Due Diligence Software

Streamline your due diligence process

Streamline your due diligence process and complete requests in half the time with our innovative project management features.

Join 2,000+ companies winning deals with DealRoom

Complete requests in half the time

.png)

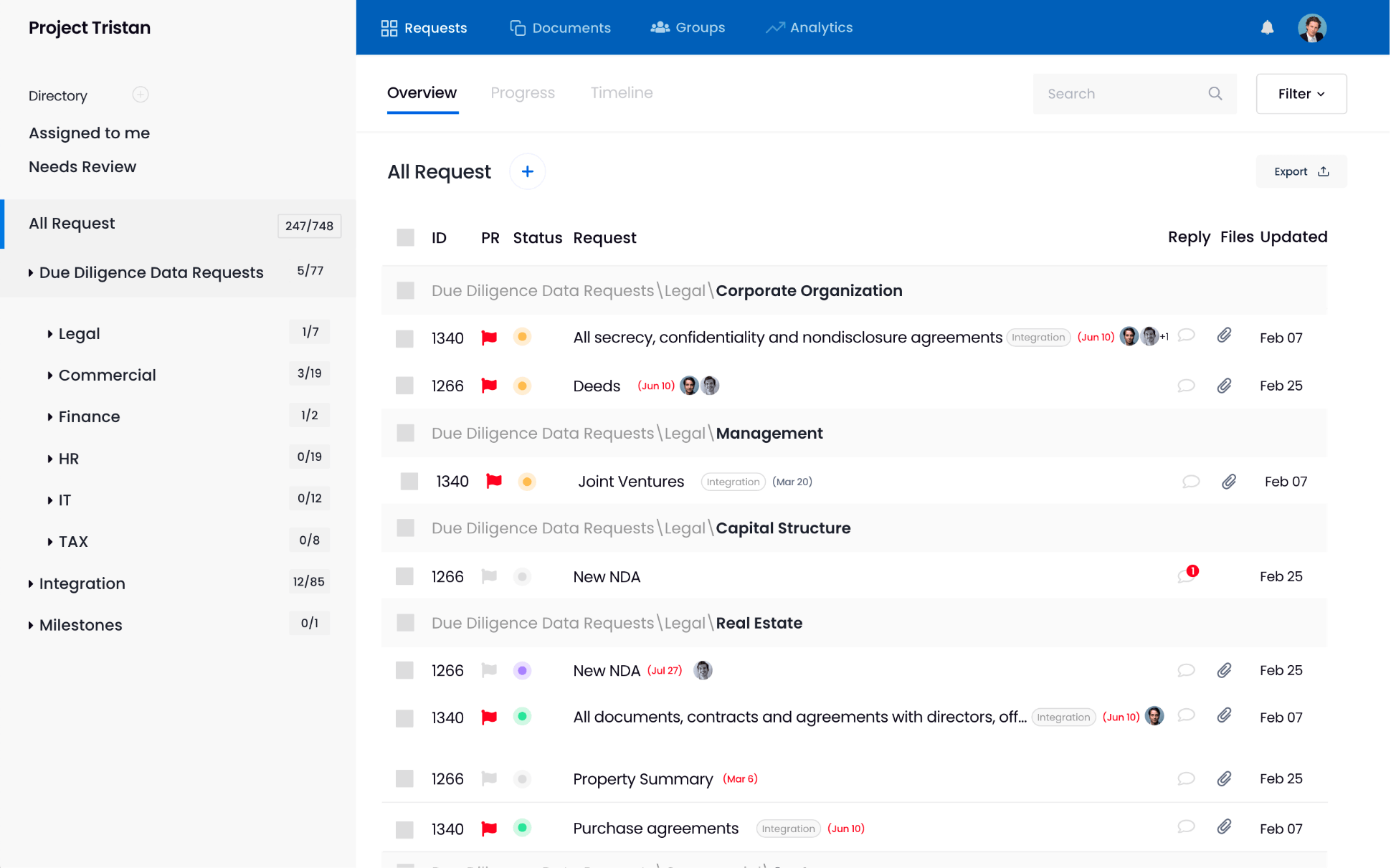

Manage diligence requests in real time

Turn your process into a better organized, predictable and risk-free procedure.

Easily track the progress

Capture and utilize important data to inform critical deal decisions and strategies. See what needs to be done to keep the deal moving forward.

.png)

Eliminate disconnected communication

Centralize all communication, tasks and files for improved collaboration and efficiency in one place.

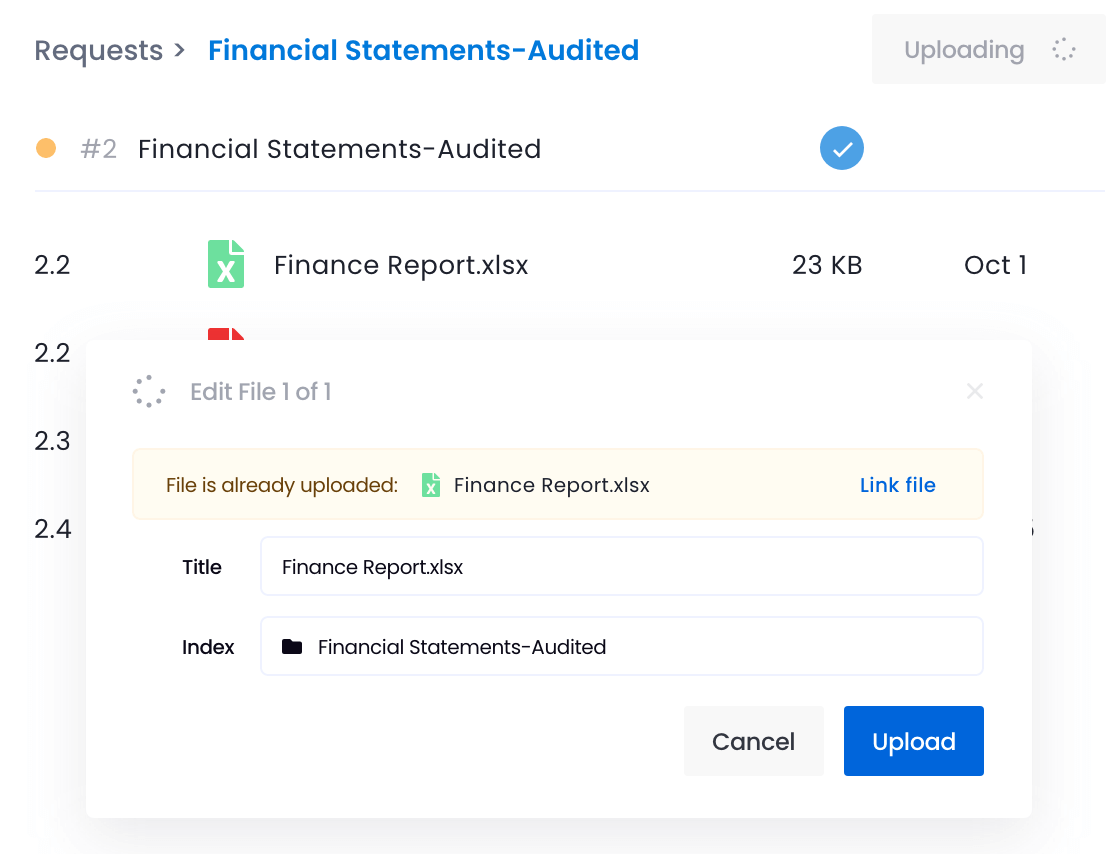

Manage documents

in one secure place

Organize and manage your documents with easy drag & drop upload, 4-levels permissions, built-in viewer, and smart notifications.

Synchronize

your process

Complete diligence requests, communicate, and manage documents on one platform by eliminating the need for Excel, emails and traditional data rooms.

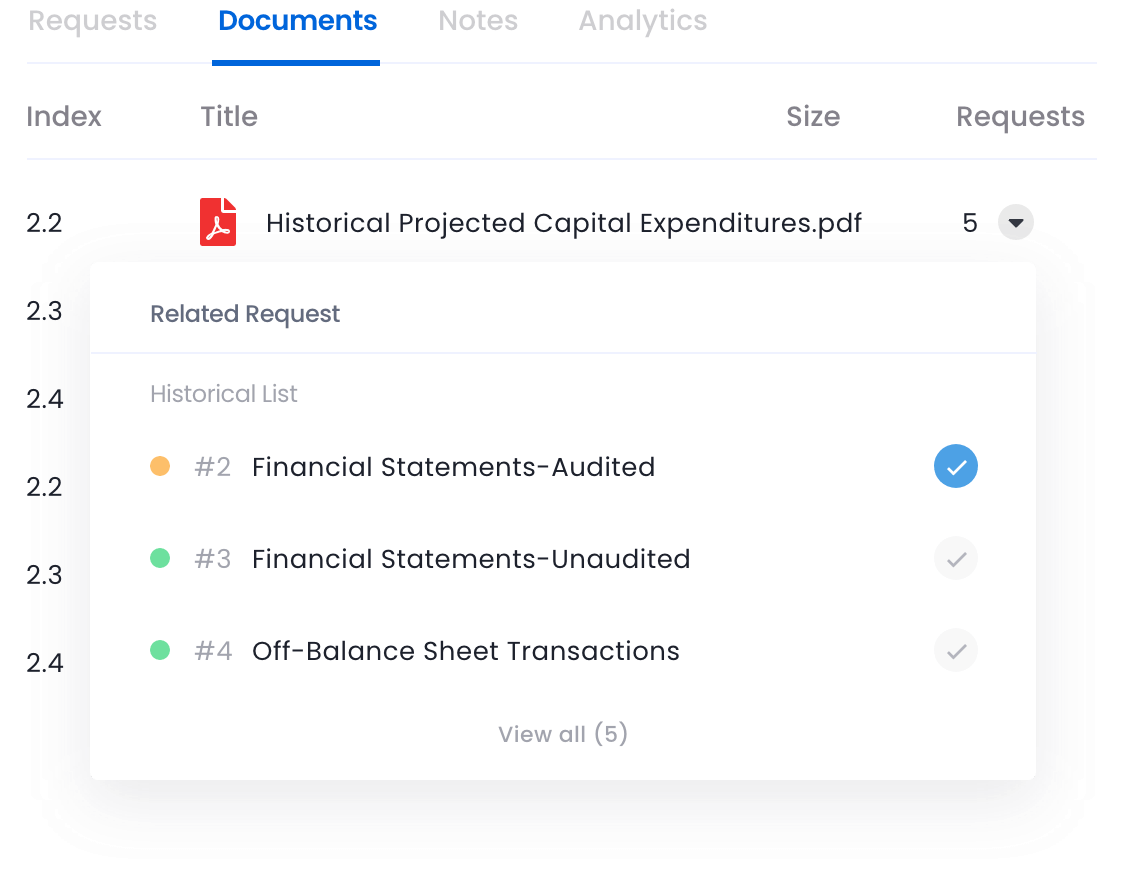

Eliminate duplicate work

Stop wasting valuable time fulfilling duplicate requests. Receive suggestions and stay informed when a similar document is needed for answering a task.

Jump-start your diligence process with

10+ pre-made templates

Utilize our pre-made playbooks to quickly start organizing and managing your transaction workflows.

Most responsive and innovative provider in the market right now

I love task tracking feature that is unique to the DealRoom, but what I like the most is the customer support.

%20(1).jpeg)

Curtis S. Chu

Private Equity Associate

Private Equity Associate

-2.png)

Let us optimize your deal management workflows

Streamline your due diligence process and complete requests in half the time with our innovative project management features.

Tackle each aspect of the deal lifecycle with DealRoom

Pipeline

Manage all your deals & contacts in one place

Learn more

Learn more

Diligence

Speed up and simplify due diligence process

Learn more

Learn more

Virtual Data Room

Plan for integration alongside diligence

Learn more

Learn more

BI Reporting

Transform how you divest parts of your business

Learn more

Learn more

.jpg)

.jpg)

.png)

.png)

.png)

.svg)

.png)