Virtual Data Rooms

For teams with smaller budgets or those working on short-term projects, free Virtual Data Rooms offer a cost-effective solution for securely managing documents. While free VDRs often offer limited features and storage, they still provide essential tools such as secure document sharing and user access controls, making them useful for simple transactions.

Here are some of the top free VDR providers that can help streamline your basic document management needs without the cost:

Google Drive

Koofr

Best Virtual Data Rooms for M&A

In M&A, securely managing large volumes of sensitive documents is crucial. Virtual Data Rooms provide the ideal solution by offering a secure, centralized platform for storing, sharing, and accessing critical deal documents. These tools help buyers, sellers, and advisors collaborate to streamline due diligence, reduce risk, and ensure smooth transactions.

Here are some of the best VDRs specifically designed to support M&A, known for their reliability, security, and efficiency:

Best Virtual Data Rooms for Due Diligence

During the due diligence process, precision and speed are key. Virtual Data Rooms are designed to help teams securely organize, track, and analyze large volumes of documents in real-time. These VDRs offer tools that simplify document review, manage requests efficiently, and maintain a clear audit trail.

Here are some of the top VDRs optimized for due diligence, offering robust features for secure and streamlined document management:

Free Virtual Data Rooms

For teams with smaller budgets or those working on short-term projects, free Virtual Data Rooms offer a cost-effective solution for securely managing documents. While free VDRs often offer limited features and storage, they still provide essential tools such as secure document sharing and user access controls, making them useful for simple transactions.

Here are some of the top free VDR providers that can help streamline your basic document management needs without the cost:

Google Drive

Koofr

VDRs vs. Full M&A Platforms

Virtual data rooms enable secure document sharing during due diligence. For some deals, that’s enough.

A VDR works well when the scope is narrow, such as a single transaction with a defined buyer group and a short diligence window. Teams can upload documents, control access, and answer questions.

Teams start to feel friction when deals become more complex, such as multiple deals running at once. Overlapping diligence requests, spreadsheets being used to track tasks, and email threads to manage Q&A create a disconnected process. Teams use separate tools for diligence tracking and integration. The VDR holds files, but nothing else stays connected.

That disconnect slows teams down. Context gets lost between stages, and deal history is stored in folders and inboxes. New stakeholders come in with no visibility into what already happened.

Full M&A platforms, such as DealRoom’s M&A Platform, integrate pipeline, tracking, due diligence, and post-merger integration into a single system. Tasks stay tied to documents, and questions stay tied to decisions. Progress remains visible from first touch to close and beyond.

The difference is continuity. A VDR supports a specific stage of the deal, while an M&A platform supports the complete deal lifecycle.

How to compare virtual data rooms and choose the right one?

Choosing the best Virtual Data Room (VDR) can feel overwhelming, especially with the many features, pricing options, and security concerns to evaluate. Understanding your project’s needs and matching them to what each VDR offers is key. Here's a simple guide to help you navigate the selection process.

Key Features to Look For

The functionality of a VDR directly impacts its usefulness for your project or transaction. While basic features like document storage and secure sharing are common, some VDRs offer more advanced capabilities to save time and enhance productivity. When comparing VDRs, ensure they offer:

Document Management:

Secure storage, bulk uploads, and drag-and-drop capabilities.Permissions Management:

Allow different access levels for team members, external partners, or clients.AI-Powered Features:

Document analysis, data extraction, and automated redaction, which are especially helpful for large M&A transactions or legal document reviews.Collaboration Tools:

Real-time Q&A, task management, and in-document commenting to improve communication and collaboration within teams.

Pricing Models and Hidden Fees

Understanding the cost structure is crucial, especially since VDRs can have a wide range of pricing models. Depending on your business needs, some models may be more cost-effective than others. Typically, pricing models include:

Per-User Pricing:

Costs increase with the number of users, ideal for smaller teams.Per-Project Pricing:

Best suited for short-term, one-off projects.Flat-Rate Subscription:

A fixed monthly or annual fee, perfect for businesses handling multiple deals or continuous usage.

Make sure to account for hidden fees, such as extra charges for exceeding storage limits or using premium features. Here are a few things to look out for.

Page-Based Pricing Risks: Some VDRs charge by page count, which creates uncertainty from day one. Large PDFs, scanned documents, and repeated uploads can inflate costs quickly. Teams may hesitate to upload early or share broadly, which can slow down the due diligence process.

Overage Fees: Storage limits user caps and bandwidth thresholds often trigger overage charges. These fees usually appear late in the process when switching platforms is no longer realistic. What starts as a predictable budget turns variable under pressure.

Archive Fees: After a deal closes, some VDR providers charge to keep data accessible. Retrieval fees, access limits, and ongoing storage costs add up, especially for teams managing multiple transactions over time.

User-Based Pricing Traps: Per-user pricing sounds fair until advisors, external counsel, and internal stakeholders need access. User counts grow fast during diligence and so do costs. Teams sometimes restrict access to control spend at the expense of collaboration.

Long-Term vs. Deal-Based Economics: Deal-based pricing works for one-off transactions. Long-term users face higher total cost when every new deal restarts the meter. Platforms designed for ongoing M&A activity tend to offer better economics over time by spreading cost across pipeline diligence and integration work.

Ease of Use

The ease of use directly impacts how quickly your team can adopt the VDR and start using it efficiently. A complex interface may slow down your projects, while an intuitive one ensures seamless operation. Consider these factors:

User Interface:

Should be clean and easy to navigate, requiring minimal training.Mobile Access:

Look for a platform with strong mobile support so your team can access data on the go.Custom Workflows:

Ability to create and adjust workflows to fit your specific needs.

Security Measures

Security is often the top priority when choosing a VDR, especially in industries like M&A, legal, and healthcare, where sensitive information is handled. Look for these key security features:

End-to-End Encryption:

Ensures that your data is secure during storage and transit.Two-Factor Authentication (2FA):

An additional layer of protection that prevents unauthorized access.Compliance with Industry Standards:

Ensure the VDR is compliant with regulations such as GDPR, HIPAA, or ISO 27001, which may be required in your industry.

Industry-Specific Features

Not all VDRs are designed for the same type of business. Choose a VDR that offers features tailored to your industry’s needs:

M&A Transactions:

Look for tools that streamline due diligence, such as audit trails, permissions management, and collaboration features.Healthcare & Life Sciences:

A VDR must comply with HIPAA and have secure features for managing patient records or research data.Legal:

Secure sharing, contract management, and tools for litigation support are essential for legal teams.

Customer Support & Onboarding

A VDR’s customer support can be a game-changer, especially during critical stages of a transaction. Reliable support ensures that any issues are resolved quickly and efficiently. Check for:

24/7 Customer Support:

Ensure round-the-clock availability, especially for international teams or time-sensitive projects.Dedicated Account Manager:

Some VDR providers offer dedicated contacts for onboarding and support.Training & Onboarding Services:

Comprehensive training ensures that your team can fully utilize the VDR's features.

Reviews & Reputation

Always research the reputation of VDR providers by reading user reviews and expert opinions. Platforms like G2, TrustRadius, and Capterra can give you real-world insights into how a VDR performs in terms of ease of use, security, and support. Look for:

Positive Reviews:

Focus on highly-rated platforms for the factors most important to your business, such as security, user experience, and customer support.Address Common Issues:

Pay attention to repeated feedback on common pain points such as lack of features, slow support response times, or technical difficulties.

Best Practices for Using a VDR

Once you've selected the right VDR, following best practices can ensure that you maximize its potential. These practices include:

File Organization:

Properly organize and label documents for easy navigation and searchability.Permission Management:

Regularly review and update permissions to ensure only the right users have access to sensitive information.Monitoring Activity:

Use audit logs and activity tracking to monitor who is accessing files and when ensuring transparency and security.

How a VDR Benefits Your Business

The right VDR can bring numerous advantages to your organization. These benefits include:

Enhanced Security:

Keep your sensitive data secure with robust encryption and strict access controls.Streamlined Workflows:

Automated processes and easy collaboration tools can reduce manual tasks and save time.Faster Transactions:

Improved organization and access to data help deals move forward more quickly.

AI Capabilities in Virtual Data Rooms

Some VDRs use AI to make files easier to manage. Others use it to help teams make decisions faster.

Document Summarization

Summaries reduce review time by pulling key points from contracts, financials, and reports. When summaries remain linked to the underlying documents and diligence tasks, they can save hours across a deal.

DealRoom AI offers document summaries as part of the due diligence workflow, so insights stay connected to requests and findings rather than living in isolation.

Clause Extraction

Clause extraction focuses on identifying specific terms, such as termination, change of control, or non-competes. This helps reviewers scan large document sets faster, but usually requires manual follow-up to assess impact.

Most platforms that offer this treat it as a search enhancement rather than an analysis tool.

Redaction Automation

Redaction is one of the most common AI use cases in VDRs. It reduces manual effort when removing personal data, pricing, or sensitive terms before sharing documents. These tools improve document preparation but do not extend into diligence execution.

Risk Flagging

More advanced platforms use AI to surface potential issues like missing documents, unusual clauses, or inconsistencies across files. This shifts AI from document handling into deal insight.

This capability matters only when flags are directly tied to diligence tasks and decision-making, rather than appearing as standalone alerts.

Diligence Analytics

Analytics look at how diligence progresses, which requests stall, which documents attract attention, and where risks cluster. This helps teams manage momentum and prioritize follow-up.

DealRoom applies AI across analysis, summaries, and workflows, so insights drive action rather than just reporting activity. Other VDRs may offer limited automation based on keywords or basic usage metrics.

Virtual Data Room Security: What to Look For

Most VDRs claim strong security. The real question is how well that security holds up once multiple teams, external advisors, and internal users start working in the same room.

Secure virtual data rooms go beyond encryption at rest and in transit. For enterprises and organizations in highly regulated industries, protecting sensitive data is paramount. The following considerations will help you select a VDR service provider that offers robust security.

Permission Granularity

Basic VDRS include folder-level access control. More mature platforms allow permissions at the document and user level with controls for viewing, printing, downloading, and time-based access. Granular permissions are especially important when different stakeholders require different visibility across the same set of due diligence documents.

Watermarking Strength

Static watermarks offer limited protection. Stronger implementations apply dynamic watermarks tied to user identity, session details, and timestamps. This creates accountability and discourages intentional leaks rather than simply labeling files.

Screenshot Prevention

Most VDRs cannot fully block screenshots at the operating system level. Instead, mature VDRs offer mitigation measures such as:

- Secure viewers

- View-only modes

- Screen overlays

- Activity logging that flags abnormal behavior

These controls raise the cost of misuse even when full prevention isn’t possible.

API Exposure

APIs enable integration with deal platforms, document systems, and internal tools. They also expand the attack surface.

Enterprise-grade VDRs restrict API access, apply role-based controls, and log all API activity. Weak API governance can bypass user-level permissions entirely.

Insider Risk Controls

External threats get attention, but insider risk can cause more damage. Strong VDRs monitor unusual behavior like mass downloads, off-hours access, or repeated failed actions. Alerts and audit trails help security teams respond before issues escalate.

Simplify your decision-making process with our list of questions to ask yourself when comparing prices

What level of security and compliance do you require?

Ensure the VDR complies with necessary regulations like GDPR, HIPAA, or ISO 27001 and offers strong encryption and multi-factor authentication.

What is the data storage capacity and scalability offered?

Consider how much data you’ll need to store and whether the VDR can scale to meet future requirements as your deal progresses.

Does the VDR support document types and formats that you use?

Make sure the VDR supports the document formats and file types necessary for your project, such as PDFs, Excel, and multimedia files.

How robust is the search functionality?

If you require the ability to search through large volumes of data, check if the VDR offers advanced search capabilities like full-text search, keyword filters, and tagging.

What integrations does the VDR support?

If your project requires using other platforms (e.g., CRM tools, project management software), determine if the VDR offers integration with these systems.

How user-friendly is the platform?

Evaluate how intuitive the VDR is for both technical and non-technical users and whether training will be required.

Can the VDR accommodate multiple projects simultaneously?

If you handle multiple deals simultaneously, check whether the VDR allows for easy management and segregation of different projects within the platform.

.png)

.png)

.png)

.svg)

.svg)

.avif)