Deal Management Software

Streamline Your M&A Process with our Unified Deal Management Platform

Stay organized, track deal flow and be able to see the big picture no matter what phase a deal is in.

Join 2,000+ companies winning deals with DealRoom

Create value and enhance every phase of the transaction

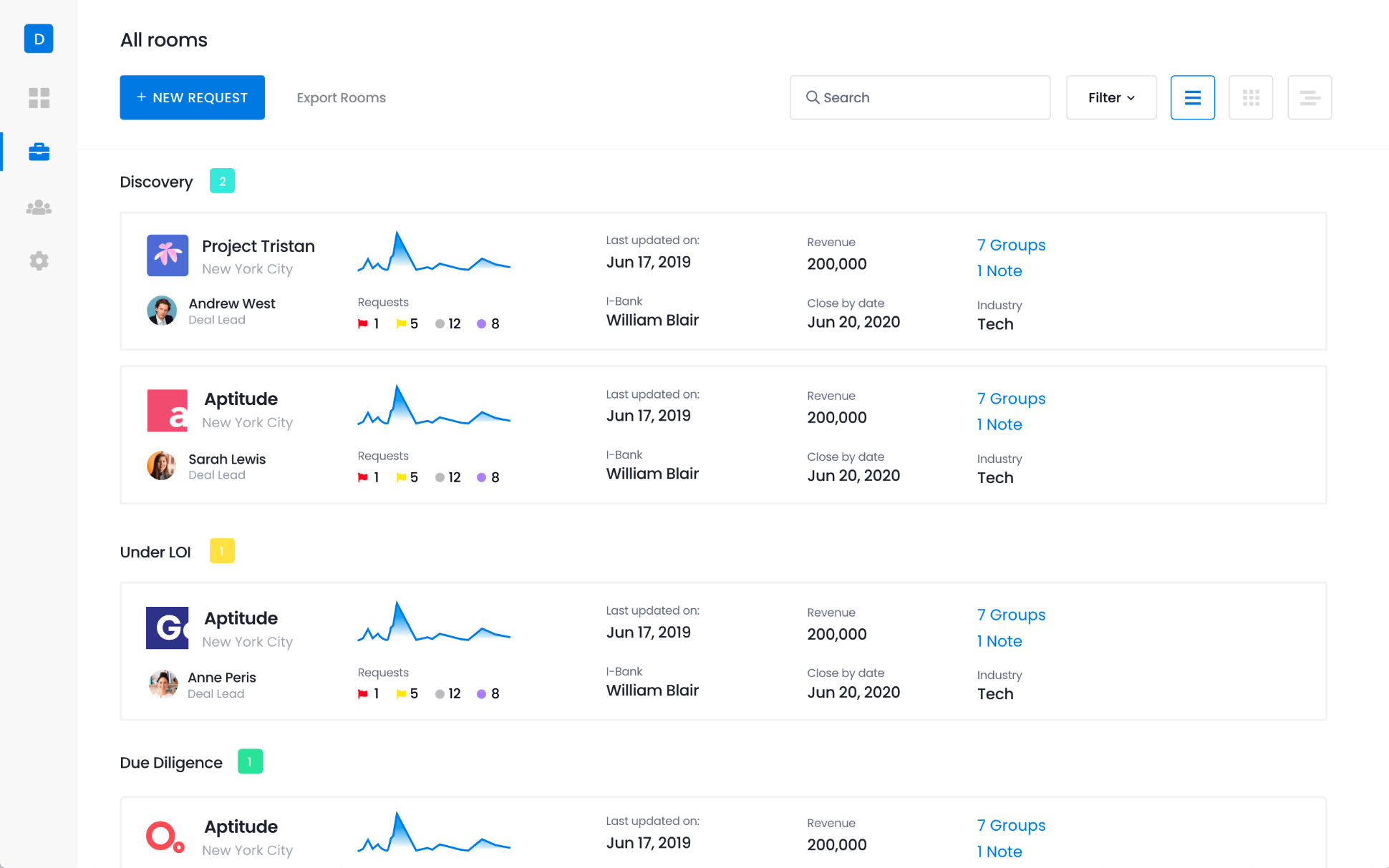

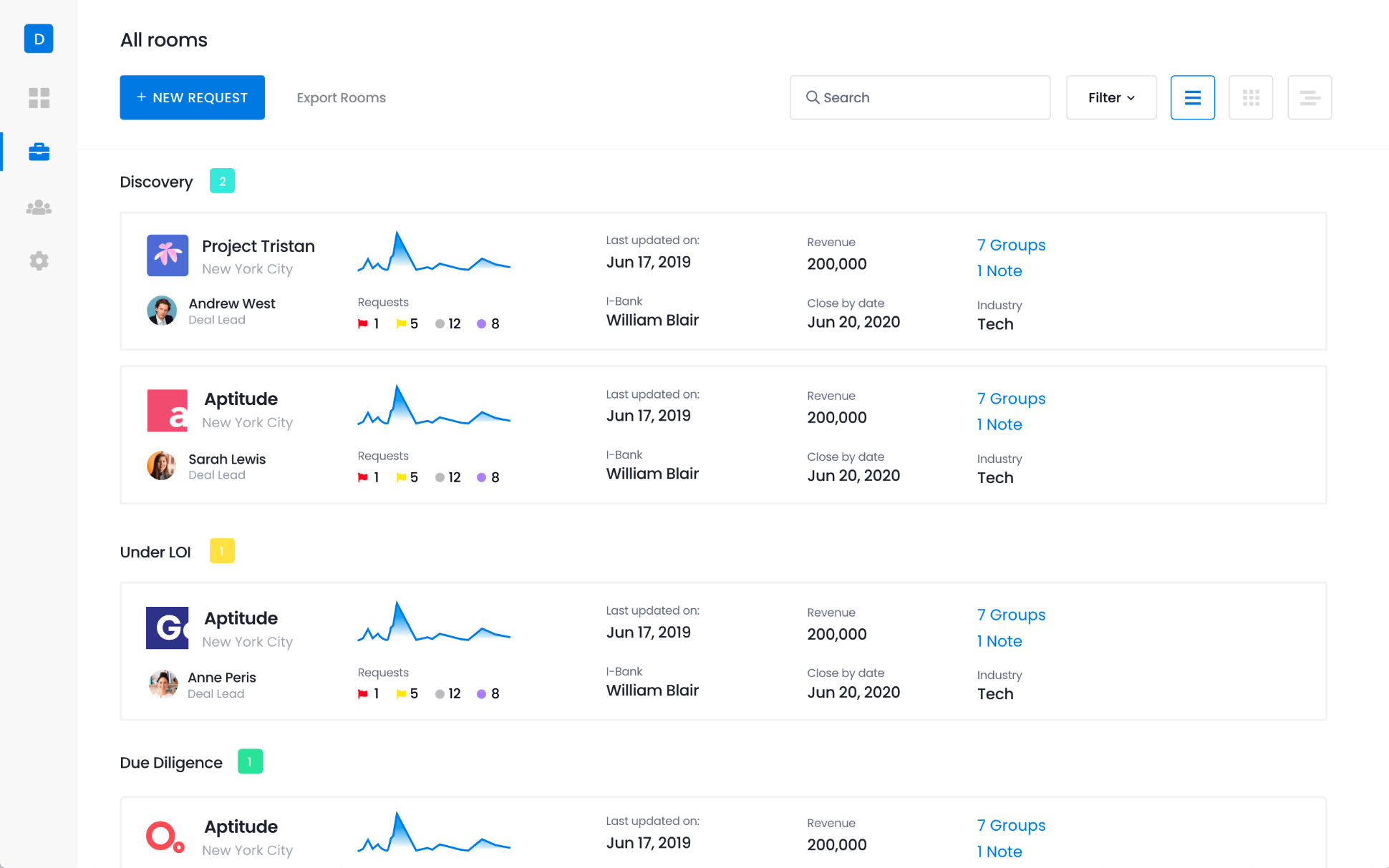

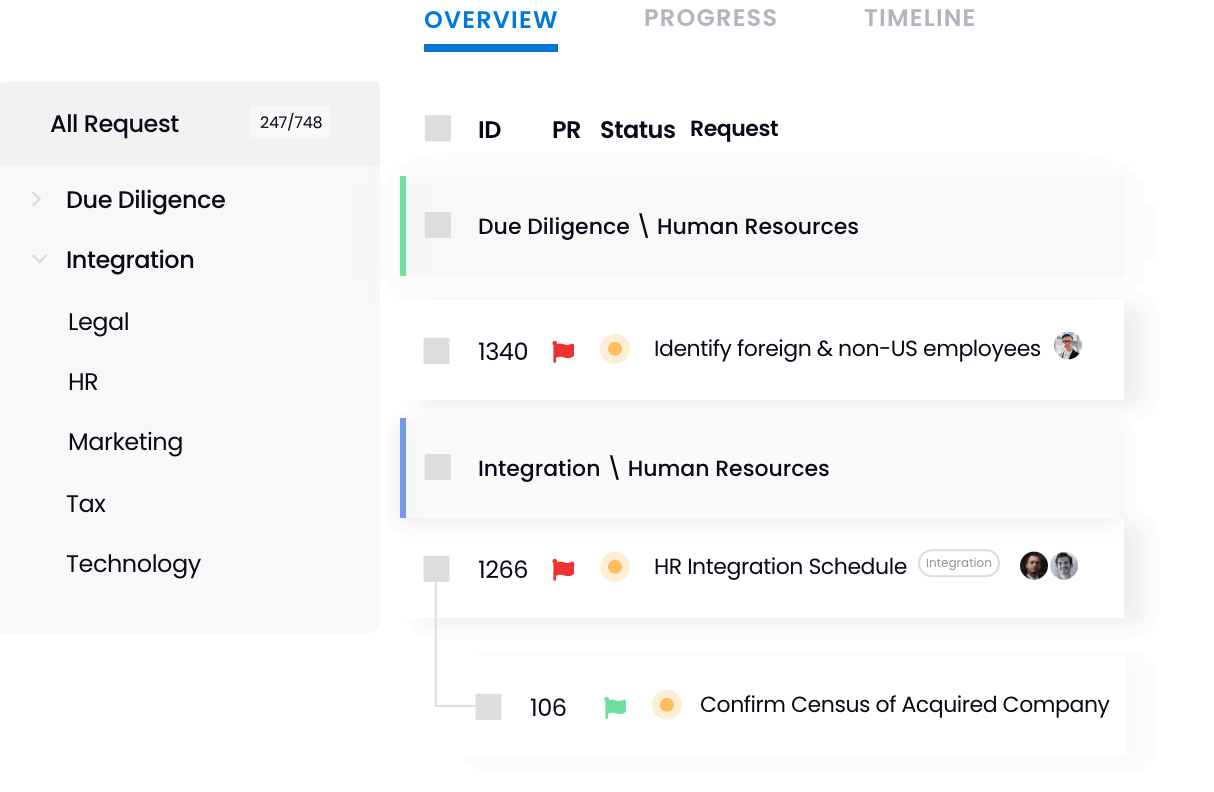

Manage all your deals in one place with pipeline management tools

DealRoom facilitates multiple deals at different stages, to provide a complete progress report of your organization’s corporate development strategy.

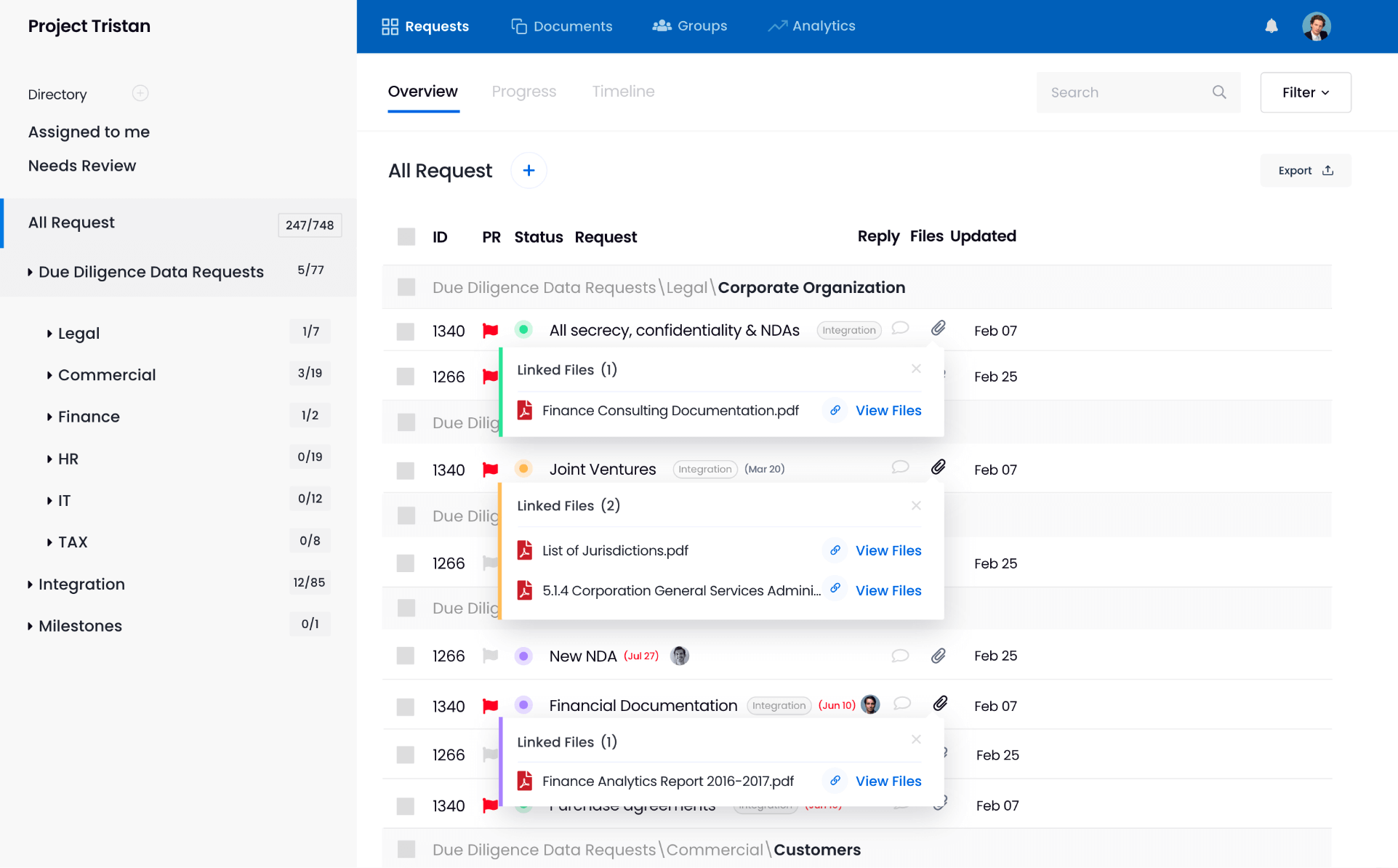

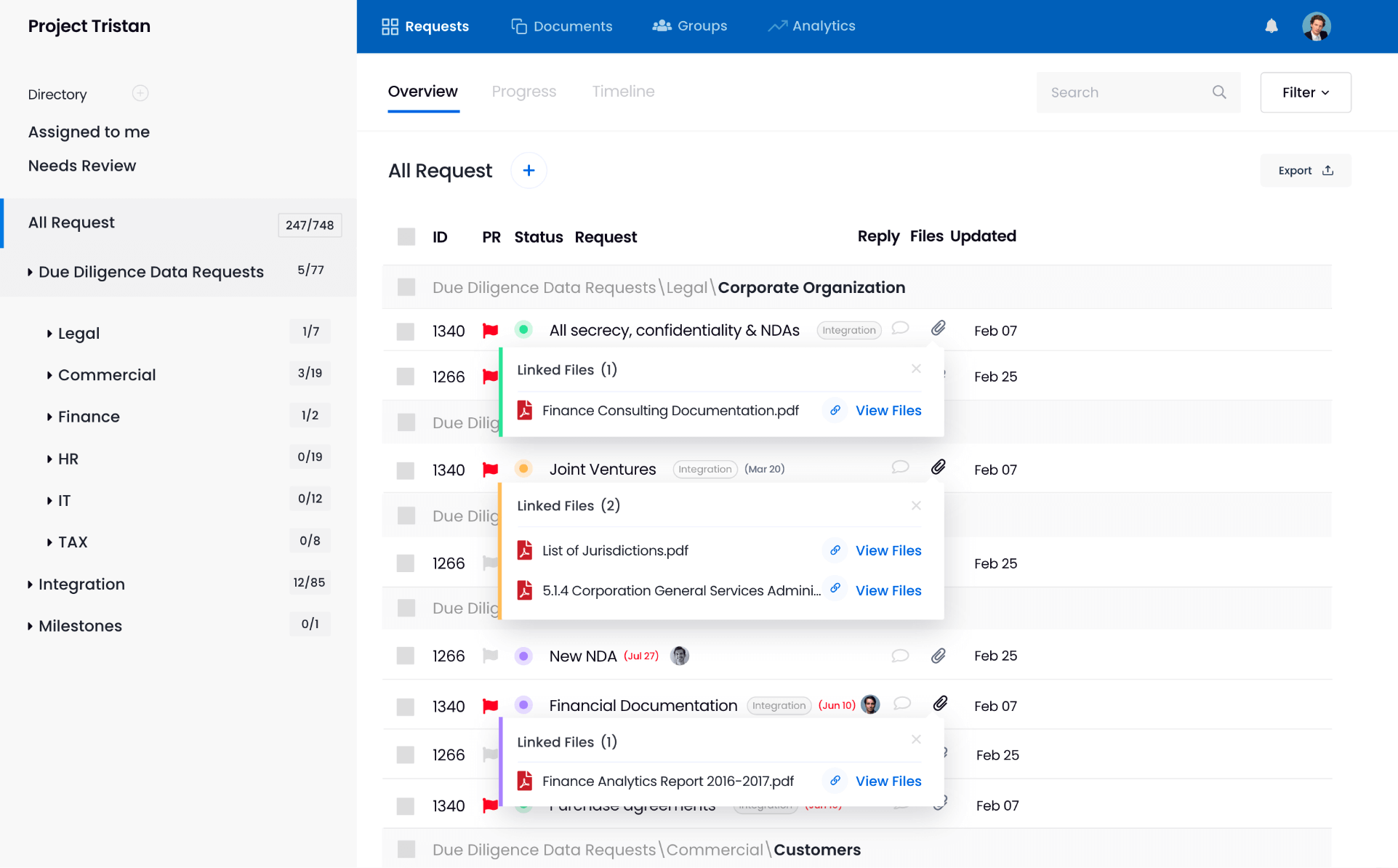

Complete due diligence up 40% faster

When teams switch to using DealRoom, diligence process is no longer spread across multiple platforms like Excel, data room and emails.

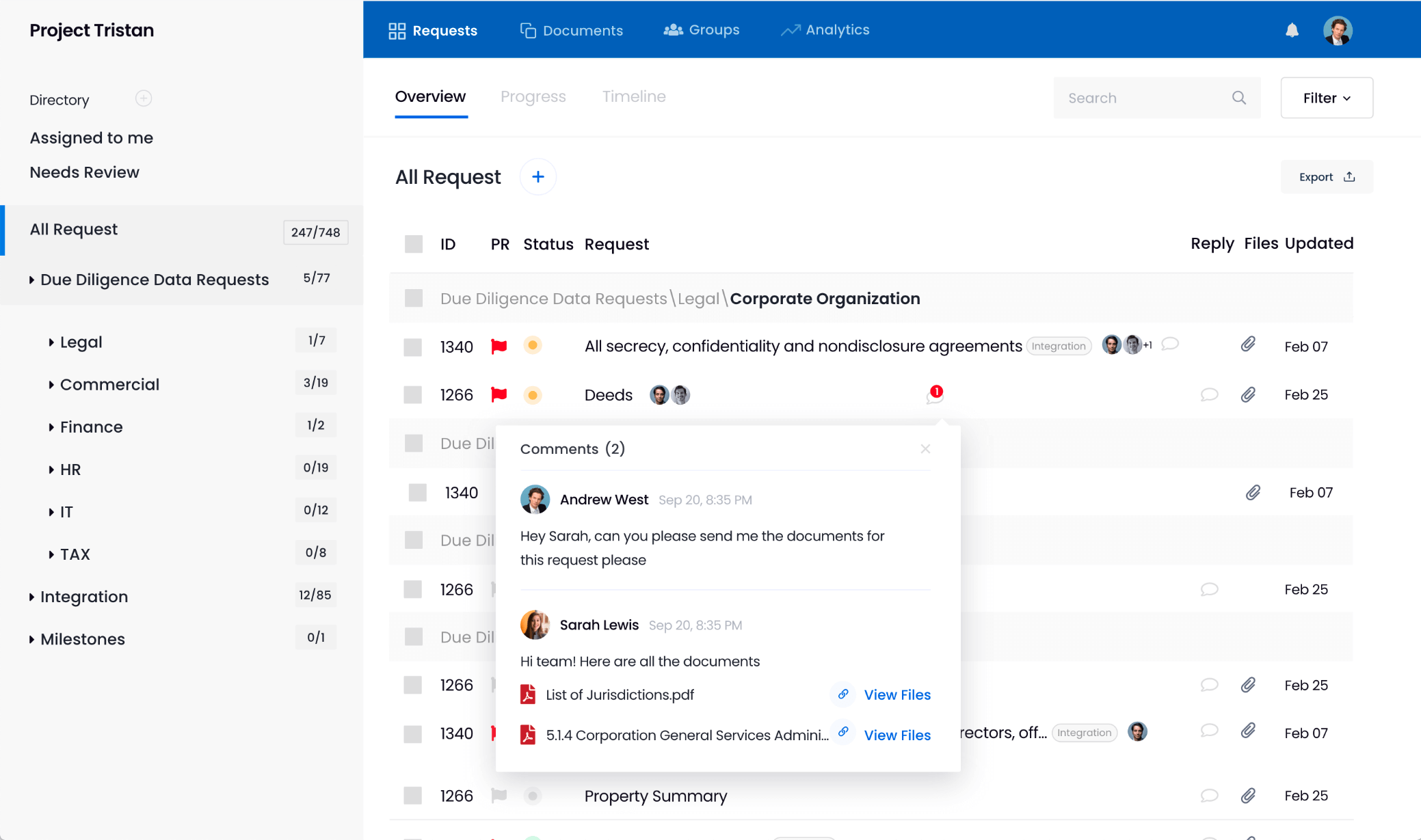

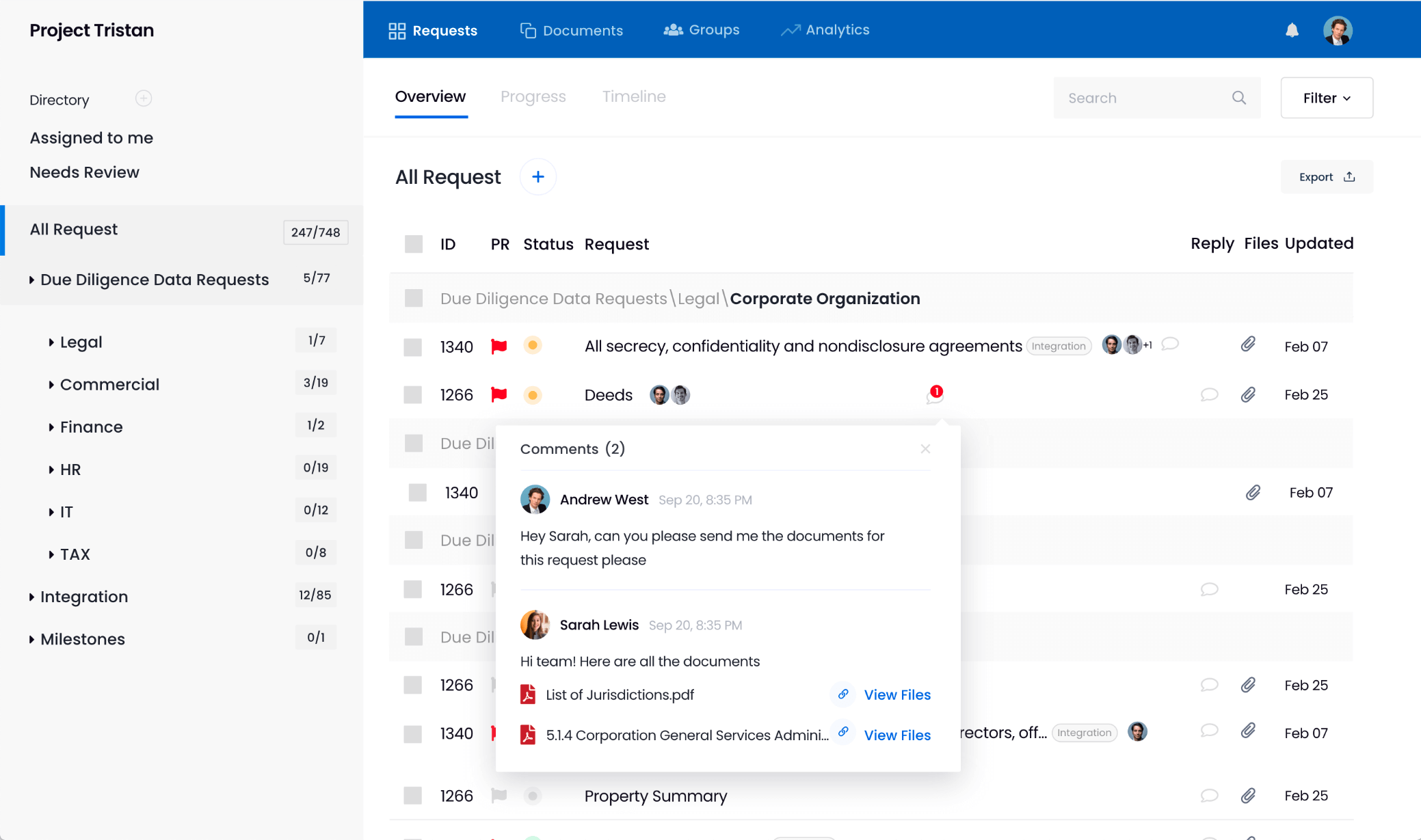

Communicate on specific requests without leaving the platform

Eliminate the need to move between platforms and generate small efficiencies which add up over time to add considerable value to the overall efficiency of your due diligence.

Integrate with tools you already use

DealRoom can integrate with modern and useful M&A tools to further create a central hub for collaboration.

View all features

.png)

Complete, accessible and easy to use.

We are managing the diligence process of several M&A transactions. DealRoom allows the transfer of documents to multiple parties with the ability to individually set groups permission schedule. Further their analytics tab allows us to see who has been active, providing a little bit of visibility on the investors interest levels.

.jpeg)

Wes Faulkenberry

Investment Banking Senior Associate

Investment Banking Senior Associate

Let us optimize your deal management workflows

Our team is here to ensure that you are getting maximum value out of the platform.

Tackle each aspect of the deal lifecycle with DealRoom

Pipeline

Manage all your deals & contacts in one place

Learn more

Learn more

Diligence

Speed up and simplify due diligence process

Learn more

Learn more

Virtual Data Room

Plan for integration alongside diligence

Learn more

Learn more

BI Reporting

Transform how you divest parts of your business

Learn more

Learn more

.jpg)

.jpg)

.png)

.png)

.png)

.svg)

.png)